|

市场调查报告书

商品编码

1665222

直视 LED 显示器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Direct View LED Display Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

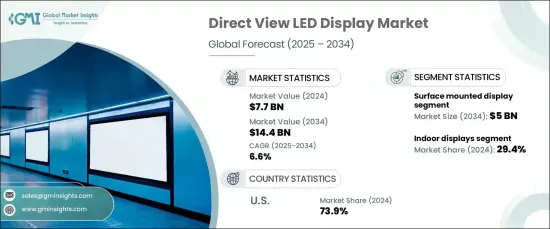

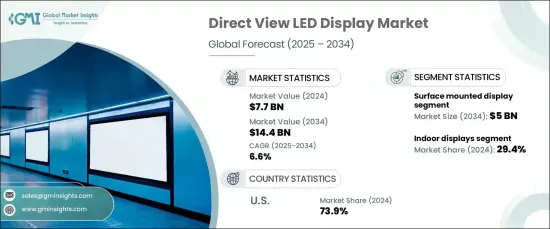

2024 年全球直视 LED 显示器市场规模达到 77 亿美元,预计 2025 年至 2034 年期间将以 6.6% 的强劲复合年增长率成长。 DVLED 显示器以其提供生动的视觉效果、无缝的性能和卓越的耐用性而闻名,正在成为各种室内和室外应用的首选解决方案。

2024 年,室内显示器将成为市场领导者,占 29.4% 的份额。其清晰的解析度、精确的色彩准确度和美观性使其在企业环境、零售空间和娱乐场所的应用中备受追捧。室内 DVLED 系统采用更精细的像素间距和优化的亮度等级设计,范围从 500 到 1,500 个单位,提供无与伦比的视觉清晰度,满足这些高端产业的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 144亿美元 |

| 复合年增长率 | 6.6% |

在技术方面,由于其紧凑的设计和卓越的耐用性,表面贴装显示器预计到 2034 年将产生 50 亿美元的市场价值。这些显示器利用表面贴装设备 (SMD) 技术,将 LED 晶片直接整合到电路板中,从而提高了亮度、色彩一致性和整体性能。这项先进技术非常适合室内和室外安装,包括动态数位看板和大尺寸显示器。

2024 年,美国市场引领全球 DVLED 市场,占有高达 73.9% 的市占率。这种主导地位很大程度上归因于 DVLED 显示器在零售、娱乐和商业领域的日益普及。零售商越来越多地利用这些显示器来实现动态店内标牌,创造引人入胜的客户体验,同时增强视觉吸引力。在城市地区,户外广告正在经历数位转型,静态广告看板让位给引人注目的数位替代品。娱乐产业也采用 DVLED 技术在体育场馆、音乐会场馆和活动场所创造身临其境的体验。

随着对视觉衝击力大、节能的显示解决方案的需求不断增长,DVLED 市场必将蓬勃发展。像素密度和智慧功能整合的技术进步正在推动创新并扩大应用。由于应用范围涵盖各个领域,直觉 LED 显示器市场在预测期内将实现显着成长并带来变革性影响。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对高品质视觉体验的需求日益增加

