|

市场调查报告书

商品编码

1766371

光电逆变器市场机会、成长动力、产业趋势分析及2025-2034年预测PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

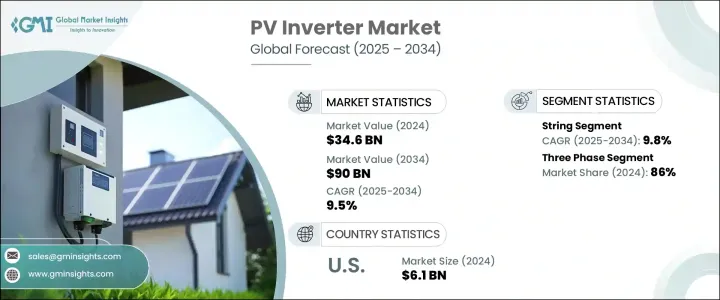

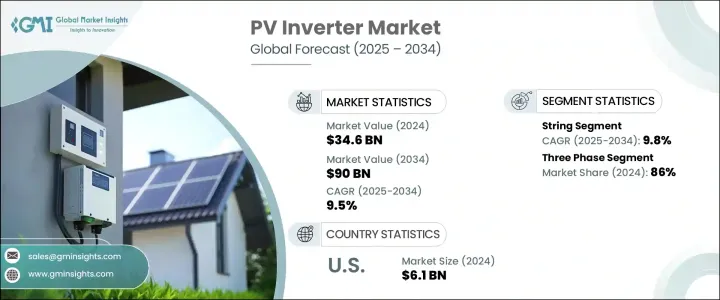

2024年,全球光电逆变器市场规模达346亿美元,预计2034年将以9.5%的复合年增长率成长,达到900亿美元。全球能源格局正在发生显着转变,再生能源日益受到重视。这项转变正在加速高效能光电系统的普及,而逆变器如今已成为现代太阳能装置的核心。随着各国努力减少对化石燃料的依赖,光电逆变器正以更快的速度融入能源基础设施。这些设备不仅能将直流电转换为交流电,还能提高系统可靠性和能源产量,使其成为各种应用中不可或缺的一部分。

对永续性的日益关注,加上有利的能源政策和公共和私营部门的支持性投资,正在为光伏逆变器的部署创造有利环境。旨在减少碳排放和优化能源消耗的法规正在加强向先进太阳能解决方案的转变。此外,受规模经济和製造流程稳定改善的推动,太阳能技术成本持续下降,使光电系统更具经济可行性。这种经济实惠的优势为那些太阳能资源丰富但在获取传统电力基础设施方面历来面临挑战的地区带来了机会。分散式能源发电的扩张进一步刺激了对能够在併网和离网环境中无缝运行的逆变器的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 346亿美元 |

| 预测值 | 900亿美元 |

| 复合年增长率 | 9.5% |

电网现代化进程也进一步增强了先进逆变器的作用。随着智慧能源网路的发展,对能够超越基本功率转换的逆变器的需求日益增长。远端诊断、即时监控、电压调节和频率支援等功能正成为下一代设备的标准配置。这些功能使其能够更好地融入智慧电网框架,并帮助公用事业公司在再生能源输入波动的情况下保持电网稳定。随着数位化在能源领域的蓬勃发展,配备资料分析和人工智慧驱动能源管理功能的光伏逆变器对于高效配电和性能优化至关重要。

在各类产品中,串式逆变器的需求日益增长,预计2034年复合年增长率将达到9.8%。其受欢迎程度源自于其可扩展性、经济实惠和易于维护的特性。由于其模组化架构有助于快速识别故障并简化系统升级,因此串式逆变器在住宅和商业领域中被广泛采用。此外,串式逆变器与储能单元的兼容性不断增强,也使其在混合安装中的吸引力不断提升。高效的热管理和紧凑的设计进一步推动了其市场份额的提升,尤其是在空间受限的项目中。

光电逆变器市场按相数细分为单相和三相繫统。 2024年,三相逆变器占据了整体市场的86%。这种主导地位可以归因于新兴经济体工业化和城市化的快速发展,这些国家对更高容量、更多样化的能源系统的需求。三相逆变器运作效率高,更适合在商业和公用事业规模的应用中大规模部署,因为这些应用对电力的需求巨大且稳定。

