|

市场调查报告书

商品编码

1665319

感应马达市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Induction Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

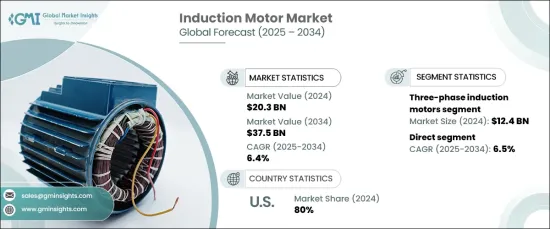

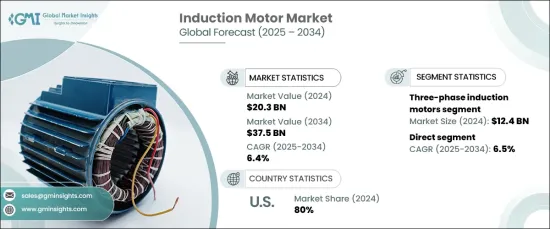

全球感应马达市场预计在 2024 年达到 203 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.4%。它们对于为製造环境中使用的机械(例如传送带、机器人系统和自动化机械)提供精确控制至关重要。

越来越多地采用工业自动化来提高生产力并降低劳动力成本是市场成长的主要动力。感应马达广泛应用于机器人和自动导引车(AGV)等领域,尤其是製造业、物流、仓储和医疗保健等产业。这些马达因其提供恆定速度和可靠扭矩的能力而受到高度重视,使其成为需要不间断运行的高性能应用的理想选择。此外,人们对能源效率的日益重视导致对节能马达的需求激增,这支持了永续的工业实践。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 203亿美元 |

| 预测值 | 375亿美元 |

| 复合年增长率 | 6.4% |

市场依产品类型分为单相和三相感应马达。三相部分引领市场,2024 年创造 124 亿美元的收入。自动化和快速工业化的不断推进进一步刺激了製造过程中对这些强劲马达的需求。

在分销通路方面,市场分为直接销售和间接销售。直销领域占据主导地位,到 2024 年将占据总市场份额的 65.8%,预计在预测期内复合年增长率为 6.5%。随着各行各业对客製化、高效解决方案的需求日益增长,直销管道因其能够提供更快、更透明的交易而受到青睐。线上销售平台的整合进一步提高了客户参与度,使购买流程更加便利和简化。

2024 年,美国感应马达市场占有 80% 的份额,预计 2025 年至 2034 年期间的复合年增长率为 6.4%。汽车、化学加工和食品生产等行业正在整合先进的系统以提高生产力同时降低营运成本。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 提高工业自动化程度

- 对节能解决方案的需求不断增长

- 电动车(EV)市场的扩张

- 产业陷阱与挑战

- 节能马达的初始成本较高

- 维护和营运挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:感应马达市场估计与预测:依产品类型,2021-2034 年

- 主要趋势

- 单相感应电动机

- 分阶段

- 电容启动

- 电容运行

- 荫蔽柱

- 三相感应电动机

- 鼠笼电动机

- 滑环电机

第 6 章:感应马达市场估计与预测:按应用,2021-2034 年

- 主要趋势

- 家用电器

- 商业电器

- 工业应用

第 7 章:感应马达市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 8 章:感应马达市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ABB

- Allied Motion Technologies

- AMETEK

- Emerson

- Hitachi

- Johnson Electric

- Mitsubishi

- Nidec

- Oriental Motor

- Regal Rexnord

- Rockwell Automation

- Schneider Electric

- Siemens

- Toshiba

- WEG Electric

The Global Induction Motor Market is on track to reach USD 20.3 billion by 2024 and is projected to expand at a CAGR of 6.4% from 2025 to 2034. Renowned for their durability, efficiency, and versatility, induction motors play a crucial role in powering automated production lines. They are integral in providing precise control for machinery used in manufacturing environments, such as conveyors, robotic systems, and automated machinery.

The increasing adoption of industrial automation to enhance productivity and reduce labor costs is a primary driver of market growth. Induction motors are widely utilized in sectors like robotics and automated guided vehicles (AGVs), particularly in industries such as manufacturing, logistics, warehousing, and healthcare. These motors are highly valued for their ability to deliver consistent speed and reliable torque, making them ideal for high-performance applications that require uninterrupted operation. Additionally, the growing emphasis on energy efficiency has led to a surge in demand for energy-saving motors, which supports sustainable industrial practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.3 Billion |

| Forecast Value | $37.5 Billion |

| CAGR | 6.4% |

The market is divided by product type into single-phase and three-phase induction motors. The three-phase segment leads the market, generating USD 12.4 billion in revenue in 2024. This segment is expected to grow at a CAGR of 6.5% through 2034, driven by its widespread use in industrial applications requiring high efficiency and the ability to handle heavy loads, such as pumps, compressors, and conveyor systems. The increasing shift toward automation and rapid industrialization further fuels the demand for these robust motors in manufacturing processes.

In terms of distribution channels, the market is split between direct and indirect sales. The direct sales segment dominates, accounting for 65.8% of the total market share in 2024, and is expected to experience a CAGR of 6.5% during the forecast period. As industries increasingly demand customized, high-efficiency solutions, the preference for direct sales channels continues to rise, thanks to their ability to provide faster, more transparent transactions. The integration of online sales platforms is further improving customer engagement, making the purchasing process more accessible and streamlined.

The U.S. induction motor market held an 80% share in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2034. This growth is fueled by the increasing emphasis on industrial automation, energy efficiency, and modernization within various sectors. Industries such as automotive, chemical processing, and food production are integrating advanced systems to boost productivity while reducing operational costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing industrial automation

- 3.6.1.2 Rising demand for energy-efficient solutions

- 3.6.1.3 Expansion of the electric vehicle (EV) market

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial cost for energy-efficient motors

- 3.6.2.2 Maintenance and operational challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Induction Motor Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Single-phase induction motors

- 5.2.1 Split phase

- 5.2.2 Capacitor-start

- 5.2.3 Capacitor-run

- 5.2.4 Shaded pole

- 5.3 Three-phase induction motors

- 5.3.1 Squirrel cage motors

- 5.3.2 Slip ring motors

Chapter 6 Induction Motor Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Household appliances

- 6.3 Commercial appliances

- 6.4 Industrial applications

Chapter 7 Induction Motor Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Induction Motor Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Allied Motion Technologies

- 9.3 AMETEK

- 9.4 Emerson

- 9.5 Hitachi

- 9.6 Johnson Electric

- 9.7 Mitsubishi

- 9.8 Nidec

- 9.9 Oriental Motor

- 9.10 Regal Rexnord

- 9.11 Rockwell Automation

- 9.12 Schneider Electric

- 9.13 Siemens

- 9.14 Toshiba

- 9.15 WEG Electric