|

市场调查报告书

商品编码

1635345

欧洲感应电动机:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Induction Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

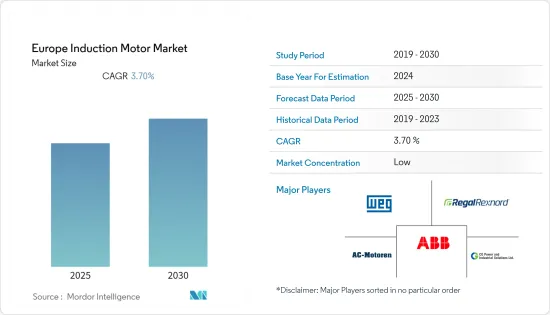

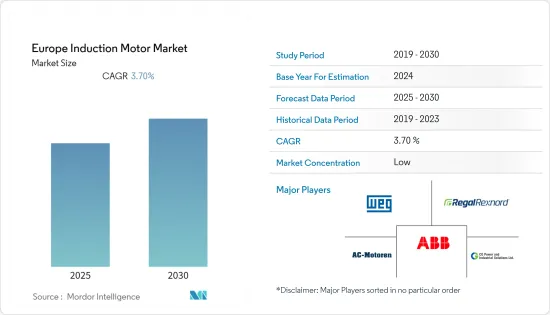

预计欧洲感应电动机市场在预测期内的复合年增长率为 3.7%。

主要亮点

- 根据欧盟委员会的分析,预计到 2030 年,感应电动机的效率要求(新法规中定义的)将减少约 10 TWh 的年电能消耗,并减少 3 Mt CO2 当量的年温室气体排放。交流感应电动机是占主导地位的马达技术,占当今马达装置容量的 90% 以上。提供单相和多相(三相)配置,尺寸范围从小于 1 马力到大于 10,000 马力。

- 电动车(EV)预计将在预测期内推动市场成长。对减少温室气体排放的日益关注以及对消费量产品的需求是市场成长的主要驱动力。例如,根据瑞银的数据,到2025年,欧洲电动车销量预计将达到633万辆,其次是中国,销量为484万辆。由马达驱动的机器消耗工业中约三分之二的电能,并对环境产生重大影响。

- 例如,波兰大约 50% 的电能消耗在感应电动机驱动系统中。在欧洲,感应电动机从效率的角度使用IE分类(国际效率)进行分类。欧盟委员会的法规给感应电动机製造商和使用者带来了一些变化和挑战。主要在德国等欧洲国家增加製造活动有助于该地区感应电动机市场的成长。

- 欧洲国家爆发的 COVID-19 正在影响该地区的汽车产业。工业製造公司正在努力应对这场流行病的直接影响,因为供应链业务和製造部门都受到了干扰,客户业务也面临类似的威胁。疫情影响了整个供应和分销网络,对工业设备製造商造成了滞后影响。这可能在相当长的一段时间内对欧洲市场构成重大挑战。

欧洲感应电动机市场趋势

节能马达推动市场成长

- 由于快速工业化,欧洲国家的许多製造商批量生产感应电动机,并以标准目录类型和尺寸进行销售。感应电动机的效率是使用时需要考虑的重要因素。在德国和英国等国家,多家公司和供应商以及各种製造商和分销商正在实施感应电动机的效率。

- 欧洲地区正在製定节能感应马达的标准。这些标准包括IE1(标准效率)、IE2(高效率)、IE3(高级效率)和IE4(超高级效率)。这些 IEC 标准允许欧洲政府指定 MEPS 效率水平,这是电动马达必须满足才能正确使用的最低能源性能标准。

- 节能马达比标准马达能更好地承受电压波动。由于节能马达的初始成本较高,因此这些马达的节能和高功率以及低维护成本的优势被认为是市场成长的驱动因素。

- 根据程式工程通报,欧盟委员会已经表示,欧洲关于节能感应电动机的法规将大有帮助。目前欧洲各地使用的马达(感应电动机)估计有 80 亿台,消耗了该地区发电量的约 50%。因此,感应马达对于降低能耗起着决定性的作用。

石油和天然气产业显着成长

- 据欧盟委员会称,欧洲的几个地区有未开发的石油和天然气潜力,即黑海和地中海,塞浦路斯、希腊、马耳他、保加利亚、罗马尼亚和葡萄牙也有探勘潜力。在这些国家,由于马达创新、效率提高和成本降低,对感应马达的需求不断增加。

- 在德国和英国等国家,石油和天然气工业所需的大部分电力都是由感应电动机提供的。透过实施更有效率的感应电动机解决方案,荷兰在欧洲地区的年总电力消耗量可以节省。

- 欧洲地区是第一个对多个类别的感应电动机马达强制执行 IE4 等级的国家。例如,容量为75kW至200kW的马达必须在2023年7月之前满足IE4级别,额定输出0.75kW至1000kW的三相马达必须在2021年7月之前满足IE3级别。