截至2024年,北美占全球光电逆变器市场的18.1%。在该地区,美国继续扮演重要角色,其市场价值从2022年的48亿美元增长至2024年的61亿美元。美国重视分散式能源发电,并得到联邦和州级政府的强力激励,创造了有利于住宅和商业屋顶太阳能发展的环境。同时,国家电网基础设施的持续升级正在推动智慧逆变器的整合。随着用户侧储能解决方案的兴起,尤其是在註重能源弹性的各州,光电逆变器的部署将进一步成长。

製造商正大力投入研发,开发一系列满足住宅、商业和公用事业规模客户特定需求的逆变器产品组合。从混合动力车型到专为工业用途设计的高容量逆变器,各家公司都在不断推出创新产品,以提升性能、提高能源产量并符合全球永续发展目标。此外,将智慧技术融入产品也成为一种显着趋势,包括数位介面、云端连接和预测性维护功能。这些进步不仅提升了使用者体验,还能让营运商更深入了解能源使用和系统健康。

为了加强全球布局,市场参与者正在采取多种策略组合。这些策略包括进入太阳能潜力巨大的新地区、建立联盟以增强服务能力,以及透过併购来利用新兴技术。数位化基础设施和基于人工智慧的监控工具日益重要,促使利害关係人将智慧功能融入其中,从而在基本能源转换之外创造更多价值。随着全球太阳能格局的日趋成熟,这些全面的策略将有助于企业保持竞争力,同时满足消费者、企业和公用事业公司不断变化的能源需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 细绳

- 微

- 中央

第六章:市场规模及预测:依阶段,2021 - 2034

- 主要趋势

- 单相

- 三相

第七章:市场规模及预测:依连结性,2021 - 2034

- 主要趋势

- 独立

- 在电网上

第八章:市场规模及预测:依标称输出功率,2021 - 2034

- 主要趋势

- ≤0.5千瓦

- 0.5 - 3 千瓦

- 3 - 33 千瓦

- 33 - 110 千瓦

- > 110 千瓦

第九章:市场规模及预测:依标称输出电压,2021 - 2034

- 主要趋势

- ≤ 230 伏

- 230 - 400 伏

- 400 - 600 伏

- > 600 伏

第 10 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第 11 章:市场规模与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 义大利

- 波兰

- 荷兰

- 奥地利

- 英国

- 法国

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 以色列

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

第十二章:公司简介

- Altenergy Power System

- Canadian Solar

- Darfon Electronics

- Delta Electronics

- Eaton

- Enphase Energy

- Fimer Group

- Fronius International

- General Electric

- Ginlong Technologies

- GoodWe

- Growatt New Energy

- Huawei Technologies

- Panasonic Corporation

- Schneider Electric

- Siemens

- Sineng Electric

- SMA Solar Technology

- SolarEdge Technologies

- Sungrow

- Tabuchi Electric

- TMEIC

The Global PV Inverter Market was valued at USD 34.6 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 90 billion by 2034. The global energy landscape is undergoing a notable transformation, with increasing emphasis on renewable power sources. This shift is accelerating the adoption of efficient photovoltaic systems, and inverters are now central to modern solar installations. As countries seek to reduce their dependence on fossil fuels, PV inverters are being integrated into energy infrastructure at a faster pace. These devices not only convert DC to AC power but also enhance system reliability and energy yield, making them indispensable across various applications.

The growing focus on sustainability, combined with favorable energy policies and supportive investment from the public and private sectors, is creating a conducive environment for PV inverter deployment. Regulations aimed at cutting carbon emissions and optimizing energy consumption are reinforcing the shift toward advanced solar solutions. Moreover, ongoing declines in solar technology costs-driven by economies of scale and steady improvements in manufacturing-are making PV systems more financially viable. This affordability is opening up opportunities in regions that are rich in solar resources but have historically faced challenges in accessing conventional power infrastructure. The expansion of distributed energy generation further supports the demand for inverters capable of operating seamlessly across grid-connected and off-grid setups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.6 Billion |

| Forecast Value | $90 Billion |

| CAGR | 9.5% |

Modernization efforts within power grids are also amplifying the role of advanced inverters. With the evolution of intelligent energy networks, there is an increased need for inverters that can perform beyond basic power conversion. Features such as remote diagnostics, real-time monitoring, voltage regulation, and frequency support are becoming standard in next-generation devices. These functionalities enable better integration into smart grid frameworks and help utilities maintain grid stability amid fluctuating renewable power inputs. As digitalization gains traction across the energy sector, PV inverters equipped with data analytics and AI-driven energy management capabilities are proving vital for efficient power distribution and performance optimization.

