|

市场调查报告书

商品编码

1687179

太阳能逆变器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

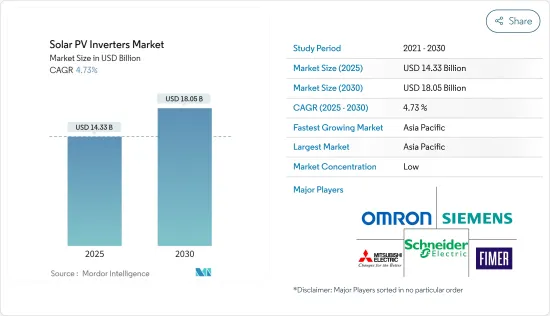

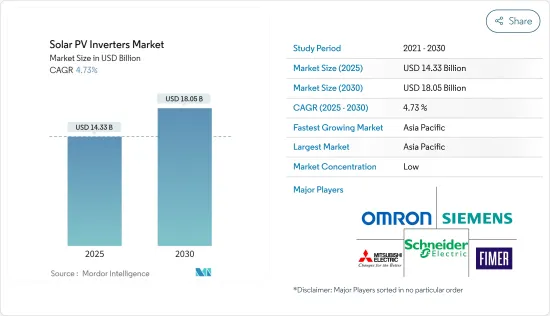

预计 2025 年太阳能逆变器市场规模为 143.3 亿美元,到 2030 年将达到 180.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.73%。

受访的市场在2020年受到了新冠肺炎疫情的影响,但目前已恢復到疫情前的水平。

预计预测期内对太阳能的需求不断增长将推动太阳能逆变器市场的成长。预计不断增加的投资和雄心勃勃的太阳能目标将推动所研究市场的成长。然而,预计预测期内串列型逆变器的技术缺陷将会阻碍太阳能光电逆变器市场的成长。

预计预测期内,太阳能光电逆变器的产品创新和最新技术的采用将为太阳能光电逆变器市场创造有利的成长机会。亚太地区占据市场主导地位,预计在预测期内将以最高的复合年增长率成长。这一增长得益于印度、中国和澳大利亚等地区国家的投资增加和政府的支持政策。

太阳能逆变器市场趋势

集中式逆变器市场预计将占据市场主导地位

集中逆变器是大型併网设备。它常用于额定输出功率超过100kWp的太阳能发电系统。落地式或地面安装的逆变器将从太阳能电池阵列收集的直流电转换为交流电以用于并联型。这些设备的容量范围从大约 50kW 到 1MW,可在室内和室外使用。

中央逆变器由一个DC-AC转换级组成。为了扩大 MPP(最大功率点)电压范围,一些逆变器还具有 DC-DC 升压级。可以使用低频变压器来升高交流电压并隔离输出。然而,这会降低效率并增加逆变器的尺寸、重量和成本。

中央逆变器的最大输入电压通常为1,000V。然而,一些现代中央逆变器的输入电压已经达到1,500V。这些逆变器可支援高达 1,500V 电压的光伏阵列,并且需要更少的 BOS(系统平衡)组件。

中央逆变器可以是单片式的(具有单一动力传动系统和多个 MPPT 追踪器),也可以是模组化的(具有多个动力传动系统)。模组化逆变器更为复杂,但如果一个或多个模组发生故障,则可以维持降低的输出,并且可以使用多 MPPT 或主从控制方法。多 MPPT 系统对每个浮动阵列使用单独的转换器和 MPPT,从而增加部分阴影条件下的整体能量收集。在主从方法中,控制器模组始终处于开启状态。当阵列中有更多的电力可用时,它会命令从属模组打开,从而在低辐射环境下最大限度地提高逆变器的效率。

中央逆变器用于公用事业规模的应用,因此必须产生与其所使用的电网相同的电压和频率。由于世界各地的电网标准不同,允许製造商自订这些参数以满足相数的特定要求,而生产的集中式逆变器大部分都是三相逆变器。

2022年1月,阳光电源在阿布达比世界未来能源高峰会上推出了全新1+X中央模组化逆变器,输出容量为1.1兆瓦。本款1+X模组化逆变器可组合8台单元,达到8.8MW的输出功率,并配备DC/ESS接口,可连接能源储存系统(ESS)。

