|

市场调查报告书

商品编码

1664903

商业和工业併网光伏逆变器市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Commercial and Industrial On Grid PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

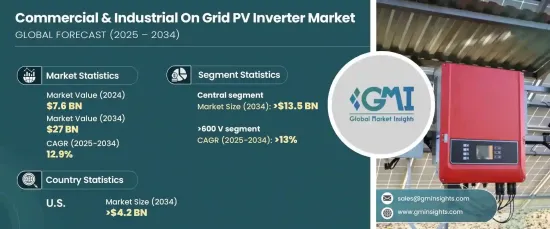

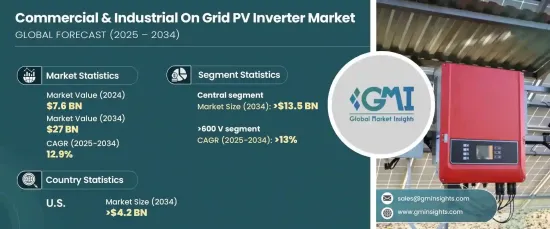

2024 年全球商业和工业併网光伏逆变器市场规模达到 76 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 12.9%。透过将太阳能电池板的直流电 (DC) 转换为与当地电网标准相容的交流电 (AC),这些系统能够在现有能源基础设施内高效利用太阳能。

主要成长动力

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 76亿美元 |

| 预测值 | 270亿美元 |

| 复合年增长率 | 12.9% |

优惠的政府政策、诱人的税收优惠以及支持再生能源应用的大量补贴将加速商业和工业领域併网光伏系统的安装。此外,业界领导者和研究人员加大对配备先进功能(如即时监控、远端诊断和智慧电网相容性)的现代化逆变器的投资,将推动市场成长。这些创新提高了效率、可靠性和操作简易性,使其成为当今能源格局中不可或缺的一部分。

预计到 2034 年,中央逆变器市场的规模将超过 135 亿美元,这得益于其简化大规模安装中的电力转换的能力。集中式系统最大限度地降低了操作复杂性,提供了具有强大耐用性的经济高效的解决方案,能够承受工业应用中经常遇到的恶劣条件。此外,其可扩展性使企业无需彻底改造系统架构即可扩展业务,从而进一步促进产品在市场上的采用。

由于对需要长距离高效电力传输的高容量应用的需求不断增加,预计到 2034 年,> 600 V 市场将以 13% 的强劲复合年增长率增长。高压系统可减少能源损失和营运成本,为企业提供更高的太阳能装置投资报酬率。此外,人们对能源安全和不间断电源的日益重视确保了这些系统的广泛应用,使企业能够在高峰负载期间保持可靠的能源供应,同时最大限度地减少对外部能源的依赖。

受能源价格飙升和对具有成本效益的替代品的需求不断增长的推动,美国商业和工业併网光伏逆变器市场预计到 2034 年将创收 42 亿美元。极端天气事件导致的电网频繁中断促使企业采用具有备用功能的先进逆变器来维持不间断运作。此外,工业园区和商业场所拥有丰富的屋顶和地面空间,这使得美国成为併网光伏逆变器的利润丰厚的市场。

目录

第 1 章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第 5 章:市场规模及预测:依产品,2021 – 2034 年

- 主要趋势

- 细绳

- 微

- 中央

第六章:市场规模及预测:依标称输出电压,2021 – 2034 年

- 主要趋势

- 230 - 400 伏

- 400 - 600 伏

- > 600 伏

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 义大利

- 波兰

- 荷兰

- 奥地利

- 英国

- 法国

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 以色列

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

第八章:公司简介

- Delta Electronics

- Fronius International

- GoodWe

- Growatt New Energy Technology

- Huawei Technologies

- SMA Solar Technology

- Sungrow Power Supply

- Solaredge Technologies

- Solis Inverters

- V-Guard Industries

The Global Commercial And Industrial On Grid PV Inverter Market reached USD 7.6 billion in 2024 and is projected to grow at an impressive CAGR of 12.9% from 2025 to 2034. These inverters serve as critical power conversion devices, seamlessly integrating solar photovoltaic (PV) systems into the electrical grid in commercial and industrial environments. By converting direct current (DC) from solar panels into alternating current (AC) compatible with local grid standards, these systems enable efficient solar power utilization within existing energy infrastructures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $27 Billion |

| CAGR | 12.9% |

Favorable government policies, attractive tax benefits, and substantial subsidies supporting renewable energy adoption are set to accelerate the installation of on-grid PV systems in the commercial and industrial sectors. Moreover, rising investments by industry leaders and researchers in developing modern inverters equipped with advanced features-such as real-time monitoring, remote diagnostics, and smart grid compatibility-will fuel market growth. These innovations improve efficiency, reliability, and operational ease, making them indispensable in today's energy landscape.

The central inverter segment is forecast to surpass USD 13.5 billion by 2034, driven by its ability to streamline power conversion in large-scale installations. Centralized systems minimize operational complexity, offering cost-effective solutions with robust durability to withstand the harsh conditions often faced in industrial applications. Additionally, their scalability allows businesses to expand operations without overhauling system architecture, further boosting product adoption in the market.

The > 600 V segment is expected to grow at a robust CAGR of 13% through 2034, owing to the increasing demand for high-capacity applications that require efficient power transmission over longer distances. High-voltage systems reduce energy losses and operational costs, providing businesses with enhanced ROI for solar installations. Furthermore, the rising emphasis on energy security and uninterrupted power supply ensures the growing adoption of these systems, empowering enterprises to maintain reliable energy access during peak loads while minimizing dependence on external sources.

The U.S. commercial and industrial on-grid PV inverter market is anticipated to generate USD 4.2 billion by 2034, fueled by surging energy prices and the rising need for cost-effective alternatives. Frequent grid disruptions caused by extreme weather events are encouraging businesses to adopt advanced inverters with backup capabilities to maintain uninterrupted operations. Additionally, the vast availability of rooftop and ground spaces in industrial parks and commercial establishments positions the U.S. as a lucrative market for on-grid PV inverters.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

Chapter 6 Market Size and Forecast, By Nominal Output Voltage, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 230 - 400 V

- 6.3 400 - 600 V

- 6.4 > 600 V

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 UK

- 7.3.7 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Delta Electronics

- 8.2 Fronius International

- 8.3 GoodWe

- 8.4 Growatt New Energy Technology

- 8.5 Huawei Technologies

- 8.6 SMA Solar Technology

- 8.7 Sungrow Power Supply

- 8.8 Solaredge Technologies

- 8.9 Solis Inverters

- 8.10 V-Guard Industries