|

市场调查报告书

商品编码

1665035

汽车电池断路装置 (BDU) 市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Automotive Battery Disconnect Unit (BDU) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

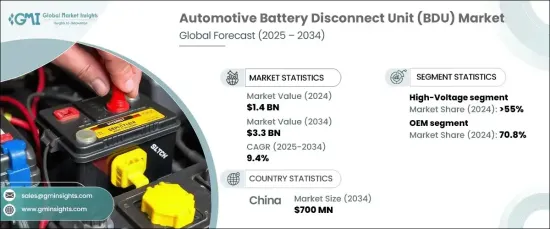

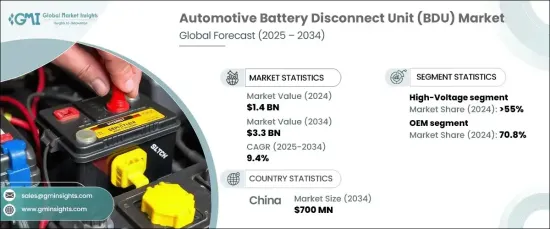

2024 年全球汽车电池断开装置市值为 14 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 9.4%。现代 BDU 现在配备了尖端感测器和物联网 (IoT) 功能,能够即时监控电压、电流和温度。这些创新大大提高了车辆的安全性和性能,使 BDU 成为现代汽车系统不可或缺的组成部分。

新兴市场中电动车 (EV) 的快速发展是先进 BDU 需求不断增长的关键驱动因素。随着各国加快向电动车转型,对具有成本效益、可扩展且具有气候适应能力的 BDU 的需求也日益增加。世界各国政府都在透过支持政策推动这一势头,包括电动车激励措施和充电基础设施的快速扩张。这种转变进一步凸显了对能够在各种条件和环境下可靠运作的 BDU 的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 33亿美元 |

| 复合年增长率 | 9.4% |

根据电压细分,市场包括高压 BDU 和低压 BDU。高压 BDU 在 2024 年占据了 55% 的市场份额,反映了其在电动和混合动力汽车中的关键作用。这些 BDU 对于管理和储存电动车电池系统中的能量至关重要,同时透过防止短路等电气危险来确保安全。随着安全法规的更加严格以及对乘用车和商用车高性能电池系统的日益关注,预计未来几年对高压 BDU 的需求将大幅增长。

根据配销通路,市场还可分为原始设备製造商 (OEM) 和售后市场。 2024 年,由于 BDU 被纳入新车的标准零件,OEM 占据 70.8% 的市场份额。 OEM 利用规模经济以具有竞争力的价格提供高品质的 BDU,满足对先进安全和自动化技术日益增长的需求。持续的创新和与供应商的策略合作进一步增强了 BDU 技术,确保其符合不断变化的监管标准和消费者偏好。

中国正在成为汽车 BDU 市场的强国,预计到 2034 年将达到 7 亿美元。该地区的快速城市化加上不断增加的可支配收入正在推动汽车销售和先进汽车技术的采用,巩固了中国作为 BDU 市场未来成长的关键参与者的地位。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原始设备製造商

- 零件供应商

- 技术提供者

- 服务提供者

- 最终用户

- 利润率分析

- 电池断路装置(BDU)价格分析

- 专利分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 新兴经济体电动车市场的扩张

- 智慧型 BDU 技术的进步

- 固态继电器的采用率不断上升

- BDU 与电池管理系统 (BMS) 和储能解决方案的整合。

- 产业陷阱与挑战

- 先进 BDU 的成本高昂

- 设计和整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按电压,2021 - 2034 年

- 主要趋势

- 高压

- 低电压

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 7 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 8 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 电动车

- 纯电动车 (BEV)

- 插电式混合动力电动车 (PHEV)

- 混合动力电动车 (HEV)

