|

市场调查报告书

商品编码

1664912

汽车儿童存在检测系统市场机会、成长动力、产业趋势分析与预测 2025 - 2034Automotive Child Presence Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

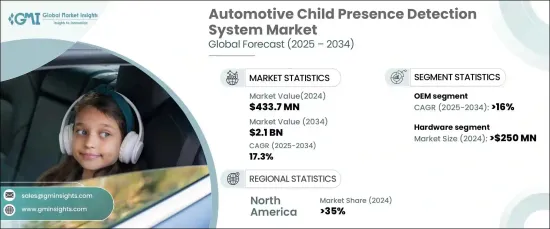

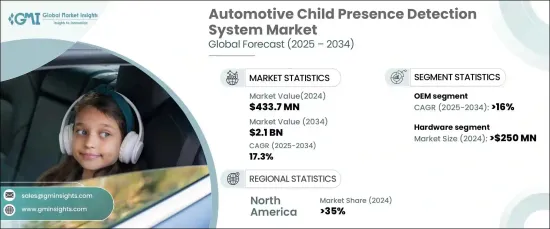

2024 年全球汽车儿童存在检测系统市场规模达到 4.337 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 17.3%。 推动这一增长的因素包括人们对儿童安全的日益关注、先进车辆安全技术的日益普及,以及为防止车辆中发生与儿童有关的事故而实施的更严格法规。随着汽车製造商和监管机构强调安全的重要性,儿童存在检测系统正在成为现代汽车的重要组成部分,在解决紧迫的安全挑战的同时,确保父母和照顾者的安心。在公共安全运动和技术能力不断提升的推动下,消费者意识的增强进一步推动了市场的发展。

驾驶员和乘客监控系统 (DOMS) 的整合正在加速这些解决方案的采用。人工智慧脸部辨识、眼动追踪和行为分析等技术透过密切监控驾驶者的注意力和乘客的健康状况,正在彻底改变车内安全。透过将儿童存在侦测功能纳入 DOMS,汽车製造商可以提供全面的安全方案来解决分心驾驶、座椅定位和无人看管儿童侦测等关键问题。这些整合解决方案强调了人们对提供更聪明、更安全的车辆的日益关注。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.337 亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 17.3% |

市场依组件分为硬体和软体。 2024 年,硬体部门引领市场,创收 2.5 亿美元。这种主导地位归功于先进感测器、雷达模组和基于摄影机的系统的广泛采用,这些系统旨在准确检测车内无人看管的儿童。这些硬体组件不仅可靠、经济高效,而且还能无缝整合到现代汽车设计中。基于雷达和超宽频 (UWB) 系统的创新显着提高了侦测精度,同时减少了误报,使这些技术成为製造商的首选。

根据销售管道,市场分为原始设备製造商(OEM)和售后市场解决方案。 OEM领域预计将实现强劲增长,预计 2025 年至 2034 年的复合年增长率为 16%。汽车製造商正在积极将雷达和人工智慧技术融入其安全功能中,以确保符合不断发展的标准并满足消费者对增强安全措施日益增长的需求。

在严格的安全法规和旨在防止车内儿童死亡的政府措施的支持下,北美在 2024 年占据了 35% 的市场份额。雷达和超音波检测系统的广泛应用,以及汽车製造商和技术提供者之间的合作,正在加强该地区在市场上的地位。公众意识的增强和国家层级的立法行动进一步推动了该地区的发展。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 组件提供者

