|

市场调查报告书

商品编码

1665219

空间 DC-DC 转换器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Space DC-DC Converter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

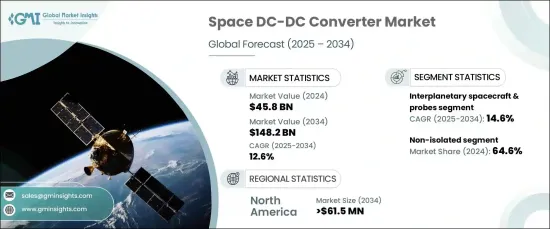

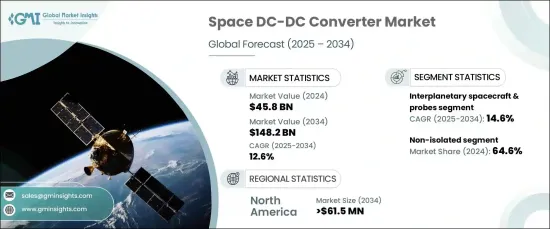

2024 年全球太空 DC-DC 转换器市场规模达到 458 亿美元,预计 2025 年至 2034 年期间将以 12.6% 的强劲复合成长率成长。小型卫星的不断扩大部署和行星际探索的突破进一步推动了对可靠的能源转换、分配和储存解决方案的需求。这些尖端技术不仅优化了性能,而且还延长了任务寿命并降低了营运成本,使其成为未来太空探索不可或缺的一部分。

市场按类型分为非隔离式和隔离式转换器,其中非隔离式部分将在 2024 年成为明显的领先者,占据 64.6% 的市场份额。非隔离转换器以其高效率和紧凑尺寸而闻名,具有快速响应时间且设计简单且具有成本效益。它们重量轻,非常适合要求最高效率和最小重量的应用,为需要高功率密度和可靠性能的系统提供完美的平衡。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 458亿美元 |

| 预测值 | 1482亿美元 |

| 复合年增长率 | 12.6% |

依平台细分,市场包括卫星、太空舱、行星际探测器、探测车和运载火箭。其中,行星际飞船和探测器将经历最快的成长,到 2034 年复合年增长率将达到惊人的 14.6%。高可靠性 DC-DC 转换器在为科学仪器、通讯系统和推进技术供电方面发挥着至关重要的作用,确保在最苛刻的条件下完成任务。

北美预计航太主导全球太空 DC-DC 转换器市场,预计到 2034 年该地区的市场规模将达到 6,150 万美元。北美完善的研发基础设施推动着持续创新,而先进的製造能力和优质材料的取得确保了生产符合太空任务严格要求的耐用、可靠的电力系统。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 太空高效率电源管理需求日益增长

- 卫星技术的进步和小型化要求

- 太空探索和卫星部署的投资不断增加

- 开发可靠、高效、耐辐射的组件

- 扩大太空太阳能发电系统的使用

- 产业陷阱与挑战

- 太空系统的开发和生产成本高昂

- 确保极端条件下的可靠性的技术挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 非隔离

- 孤立

第六章:市场估计与预测:按输出功率,2021-2034 年

- 主要趋势

- <10瓦

- 10-29瓦

- 30-99瓦

- 100-250瓦

- 251-500瓦

- 501-1000瓦

- >1000瓦

第 7 章:市场估计与预测:依外形尺寸,2021 年至 2034 年

- 主要趋势

- 底盘安装

- 封闭式

- 砖

- 离散的

第 8 章:市场估计与预测:按平台,2021-2034 年

- 主要趋势

- 卫星

- 小型卫星(< 500 公斤)

- 中型卫星(501-1000 公斤)

- 大型卫星(> 1000 公斤)

- 胶囊/货物

- 行星际太空船和探测器

- 探测车/太空船着陆器

- 运载火箭

第 9 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 高度和轨道控制系统

- 地面机动和导航系统

- 命令和资料处理系统

- 环境监测系统

- 卫星热电箱

- 电力子系统

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Advanced Energy Industries Inc.

- Airbus Group SE

- Astronics Corporation

- Crane Co.

- EPC Space

- Infineon Technologies AG

- Microsemi Corporation

- Modular Devices Inc.

