|

市场调查报告书

商品编码

1665245

光感测器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Light Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

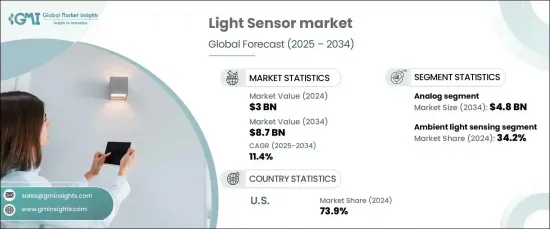

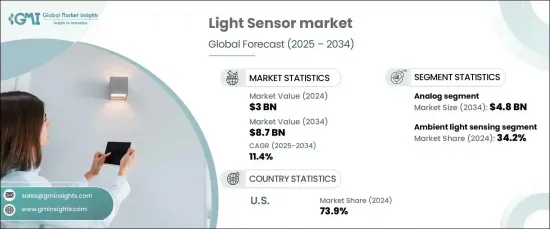

2024 年全球光感测器市场规模达到 30 亿美元,预计将经历大幅增长,预计 2025 年至 2034 年的复合年增长率为 11.4%。这些创新显着提高了感测器功能,例如更宽的光谱检测和在各种照明条件下增强的性能。因此,光感测器的应用正在扩展到多个行业,并提供了新的成长机会。

市场按类型细分为环境光感应、接近检测、RGB 颜色感应、手势识别和紫外线/红外线 (IR) 检测。其中,环境光感应领域在 2024 年占据市场主导地位,占有 34.2% 的份额。环境光感测器对于测量周围光强度和调整设备设定以优化性能至关重要。这些感测器广泛应用于电子产品,透过自动调节亮度等级和节省电力,帮助增强使用者体验、提高能源效率并优化设备功能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 87亿美元 |

| 复合年增长率 | 11.4% |

从产量来看,光感测器市场分为类比感测器和数位感测器。预计到 2034 年,类比感测器领域将产生 48 亿美元的收入。它们的可靠性和与类比系统的无缝整合使其在环境光检测、智慧照明和节能係统等应用中特别有益。消费性电子、汽车和工业自动化等产业越来越依赖这些感测器来提高营运效率和性能。

2024年美国光感测器市场占全球市场份额的73.9%。这种主导地位很大程度上归功于该国强大的技术基础设施以及消费性电子、汽车和医疗保健等关键领域对光感测器的高需求。物联网设备的日益普及和自主技术的进步进一步促进了对先进光感测器的需求不断增长。此外,政府对智慧城市计画和永续基础设施的支持正在加速光感测器在公共和商业应用中的采用,进一步巩固了美国作为市场领导者的地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 光感测技术的技术进步

- 智慧型设备和物联网应用的普及率不断提高

- 增加节能解决方案和永续发展重点

- 汽车工业和自动驾驶汽车的成长

- 产业陷阱与挑战

- 先进光感测技术成本高

- 整合复杂性和相容性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 环境光感应

- 接近探测器

- RGB 颜色感应

- 手势识别

- 紫外线/红外线(IR)检测

第六章:市场估计与预测:依产量,2021-2034 年

- 主要趋势

- 模拟

- 数位的

第 7 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 光电二极体

- 光电电晶体

- 电荷耦合元件 (CCD)

- 互补金属氧化物半导体 (CMOS) 感测器

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 消费性电子产品

- 智慧型手机

- 电视机

- 平板电脑

- 穿戴式装置

- 汽车

- 工业的

- 其他

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Analog Devices, Inc.

- ams-OSRAM AG

- Broadcom Inc.

- Everlight Electronics Co., Ltd.

- Geospace Technologies Corporation

- Hamamatsu Photonics KK

- Honeywell International Inc.

- Infineon Technologies AG

- Kyocera Corporation

- Lite-On Technology Corporation

- Microchip Technology Incorporated

- NXP Semiconductors NV

- ON Semiconductor Corporation

- OSRAM Opto Semiconductors GmbH

- Panasonic Corporation

- ROHM Semiconductor

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- STMicroelectronics NV

- TDK Corporation

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

The Global Light Sensor Market reached USD 3 billion in 2024 and is expected to experience substantial growth, with a projected CAGR of 11.4% from 2025 to 2034. This impressive growth is being driven by rapid advancements in technology, which have led to the creation of highly sensitive, compact, and multi-spectral light sensors. These innovations have significantly improved sensor capabilities, such as broader spectrum detection and enhanced performance under various lighting conditions. As a result, the applications of light sensors are expanding across multiple industries, offering new opportunities for growth.