- 製造商

- 经销商

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 案例研究

- 成本分析

- 衝击力

- 成长动力

- 车辆儿童安全风险意识不断增强

- 感测技术的技术进步

- 人工智慧与机器学习的日益融合

- 全球汽车安全标准不断提高

- 产业陷阱与挑战

- 技术复杂性

- 全球安全法规的变化

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 感应器

- 相机

- 超音波系统

- 雷达系统

- 软体

第 6 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 电动车

- 冰

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 掀背车

- 轿车

- 越野车

- 中紫外线

- 其他的

第 8 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aisin

- Aker

- Aptiv

- Continental

- Delphi

- Denso

- Faurecia

- Hyundai Motor

- Infineon

- Magna

- Murata Manufacturing

- NXP Semiconductors

- Robert Bosch

- STMicroelectronics

- TDK

- Texas Instruments

- UniMax Electronics

- Valeo

- Visteon

- ZF Friedrichshafen

The Global Automotive Child Presence Detection System Market reached USD 433.7 million in 2024 and is expected to grow at a remarkable CAGR of 17.3% from 2025 to 2034. This growth is driven by heightened concerns about child safety, the increasing adoption of advanced vehicle safety technologies, and the enforcement of stricter regulations aimed at preventing child-related incidents in vehicles. As automakers and regulatory bodies emphasize the importance of safety, child presence detection systems are emerging as a vital component in modern vehicles, ensuring peace of mind for parents and caregivers while addressing pressing safety challenges. Enhanced consumer awareness, driven by public safety campaigns and rising technological capabilities, is further propelling the market forward.

The integration of Driver and Occupant Monitoring Systems (DOMS) is accelerating the adoption of these solutions. Technologies such as artificial intelligence-powered facial recognition, eye-tracking, and behavioral analysis are transforming in-cabin safety by closely monitoring driver attentiveness and occupant well-being. By incorporating child presence detection functionalities into DOMS, automakers are offering holistic safety packages that address critical issues like distracted driving, seat positioning, and the detection of unattended children. These integrated solutions underscore the growing focus on delivering smarter, safer vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $433.7 Million |

| Forecast Value | $2.1 Billion |

| CAGR | 17.3% |

The market is segmented by components into hardware and software. In 2024, the hardware segment led the market, generating USD 250 million. This dominance is attributed to the widespread adoption of advanced sensors, radar modules, and camera-based systems designed to accurately detect unattended children in vehicles. These hardware components are not only reliable and cost-effective but also seamlessly integrated into modern automotive designs. Innovations in radar-based and ultra-wideband (UWB) systems have significantly enhanced detection precision while reducing false alarms, making these technologies a preferred choice for manufacturers.

By sales channels, the market is divided into original equipment manufacturers (OEMs) and aftermarket solutions. The OEM segment is expected to witness robust growth, with a projected CAGR of 16% from 2025 to 2034. Regulatory mandates requiring the inclusion of child presence detection systems in new vehicles are a major driver. Automakers are actively incorporating radar and AI-powered technologies into their safety features to ensure compliance with evolving standards and to meet growing consumer demand for enhanced safety measures.

North America accounted for 35% of the market share in 2024, supported by stringent safety regulations and government initiatives aimed at preventing child fatalities in vehicles. The widespread adoption of radar and ultrasonic detection systems, alongside partnerships between automakers and technology providers, is strengthening the region's position in the market. Increased public awareness and state-level legislative actions are further fueling growth in this region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Case study

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising awareness of vehicular child safety risks

- 3.9.1.2 Technological advancements in sensing technologies

- 3.9.1.3 Growing integration of AI and machine learning

- 3.9.1.4 Increasing automotive safety standards globally

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Technological complexity

- 3.9.2.2 Variability in global safety regulations

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Cameras

- 5.2.3 Ultrasonic systems

- 5.2.4 Radar systems

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Electric vehicle

- 6.3 ICE

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hatchback

- 7.3 Sedan

- 7.4 SUV

- 7.5 MUV

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aisin

- 10.2 Aker

- 10.3 Aptiv

- 10.4 Continental

- 10.5 Delphi

- 10.6 Denso

- 10.7 Faurecia

- 10.8 Hyundai Motor

- 10.9 Infineon

- 10.10 Magna

- 10.11 Murata Manufacturing

- 10.12 NXP Semiconductors

- 10.13 Robert Bosch

- 10.14 STMicroelectronics

- 10.15 TDK

- 10.16 Texas Instruments

- 10.17 UniMax Electronics

- 10.18 Valeo

- 10.19 Visteon

- 10.20 ZF Friedrichshafen