Among the different product types, string inverters are experiencing heightened demand, with expectations of growing at a CAGR of 9.8% through 2034. Their popularity stems from their scalability, affordability, and ease of maintenance. These systems are widely adopted in both residential and commercial sectors, as their modular architecture facilitates quick fault identification and simplified system upgrades. Additionally, the increasing compatibility of string inverters with energy storage units has broadened their appeal across hybrid installations. Their efficient thermal management and compact designs further contribute to their rising market share, especially in space-constrained projects.

The PV inverter market is segmented by phase into single-phase and three-phase systems. In 2024, three-phase inverters accounted for 86% of the overall market. This dominance can be attributed to the rapid pace of industrialization and urban development in emerging economies, which demand higher-capacity and more versatile energy systems. Three-phase inverters offer operational efficiency and are better suited for large-scale deployments in commercial and utility-scale applications, where power requirements are substantial and consistent.

North America, as of 2024, represented 18.1% of the global PV inverter market. Within this region, the United States continues to be a key contributor, with market values rising from USD 4.8 billion in 2022 to USD 6.1 billion in 2024. The country's emphasis on decentralized energy generation, supported by robust federal and state-level incentives, has fostered an environment conducive to rooftop solar growth in both residential and commercial settings. At the same time, ongoing upgrades to the national grid infrastructure are driving the integration of smart inverters. With the rise of behind-the-meter storage solutions, particularly in states focused on energy resilience, the deployment of PV inverters is set to grow further.

Manufacturers are investing heavily in R&D to develop a broad portfolio of inverters tailored to specific customer needs across residential, commercial, and utility-scale sectors. From hybrid models to high-capacity inverters designed for industrial use, companies are rolling out innovations that improve performance, enhance energy yield, and align with global sustainability goals. There is also a noticeable trend toward embedding intelligent technologies into products, including digital interfaces, cloud connectivity, and predictive maintenance capabilities. These advancements not only improve user experience but also offer operators deeper insights into energy usage and system health.

To strengthen their global footprint, market participants are leveraging a combination of strategies. These include entering new geographic regions with high solar potential, forming alliances to enhance service offerings, and pursuing mergers to tap into emerging technologies. The increasing relevance of digital infrastructure and AI-based monitoring tools is leading stakeholders to incorporate smart features that add value beyond basic energy conversion. As the global solar landscape matures, these comprehensive strategies will help companies remain competitive while addressing the evolving energy demands of consumers, businesses, and utilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Standalone

- 7.3 On grid

Chapter 8 Market Size and Forecast, By Nominal Output Power, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 ≤ 0.5 kW

- 8.3 0.5 - 3 kW

- 8.4 3 - 33 kW

- 8.5 33 - 110 kW

- 8.6 > 110 kW

Chapter 9 Market Size and Forecast, By Nominal Output Voltage, 2021 - 2034 (USD Billion & MW)

- 9.1 Key trends

- 9.2 ≤ 230 V

- 9.3 230 - 400 V

- 9.4 400 - 600 V

- 9.5 > 600 V

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & MW)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial & industrial

- 10.4 Utility

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 Italy

- 11.3.3 Poland

- 11.3.4 Netherlands

- 11.3.5 Austria

- 11.3.6 UK

- 11.3.7 France

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Australia

- 11.4.3 India

- 11.4.4 Japan

- 11.4.5 South Korea

- 11.5 Middle East & Africa

- 11.5.1 Israel

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

- 11.5.4 South Africa

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Mexico

- 11.6.3 Chile

Chapter 12 Company Profiles

- 12.1 Altenergy Power System

- 12.2 Canadian Solar

- 12.3 Darfon Electronics

- 12.4 Delta Electronics

- 12.5 Eaton

- 12.6 Enphase Energy

- 12.7 Fimer Group

- 12.8 Fronius International

- 12.9 General Electric

- 12.10 Ginlong Technologies

- 12.11 GoodWe

- 12.12 Growatt New Energy

- 12.13 Huawei Technologies

- 12.14 Panasonic Corporation

- 12.15 Schneider Electric

- 12.16 Siemens

- 12.17 Sineng Electric

- 12.18 SMA Solar Technology

- 12.19 SolarEdge Technologies

- 12.20 Sungrow

- 12.21 Tabuchi Electric

- 12.22 TMEIC