|

市场调查报告书

商品编码

1665285

空间物流市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Space Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

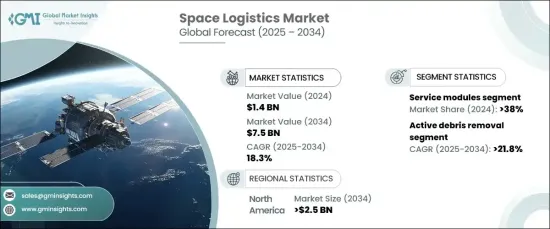

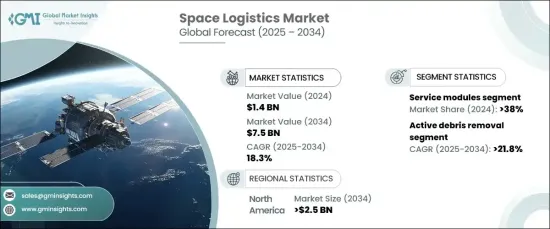

2024 年全球太空物流市场价值为 14 亿美元,将经历强劲增长,预计 2025 年至 2034 年的年复合成长率(CAGR) 为 18.3%。 这一增长主要受到卫星部署、在轨服务和太空探索计划日益增长的需求的推动。可重复使用发射技术的创新,加上用于通讯和地球观测的卫星星座的不断增加,大大增加了对太空高效运输和营运支援的需求。此外,太空旅游和采矿等商业活动的兴起,以及政府主导的雄心勃勃的月球和火星计划,正在催化技术进步并开闢新的成长机会。

太空物流市场分为多种类型,包括服务模组、任务扩展舱(MEP)、货物模组、机械手臂和操纵器以及太空拖船。 2024 年,服务模组部门将占据 38% 的市场份额,预计将实现显着成长。这些模组透过提供推进、动力和通讯系统等关键功能,对于维持卫星运作至关重要。随着卫星星座部署的扩大,服务模组在延长卫星寿命和支援轨道永续性方面发挥关键作用,推动了其在整个领域的快速应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 18.3% |

市场还根据营运进行细分,关键领域包括寿命延长、最后一英里交付、主动碎片清除、空间态势感知以及在轨组装和製造。预计到 2034 年,主动碎片清除领域将以惊人的 21.8% 的复合年增长率成长。正在开发机械手臂、网和鱼叉等尖端工具来捕获未使用的卫星和碎片,而人工智慧演算法则提高复杂轨道环境中的导航和操作精度。

预计到 2034 年,北美太空物流市场规模将达到 25 亿美元。可重复使用运载火箭的采用在降低营运成本、增加发射频率方面发挥了关键作用,使太空物流运作更有效率、更具成本效益。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 卫星发射需求增加

- 太空运输和基础设施的进步

- 不断增长的可重复使用发射系统和太空船

- 太空中复杂有效载荷部署的需求不断增长

- 转向太空服务以及部署和管理卫星舰队的灵活模式

- 产业陷阱与挑战

- 太空行动成本高昂

- 空间交通管理与碎片减缓

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 任务扩展舱 (MEP)

- 货物模组

- 服务模组

- 机械手臂和机械手

- 太空拖船

第六章:市场估计与预测:按运营,2021-2034 年

- 主要趋势

- 最后一哩配送

- 空间态势感知

- 延长寿命

- 主动清除碎片

- 在轨组装和製造

第 7 章:市场估计与预测:按 Orbit,2021 年至 2034 年

- 主要趋势

- 近地轨道

- 低地球轨道

- 地球静止轨道

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 商业的

- 政府和国防

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Arianespace

- Astroscale

- Atomos Space

- Blue Origin

- ClearSpace

- D-Orbit

- Exolaunch

- Japan Aerospace Exploration Agency

- Lockheed Martin

- Maxar Technologies

- Northrop Grumman

- Rocket Lab

- SpaceX

- Thales Alenia Space

The Global Space Logistics Market, valued at USD 1.4 billion in 2024, is set to experience robust growth with a projected compound annual growth rate (CAGR) of 18.3% from 2025 to 2034. This growth is largely driven by the increasing demand for satellite deployment, in-orbit servicing, and space exploration programs. Innovations in reusable launch technologies, coupled with the rising deployment of satellite constellations for communication and Earth observation, have significantly boosted the need for efficient transportation and operational support in space. Furthermore, the rise of commercial ventures, such as space tourism and mining, along with ambitious government-led missions to the Moon and Mars, are catalyzing technological advancements and opening up new growth opportunities.

The space logistics market is segmented into various types, including service modules, Mission Extension Pods (MEPs), cargo modules, robotic arms and manipulators, and space tugs. In 2024, the service modules segment held a substantial 38% market share and is expected to see significant growth. These modules have become essential for maintaining satellite operations by providing critical functions such as propulsion, power, and communication systems. As the deployment of satellite constellations expands, service modules are playing a key role in extending satellite lifespans and supporting orbital sustainability, driving their rapid adoption across the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 billion |

| Forecast Value | $7.5 billion |

| CAGR | 18.3% |

The market is also segmented by operation, with key areas including life extension, last-mile delivery, active debris removal, space situational awareness, and on-orbit assembly and manufacturing. The active debris removal segment is forecasted to grow at an impressive CAGR of 21.8% through 2034. This growth is fueled by advancements in autonomous robotics and artificial intelligence (AI) technologies, which enhance space debris management systems. Cutting-edge tools such as robotic arms, nets, and harpoons are being developed to capture unused satellites and debris, while AI-powered algorithms improve navigation and operational precision in complex orbital environments.

North America space logistics market is projected to reach USD 2.5 billion by 2034. The U.S. market, in particular, is experiencing significant growth due to the increasing demand for satellite deployment and advancements in space infrastructure. The adoption of reusable launch vehicles has played a critical role in reducing operational costs and increasing launch frequencies, making space logistics operations more efficient and cost-effective.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased satellite launch demand

- 3.6.1.2 Advancements in space transportation and infrastructure

- 3.6.1.3 Growing reusable launch systems and spacecraft

- 3.6.1.4 Rising demand for complex payload deployment in space

- 3.6.1.5 Shift toward space as a service and flexible models for deploying and managing satellite fleets

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of space operations

- 3.6.2.2 Space traffic management and debris mitigation

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Mission extension pods (MEPs)

- 5.3 Cargo modules

- 5.4 Service modules

- 5.5 Robotic arms and manipulators

- 5.6 Space tugs

Chapter 6 Market Estimates & Forecast, By Operation, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Last mile delivery

- 6.3 Space situational awareness

- 6.4 Life-extension

- 6.5 Active debris removal

- 6.6 On-orbit assembly and manufacturing

Chapter 7 Market Estimates & Forecast, By Orbit, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Near earth orbit

- 7.3 Lower earth orbit

- 7.4 Geostationary orbit

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Government and defense

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arianespace

- 10.2 Astroscale

- 10.3 Atomos Space

- 10.4 Blue Origin

- 10.5 ClearSpace

- 10.6 D-Orbit

- 10.7 Exolaunch

- 10.8 Japan Aerospace Exploration Agency

- 10.9 Lockheed Martin

- 10.10 Maxar Technologies

- 10.11 Northrop Grumman

- 10.12 Rocket Lab

- 10.13 SpaceX

- 10.14 Thales Alenia Space