|

市场调查报告书

商品编码

1665065

汽车电池管理系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Battery Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

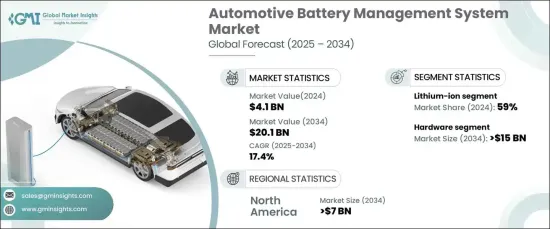

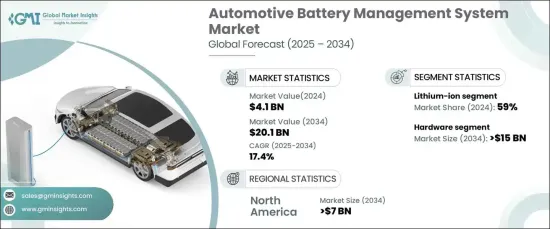

2024 年全球汽车电池管理系统市场价值为 41 亿美元,预计将大幅成长,预计 2025 年至 2034 年的复合年增长率为 17.4%。更严格的环境法规、政府补贴和电池技术的不断进步进一步推动了这一成长。对永续交通的投资也在增加,而人工智慧 (AI)、物联网 (IoT) 和预测分析的创新正在加速对下一代 BMS 解决方案的需求。

对提高电池安全性和性能的关注推动了先进的电池监控和保护集成电路(IC)在 BMS 中的整合。这些先进的系统旨在监控电池健康状况、温度和充电水平等关键参数,防止过度充电和过热等危险。随着电动车和储能係统的普及,对可靠、高性能保护技术的需求也日益增长,这使得 BMS 成为确保安全、高效的储能解决方案的关键组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 201亿美元 |

| 复合年增长率 | 17.4% |

市场分为硬体和软体组件。 2024 年,硬体领域占据了 78% 的市场份额,预计到 2034 年将创造 150 亿美元的市场价值。对具有即时监控功能的小巧、轻巧组件的追求进一步加速了该领域的创新,为其在未来几年的持续扩张奠定了基础。

就电池类型而言,市场包括锂离子、铅酸、镍基和其他电池技术。 2024 年,锂离子电池将占 59% 的市场份额,预计将保持主导地位。它们卓越的能量密度、更长的使用寿命和先进的安全性能使其成为电动车的首选。人工智慧驱动的分析、提高的充电效率和成本优化工作的不断发展,正在推动锂离子系统 BMS 技术的进步,确保它们继续提供卓越的性能和可靠性。

2024 年,北美汽车 BMS 市场占全球市场份额的 37%,预计到 2034 年将创收 70 亿美元。这项转变的关键驱动因素包括严格的排放标准、政府激励措施以及对永续交通的更广泛重视。人工智慧整合、增强的安全功能和性能优化等新兴趋势继续推动该地区对电动车的采用,进一步支持 BMS 市场的扩张。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 零件製造商

