|

市场调查报告书

商品编码

1665286

农业喷雾器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Agricultural Sprayers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

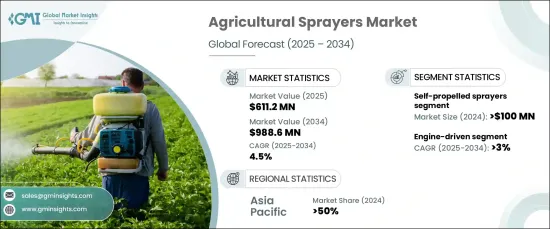

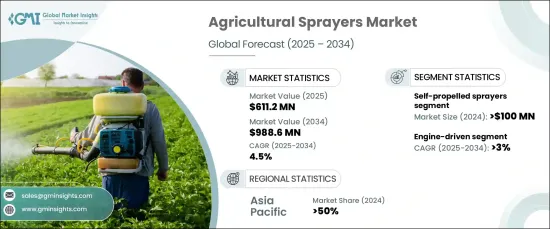

2024 年全球农业喷雾器市场规模达到 6.112 亿美元,预计 2025 年至 2034 年期间将以 4.5% 的强劲复合年增长率增长。为了保持竞争力,农业喷雾器行业的公司正在建立策略合作伙伴关係和收购,以加强技术创新并扩大其产品组合。这些努力有助于整体市场的扩张,并将农业喷雾器定位为现代农业实践中必不可少的工具。

市场按产品类型细分,主要类别包括自走式喷雾器、悬吊式喷雾器、手持式喷雾器、背负式喷雾器、拖曳式喷雾器、空中喷雾器等。其中,自走式喷雾器市场在 2024 年创收 1 亿美元,预计将稳定成长。 GPS 整合和自动化等技术进步显着提高了这些喷雾器的操作效率和精度。变数速率技术和即时监控系统等功能有助于优化投入使用、减少环境影响、改善作物保护,使自走式喷雾器成为永续农业实践不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.112亿美元 |

| 预测值 | 9.886 亿美元 |

| 复合年增长率 | 4.5% |

就动力源而言,市场分为手排、电池供电、引擎驱动和太阳能供电等选项。预计预测期内,引擎驱动部分的复合年增长率为 3%。这种成长的动力来自于农业机械化的不断提高以及对更高生产力同时减少化学品使用的需求。最新的引擎技术提高了燃油效率并减少了排放,进一步吸引了具有环保意识的农民并促进了该领域的成长。

2024 年,亚太地区占据农业喷雾器市场的 50% 主导份额。该地区各国正在大力投资农业设备和现代化农业解决方案,以提高生产力并应对粮食安全挑战。随着机械化程度不断提高,对高效能农业喷雾器的需求预计将上升,进一步巩固亚太地区在全球市场的领导地位。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商格局