- 成本下降和技术进步

- 户外广告和数位看板的采用日益广泛

- 互动式显示器日益流行

- 产业陷阱与挑战

- 初期投资及维护成本高

- 技术挑战和复杂集成

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按显示类型,2021 年至 2034 年

- 主要趋势

- 室内显示幕

- 户外显示器

- 体育场萤幕

- 数位看板

第 6 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 表面贴装显示器

- 板载晶片显示

- MicroLED 显示器

- 量子点显示器

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 广告

- 运动的

- 运输

- 零售

- 广播

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 政府

- 商业的

- 教育

- 住宅

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Absen

- AOTO Electronics

- Barco NV

- Christie Digital Systems

- Daktronics

- Delta Electronics

- INFiLED

- Ledman Optoelectronic

- Leyard Optoelectronic

- LG Electronics

- Lighthouse Technologies

- NEC Display Solutions

- Planar Systems

- ROE Visual

- Samsung Electronics

- Shenzhen Absen Optoelectronic

- Shenzhen Liantronics

- SiliconCore Technology

- Unilumin Group

- Yaham Optoelectronics

The Global Direct View LED Display Market reached USD 7.7 billion in 2024 and is anticipated to grow at a robust CAGR of 6.6% from 2025 to 2034. The increasing demand for high-resolution, energy-efficient displays is fueling this growth across commercial, entertainment, and retail sectors. Renowned for their ability to deliver vibrant visuals, seamless performance, and exceptional durability, DVLED displays are becoming the go-to solution for a wide range of indoor and outdoor applications.

In 2024, indoor displays emerged as the market leader, capturing a 29.4% share. Their sharp resolution, precise color accuracy, and aesthetic appeal make them highly sought after for applications in corporate environments, retail spaces, and entertainment venues. Designed with finer pixel pitches and optimized brightness levels ranging from 500 to 1,500 units, indoor DVLED systems offer unmatched visual clarity, meeting the demands of these high-profile sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $14.4 Billion |

| CAGR | 6.6% |

On the technology front, surface-mounted displays are projected to generate USD 5 billion by 2034, driven by their compact design and superior durability. Leveraging Surface Mounted Device (SMD) technology, these displays feature LED chips directly integrated into circuit boards, enhancing brightness, color consistency, and overall performance. This advanced technology is ideal for both indoor and outdoor installations, including dynamic digital signage and large-format displays.

The U.S. market led the global DVLED landscape in 2024, holding an impressive 73.9% share. This dominance is largely attributed to the growing adoption of DVLED displays across retail, entertainment, and commercial sectors. Retailers are increasingly leveraging these displays for dynamic in-store signage, creating engaging customer experiences while enhancing visual appeal. In urban areas, outdoor advertising is undergoing a digital transformation as static billboards give way to eye-catching digital alternatives. The entertainment industry is also embracing DVLED technology to create immersive experiences in sports arenas, concert venues, and event spaces.

As the demand for visually striking, energy-efficient display solutions continues to rise, the DVLED market is set to flourish. Technological advancements in pixel density and the integration of smart features are driving innovation and expanding adoption. With applications spanning diverse sectors, the direct view LED display market is poised for significant growth and transformative impact over the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-quality visual experiences

- 3.6.1.2 Declining costs and technological advancements

- 3.6.1.3 Growing adoption in outdoor advertising and digital signage

- 3.6.1.4 Rising popularity of interactive displays

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and maintenance costs

- 3.6.2.2 Technical challenges and complex integration

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Display Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Indoor displays

- 5.3 Outdoor displays

- 5.4 Stadium screens

- 5.5 Digital signage

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Surface mounted display

- 6.3 Chip on board display

- 6.4 MicroLED display

- 6.5 Quantum dot display

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Advertising

- 7.3 Sports

- 7.4 Transportation

- 7.5 Retail

- 7.6 Broadcasting

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Government

- 8.3 Commercial

- 8.4 Educational

- 8.5 Residential

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Absen

- 10.2 AOTO Electronics

- 10.3 Barco NV

- 10.4 Christie Digital Systems

- 10.5 Daktronics

- 10.6 Delta Electronics

- 10.7 INFiLED

- 10.8 Ledman Optoelectronic

- 10.9 Leyard Optoelectronic

- 10.10 LG Electronics

- 10.11 Lighthouse Technologies

- 10.12 NEC Display Solutions

- 10.13 Planar Systems

- 10.14 ROE Visual

- 10.15 Samsung Electronics

- 10.16 Shenzhen Absen Optoelectronic

- 10.17 Shenzhen Liantronics

- 10.18 SiliconCore Technology

- 10.19 Unilumin Group

- 10.20 Yaham Optoelectronics