- 电池製造商

- 系统整合商

- OEM

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利格局

- 重要新闻及倡议

- 监管格局

- 技术差异化

- 先进的资料分析和人工智慧集成

- 模组化与集中式拓扑

- 固态电池集成

- 无线通讯功能

- 衝击力

- 成长动力

- 电动车(EV)普及率不断提高推动需求

- 日益关注能源效率和永续性

- 政府法规促进清洁能源技术

- 电池技术和储能技术的进步

- 产业陷阱与挑战

- 先进BMS技术开发成本高

- 与现有车辆架构的复杂集成

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 电池IC

- 电池感应器

- 其他的

- 软体

第六章:市场估计与预测:按电池,2021 - 2034 年

- 主要趋势

- 锂离子

- 铅酸

- 镍基

- 其他的

第 7 章:市场估计与预测:按拓扑,2021 - 2034 年

- 主要趋势

- 集中

- 模组化的

- 分散式

第 8 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车

- 丙型肝炎病毒

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- ABB

- Analog Devices

- Bird Global

- Bosch

- Continental

- Eatron

- Ficosa

- Infineon

- Johnson Matthey

- LG Chem

- Marelli

- Midtronics

- Nuvation Energy

- NXP

- Panasonic

- Qorvo

- Renesas Electronics

- Sensata

- Texas Instruments

- Toshiba

The Global Automotive Battery Management System Market, valued at USD 4.1 billion in 2024, is poised for significant growth, with a projected CAGR of 17.4% from 2025 to 2034. The rise in electric vehicle (EV) adoption is a key factor driving this market expansion. This growth is further fueled by stricter environmental regulations, government subsidies, and continuous advancements in battery technologies. Investments in sustainable transportation are also increasing, while innovations in artificial intelligence (AI), the Internet of Things (IoT), and predictive analytics are accelerating the demand for next-generation BMS solutions.

The focus on enhancing battery safety and performance is propelling the integration of advanced battery monitoring and protection integrated circuits (ICs) within BMS. These advanced systems are designed to monitor critical parameters such as battery health, temperature, and charge levels, preventing hazards like overcharging and overheating. As the adoption of EVs and energy storage systems continues to rise, the demand for reliable, high-performance protection technologies grows, making BMS a crucial component in ensuring safe and efficient energy storage solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $20.1 Billion |

| CAGR | 17.4% |

The market is segmented into hardware and software components. In 2024, the hardware segment commanded a dominant 78% of the market share and is expected to generate USD 15 billion by 2034. This growth is driven by advancements in microcontrollers, sensors, and power management ICs that enhance energy efficiency, battery protection, and thermal management. The push for compact, lightweight components capable of real-time monitoring is further accelerating innovation in this segment, positioning it for continued expansion in the coming years.

In terms of battery type, the market includes lithium-ion, lead-acid, nickel-based, and other battery technologies. Lithium-ion batteries hold a commanding 59% market share in 2024 and are expected to maintain dominance. Their superior energy density, extended lifespan, and advanced safety features make them the preferred choice for EVs. The ongoing evolution of AI-driven analytics, improved charging efficiency, and cost optimization efforts are driving advancements in BMS technologies for lithium-ion systems, ensuring they continue to offer exceptional performance and reliability.

North America automotive BMS market accounted for 37% of the global market share in 2024 and is projected to generate USD 7 billion by 2034. The U.S. automotive industry is experiencing a significant shift toward electric mobility, with growing demand for BMS solutions to support the rise of EVs. Key drivers of this transition include stringent emission standards, government incentives, and a broader emphasis on sustainable transportation. Emerging trends such as AI integration, enhanced safety features, and performance optimization continue to boost the region's adoption of electric vehicles, further supporting the expansion of the BMS market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Battery manufacturers

- 3.2.4 System integrators

- 3.2.5 OEM

- 3.2.6 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Technology differentiators

- 3.8.1 advanced data analytics and AI integration

- 3.8.2 Modular vs. centralized topology

- 3.8.3 Solid-State battery integration

- 3.8.4 Wireless communication capabilities

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing electric vehicle (EV) adoption driving demand

- 3.9.1.2 Rising focus on energy efficiency and sustainability

- 3.9.1.3 Government regulations promoting clean energy technologies

- 3.9.1.4 Advancements in battery technologies and energy storage

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High development costs for advanced BMS technologies

- 3.9.2.2 Complex integration with existing vehicle architectures

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Battery IC

- 5.2.2 Battery sensors

- 5.2.3 Others

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Lithium-ion

- 6.3 Lead-acid

- 6.4 Nickel-based

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Topology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Centralized

- 7.3 Modular

- 7.4 Distributed

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 LCV

- 8.3.2 HCV

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Analog Devices

- 10.3 Bird Global

- 10.4 Bosch

- 10.5 Continental

- 10.6 Eatron

- 10.7 Ficosa

- 10.8 Infineon

- 10.9 Johnson Matthey

- 10.10 LG Chem

- 10.11 Marelli

- 10.12 Midtronics

- 10.13 Nuvation Energy

- 10.14 NXP

- 10.15 Panasonic

- 10.16 Qorvo

- 10.17 Renesas Electronics

- 10.18 Sensata

- 10.19 Texas Instruments

- 10.20 Toshiba