- 组件提供者

- 製造商

- 经销商

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 案例研究

- 成本分析

- 衝击力

- 成长动力

- 精准农业技术的采用日益增多

- 对高效能作物保护解决方案的需求日益增加

- 人们对永续农业实践的认识不断提高

- 喷雾器技术和自动化的进步

- 产业陷阱与挑战

- 先进喷雾器的初始投资成本高

- 新技术与现有设备整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 手持喷雾器

- 背负式喷雾器

- 牵引式喷雾机

- 悬挂式喷雾器

- 自走式喷雾机

- 空中喷雾机

- 其他的

第 6 章:市场估计与预测:按电源分类,2021 - 2034 年

- 主要趋势

- 手动的

- 电池供电

- 引擎驱动

- 太阳能

第七章:市场估计与预测:依产能,2021 - 2034 年

- 主要趋势

- 音量低

- 中等音量

- 高容量

第 8 章:市场估计与预测:按作物,2021 - 2034 年

- 主要趋势

- 谷物

- 油籽和豆类

- 水果和蔬菜

- 其他的

第 9 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 油压喷嘴

- 空气辅助静电

- 超低容量 (ULV) 喷洒

- 精密喷涂

- 其他的

第 10 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 离线

第 11 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 田间喷洒

- 果园喷药

- 种植园喷药

- 其他的

第 12 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 13 章:公司简介

- AGCO

- Alamo

- Changfa Agricultural Equipment

- CLAAS KGaA

- CNH Industrial

- Excel Industries

- Horsch Maschinen

- Jacto

- JCB Agriculture

- John Deere

- Kubota

- Kuhn

- Lovol Heavy

- Mahindra & Mahindra

- Massey Ferguson

- New Holland Agriculture

- SDF Group

- TAFE Motors and Tractors

- Valtra

- YTO Group

The Global Agricultural Sprayers Market reached USD 611.2 million in 2024 and is projected to grow at a robust CAGR of 4.5% from 2025 to 2034. This growth is being driven by the increasing adoption of precision agriculture techniques and the growing demand for effective crop protection solutions. To stay competitive, companies in the agricultural sprayers industry are forging strategic partnerships and acquisitions to enhance technological innovations and expand their product portfolios. These efforts are contributing to the overall market expansion and positioning agricultural sprayers as essential tools in modern farming practices.

The market is segmented by product type, with key categories including self-propelled sprayers, mounted sprayers, handheld sprayers, knapsack sprayers, trailed sprayers, aerial sprayers, and others. Among these, the self-propelled sprayers segment generated USD 100 million in 2024 and is expected to experience steady growth. Technological advancements such as GPS integration and automation are significantly enhancing the operational efficiency and precision of these sprayers. Features like variable rate technology and real-time monitoring systems help optimize input usage, reduce environmental impact, and improve crop protection, making self-propelled sprayers integral to sustainable farming practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $611.2 Million |

| Forecast Value | $988.6 Million |

| CAGR | 4.5% |

In terms of power source, the market is divided into manual, battery-operated, engine-driven, and solar-powered options. The engine-driven segment is anticipated to grow at a CAGR of 3% during the forecast period. This growth is being fueled by the increasing mechanization of agriculture and the demand for higher productivity while minimizing chemical usage. The latest engine technologies, which offer improved fuel efficiency and reduced emissions, are further attracting environmentally conscious farmers and contributing to the segment's growth.

The Asia Pacific region held a dominant 50% share of the agricultural sprayers market in 2024. This strong market presence is driven by rising food demand and the widespread adoption of advanced farming technologies. Countries in this region are investing heavily in agricultural equipment and modern farming solutions to boost productivity and tackle food security challenges. As mechanization continues to expand, the demand for efficient agricultural sprayers is expected to rise, further solidifying Asia Pacific's leadership in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Case study

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of precision agriculture techniques

- 3.9.1.2 Increasing need for efficient crop protection solutions

- 3.9.1.3 Growing awareness of sustainable farming practices

- 3.9.1.4 Advancements in sprayer technology and automation

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial investment costs for advanced sprayers

- 3.9.2.2 Complexity in integrating new technologies with existing equipment

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Handheld sprayer

- 5.3 Knapsack sprayer

- 5.4 Trailed sprayer

- 5.5 Mounted sprayer

- 5.6 Self-propelled sprayer

- 5.7 Aerial sprayer

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Battery-operated

- 6.4 Engine-driven

- 6.5 Solar-powered

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Low volume

- 7.3 Medium volume

- 7.4 High volume

Chapter 8 Market Estimates & Forecast, By Crop, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Cereals & grains

- 8.3 Oilseeds & pulses

- 8.4 Fruits & vegetables

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hydraulic nozzles

- 9.3 Air-assisted electrostatic

- 9.4 Ultra-Low Volume (ULV) spraying

- 9.5 Precision spraying

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 Field spraying

- 11.3 Orchard spraying

- 11.4 Plantation spraying

- 11.5 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Southeast Asia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 AGCO

- 13.2 Alamo

- 13.3 Changfa Agricultural Equipment

- 13.4 CLAAS KGaA

- 13.5 CNH Industrial

- 13.6 Excel Industries

- 13.7 Horsch Maschinen

- 13.8 Jacto

- 13.9 JCB Agriculture

- 13.10 John Deere

- 13.11 Kubota

- 13.12 Kuhn

- 13.13 Lovol Heavy

- 13.14 Mahindra & Mahindra

- 13.15 Massey Ferguson

- 13.16 New Holland Agriculture

- 13.17 SDF Group

- 13.18 TAFE Motors and Tractors

- 13.19 Valtra

- 13.20 YTO Group