|

市场调查报告书

商品编码

1665045

电动车牵引逆变器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测EV Traction Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

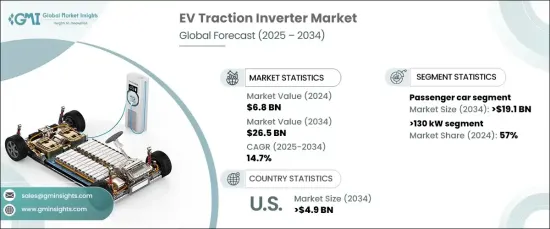

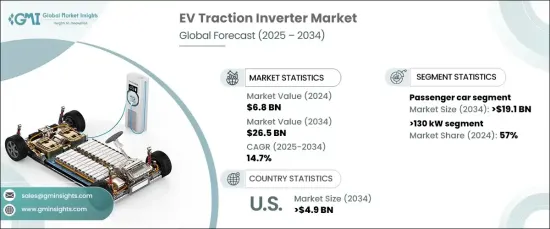

2024 年全球电动车牵引逆变器市场价值为 68 亿美元,预计 2025 年至 2034 年期间将以 14.7% 的强劲复合年增长率增长。 全球范围内电动汽车 (EV) 的普及率激增是该市场增长的主要驱动力,因为各国政府都在推广电动车 (ICE) 的更永续、更内燃机、更永续汽车和电动汽车。这些努力旨在大幅减少温室气体排放并应对气候变迁的迫切挑战。

电力电子技术的进步正在彻底改变牵引逆变器的性能和效率。碳化硅和氮化镓等宽频隙半导体等突破性创新正在实现更高的能源效率、更好的热管理和更紧凑的设计。这些技术对于满足日益增长的延长行驶里程、更快充电时间和卓越车辆性能的需求至关重要,因此在快速发展的电动车产业中不可或缺。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 68亿美元 |

| 预测值 | 265亿美元 |

| 复合年增长率 | 14.7% |

根据车辆类型,市场分为乘用车和商用车。 2024 年,乘用车市场占据市场主导地位,占总份额的 73%,预计到 2034 年将创造 191 亿美元的市场价值。由于市场规模更大、产量更高,乘用车转型为电动车的速度比商用车更快。

根据输出功率,电动车牵引逆变器市场分为 <= 130 kW 和 >130 kW 两部分。受高性能电动车日益增长的偏好以及重型商用车队的电气化推动,130 kW 以上的细分市场将在 2024 年占据 57% 的市场份额。高功率逆变器对于提供卓越的扭力、加速和扩大续航里程至关重要,可满足高端电动车和严苛的商业应用的需求。这些先进的逆变器经过精心设计,可在高性能条件下高效运行,确保可靠性和最佳能源利用率。

美国电动车牵引逆变器市场在 2024 年占据 83% 的份额,预计到 2034 年将达到 49 亿美元。此外,对电动车生产和牵引逆变器等关键零件开发的大量投资正在推动市场的成长轨迹。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 技术提供者

- 零件供应商

- 製造商

- 原始设备製造商

- 供应商概况

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 电动车(EV)的普及率不断提高

- 电力电子技术的进步

- 商用车电气化

- 增加对充电基础设施的投资

- 产业陷阱与挑战

- 电动车及其零件的初始成本高

- 技术复杂性与热管理

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 纯电动车

- 油电混合车

- 插电式混合动力汽车

第六章:市场估计与预测:按输出功率,2021 - 2034 年

- 主要趋势

- <=130千瓦

- >130 千瓦

第 7 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 绝缘栅双极电晶体

- 场效电晶体

第 8 章:市场估计与预测:依半导体材料,2021 - 2034 年

- 主要趋势

- 氮化镓

- 硅

- 碳化硅

第 9 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- BorgWarner Inc.

- Continental AG

- DENSO Corporation

- Drive System Design Ltd

- Eaton Corporation

- Hitachi Astemo Ltd

- Hyundai Mobis Co. Ltd.