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aptiv

- Automotive Grade Linux

- Bosch

- Continental

- Denso

- Eaton

- Honeywell

- Johnson Controls

- Kyocera

- Lear

- Littelfuse

- Mitsubishi Electric

- Panasonic

- Schaeffler

- Sensata Technologies

- Siemens

- STMicroelectronics

- Valeo

- Vitesco Technologies

- ZF Friedrichshafen

The Global Automotive Battery Disconnect Unit Market was valued at USD 1.4 billion in 2024 and is forecasted to grow at a remarkable CAGR of 9.4% between 2025 and 2034. This growth is propelled by advancements in BDU technology, particularly the integration of smart monitoring systems. Modern BDUs are now equipped with cutting-edge sensors and Internet of Things (IoT) capabilities, enabling real-time monitoring of voltage, current, and temperature. These innovations significantly enhance vehicle safety and performance, making BDUs an indispensable component of modern automotive systems.

The surging adoption of electric vehicles (EVs) in emerging markets is a key driver behind the increasing demand for advanced BDUs. As nations accelerate their transition to electric mobility, the need for cost-effective, scalable, and climate-resilient BDUs is on the rise. Governments worldwide are fueling this momentum with supportive policies, including EV incentives and the rapid expansion of charging infrastructure. This shift further underscores the demand for BDUs engineered to operate reliably across diverse conditions and environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 9.4% |

Segmented by voltage, the market comprises high-voltage and low-voltage BDUs. High-voltage BDUs accounted for 55% of the market share in 2024, reflecting their pivotal role in electric and hybrid vehicles. These BDUs are critical for managing and storing energy in EV battery systems while ensuring safety by preventing electrical hazards such as short circuits. With stricter safety regulations and a growing focus on high-performance battery systems for both passenger and commercial vehicles, the demand for high-voltage BDUs is expected to witness substantial growth in the coming years.

The market is also categorized by distribution channel into original equipment manufacturers (OEMs) and the aftermarket. In 2024, OEMs dominated with a 70.8% market share, driven by the incorporation of BDUs as standard components in new vehicles. OEMs leverage economies of scale to deliver high-quality BDUs at competitive prices, meeting the rising demand for advanced safety and automation technologies. Continuous innovation and strategic collaborations with suppliers further enhance BDU technology, ensuring it aligns with evolving regulatory standards and consumer preferences.

China is emerging as a powerhouse in the automotive BDU market, projected to reach USD 700 million by 2034. As a global leader in automotive manufacturing, China is experiencing a surge in demand for BDUs as automakers prioritize safety, energy efficiency, and performance in their EV offerings. The region's rapid urbanization, coupled with increasing disposable incomes, is driving vehicle sales and the adoption of advanced automotive technologies, solidifying China's position as a key player in the BDU market's future growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 OEMs

- 3.2.2 Component suppliers

- 3.2.3 Technology providers

- 3.2.4 Service providers

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Price analysis of Battery Disconnect Unit (BDU)

- 3.5 Patent analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Expansion of EV markets in emerging economies

- 3.9.1.2 Advances in smart BDU technologies

- 3.9.1.3 Rising adoption of solid-state relays

- 3.9.1.4 Integration of BDUs with battery management systems (BMS) and energy storage solutions.

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High costs of advanced BDUs

- 3.9.2.2 Complexity in design and integration

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 High voltage

- 5.3 Low voltage

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Electric vehicles

- 8.3.1 Battery Electric Vehicles (BEVs)

- 8.3.2 Plug-in Hybrid Electric Vehicles (PHEVs)

- 8.3.3 Hybrid Electric Vehicles (HEVs)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Automotive Grade Linux

- 10.3 Bosch

- 10.4 Continental

- 10.5 Denso

- 10.6 Eaton

- 10.7 Honeywell

- 10.8 Johnson Controls

- 10.9 Kyocera

- 10.10 Lear

- 10.11 Littelfuse

- 10.12 Mitsubishi Electric

- 10.13 Panasonic

- 10.14 Schaeffler

- 10.15 Sensata Technologies

- 10.16 Siemens

- 10.17 STMicroelectronics

- 10.18 Valeo

- 10.19 Vitesco Technologies

- 10.20 ZF Friedrichshafen