- Renesas Electronics Corporation

- STMicroelectronics

- SynQor Inc.

- Texas Instruments Incorporated

- Thales Group

- Vicor Corporation

- VPT

The Global Space DC-DC Converter Market reached USD 45.8 billion in 2024 and is projected to grow at a robust CAGR of 12.6% between 2025 and 2034. This remarkable growth is fueled by the increasing demand for efficient power management systems, driven by the rising complexity and frequency of space missions. Expanding deployments of small satellites and breakthroughs in interplanetary exploration are further propelling the need for reliable energy conversion, distribution, and storage solutions. These cutting-edge technologies not only optimize performance but also extend mission lifespans and reduce operational costs, making them indispensable to the future of space exploration.

The market is categorized by type into non-isolated and isolated converters, with the non-isolated segment emerging as the clear leader in 2024, holding 64.6% of the market share. Known for their high efficiency and compact size, non-isolated converters deliver fast response times and are designed for simplicity and cost-effectiveness. Their lightweight nature makes them ideal for applications demanding maximum efficiency and minimal weight, offering a perfect balance for systems requiring high power density and reliable performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.8 Billion |

| Forecast Value | $148.2 Billion |

| CAGR | 12.6% |

When segmented by platform, the market includes satellites, capsules, interplanetary probes, rovers, and launch vehicles. Among these, interplanetary spacecraft and probes are set to experience the fastest growth, with an impressive CAGR of 14.6% through 2034. These platforms require robust and resilient power systems capable of enduring extreme environmental conditions while delivering reliable energy distribution for mission-critical operations. High-reliability DC-DC converters play an essential role in powering scientific instruments, communication systems, and propulsion technologies, ensuring mission success in the most demanding conditions.

North America is poised to dominate the global space DC-DC converter market, with the region projected to reach USD 61.5 million by 2034. This leadership is fueled by significant investments in aerospace, defense, and space exploration. North America's well-established research and development infrastructure drives continuous innovation, while advanced manufacturing capabilities and access to premium-quality materials ensure the production of durable and dependable power systems tailored to the rigorous demands of space missions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for efficient power management in space

- 3.6.1.2 Advancements in satellite technology and miniaturization requirements

- 3.6.1.3 Rising investments in space exploration and satellite deployments

- 3.6.1.4 Development of reliable, high-efficiency, radiation-tolerant components

- 3.6.1.5 Expanding use of space-based solar power generation systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of development and production for space systems

- 3.6.2.2 Technical challenges in ensuring reliability under extreme conditions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Non-isolated

- 5.3 Isolated

Chapter 6 Market Estimates & Forecast, By Output Power, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 <10W

- 6.3 10-29W

- 6.4 30-99W

- 6.5 100-250W

- 6.6 251-500W

- 6.7 501-1000W

- 6.8 >1000W

Chapter 7 Market Estimates & Forecast, By Form Factor, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Chassis mount

- 7.3 Enclosed

- 7.4 Brick

- 7.5 Discrete

Chapter 8 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Satellites

- 8.2.1 Small satellites (< 500 Kg)

- 8.2.2 Medium satellites (501-1000 Kg)

- 8.2.3 Large satellites (> 1000 Kg)

- 8.3 Capsules/Cargos

- 8.4 Interplanetary spacecraft & probes

- 8.5 Rovers/Spacecraft landers

- 8.6 Launch vehicles

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Altitude & orbital control systems

- 9.3 Surface mobility and navigation systems

- 9.4 Command & data handling systems

- 9.5 Environmental monitoring systems

- 9.6 Satellite thermal power box

- 9.7 Electric power subsystems

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Advanced Energy Industries Inc.

- 11.2 Airbus Group SE

- 11.3 Astronics Corporation

- 11.4 Crane Co.

- 11.5 EPC Space

- 11.6 Infineon Technologies AG

- 11.7 Microsemi Corporation

- 11.8 Modular Devices Inc.

- 11.9 Renesas Electronics Corporation

- 11.10 STMicroelectronics

- 11.11 SynQor Inc.

- 11.12 Texas Instruments Incorporated

- 11.13 Thales Group

- 11.14 Vicor Corporation

- 11.15 VPT