|

市场调查报告书

商品编码

1665401

陆域行动无线电 (LMR) 市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Land Mobile Radio(LMR) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

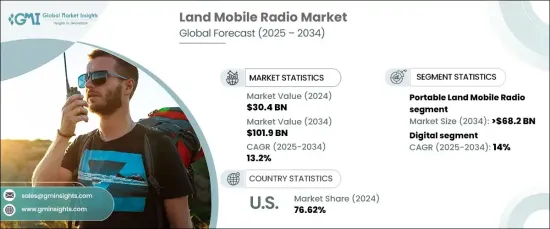

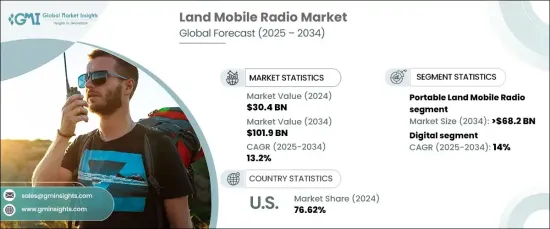

预计到 2024资料全球陆地行动无线电市场规模将达到 304 亿美元,并在 2025 年至 2034 年期间以 13.2% 的强劲复合年增长率增长。越来越多的组织正在摆脱传统的类比系统,转而采用 P25 和 TETRA 等数位解决方案,以满足对安全高效通讯工具日益增长的需求。随着技术的进步,混合 LMR-LTE 系统日益受到关注,提供了增强的连接性和可扩展性。儘管 5G 等宽频技术正在成为竞争对手,但 LMR 系统凭藉其可靠性和弹性,在高风险环境中仍然不可或缺。 LMR 市场正在不断发展以满足具有关键任务需求的行业的需求,专注于提高营运效率,同时整合物联网 (IoT) 等尖端技术以提供更客製化和有效的解决方案。

该市场的主要驱动力之一是 LMR-LTE 混合解决方案的日益普及。这些系统将 LMR 语音通讯的可靠性与 LTE 网路资料传输的速度和可扩展性相结合。这种整合使组织能够在一个平台上满足不同的通讯需求,从而提高整体效能和连接性。领先的公司正在优先开发整合 LMR 和 LTE 技术的解决方案,以提供即时资料并简化营运。随着各行各业对包括 GPS 追踪和多媒体共享等功能在内的更先进的通讯选项的需求,市场正在见证旨在满足这些不断变化的需求的重大创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 304亿美元 |

| 预测值 | 1019亿美元 |

| 复合年增长率 | 13.2% |

便携式 LMR 设备的需求也在不断增长,这得益于其在公共安全、国防和公用事业领域的应用。这些便携式系统具有更高的耐用性、更好的覆盖范围以及与数位技术的更好的兼容性。随着组织优先考虑安全性和营运效率,这些设备由于整合了 GPS、加密和语音记录功能而越来越受欢迎。 LMR 市场的数位技术领域正在迅速扩张,数位解决方案可提供更清晰的音讯、更有效率的频谱使用和增强的资料服务。政府法规要求升级紧急应变人员的通讯系统,进一步支持了这项成长。此外,软体定义无线电和基于 IP 的系统的进步为客製化和可扩展性开闢了新的机会。这些创新正在重塑 LMR 市场,使数位通讯系统对于智慧城市计画和其他关键基础设施至关重要。

在北美,美国占据 LMR 市场主导地位,占有 76.62% 的显着份额。这一强大的市场地位是由公共安全、国防和商业领域对安全通讯系统日益增长的需求所推动的。受法规对提高互通性和通讯可靠性的追求的推动,类比系统向数位系统发生了明显的转变。此外,人工智慧、基于云端的 LMR 系统和 5G 技术的创新正在加速这一转变,确保 LMR 解决方案仍然是各个行业不可或缺的一部分。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 与宽频网路的融合度不断提高

- 数位化产品需求激增

- 商业领域越来越多地采用陆地行动无线电

- 越来越重视公共安全和紧急准备

- 陆地行动无线电系统的技术进步与创新

- 产业陷阱与挑战

- 互通性和整合性问题

- 部署 LMR 系统成本高昂

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 便携的

- 车载(移动)

第 6 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 数位的

- 模拟

第 7 章:市场估计与预测:按频率,2021 年至 2034 年

- 主要趋势

- 25–174兆赫(甚高频)

- 200–512兆赫(超高频)

- 700 MHZ 以上 (SHF)

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 商业的

- 零售

- 运输

- 实用工具

- 矿业

- 其他的

- 公安

- 其他(医疗、建筑)

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- MEA 其他地区

第十章:公司简介

- Airbus

- Baofeng

- BK Technologies

- Cobra Electronics

- Codan Radio Communications

- Hytera Communications Corporation Ltd

- ICOM Inc.