因此,预计电力需求的增加、政府对电力产业脱碳的倡议以及中央逆变器成本的下降将在预测期内推动该产业的成长。

亚太地区占市场主导地位

亚太地区在 2021 年占据了太阳能逆变器市场的主导地位,预计未来仍将继续保持主导地位。预计大部分需求将来自中国,中国也是世界上最大的太阳能生产国。

在中国,人们越来越重视具有零电压穿越(ZVRT)功能的太阳能逆变器。为了满足该系统的标准,太阳能发电厂必须持续运作而不发生故障。由于该国是世界上太阳能发电量最大的国家,因此这项措施具有更重要的意义。

随着世界各地,特别是亚太地区对工业化造成的污染的担忧日益加剧,该地区的太阳能发电获得了显着发展势头。作为《巴黎协定》承诺的一部分,印度政府设定了一个雄心勃勃的目标,即在2022年实现175吉瓦的可再生能源装置容量。在这175吉瓦中,100吉瓦将用于太阳能发电,而这其中的40吉瓦(40%)将透过分散式和屋顶规模的太阳能发电工程来实现。为了实现这一宏伟目标,政府于 2019 年启动了多个新计划,包括太阳能屋顶第二阶段、PM-KUSUM 和超大型可再生能源发电园区 (UMREPP) 的开发。

印度太阳能发电潜力超过750GW,该国《2047年能源安全情境》显示,到2047年,印度太阳能发电装置容量可达479GW左右。印度太阳辐射强,太阳能发电已实现市电平价,推动光伏成为主流能源来源,公用事业和屋顶光伏领域的装置容量不断提升。

截至 2021 年 11 月,阳光电源自 2014 年以来已在印度出货超过 10 GW 的太阳能逆变器。这是由于全国对太阳能的需求不断增加。 2022年3月,阳光电源将印度工厂产能扩大至每年10GW。预计製造业的如此大规模发展将在预测期内推动所研究市场的成长。

因此,由于中国、印度和马来西亚等国家推出的各种政府倡议,预计亚太地区将在预测期内主导太阳能逆变器市场。

光电逆变器产业概况

太阳能逆变器市场比较分散。市场的主要企业(不分先后顺序)包括 FIMER SpA、施耐德电气 SE、西门子股份公司、三菱电机株式会社、欧姆龙株式会社。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按逆变器类型

- 集中式逆变器

- 串列型逆变器

- 微型逆变器

- 按应用

- 住宅

- 商业和工业

- 实用规模

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- FIMER SpA

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

- Omron Corporation

- General Electric Company

- SMA Solar Technology AG

- Delta Energy Systems Inc.

- Enphase Energy Inc.

- SolarEdge Technologies Inc.

- Huawei Technologies Co. Ltd

第七章 市场机会与未来趋势

The Solar PV Inverters Market size is estimated at USD 14.33 billion in 2025, and is expected to reach USD 18.05 billion by 2030, at a CAGR of 4.73% during the forecast period (2025-2030).

Although the market studied was affected by COVID-19 in 2020, it has recovered and reached pre-pandemic levels.

The growing demand for solar power is expected to stimulate the growth of the solar PV inverters market during the forecast period. Increasing investments and ambitious solar energy targets are expected to drive the growth of the market studied. However, technical drawbacks of string inverters are expected to hamper the growth of the solar PV inverters market during the forecast period.

Product innovation and adaptation of the latest technologies in solar PV inverters are anticipated to create lucrative growth opportunities for the solar PV inverters market during the forecast period. Asia-Pacific dominates the market, and it is expected to record the highest CAGR during the forecast period. This growth is attributed to the increasing investments and supportive government policies in the countries of this region, including India, China, and Australia.

Solar PV Inverter Market Trends

Central Inverters Segment Expected to Dominate the Market

A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50kW to 1MW and can be used indoors or outdoors.

A central inverter consists of one DC-AC conversion stage. Some inverters also have a DC-DC boost stage to increase their MPP (maximum power point) voltage range. Low-frequency transformers are sometimes used to boost the AC voltage and provide isolation at the output. However, this reduces efficiency and increases the inverter's size, weight, and cost.

