|

市场调查报告书

商品编码

1690798

商务用地面行动无线:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Land Professional Mobile Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

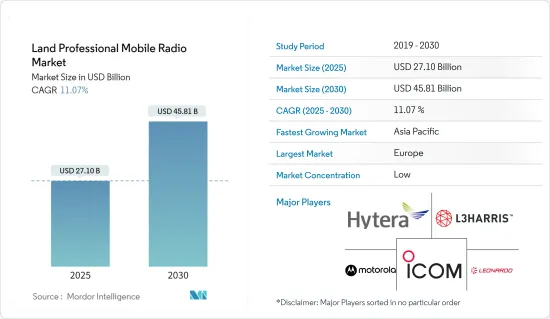

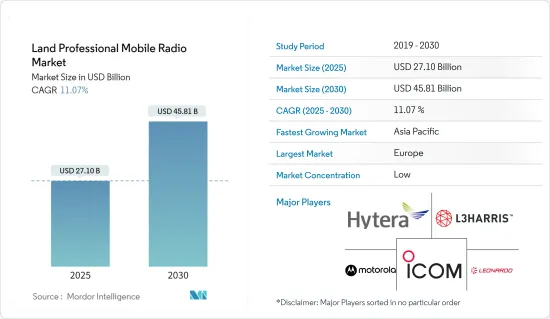

预计 2025 年商务用地面行动无线市场规模为 271 亿美元,到 2030 年将达到 458.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.07%。

主要亮点

- 由于执法和公共机构对改善通讯技术的关注度不断提高,市场正在迅速扩张。此外,商务用地面行动无线系统也主要用于交通运输、製造、公共产业、医疗保健和其他工业部门。

- 由于各种环境中快速、安全传输的不断增加,对商务用地面行动无线的需求也很高。此外,许多关键任务通讯技术支援执法机构存取视讯串流和即时资料。因此,结合视讯串流和资料应用也有助于提高决策能力。

- 政府透过投资和合作增加支持以促进商务用陆地无线电的采用,预计将刺激需求并促进市场成长率。例如,2023 年 3 月,CISA、SAFECOM 和国家州级互通性协调员委员会制定了地面行动无线(LMR) 文件,旨在探讨公共机构如何采用 LMR 技术,为部署和集成 LMR 系统提供最佳实践,解决 LMR 运营和维护问题,并讨论 IT 专业人员和 LMR 工程师之间可能存在的脱节。

- 此外,该市场的许多领先供应商都在不断创新其产品,以在竞争中脱颖而出,并积极寻求伙伴关係活动。

- 由于频宽限制,商务用地面行动无线市场面临许多限制和挑战。为了克服这些困难并确保 PMR 系统的持续扩展和有效性,必须透过适当的频率分配、协调和技术开发来解决这些限制。

- 此外,LTE(长期演进)与LMR的融合也不断推进。儘管已经为 LTE 开发了故障恢復标准,但地面行动无线技术仍然很有价值,因为它提供了多种故障安全选项,即使网路组件受损或服务遗失也能维持通讯。

- 同时,科技正在提高我们情境察觉和应对紧急情况的能力。例如,专用于储存有关危险材料或患者监测设备的资讯的应用程式属于此类。这些应用表明,初期应变人员需要不断地交谈和交换讯息,无论是文字、图像还是附加资讯元素。这些因素对预测期内的市场成长率有着至关重要的影响。

商务用地面行动无线市场趋势

军事和国防应用类型预计将占据相当大的市场占有率

- 军事和国防领域一直处于技术进步的前沿。近年来,地面行动无线(LMR)的普及极大地改变了军队的行动方式。 LMR 也称为双向无线对讲机,它彻底改变了战场通讯能力,成为军事和国防工业的重要工具。

- 有效的沟通是成功的军事行动的支柱。 LMR 提供可靠、安全、即时的通讯管道,实现步兵、装甲师和支援队等部队之间的无缝协调。与传统无线电不同,LMR 提供加密通道,即使在恶劣环境下也能确保安全通讯。