- Kenwood Communications (a division of JVCKENWOOD)

- L3Harris Technologies, Inc.

- Leonardo SpA

- Motorola Solutions, Inc.

- Sepura

- Sepura Limited

- Simoco Wireless Solutions Limited

- Tait Communications

- Thales Group

- Zetron, Inc.

- Zycomm Electronics

The Global Land Mobile Radio Market is projected to reach USD 30.4 billion by 2024 and grow at a robust CAGR of 13.2% from 2025 to 2034. LMR technology plays a critical role in providing reliable voice and data communication systems, especially in sectors like public safety, transportation, and utilities. Organizations are increasingly moving away from traditional analog systems and embracing digital solutions, such as P25 and TETRA, to meet the rising demand for secure and efficient communication tools. As technology advances, hybrid LMR-LTE systems are gaining traction, offering enhanced connectivity and scalability. Although broadband technologies like 5G are emerging as competitors, LMR systems continue to be indispensable in high-stakes environments due to their reliability and resilience. The LMR market is evolving to cater to industries with mission-critical needs, focusing on improving operational efficiency while integrating cutting-edge technologies like the Internet of Things (IoT) for more customized and effective solutions.

One of the main drivers of this market is the growing adoption of LMR-LTE hybrid solutions. These systems combine the reliability of LMR for voice communication with the speed and scalability of LTE networks for data transfer. This integration allows organizations to address diverse communication needs in one platform, improving overall performance and connectivity. Leading companies are prioritizing the development of solutions that integrate both LMR and LTE technologies to provide real-time data and streamline operations. As industries demand more advanced communication options that include features like GPS tracking and multimedia sharing, the market is witnessing significant innovation aimed at meeting these evolving needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.4 Billion |

| Forecast Value | $101.9 Billion |

| CAGR | 13.2% |

The demand for portable LMR devices is also rising, driven by their applications in public safety, defense, and utilities. These portable systems offer increased durability, better coverage, and improved compatibility with digital technologies. As organizations prioritize safety and operational efficiency, these devices are gaining popularity due to their integration of GPS, encryption, and voice recording functionalities. The digital technology segment of the LMR market is expanding rapidly, with digital solutions providing clearer audio, more efficient spectrum usage, and enhanced data services. Government regulations that call for upgraded communication systems for emergency responders are further supporting this growth. Additionally, advancements in software-defined radios and IP-based systems are opening new opportunities for customization and scalability. These innovations are reshaping the LMR market, making digital communication systems vital for smart city initiatives and other critical infrastructure.

In North America, the U.S. dominates the LMR market, holding a significant share of 76.62%. This strong market position is driven by the increased need for secure communication systems in public safety, defense, and commercial sectors. There is a noticeable shift from analog to digital systems, fueled by regulations that push for better interoperability and communication reliability. Furthermore, innovations in AI, cloud-based LMR systems, and 5G technologies are accelerating the transition, ensuring that LMR solutions remain integral to various industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Growth drivers

- 3.7.1 Rising integration with broadband networks

- 3.7.2 Surge in demand for digitalized products

- 3.7.3 Increasing adoption of land mobile radios in the commercial sector

- 3.7.4 Growing emphasis on public safety and emergency preparedness

- 3.7.5 Technological advancements and innovations in land mobile radio systems

- 3.8 Industry pitfalls & challenges

- 3.8.1 Interoperability and integration issues

- 3.8.2 High cost of deploying LMR systems

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD billion & Units)

- 5.1 Key trends

- 5.2 Portable

- 5.3 Vehicle-Mounted (Mobile)

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD billion & Units)

- 6.1 Key trends

- 6.2 Digital

- 6.3 Analog

Chapter 7 Market Estimates & Forecast, By Frequency, 2021-2034 (USD billion & Units)

- 7.1 Key trends

- 7.2 25–174 MHZ (VHF)

- 7.3 200–512 MHZ (UHF)

- 7.4 700 MHZ & ABOVE (SHF)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD billion & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.2.1 Retail

- 8.2.2 Transportation

- 8.2.3 Utilities

- 8.2.4 Mining

- 8.2.5 Others

- 8.3 Public Safety

- 8.4 Others (healthcare, construction)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 Baofeng

- 10.3 BK Technologies

- 10.4 Cobra Electronics

- 10.5 Codan Radio Communications

- 10.6 Hytera Communications Corporation Ltd

- 10.7 ICOM Inc.

- 10.8 Kenwood Communications (a division of JVCKENWOOD)

- 10.9 L3Harris Technologies, Inc.

- 10.10 Leonardo S.p.A.

- 10.11 Motorola Solutions, Inc.

- 10.12 Sepura

- 10.13 Sepura Limited

- 10.14 Simoco Wireless Solutions Limited

- 10.15 Tait Communications

- 10.16 Thales Group

- 10.17 Zetron, Inc.

- 10.18 Zycomm Electronics