|

市场调查报告书

商品编码

1666528

自动贴标机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automated Labeling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

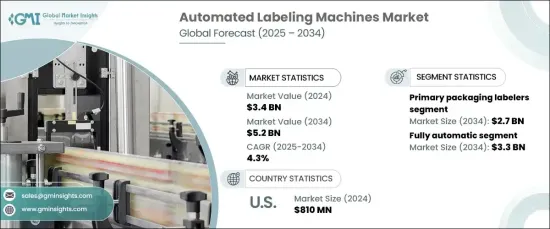

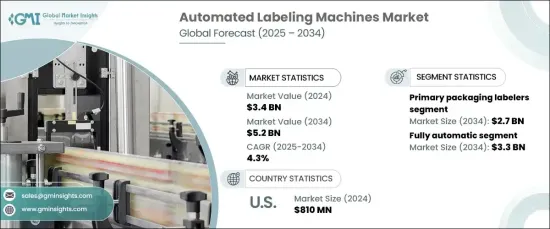

2024 年全球自动贴标机市场价值为 34 亿美元,预计 2025 年至 2034 年期间将以 4.3% 的复合年增长率稳步增长。这些机器广泛应用于製药、食品和饮料、化妆品和消费品等准确性和一致性至关重要的领域。电子商务的成长和优化生产线的需求进一步推动了自动标籤系统的采用。

机器人、人工智慧和机器视觉等技术进步显着提高了这些机器的功能。这些创新使机器能够以更快的速度和更高的精度处理各种标籤类型和包装格式,使其成为需要高吞吐量的环境的理想选择。此外,永续发展的推动力正在影响製造商开发环保标籤选项,例如可生物降解和可回收材料,从而重塑市场。随着企业致力于提高营运效率、削减劳动成本并满足严格的法规,对自动贴标机的需求持续上升。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 52亿美元 |

| 复合年增长率 | 4.3% |

市场分为初级、二级和三级包装标籤机。负责给瓶子或盒子等产品容器贴标的初级包装贴标机占据市场主导地位。二级包装贴标机负责处理纸箱和捆包等外包装,而三级包装贴标机则专注于托盘等较大单元。每种类型在提高生产力、减少人为错误和确保整个供应链的法规合规性方面都发挥着至关重要的作用。

市场也区分半自动机器和全自动机器。全自动贴标机占据最大份额,可提供高速、精确的贴标,几乎不需要操作员参与。这些机器在需要一致且快速贴标的大规模生产环境中受到青睐。相较之下,半自动系统适用于较小的操作,需要一些手动输入,但仍比传统方法提供显着的效率提升。

在北美,美国是自动贴标机的主要市场,2024 年价值为 8.1 亿美元。人工智慧整合和机器视觉等技术创新正在改变标籤流程,从而增强品质控制和维护。此外,对永续、环保标籤解决方案的需求正在推动产业走向更环保的替代品。随着这些趋势的持续,美国自动贴标机市场将保持稳定成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 各行业对高效、高速、准确的标籤解决方案的需求日益增加

- 製造和包装业务自动化趋势日益增强

- 产业陷阱与挑战

- 自动贴标机成本高

- 与自动贴标机相关的互通性问题

- 成长动力

- 成长潜力分析

- 技术概览

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:自动贴标机市场估计与预测:依类型,2021-2034

- 主要趋势

- 初级包装贴标机

- 二次包装贴标机

- 三级包装贴标机

第六章:自动贴标机市场估计与预测:依贴标方法,2021-2034 年

- 主要趋势

- 自黏/压敏标籤

- 套标

- 胶基

- 其他的

第 7 章:自动贴标机市场估计与预测:按机器类型 2021-2034

- 主要趋势

- 半自动

- 全自动

第 8 章:自动贴标机市场估计与预测:依容量 2021-2034

- 主要趋势

- 每分钟最多 200 个产品

- 200 至 500 个产品/分钟

- 500 至 1000 个产品/分钟

- 每分钟 1000 件以上

第 9 章:自动贴标机市场估计与预测:按标籤类型 2021-2034

- 主要趋势

- 顶部贴标

- 底部贴标

- 顶部和底部标籤

第 10 章:自动贴标机市场估计与预测:依最终用途产业 2021-2034

- 主要趋势

- 化学品

- 消费品

- 电子产品

- 食品和饮料

- 製药

- 消费品

- 其他(物流航运等)

