|

市场调查报告书

商品编码

1665070

汽车电气分配系统市场机会、成长动力、产业趋势分析与预测 2025 - 2034Automotive Electrical Distribution Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

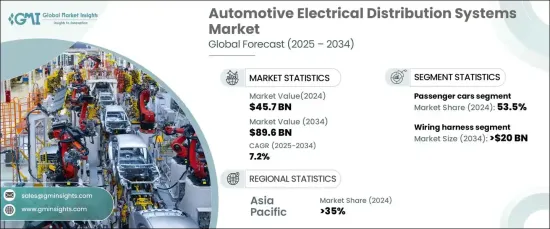

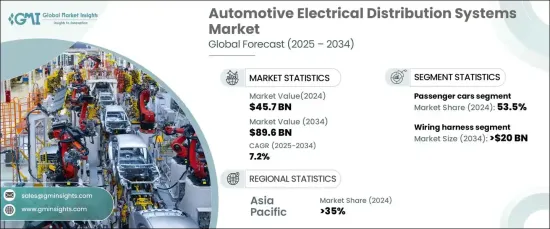

2024 年全球汽车电气分配系统市场价值为 457 亿美元,预计 2025 年至 2034 年期间将以 7.2% 的强劲复合年增长率成长。

市场扩张的一个关键驱动力是对高阶驾驶辅助系统 (ADAS) 的需求不断增长。这些尖端技术,例如自适应巡航控制、车道保持辅助、自动停车、防撞和紧急制动,依靠复杂的传感器、摄影机、雷达和电子设备网路来即时处理资料。这种复杂性凸显了复杂的电力分配系统在实现 ADAS 功能方面的关键作用,从而进一步推动市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 457亿美元 |

| 预测值 | 896亿美元 |

| 复合年增长率 | 7.2% |

市场按组件细分,包括线束、保险丝和继电器系统、开关和感知器、连接器和端子、控制模组(ECU)等。 2024 年,线束领域占据了 24% 的市场份额,预计到 2034 年将创造 200 亿美元的市场价值。

根据车辆类型,市场包括乘用车、商用车、非公路用车、电动和混合动力汽车。 2024 年,乘用车占据市场主导地位,占 53.5% 的份额,这得益于高产量和广泛的应用。这些车辆采用了广泛的电气元件来为先进的系统提供动力,包括资讯娱乐、气候控制、照明、安全功能、动力系统管理和 ADAS,以满足现代消费者的需求。

亚太地区已成为汽车电气配电系统市场的重要参与者,到 2024 年将占 35% 的份额。中国等国家是传统汽车和电动车生产的主要贡献者,推动了对电池管理系统 (BMS)、高压线束和 ECU 等基本配电组件的需求。这些组件对于高效配电和能源管理至关重要,尤其是在电动车中。

报告内容

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 汽车原厂设备製造商

- 技术提供者

- 半导体製造商

- 最终用户

- 利润率分析

- 技术与创新格局

- 成本明细

- 专利格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 电动和混合动力车的普及率不断提高

- 严格的排放和燃油效率法规

- 先进驾驶辅助系统(ADAS) 的需求

- 严格的排放和燃油效率法规

- 产业陷阱与挑战

- 全球半导体短缺

- 製造成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 线束

- 保险丝和继电器

- 开关和感测器

- 连接器和端子

- 控制模组 (ECU)

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车

- 丙型肝炎病毒

- 越野车

- 电动车和混合动力车

第 7 章:市场估计与预测:按电压,2021 - 2034 年

- 主要趋势

- 12伏

- 48伏

- 400V以上

第 8 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 传统的

- 先进的

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Amphenol

- Aptiv

- Draexlmaier

- Eaton

- Furukawa Electric

- Lear

- Leoni

- Littelfuse

- Magna International

- PKC Group

- Prysmian Group

- Rheinmetall

- Samvardhana Motherson

- Spark Minda

- Sumitomo Electric Industries

- TE Connectivity

- Vitesco Technologies

- Yazaki

The Global Automotive Electrical Distribution System Market was valued at USD 45.7 billion in 2024 and is projected to expand at a robust CAGR of 7.2% between 2025 and 2034. This growth is driven by the surging adoption of electric and hybrid vehicles, which rely extensively on advanced electrical components to optimize power management, energy efficiency, and overall vehicle performance.

A key driver of market expansion is the rising demand for Advanced Driver Assistance Systems (ADAS). These cutting-edge technologies, such as adaptive cruise control, lane-keeping assistance, automatic parking, collision avoidance, and emergency braking, rely on an intricate network of sensors, cameras, radars, and electronic devices to process data in real time. This complexity underscores the critical role of sophisticated electrical distribution systems in enabling ADAS functionalities, further propelling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.7 Billion |

| Forecast Value | $89.6 Billion |

| CAGR | 7.2% |

The market is segmented by components, including wiring harnesses, fuse and relay systems, switches and sensors, connectors and terminals, control modules (ECUs), and others. In 2024, the wiring harness segment held a 24% market share and is anticipated to generate USD 20 billion by 2034. Wiring harnesses are integral to automotive electrical distribution systems, serving as the backbone for transmitting electrical power and signals across various vehicle components.

By vehicle type, the market encompasses passenger cars, commercial vehicles, off-highway vehicles, and electric and hybrid vehicles. Passenger cars dominated the market in 2024, capturing a 53.5% share, driven by high production volumes and widespread adoption. These vehicles incorporate a broad spectrum of electrical components to power advanced systems, including infotainment, climate control, lighting, safety features, powertrain management, and ADAS, catering to modern consumer demands.

The Asia Pacific region emerged as a significant player in the automotive electrical distribution system market, accounting for a 35% share in 2024. This dominance is attributed to the region's position as a global hub for automotive manufacturing and the rapid adoption of electric vehicles. Nations like China are leading contributors to both conventional and electric vehicle production, driving demand for essential electrical distribution components such as battery management systems (BMS), high-voltage wiring harnesses, and ECUs. These components are crucial for efficient power distribution and energy management, particularly in electric vehicles.

Report Content

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Technology providers

- 3.2.3 Semiconductor manufacturers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Cost breakdown

- 3.6 Patent landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing adoption of electric and hybrid vehicles

- 3.9.1.2 Stringent emission and fuel efficiency regulations

- 3.9.1.3 Demand for advanced driver assistance systems (ADAS)

- 3.9.1.4 Stringent emission and fuel efficiency regulations

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Global semiconductor shortage

- 3.9.2.2 High manufacturing costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Wiring harness

- 5.3 Fuse & relay

- 5.4 Switches & sensors

- 5.5 Connectors & terminals

- 5.6 Control modules (ECUs)

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 HCV

- 6.4 Off highway vehicle

- 6.5 EVs and hybrid

Chapter 7 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 12v

- 7.3 48v

- 7.4 Above 400V

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Conventional

- 8.3 Advanced

Chapter 9 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amphenol

- 11.2 Aptiv

- 11.3 Draexlmaier

- 11.4 Eaton

- 11.5 Furukawa Electric

- 11.6 Lear

- 11.7 Leoni

- 11.8 Littelfuse

- 11.9 Magna International

- 11.10 PKC Group

- 11.11 Prysmian Group

- 11.12 Rheinmetall

- 11.13 Samvardhana Motherson

- 11.14 Spark Minda

- 11.15 Sumitomo Electric Industries

- 11.16 TE Connectivity

- 11.17 Vitesco Technologies

- 11.18 Yazaki