|

市场调查报告书

商品编码

1664902

肥胖数位健康市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Digital Health for Obesity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

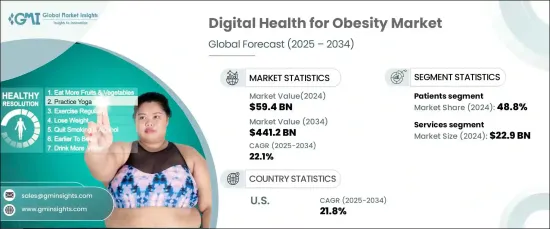

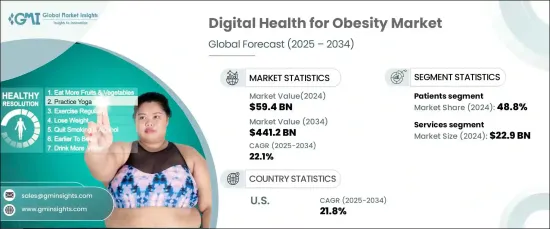

2024 年全球肥胖数位健康市场价值为 594 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到惊人的 22.1%。 这一快速扩张的推动因素是全球肥胖患病率的上升以及人工智能和资料分析等尖端技术的日益普及,这些技术通过个性化和有效的解决方案彻底改变了体重管理。

全球市场分为软体、硬体和服务,其中服务业占据主导地位。 2024 年,服务业占据主导地位,价值达 229 亿美元。它的突出地位源于它能够提供全面的支持,包括个人化咨询、远端监控和为管理肥胖等健康状况的个人提供持续指导。透过弥合技术与病患照护之间的差距,服务可确保提供客製化的建议和持续的使用者参与,使其成为数位健康生态系统中不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 594亿美元 |

| 预测值 | 4412亿美元 |

| 复合年增长率 | 22.1% |

根据最终用途,市场分为患者、提供者、付款人和其他最终用户,其中患者细分市场在 2024 年占据最大的市场份额,为 48.8%。患者是数位健康工具的主要用户,他们利用行动应用程式、穿戴式装置和其他技术来有效监测和管理肥胖。人们对健康意识的不断增强,加上自我管理的轻鬆和便捷,进一步推动了个人采用数位健康解决方案。

美国肥胖数位健康市场预计将在 2032 年之前保持主导地位,复合年增长率高达 21.8%。这种领导地位得益于由科技公司、医疗保健提供者和研究机构组成的强大生态系统,它们推动数位健康解决方案的创新。此外,美国肥胖症和相关慢性病的盛行率上升也增加了对有效管理工具的需求,包括行动应用程式、穿戴式装置和远距医疗平台。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肥胖盛行率上升

- 行动医疗和穿戴式装置的普及率不断提高

- 远距医疗和远端监控的进展

- 提高对预防保健的认识和关注

- 产业陷阱与挑战

- 资料隐私和安全问题

- 数位化意识和可访问性较低

- 成长动力

- 成长潜力分析

- 监管格局

- 科技趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 软体

- 硬体

- 服务

第 6 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 患者

- 提供者

- 付款人

- 其他最终用途

第 7 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Allurion

- Calibrate Health

- Ilant Health

- Intellihealth

- Noom

- Omada Health

- Qardio

- Teladoc Health

- Twin Health

- Vida Health

- Virta Health

- Welldoc

- WW International

The Global Digital Health For Obesity Market was valued at USD 59.4 billion in 2024 and is anticipated to grow at an impressive CAGR of 22.1% from 2025 to 2034. This rapid expansion is driven by the rising global prevalence of obesity and the increasing adoption of cutting-edge technologies such as AI and data analytics, revolutionizing weight management with personalized and effective solutions.

The global market is categorized into software, hardware, and services, with the services segment leading the charge. In 2024, the services segment held a dominant position, valued at USD 22.9 billion. Its prominence stems from its ability to deliver comprehensive support, including personalized consultations, remote monitoring, and ongoing guidance for individuals managing health conditions like obesity. By bridging the gap between technology and patient care, services ensure tailored recommendations and sustained user engagement, making them indispensable in the digital health ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $59.4 Billion |

| Forecast Value | $441.2 Billion |

| CAGR | 22.1% |

By end use, the market is segmented into patients, providers, payers, and other end-users, with the patients segment capturing the largest market share of 48.8% in 2024. This leadership position is fueled by the surging demand for personalized and accessible healthcare solutions. Patients are the primary users of digital health tools, leveraging mobile apps, wearables, and other technologies to effectively monitor and manage obesity. The growing awareness of health and wellness, coupled with the ease and convenience of self-management, is further propelling the adoption of digital health solutions among individuals.

The U.S. digital health for obesity market is set to maintain its dominance through 2032, with a robust CAGR of 21.8%. This leadership is underpinned by a strong ecosystem of technology companies, healthcare providers, and research institutions, which drive innovation in digital health solutions. Additionally, the rising prevalence of obesity and associated chronic diseases in the U.S. has amplified the demand for effective management tools, including mobile apps, wearables, and telemedicine platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of obesity

- 3.2.1.2 Growing adoption of mHealth and wearable devices

- 3.2.1.3 Advances in telemedicine and remote monitoring

- 3.2.1.4 Increasing awareness and focus on preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Low digital awareness and accessibility

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology trends

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Hardware

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Patients

- 6.3 Providers

- 6.4 Payers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Allurion

- 8.2 Calibrate Health

- 8.3 Ilant Health

- 8.4 Intellihealth

- 8.5 Noom

- 8.6 Omada Health

- 8.7 Qardio

- 8.8 Teladoc Health

- 8.9 Twin Health

- 8.10 Vida Health

- 8.11 Virta Health

- 8.12 Welldoc

- 8.13 WW International