|

市场调查报告书

商品编码

1665230

眼科光凝器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ophthalmic Photocoagulator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

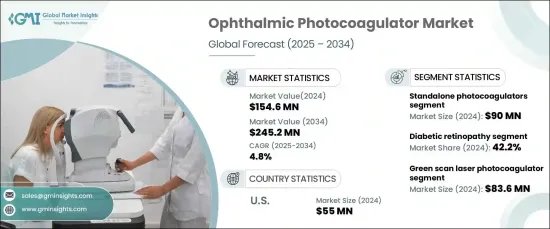

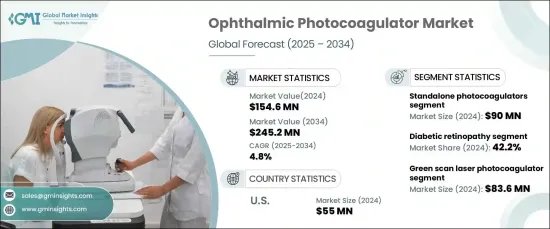

2024 年全球眼科光凝固器市场价值为 1.546 亿美元,预计 2025 年至 2034 年期间将以 4.8% 的强劲复合年增长率增长。 推动这一增长的主要驱动因素包括视网膜疾病患病率的不断上升、医疗保健基础设施的扩展以及对移动和家庭医疗保健解决方案的需求不断增长。

远距眼科在这项扩展中发挥关键作用,使患者,特别是老年人和行动不便的患者,能够远端获得咨询和小型治疗。便携式设备与远距医疗平台的结合,增强了医疗服务不足和农村地区获得眼科护理的机会,推动了眼科光凝器的普及。此外,非政府组织(NGO)和医疗机构正在利用远距眼科来提高发展中国家的眼科护理的可近性,进一步推动市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.546亿美元 |

| 预测值 | 2.452亿美元 |

| 复合年增长率 | 4.8% |

全球范围内向现代生活习惯的转变,例如久坐不动、不良饮食和肥胖率上升,导致糖尿病和高血压等慢性病的增加。这些健康问题是糖尿病视网膜病变和高血压视网膜病变等视网膜疾病的主要风险因素。预计到 2045 年全球糖尿病患者人数将达到 7 亿,对雷射光凝固等有效治疗的需求将持续上升,从而支持眼科光凝器市场的长期成长。

就产品类型而言,市场分为便携式光凝器和独立式光凝器。独立式光凝固器目前占据最大的市场份额,2024 年价值为 9,000 万美元。这些系统具有先进的功能,包括增强的光束稳定性、更广泛的治疗范围和卓越的冷却系统,使其成为治疗需要长期使用的慢性视网膜疾病的理想选择。

市场也按最终用户类别划分,包括医院、门诊手术中心和眼科诊所。医院部门在 2024 年引领市场,预计到 2034 年市场价值将达到 1.135 亿美元。

2024 年,美国眼科光凝固器市场价值为 5,500 万美元。这反过来有望进一步加速北美市场的成长,促进先进眼科技术在医院和门诊环境中的使用。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 眼部疾病盛行率上升

- 提高认识和诊断率

- 产品技术进步

- 产业陷阱与挑战

- 设备成本高且监管要求严格

- 成长动力

- 成长潜力分析

- 监管格局

- 报销场景

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 独立式光凝固器

- 便携式光凝器

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 糖尿病视网膜病变

- 老年黄斑部病变(AMD)

- 青光眼

- 视网膜撕裂与脱离

- 其他应用

第 7 章:市场估计与预测:按波长,2021 – 2034 年

- 主要趋势

- 绿扫描雷射光凝器

- 黄扫描雷射光凝器

- 多色扫描雷射光凝器

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 眼科诊所

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ARC Laser

- Alcon

- Appasamy Associates

- Bausch + Lomb

- Coherent

- IRIDEX

- LIGHTMED

- Lumenis

- Lumibird Medical

- MERIDIAN

- NIDEK

- Phoenix-Micron

- Topcon

The Global Ophthalmic Photocoagulator Market was valued at USD 154.6 million in 2024 and is forecasted to grow at a robust CAGR of 4.8% from 2025 to 2034. Key drivers fueling this growth include the increasing prevalence of retinal diseases, the expansion of healthcare infrastructure, and the rising demand for mobile and home-based healthcare solutions.

Tele-ophthalmology plays a pivotal role in this expansion, enabling patients, especially the elderly and those with limited mobility, to access consultations and minor treatments remotely. The integration of portable devices with telemedicine platforms is enhancing access to eye care in underserved and rural regions, driving the adoption of ophthalmic photocoagulators. Furthermore, non-governmental organizations (NGOs) and healthcare institutions are using tele-ophthalmology to improve eye care accessibility in developing countries, further propelling the market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $154.6 Million |

| Forecast Value | $245.2 Million |

| CAGR | 4.8% |

The global shift toward modern lifestyle habits, such as sedentary behavior, poor diets, and rising obesity rates, is contributing to the increase in chronic conditions like diabetes and hypertension. These health issues are major risk factors for retinal diseases, such as diabetic retinopathy and hypertensive retinopathy. With the global diabetic population expected to reach 700 million by 2045, the demand for effective treatments like laser photocoagulation will continue to rise, supporting the ophthalmic photocoagulator market's long-term growth.

In terms of product types, the market is segmented into portable and standalone photocoagulators. The standalone segment currently holds the largest market share, valued at USD 90 million in 2024. Standalone photocoagulators are preferred in high-demand healthcare settings like hospitals and ophthalmology centers. These systems offer advanced features, including enhanced beam stability, broader treatment ranges, and superior cooling systems, making them ideal for treating chronic retinal diseases that require prolonged usage.

The market is also divided by end-user categories, including hospitals, ambulatory surgery centers, and ophthalmology clinics. The hospital segment led the market in 2024, with a projected market value of USD 113.5 million by 2034. Hospitals remain the primary location for complex ophthalmic procedures, as they are equipped to provide specialized care, especially for high-risk retinal conditions.

The U.S. ophthalmic photocoagulator market was valued at USD 55 million in 2024. The country's favorable reimbursement policies, particularly through Medicare, are making laser treatments more accessible, especially for older adults who are more likely to suffer from retinal diseases. This, in turn, is expected to further accelerate market growth in North America, promoting the use of advanced ophthalmic technologies in hospitals and outpatient settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of eye disorders

- 3.2.1.2 Increasing awareness and diagnosis rates

- 3.2.1.3 Technological advancements in products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device cost and stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Standalone photocoagulators

- 5.3 Portable photocoagulators

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetic retinopathy

- 6.3 Age-related macular degeneration (AMD)

- 6.4 Glaucoma

- 6.5 Retinal tears and detachments

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Wavelength, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Green scan laser photocoagulator

- 7.3 Yellow scan laser photocoagulator

- 7.4 Multicolor scan laser photocoagulator

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgery centers

- 8.4 Ophthalmology clinics

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 A.R.C. Laser

- 10.2 Alcon

- 10.3 Appasamy Associates

- 10.4 Bausch + Lomb

- 10.5 Coherent

- 10.6 IRIDEX

- 10.7 LIGHTMED

- 10.8 Lumenis

- 10.9 Lumibird Medical

- 10.10 MERIDIAN

- 10.11 NIDEK

- 10.12 Phoenix-Micron

- 10.13 Topcon