- Infineon Technologies AG

- John Deere Electronic Solutions

- Lear Corporation

- LG Magna e-Powertrain

- Marelli Corporation

- Meidensha Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Tesla, Inc.

- Toyota Industries Corporation

- Valeo SA

- Vitesco Technologies

- ZF Friedrichshafen AG

The Global EV Traction Inverter Market was valued at USD 6.8 billion in 2024 and is projected to expand at a robust CAGR of 14.7% from 2025 to 2034. The surging adoption of electric vehicles (EVs) worldwide is a key driver of this market growth, as governments promote EVs as a cleaner and more sustainable alternative to internal combustion engine (ICE) vehicles. These efforts aim to significantly reduce greenhouse gas emissions and tackle the pressing challenges of climate change.

Advancements in power electronics are revolutionizing traction inverter performance and efficiency. Breakthrough innovations, such as wide-bandgap semiconductors like silicon carbide and gallium nitride, are enabling greater energy efficiency, improved thermal management, and more compact designs. These technologies are critical for addressing the growing demand for extended driving ranges, faster charging times, and superior vehicle performance, making them indispensable in the rapidly evolving EV industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $26.5 Billion |

| CAGR | 14.7% |

By vehicle type, the market is divided into passenger cars and commercial vehicles. In 2024, the passenger car segment led the market, accounting for 73% of the total share, and is projected to generate USD 19.1 billion by 2034. This growth is propelled by the increasing use of EVs for personal transportation, spurred by heightened environmental consciousness, government incentives, and volatile fuel prices. Passenger cars are transitioning to electric mobility at a faster pace than commercial vehicles, thanks to their larger market base and higher production volumes.

Based on output power, the EV traction inverter market is categorized into <=130 kW and >130 kW segments. The >130 kW segment held 57% of the market share in 2024, driven by the rising preference for high-performance EVs and the electrification of heavy-duty commercial fleets. High-powered inverters are crucial for delivering exceptional torque, acceleration, and extended range, catering to the needs of premium EVs and demanding commercial applications. These advanced inverters are engineered to operate efficiently under high-performance conditions, ensuring reliability and optimal energy utilization.

The U.S. EV traction inverter market dominated with an 83% share in 2024 and is projected to reach USD 4.9 billion by 2034. The country's well-established EV manufacturing ecosystem and growing consumer demand are key factors fueling this expansion. Additionally, significant investments in EV production and the development of critical components, including traction inverters, are bolstering the market growth trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 OEMs

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing adoption of electric vehicles (EV)

- 3.7.1.2 Advancements in power electronics technology

- 3.7.1.3 Electrification of commercial vehicles

- 3.7.1.4 Increasing investments in charging infrastructure

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs of EV and components

- 3.7.2.2 Technical complexity and thermal management

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 BEV

- 5.3 HEV

- 5.4 PHEV

Chapter 6 Market Estimates & Forecast, By Output Power, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 <=130 kW

- 6.3 >130 kW

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 IGBT

- 7.3 MOSFET

Chapter 8 Market Estimates & Forecast, By Semiconductor Material, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 GaN

- 8.3 Si

- 8.4 SiC

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Passenger car

- 9.3 Commercial vehicle

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 BorgWarner Inc.

- 11.2 Continental AG

- 11.3 DENSO Corporation

- 11.4 Drive System Design Ltd

- 11.5 Eaton Corporation

- 11.6 Hitachi Astemo Ltd

- 11.7 Hyundai Mobis Co. Ltd.

- 11.8 Infineon Technologies AG

- 11.9 John Deere Electronic Solutions

- 11.10 Lear Corporation

- 11.11 LG Magna e-Powertrain

- 11.12 Marelli Corporation

- 11.13 Meidensha Corporation

- 11.14 Mitsubishi Electric Corporation

- 11.15 Robert Bosch GmbH

- 11.16 Tesla, Inc.

- 11.17 Toyota Industries Corporation

- 11.18 Valeo SA

- 11.19 Vitesco Technologies

- 11.20 ZF Friedrichshafen AG