- 在德国、法国和英国等许多欧洲国家,感应感应电动机占石油和天然气产业电力消耗量的大部分。例如,在欧洲,感应电动机估计占石油和天然气产业所有工业电力消耗的约 70%。

欧洲感应电动机产业概况

欧洲感应电动机市场竞争激烈,竞争製造商包括 WEG、ABB、Elprom Harmanli、德昌电机控股有限公司、Brook Crompton、Nidec Industrial Solutions、Menzel Elektromotoren、Regal Rexnord Corporation、AC-Motoren GmbH 和 CG Power &Industrial Solutions有限公司,它包括公司正在透过建立多个伙伴关係关係、投资计划以及将新产品推向市场来扩大市场占有率。

- 2021 年 11 月 - 随着马达在电动车中的广泛应用,Weg 扩大了与汽车製造和移动领域的全球参与者 Stellantis Group 的业务,为标緻的e-EXPERT 和雪铁龙的E-JUMPY 车主开发新的电动实用公共事业。 WEG 电动移动(WEMOB) PARKING 具有高达22kW 的功率,专为停车场、企业和车队所有者的半快速充电而设计,提供高安全水平、可靠性和连接性,并具有实时和远程信息,为电动汽车车队管理提供性。

- 2021 年 2 月 - Regal Rexnord Corporation 将与 Rexnord 的 PMC 部门合併,创建世界一流的电力传输提供者。 Regal Rexnord Corporation 是马达和控制装置、发电和输电产品工程和製造领域的领先公司之一,为世界各地的客户提供服务。这提供了一流的动力传输产品组合的补充马达,Regal 的 Balance 产品组合将被重新建立。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对感应电动机市场的影响

第五章市场动态

- 市场驱动因素

- 住宅和工业领域对节能的需求不断增加

- 扩大电动车的应用

- 市场挑战

- 替代技术的研究和开发

第六章 市场细分

- 按类型

- 单相感应电动机

- 三相感应电动机

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 发电

- 用水和污水

- 金属/矿业

- 饮食

- 离散製造业

- 其他最终用户产业

- 按国家/地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 欧洲

第七章供应商市场占有率分析

第八章 竞争格局

- 公司简介

- ABB

- WEG

- Regal Rexnord Corporation

- AC-MOTOREN GmbH

- CG Power & Industrial Solutions Ltd

- ELPROM HARMANLI

- Johnson Electric Holdings Limited

- Brook Crompton

- Nidec Motor Corporation

- Menzel Elektromotoren

第九章投资分析

第10章市场的未来

The Europe Induction Motor Market is expected to register a CAGR of 3.7% during the forecast period.

Key Highlights

- According to the European Commission analysis, it has been estimated that the induction motor efficiency requirements (defined by the new Regulation) would lead to a limitation of annual electric energy consumption by approximately 10TWh and a decrease of yearly greenhouse gases emission by 3 Mt equivalent of carbon dioxide to the year 2030. The AC induction motor is the dominant motor technology today, representing more than 90% of installed motor capacity. They are available in single-phase and polyphase (three-phase) configurations, in sizes ranging from less than one to more than ten thousand horsepower (hp).

- Electric vehicles (EVs) are expected to boost the market's growth over the forecast period. The intensifying focus aimed at reducing greenhouse gas emissions and the demand for products that consume less energy are the major factors for market growth. For instance, the projected electric vehicle sales in Europe by 2025 are expected to reach 6.33 million units, followed by China with 4.84 million units, according to UBS. Machines driven by electrical motors consume around 2/3 of all the electrical energy used in industry, which also greatly impacts the environment.

- For example, approximately 50% of electric energy produced in Poland is consumed by driving systems with induction motors. In Europe, the division of induction motors from the efficiency perspective is performed employing IE classification (International Efficiency). The European Commission Regulation introduces several changes and challenges for induction motor manufacturers and the users. The increasing manufacturing activities, mainly in European Countries like Germany, contribute to the growth of the induction motors market in the region.

- The COVID-19 outbreak in European countries has affected the automobile industry in the region. Industrial manufacturing companies are grappling with the immediate effect of the pandemic, as both the supply chain operations and manufacturing units were disrupted, and the customers' operations faced similar threats. This exponentially affected the whole supply and distribution network, hitting industrial equipment companies with a lag. This will act as a significant challenge for the European market for a considerable period.

Europe Induction Motor Market Trends

Energy-Efficient Motors Drive the Market Growth

- Due to rapid industrialization, induction motors are massproduced by many manufacturers in European countries and sold in standard catalog types and sizes. The efficiency of an induction motor is an essential factor to consider while using it. In countries like Germany and the United kingdom, several companies and suppliers, as well as various manufacturers and distributors, have introduced the efficiency of induction motors.