- LMR 允许军事人员交换关键讯息、传达命令并请求立即援助。无需依赖蜂巢式网路等脆弱通讯基础设施即可通讯的能力使得 LMR 成为偏远地区和复杂地形中的重要资产。这种改进的通讯不仅提高了作战效率,而且还能够更快地做出反应和了解情况,确保部队的安全。

- 据北大西洋公约组织(NATO)称,军事和国防费用正在增加。例如,美国将在 2022 年花费 8,218.3 亿美元,到 2023 年将达到 8,600 亿美元。预计这将对所研究的市场产生正面影响。

- 在军事和国防领域不断增长的需求的推动下,LMR 正在经历重大技术进步。製造商正在整合 GPS 追踪、蓝牙连接和资料网路整合等功能,以使 LMR 更加实用、更加多功能。这使得即时位置追踪、资料传输和指挥控制系统整合成为可能。

- 此外,语音辨识和人工智慧的融合有望实现免持操作和智慧语音命令,进一步增强 LMR 的功能。军事和国防部门的成长极大地促进了 LMR 的市场应用。

预计欧洲将占据主要市场占有率

- 在欧洲,德国、法国和义大利等国家越来越多地采用垂直磁记录 (PMR) 技术来支援其关键的通讯需求。欧洲使用最广泛的 PMR 标准是陆地集群无线电 (TETRA)。 TETRA提供高效率的语音和资料通讯能力,被欧洲防务部门广泛采用。

- PMR 系统在公共和紧急服务中发挥着至关重要的作用。警察、消防和其他紧急应变组织依靠 PMR 网路在危机情况下实现有效通讯。这些系统提供专用频道、加密和群组通讯功能,以确保紧急情况下的通讯安全可靠。由于这些优势,欧洲地区许多国家都已实施PMR系统。

- 例如,德国海军投资了摩托罗拉系统公司的新型任务关键型通讯网络,为 16 艘海军舰艇提供安全的数位无线电通讯,并将其作为德国海军的训练平台,为负责确保海上船员安全和海军舰艇作战准备的船上安全团队提供支援。

- 此外,该地区的许多公司都是以製造业为基础的,并在其工业和製造设施中广泛使用 PMR 系统。这些系统促进了工人、监督和维护团队之间的沟通,以确保顺利运作、提高生产力并更快地对事故和紧急情况做出反应。 PMR 网路对于大型工厂、仓库和建筑工地来说非常有价值。

- 欧洲国家 PMR 的使用日益广泛,这得益于各领域对安全、可靠和专用通讯系统的需求。 PMR技术不断发展,提供数位语音通讯、资料传输和与其他技术的整合等先进功能,进一步扩大其在各行业的应用和优势。

商务用地面行动无线产业概况

商务用地面行动无线市场竞争激烈,主要公司包括海能达通讯有限公司、ICOM Inc.、L3Harris Technologies, Inc.、Leonardo SpA 和摩托罗拉系统公司。市场参与者正在采用合作、协议和收购等策略来增强其产品供应并获得永续的竞争优势。

2022 年 10 月,Simoco Solutions 与 Excelerate Technology 签署了独家经销协议,建立伙伴关係,将物联网 (IoT)、LTE 和卫星产品引入澳洲地区。 Excelerate 是一家混合 LTE 和卫星连接的全球供应商,它提供的解决方案即使在无法使用传统选项的地方也能确保可靠的通讯。这项突破性的技术在地面通讯稀缺、拥挤、受到威胁或中断的地区发挥着至关重要的作用。

2022年8月,摩托罗拉系统在巴西推出了WAVE PTX。它是一种宽频型的即时通讯服务,无论使用何种网路技术,均可在全国范围内提供全面覆盖。 WAVE PTX 可实现组织内不同工作团队之间的无缝可靠连接,从而实现持续营运并最大限度地提高生产力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 主要经济趋势分析