A central inverter typically has a maximum input voltage of 1,000V. However, some newer central inverters already come with 1,500V input voltage. These inverters allow PV arrays based on a maximum voltage of 1,500V, requiring fewer BOS (balance of system) components.

Central inverters can be monolithic (using a single power train and multi-MPPT tracker) or modular (using multiple power trains). Modular inverters are more complex but can maintain reduced power output if one or more modules fail and can use either a multi-MPPT or a master-slave control approach. The multi-MPPT system uses a separate converter and MPPT for each floating sub-array, increasing the overall energy harvest under partial shading conditions. In the master-slave approach, the controller module is always on. It commands the slave modules to switch on when more power is available from the array, which maximizes inverter efficiency in low-insolation environments.

As central inverters are used for utility-scale applications, they should produce the same voltage and frequency as that of the electric grid where they are used. As there are a lot of different electric grid standards worldwide, manufacturers are allowed to customize these parameters to match the specific requirements in terms of the number of phases; most central inverters manufactured are three-phase inverters.

In January 2022, Sungrow launched its new 1+X central modular inverter with an output capacity of 1.1MW at the World Future Energy Summit in Abu Dhabi. This 1+X modular inverter can be combined into eight units to reach a power of 8.8MW and features a DC/ESS interface for the connection of energy storage systems (ESS).

Therefore, the growing demand for electricity, the government's efforts to decarbonize the power sector, and the declining costs of central inverters are expected to drive the segment's growth during the forecast period.

Asia-Pacific to Dominate the Market

Asia-Pacific dominated the solar PV inverter market in 2021, and it is expected to continue its dominance over the coming years. Most of the demand is expected to come from China, which is also the largest producer of solar energy in the world.

There has been an increased emphasis on solar inverters in China, providing a zero-voltage ride through (ZVRT) scheme. To meet the scheme norms, the solar PV power plants must continue to operate without breaking. This is even more significant as the country hosts the largest amount of solar power generation in the world.

With the rising concerns over pollution across the world due to industrialization, especially in Asia-Pacific, regional solar power generation gained considerable momentum. As part of the Paris Agreement commitments, the Government of India set an ambitious target of achieving 175 GW of renewable energy capacity by 2022. Out of the 175 GW, 100 GW was earmarked for solar capacity with 40 GW (40%), which was expected to be achieved through decentralized and rooftop-scale solar projects. To achieve this huge target, the government launched several new programs in 2019, like the solar rooftop phase-2, PM-KUSUM, and the development of ultra mega renewable energy power parks (UMREPPs).

India's solar potential is more than 750 GW, and the country's energy security scenario 2047 shows a possibility of achieving around 479 GW of solar PV installed capacity by 2047. Solar power in India, bestowed with high solar irradiance, has already achieved grid parity that encourages the adoption of solar power as a mainstream energy source, pushing forward the capacity installations in the utility-scale and rooftop solar segments.

As of November 2021, Sungrow Power Supply Co. Ltd has shipped more than 10 GW of solar inverters in India since 2014. This is due to the increased demand for solar energy across the country. In March 2022, Sungrow increased its fab capacity in India to 10GW/annum capacity. Such a large development in the manufacturing sector is expected to boost the growth of the market studied during the forecast period.

Therefore, with various government initiatives launched by China, India, Malaysia, etc., Asia-Pacific is expected to dominate the solar PV inverter market during the forecast period.

Solar PV Inverter Industry Overview

The solar PV inverters market is fragmented in nature. Some of the major players in the market (in no particular order) include FIMER SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and Omron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIMER SpA

- 6.3.2 Schneider Electric SE

- 6.3.3 Siemens AG

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 Omron Corporation

- 6.3.6 General Electric Company

- 6.3.7 SMA Solar Technology AG

- 6.3.8 Delta Energy Systems Inc.

- 6.3.9 Enphase Energy Inc.

- 6.3.10 SolarEdge Technologies Inc.

- 6.3.11 Huawei Technologies Co. Ltd