- The European region has set standards for energy-efficient induction motors. These standards include IE1 (standard efficiency), IE2 (high efficiency), IE3 (premium efficiency), and IE4 (super premium efficiency). These IEC codes allow the government of Europe to specify efficiency levels for MEPS, the Minimum Energy Performance Standards that electric motors have to meet for proper use.

- Energy-efficient motors can better withstand voltage variations compared to standard motors. As energy-efficient motors come with a high initial cost, the benefits in terms of energy savings and greater output, as well as a lower maintenance cost of these motors, turned out to be driving factors for the market growth.

- According to process engineering, the European Commission has already indicated that European regulations regarding energy-efficient induction motors will be of great use. The estimated eight billion electric motors (Induction Motors) in use currently across Europe consume approximately 50% of the electric power generated in the European region. Thus induction motors, therefore, play a decisive role when it comes to reducing energy consumption.

Oil & Gas Industry to Witness Significant Growth

- According to European Commission, in some parts of Europe, namely in the Black Sea and the Mediterranean, there is unexploited oil and gas potential, with some exploration potential in Cyprus, Greece, Malta, Bulgaria, Romania, and Portugal. There is an increasing demand for induction motors in these countries due to the technological innovation and improvements in efficiency and cost-reduction of the motors.

- Most of the electricity needed for the oil and gas industry in countries like Germany and the United Kingdom is necessary for induction motors. By implementing higher-efficient solutions of induction motors, the total annual electricity consumption of the Netherlands could be saved in the European region.

- The European region is the first country to make the IE4 level mandatory for some categories of induction motors. For instance, Motors between 75kW and 200kW must meet the IE4 level as of July 2023, and by July 2021, the three-phase motors with a rated output between 0.75kW and equal to or below 1000kW must reach the IE3 level.

- In many European countries like Germany, France, and the United Kingdom, induction motors dominate and account for the largest total electricity consumption in the oil and gas sector. For instance, in Europe, induction motors are estimated to account for about 70% of all industrial electricity consumption in the oil and gas industry.

Europe Induction Motor Industry Overview

The Europe Induction Motor Market is competitive and consists of several partakers like WEG, ABB, Elprom Harmanli, Johnson Electric Holdings Limited, Brook Crompton, Nidec Industrial Solutions, Menzel Elektromotoren, Regal Rexnord Corporation , AC-Motoren GmbH, CG Power & Industrial Solutions Ltd and many more. The companies are increasing their market share by forming multiple partnerships, investing in projects, and launching new products in the market.

- November 2021 - As electric motors are widely used in Electric Vehicles, the company Weg expands its business partnership with Stellantis Group, a global player in automobile manufacturing and mobility player, with the launch of new electric utility vehicles: e-EXPERT by Peugeot and E-JUMPY by Citroen to serve fleet owners. Designed for semi-fast recharges in parking lots, companies, and fleet owners, Weg Electric Mobility (WEMOB) PARKING, up to 22 kW, offers high safety level, reliability, and connectivity with real-time and remote information for electric vehicle fleets management.

- February 2021 - Regal Rexnord Corporation, combined with Rexnord's PMC Segment, is creating a world-class power transmission provider. Regal Rexnord Corporation is one of the prominent player in the engineering and manufacturing of electric motors and controls, power generation, and power transmission products, serving customers worldwide. This combines complementary best-in-class power transmission portfolios and re-balances the Regal portfolio between Power Transmission (47% of pro forma sales), Motors (38%), and Niche/Specialty Products (15%).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Induction Motor Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Elevated Requirement of Power Savings in Residential and Industrial Sectors

- 5.1.2 Increasing Application in Electric Vehicles

- 5.2 Market Challenges

- 5.2.1 Research&Development of Alternative Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single-phase Induction Motor

- 6.1.2 Three-phase Induction Motor

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Metal & Mining

- 6.2.6 Food & Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 Europe

- 6.3.1.1 Germany

- 6.3.1.2 France

- 6.3.1.3 United Kingdom

- 6.3.1.4 Italy

- 6.3.1.5 Rest of Europe

- 6.3.1 Europe

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB

- 8.1.2 WEG

- 8.1.3 Regal Rexnord Corporation

- 8.1.4 AC-MOTOREN GmbH

- 8.1.5 CG Power & Industrial Solutions Ltd

- 8.1.6 ELPROM HARMANLI

- 8.1.7 Johnson Electric Holdings Limited

- 8.1.8 Brook Crompton

- 8.1.9 Nidec Motor Corporation

- 8.1.10 Menzel Elektromotoren