第五章 市场动态

- 市场驱动因素

- 国防支出增加,军事通讯设备需求增加

- 从类比系统过渡到数位系统

- 市场限制

- 频宽限制

第六章 市场细分

- 依技术分类

- 模拟

- 数位的

- 按应用程式类型

- 零售

- 运输

- 军事和国防

- 执法

- 紧急医疗服务

- 其他用途

- 按地区

- 北美洲

- 依技术分类

- 模拟

- 数位的

- 按应用

- 零售

- 运输

- 军事和国防

- 执法

- 紧急医疗服务

- 其他用途

- 欧洲

- 依技术分类

- 模拟

- 数位的

- 按应用

- 零售

- 运输

- 军事和国防

- 执法

- 紧急医疗服务

- 其他用途

- 亚太地区

- 依技术分类

- 模拟

- 数位的

- 按应用程式类型

- 零售

- 运输

- 军事和国防

- 执法

- 紧急医疗服务

- 其他用途

- 拉丁美洲

- 依技术分类

- 模拟

- 数位的

- 按应用

- 零售

- 运输

- 军事和国防

- 执法

- 紧急医疗服务

- 其他用途

- 中东和非洲

- 依技术分类

- 模拟

- 数位的

- 按应用

- 零售

- 运输

- 军事和国防

- 执法

- 紧急医疗服务

- 其他用途

- 北美洲

第七章 竞争格局

- 公司简介

- Hytera Communications Corporation Ltd

- ICOM Inc.

- L3Harris Technologies, Inc.

- Leonardo SpA

- Motorola Solutions, Inc.

- Simoco Wireless Solutions Limited

- Tait Communications

- Thales Group

- Sepura Limited

- Zetron, Inc.

第八章投资分析

第九章:市场的未来

The Land Professional Mobile Radio Market size is estimated at USD 27.10 billion in 2025, and is expected to reach USD 45.81 billion by 2030, at a CAGR of 11.07% during the forecast period (2025-2030).

Key Highlights

- The market is proliferating due to the rapidly increasing focus on improving communication technologies among law enforcement agencies and public safety organizations. Moreover, land professional mobile radio systems are also majorly used in transportation, manufacturing, utilities, healthcare, and other industry verticals.

- Land professional mobile radio is also in high demand due to continuously rising quick and secure transmissions in various environments. Moreover, many mission-critical communications technologies support law enforcement organizations to stream video and access real-time data. Therefore, it also helps improve decision-making capabilities by incorporating video streaming and data applications.

- The growing government aid through investments and collaborations to boost the adoption of professional land radios is analyzed to boost the demand, thereby contributing to the market growth rate. For instance, in March 2023, A document on land mobile radio (LMR) for IT professionals was developed by CISA, SAFECOM, and the National Council of Statewide Interoperability Coordinators to explore how public safety organizations implement LMR technologies, provide best practices for LMR system implementation and integration, address some LMR operational and maintenance issues, and discuss possible disconnects between IT professionals and LMR engineers.

- Moreover, many major vendors in this market are continuously innovating their products to create a distinct differentiation from their competitors and indulging in partnership activities, which is expected to broaden the reach of the market over the forecast period.

- There are several constraints and challenges faced by the land professional mobile radio market due to the spectrum bandwidth limitation. To overcome these difficulties and guarantee the continuous expansion and effectiveness of PMR systems, efforts to resolve these constraints through appropriate spectrum allocation, harmonization, and technology developments are essential.

- The integration of long-term evolution (LTE) with LMRs is also gaining traction, as the importance of integration, instead of substitution, is greater. Despite the development of LTE failback standards, land mobile radio technology will remain valuable for its variety of failsafe options to maintain communications even if network components are damaged or out of service.

- At the same time, their situational awareness and ability to respond to emergencies are being improved by technology. For example, purpose-built applications to store information on dangerous materials or patient monitoring devices fall into this category. These applications demonstrate the need for first responders to talk at all times and that they should also exchange information such as text, pictures, or even additional elements of information. These factors essentially contribute to the market growth rate during the forecast period.

