|

市场调查报告书

商品编码

1665208

化妆品包装机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cosmetics Packaging Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

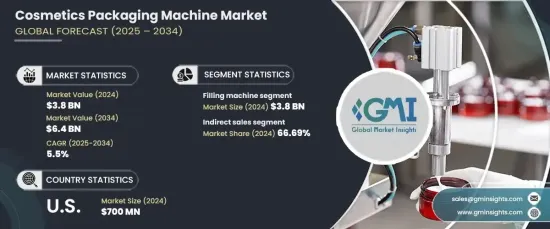

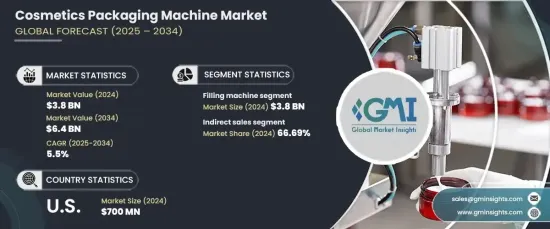

2024 年全球化妆品包装机市场价值达到 38 亿美元,预计 2025 年至 2034 年期间将以 5.5% 的强劲复合年增长率增长。随着消费者偏好的不断变化,对多样化美容产品的需求日益增加,包装机械产业正在适应以满足这些日益增长的需求。

市场根据包装过程中使用的机械类型进行细分。这些关键部分包括灌装机、贴标机、封盖机、包装机等。其中,灌装机占据市场主导地位,2024 年的价值为 38 亿美元。它们的准确性和减少浪费的能力使它们成为化妆品行业的重要组成部分。受高容量、高效机械需求不断增长的推动,预计 2025 年至 2034 年间该领域的复合年增长率将达到 6%。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 38亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 5.5% |

在分销通路方面,化妆品包装机市场分为直接销售和间接销售,其中间接销售占据主导地位,为66.69%。这反映了经销商和代理商在扩大包装机械覆盖范围至更广泛客户群方面的重要性。这些中介机构提供维护、安装和售后支援等有价值的服务,从而提升了客户体验并刺激了市场扩张。

在美国,化妆品包装机市场在 2024 年创收 7 亿美元,预计未来十年的复合年增长率为 5.3%。对个人化、优质和环保化妆品的需求日益增长,推动了对将功能性与永续性相结合的先进包装解决方案的需求。此外,电子商务的快速成长加剧了对紧凑、高效和保护性包装的需求,以满足直接面向消费者的销售日益增长的趋势。美国领先的美容品牌在产品和包装设计上不断创新,进一步推动了对最先进包装机械的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析。

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 全球对护肤品、化妆品和个人护理产品的需求不断增加

- 消费者对永续包装解决方案的偏好日益增加

- 包装技术的创新,例如智慧包装、环保材料和自动化

- 产业陷阱与挑战

- 化妆品包装机相关成本高

- 有关产品安全和包装标准的严格指导方针

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 灌装机

- 贴标机

- 旋盖机

- 包覆机

- 其他的

第 6 章:市场估计与预测:按功能,2021 年至 2034 年

- 主要趋势

- 自动化

- 半自动化

第 7 章:市场估计与预测:依封装类型,2021-2034 年

- 主要趋势

- 容器

- 瓶子

- 泵浦和分配器

- 管装、袋装和棒装

- 其他的

第 8 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 塑胶

- 纸/纸板

- 玻璃

- 金属

- 其他的

第 9 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 皮肤护理

- 头髮护理

- 指甲护理

- 化妆品

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接销售

- 间接销售

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 12 章:公司简介

- APACKS

- Coesia Group

- Fuji Machinery

- IMA

- Krones

- Liquid Packaging Solutions

- Marchesini Group

- Packsys Global Ltd

- ProMach

- Prosy's Innovative Packaging Equipment

- Sidel

- Syntegon Technology

- Turbol Packaging Machine

- Vetraco

- Wimco

- Zhejiang Rigao Machinery Corporation

The Global Cosmetics Packaging Machine Market reached a value of USD 3.8 billion in 2024 and is projected to grow at a robust CAGR of 5.5% from 2025 to 2034. This growth is largely driven by the surging global demand for skincare, makeup, and personal care products, all of which require efficient and scalable packaging solutions. As consumer preferences continue to evolve, with an increasing appetite for diverse beauty products, the packaging machinery industry is adapting to meet these expanding demands.

The market is segmented based on the types of machinery used in the packaging process. These key segments include filling machines, labeling machines, capping machines, wrapping machines, and others. Of these, filling machines dominate the market, with a value of USD 3.8 billion in 2024. Filling machines are critical in dispensing fluid or cream-based products like shampoos, lotions, and serums into containers. Their accuracy and ability to minimize waste make them a vital component in the cosmetics industry. This segment is expected to experience a growth rate of 6% CAGR between 2025 and 2034, driven by the rising demand for high-capacity, efficient machinery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.5% |

When it comes to distribution channels, the cosmetics packaging machine market is divided into direct and indirect sales, with indirect sales holding a dominant share of 66.69%. This reflects the importance of distributors and agents in broadening the reach of packaging machinery to a wider client base. These intermediaries provide valuable services, such as maintenance, installation, and after-sales support, which enhance the customer experience and stimulate market expansion.

In the U.S., the cosmetics packaging machine market generated USD 700 million in 2024 and is expected to grow at a CAGR of 5.3% over the next decade. The increasing demand for personalized, premium, and eco-friendly cosmetic products is driving the need for advanced packaging solutions that combine functionality with sustainability. Additionally, the rapid growth of e-commerce has intensified the need for compact, efficient, and protective packaging, catering to the growing trend of direct-to-consumer sales. Leading beauty brands in the U.S. continue to innovate in both product and packaging design, further boosting the demand for state-of-the-art packaging machinery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing global demand for skincare, makeup, and personal care products

- 3.6.1.2 Rising consumer preference for sustainable packaging solution

- 3.6.1.3 Innovations in packaging technologies, such as smart packaging, eco-friendly materials, and automation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost associated with the cosmetics packaging machine

- 3.6.2.2 Strict guidelines regarding product safety and packaging standards

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling machine

- 5.3 Labelling machine

- 5.4 Capping machine

- 5.5 Wrapping machine

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Function, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automated

- 6.3 Semiautomated

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Containers

- 7.3 Bottles

- 7.4 Pumps & dispensers

- 7.5 Tubes, sachets & sticks

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Plastic

- 8.3 Paper/paperboard

- 8.4 Glass

- 8.5 Metal

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Skin care

- 9.3 Hair care

- 9.4 Nail care

- 9.5 Make up

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 APACKS

- 12.2 Coesia Group

- 12.3 Fuji Machinery

- 12.4 IMA

- 12.5 Krones

- 12.6 Liquid Packaging Solutions

- 12.7 Marchesini Group

- 12.8 Packsys Global Ltd

- 12.9 ProMach

- 12.10 Prosy's Innovative Packaging Equipment

- 12.11 Sidel

- 12.12 Syntegon Technology

- 12.13 Turbol Packaging Machine

- 12.14 Vetraco

- 12.15 Wimco

- 12.16 Zhejiang Rigao Machinery Corporation