The market is segmented by type into ambient light sensing, proximity detection, RGB color sensing, gesture recognition, and UV/infrared (IR) detection. Among these, the ambient light sensing segment led the market in 2024, holding a 34.2% share. Ambient light sensors are crucial in measuring the surrounding light intensity and adjusting device settings to optimize performance. These sensors are widely used in electronics, helping to enhance user experience, improve energy efficiency, and optimize device functionality by automatically adjusting brightness levels and conserving power.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 billion |

| Forecast Value | $8.7 billion |

| CAGR | 11.4% |

In terms of output, the light sensor market is divided into analog and digital sensors. The analog sensor segment is expected to generate USD 4.8 billion in revenue by 2034. Analog light sensors are preferred in applications that require continuous output signals proportional to light intensity, making them ideal for precise and real-time measurements. Their reliability and seamless integration with analog systems make them particularly beneficial in applications such as ambient light detection, smart lighting, and energy-saving systems. Industries like consumer electronics, automotive, and industrial automation are increasingly dependent on these sensors to improve operational efficiency and performance.

In 2024, the U.S. light sensor market accounted for 73.9% of the global market share. This dominance is largely due to the country's strong technological infrastructure and high demand for light sensors in key sectors like consumer electronics, automotive, and healthcare. The growing proliferation of IoT devices and advancements in autonomous technologies further contribute to the rising need for advanced light sensors. Moreover, government support for smart city projects and sustainable infrastructure is accelerating the adoption of light sensors in public and commercial applications, further solidifying the U.S. position as a market leader.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Technological advancements in light sensing technology

- 3.6.1.2 Rising adoption of smart devices and IoT applications

- 3.6.1.3 Increase in energy-efficient solutions and sustainability focus

- 3.6.1.4 Growth in automotive industry and autonomous vehicles

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of advanced light sensing technologies

- 3.6.2.2 Integration complexity and compatibility issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Volume Unit)

- 5.1 Key trends

- 5.2 Ambient light sensing

- 5.3 Proximity detector

- 5.4 RGB color sensing

- 5.5 Gesture recognition

- 5.6 UV/infrared light (IR) detection

Chapter 6 Market Estimates & Forecast, By Output, 2021-2034 (USD Billion) (Volume Unit)

- 6.1 Key trends

- 6.2 Analog

- 6.3 Digital

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Volume Unit)

- 7.1 Key trends

- 7.2 Photodiodes

- 7.3 Phototransistors

- 7.4 Charge-Coupled devices (CCDs)

- 7.5 Complementary metal-oxide-semiconductor (CMOS) sensors

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Volume Unit)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.2.1 Smartphones

- 8.2.2 Televisions

- 8.2.3 Tablets

- 8.2.4 Wearables

- 8.3 Automotive

- 8.4 Industrial

- 8.5 Other

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Volume Unit)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Analog Devices, Inc.

- 10.2 ams-OSRAM AG

- 10.3 Broadcom Inc.

- 10.4 Everlight Electronics Co., Ltd.

- 10.5 Geospace Technologies Corporation

- 10.6 Hamamatsu Photonics K.K.

- 10.7 Honeywell International Inc.

- 10.8 Infineon Technologies AG

- 10.9 Kyocera Corporation

- 10.10 Lite-On Technology Corporation

- 10.11 Microchip Technology Incorporated

- 10.12 NXP Semiconductors N.V.

- 10.13 ON Semiconductor Corporation

- 10.14 OSRAM Opto Semiconductors GmbH

- 10.15 Panasonic Corporation

- 10.16 ROHM Semiconductor

- 10.17 Samsung Electronics Co., Ltd.

- 10.18 Sharp Corporation

- 10.19 STMicroelectronics N.V.

- 10.20 TDK Corporation

- 10.21 Texas Instruments Incorporated

- 10.22 Vishay Intertechnology, Inc.