Land Professional Mobile Radio Market Trends

Military and Defense Application Type Segment is Expected to Hold Significant Market Share

- The military and defense sector has always been at the forefront of technological advancements. In recent years, the proliferation of land mobile radios (LMRs) has significantly transformed how armed forces operate. LMRs, also known as two-way radios, have revolutionized communication capabilities on the battlefield and have become a critical tool for the military and defense sectors.

- Effective communication is the backbone of any successful military operation. LMRs offer reliable, secure, real-time communication channels that enable seamless coordination between units, including infantry, armored divisions, and support teams. Unlike traditional radios, LMRs provide encrypted channels, ensuring secure communication even in hostile environments.

- LMRs allow military personnel to exchange vital information, relay orders, and request immediate support. The ability to communicate without relying on vulnerable communication infrastructure, such as cellular networks, makes LMRs an essential asset in remote and challenging terrains. This improved communication not only enhances operational efficiency but also ensures the safety of troops by enabling rapid response and situational awareness.

- According to the North Atlantic Treaty Organization (NATO), military and defense expenditures have increased. For example, in 2022, the United States spent USD 821.83 billion, reaching USD 860 billion in 2023. This is expected to make a favorable impact on the market studied.

- LMRs have witnessed significant technological advancements driven by the increasing military and defense sector demands. Manufacturers are incorporating features such as GPS tracking, Bluetooth connectivity, and integration with data networks to enhance the functionality and versatility of LMRs. This enables real-time location tracking, data transmission, and command and control systems integration.

- Additionally, the integration of voice recognition and artificial intelligence capabilities holds promise for further enhancing the capabilities of LMRs, allowing for hands-free operation and intelligent voice-based commands. The growth of the military and defense sector owes much to the widespread adoption of LMRs in the market.

Europe is Expected to Hold Significant Market Share

- In Europe, perpendicular magnetic recording (PMR) technology has been increasingly adopted in countries such as Germany, France, Italy, and others to support critical communication needs. The most used PMR standard in Europe is the terrestrial trunked radio (TETRA). TETRA provides efficient voice and data communication capabilities and is widely adopted by the defense sector in various European countries.

- PMR systems have played a crucial role in public safety and emergency services. Police, fire departments, and other emergency response organizations rely on PMR networks for effective communication during critical situations. These systems provide dedicated channels, encryption capabilities, and group communication features that ensure secure and reliable communication during emergencies. Looking at these benefits, many countries in the European region are deploying PMR systems.

- For instance, German Navy invested in new mission-critical communication networks from Motorola Solutions to provide secure digital radio communications for 16 naval vessels and training platforms for the German Navy to support onboard security teams responsible for the safety of crews at sea and the operational readiness of naval vessels.

- Moreover, many companies in the European region have a manufacturing sector hub and extensive use of PMR systems in industrial and manufacturing facilities. They facilitate communication among workers, supervisors, and maintenance teams, ensuring smooth operations, enhanced productivity, and swift response to incidents or emergencies. PMR networks are precious in large-scale factories, warehouses, and construction sites.

- The growing use of PMR in European countries can be attributed to the need for secure, reliable, and dedicated communication systems in diverse sectors. PMR technology continues to evolve, offering advanced features like digital voice communication, data transmission, and integration with other technologies, further expanding its applications and benefits across industries.

Land Professional Mobile Radio Industry Overview

The land professional mobile radio market is highly competitive with the presence of major players like Hytera Communications, Corporation Ltd, ICOM Inc., L3Harris Technologies, Inc., Leonardo SpA, and Motorola Solutions, Inc. Players in the market are adopting strategies such as partnerships, agreements, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In October 2022, SimocoSolutions forged an exclusive distribution agreement with ExcelerateTechnology to establish a partnership to introduce Internet-of-Things (IoT), LTE, and satellite products into the Australasia region. Excelerate, a worldwide provider of hybrid LTE and satellite connectivity, offers solutions that ensure dependable communication even in locations where traditional options are unavailable. This groundbreaking technology plays a crucial role in areas lacking terrestrial communication services, experiencing congestion, facing threats, or encountering disruptions.

In August 2022, Motorola Solutions introduced WAVE PTX in Brazil, a broadband-based instant communication service that provides comprehensive coverage across the country regardless of the network technology used. WAVE PTX enables seamless and dependable connectivity between various work teams within organizations, ensuring continuous operations and maximizing productivity levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Analysis of Key Economic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Defense Expenditure And Increasing Demand for Military Communication Equipment

- 5.1.2 Migration from Analog to Digital Systems

- 5.2 Market Restraints

- 5.2.1 Limitations in the Spectrum Bandwidth

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Analog

- 6.1.2 Digital

- 6.2 By Application Type

- 6.2.1 Retail

- 6.2.2 Transportation

- 6.2.3 Military and Defense

- 6.2.4 Law Enforcement Agencies

- 6.2.5 Emergency and Medical Services

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 By Technology

- 6.3.1.1.1 Analog

- 6.3.1.1.2 Digital

- 6.3.1.2 By Application

- 6.3.1.2.1 Retail

- 6.3.1.2.2 Transportation

- 6.3.1.2.3 Military and Defense

- 6.3.1.2.4 Law Enforcement Agencies

- 6.3.1.2.5 Emergency and Medical Services

- 6.3.1.2.6 Other Applications

- 6.3.2 Europe

- 6.3.2.1 By Technology

- 6.3.2.1.1 Analog

- 6.3.2.1.2 Digital

- 6.3.2.2 By Application

- 6.3.2.2.1 Retail

- 6.3.2.2.2 Transportation

- 6.3.2.2.3 Military and Defense

- 6.3.2.2.4 Law Enforcement Agencies

- 6.3.2.2.5 Emergency and Medical Services

- 6.3.2.2.6 Other Applications

- 6.3.3 Asia Pacific

- 6.3.3.1 By Technology

- 6.3.3.1.1 Analog

- 6.3.3.1.2 Digital

- 6.3.3.2 By Application Type

- 6.3.3.2.1 Retail

- 6.3.3.2.2 Transportation

- 6.3.3.2.3 Military and Defense

- 6.3.3.2.4 Law Enforcement Agencies

- 6.3.3.2.5 Emergency and Medical Services

- 6.3.3.2.6 Other Applications

- 6.3.4 Latin America

- 6.3.4.1 By Technology

- 6.3.4.1.1 Analog

- 6.3.4.1.2 Digital

- 6.3.4.2 By Application

- 6.3.4.2.1 Retail

- 6.3.4.2.2 Transportation

- 6.3.4.2.3 Military and Defense

- 6.3.4.2.4 Law Enforcement Agencies

- 6.3.4.2.5 Emergency and Medical Services

- 6.3.4.2.6 Other Applications

- 6.3.5 Middle East and Africa

- 6.3.5.1 By Technology

- 6.3.5.1.1 Analog

- 6.3.5.1.2 Digital

- 6.3.5.2 By Application

- 6.3.5.2.1 Retail

- 6.3.5.2.2 Transportation

- 6.3.5.2.3 Military and Defense

- 6.3.5.2.4 Law Enforcement Agencies

- 6.3.5.2.5 Emergency and Medical Services

- 6.3.5.2.6 Other Applications

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hytera Communications Corporation Ltd

- 7.1.2 ICOM Inc.

- 7.1.3 L3Harris Technologies, Inc.

- 7.1.4 Leonardo SpA

- 7.1.5 Motorola Solutions, Inc.

- 7.1.6 Simoco Wireless Solutions Limited

- 7.1.7 Tait Communications

- 7.1.8 Thales Group

- 7.1.9 Sepura Limited

- 7.1.10 Zetron, Inc.