第 11 章:自动贴标机市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 12 章:自动贴标机市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第 13 章:公司简介

- Accutek

- B + B Automations

- BellatRx

- Brady

- CTM Labeling Systems

- FoxJet

- Herma

- KHS

- Krones

- Marchesini Group

- PE Labellers

- ProMach

- Sacmi Imola

- SaintyCo

- Sidel Group

The Global Automated Labeling Machines Market, valued at USD 3.4 billion in 2024, is projected to grow at a steady CAGR of 4.3% between 2025 and 2034. The demand for efficient, high-speed, and precise labeling solutions across industries is propelling the market forward. These machines are widely used in sectors such as pharmaceuticals, food and beverages, cosmetics, and consumer goods, where accuracy and consistency are vital. The growth of e-commerce and the need for optimized production lines are further boosting the adoption of automated labeling systems.

Technological advancements, including robotics, AI, and machine vision, have significantly improved the functionality of these machines. These innovations enable machines to handle diverse label types and packaging formats with enhanced speed and precision, making them ideal for environments requiring high throughput. Additionally, the push for sustainability is influencing manufacturers to develop eco-friendly labeling options, such as biodegradable and recyclable materials, which is reshaping the market. As businesses aim to boost operational efficiency, cut labor costs, and meet strict regulations, the demand for automated labeling machines continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 4.3% |

The market is categorized into primary, secondary, and tertiary packaging labelers. Primary packaging labelers, responsible for labeling product containers like bottles or boxes, dominate the market. Secondary packaging labelers handle outer packaging like cartons and bundles, while tertiary labelers focus on larger units like pallets. Each type plays a crucial role in improving productivity, reducing human error, and ensuring regulatory compliance across the supply chain.

The market also distinguishes between semi-automatic and fully automatic machines. Fully automatic labeling machines hold the largest share, offering high-speed, precision labeling with minimal operator involvement. These machines are favored in large-scale production environments that demand consistent and rapid labeling. In contrast, semi-automatic systems cater to smaller operations, requiring some manual input but still offering significant efficiency improvements over traditional methods.

In North America, the U.S. stands as the leading market for automated labeling machines, valued at USD 810 million in 2024. The country's robust manufacturing infrastructure, widespread use of automation technologies, and stringent regulatory standards are key factors driving this market. Technological innovations, such as AI integration and machine vision, are transforming labeling processes, thus enhancing quality control and maintenance. Furthermore, the demand for sustainable, eco-friendly labeling solutions is pushing the industry toward greener alternatives. As these trends continue, the U.S. market for automated labeling machines is set to maintain steady growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for efficient, high-speed, and accurate labeling solutions across industries

- 3.6.1.2 Growing trend of automation in manufacturing and packaging operations

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost associated with the automated labeling machines

- 3.6.2.2 Interoperability issues associated with the automated labeling machines

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Automated Labeling Machines Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary packaging labelers

- 5.3 Secondary packaging labelers

- 5.4 Tertiary packaging labelers

Chapter 6 Automated Labeling Machines Market Estimates & Forecast, By Labeling Method, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Self-adhesive/pressure-sensitive labeling

- 6.3 Sleeve labeling

- 6.4 Glue-based

- 6.5 Others

Chapter 7 Automated Labeling Machines Market Estimates & Forecast, By Machine Type 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Semi-automatic

- 7.3 Fully automatic

Chapter 8 Automated Labeling Machines Market Estimates & Forecast, By Capacity 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Up to 200 products/min

- 8.3 200 to 500 products/min

- 8.4 500 to 1000 products/min

- 8.5 Above 1000 products/min

Chapter 9 Automated Labeling Machines Market Estimates & Forecast, By Labeling Type 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Top labeling

- 9.3 Bottom labeling

- 9.4 Top & bottom labeling

Chapter 10 Automated Labeling Machines Market Estimates & Forecast, By End Use Industry 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Chemicals

- 10.3 Consumer goods

- 10.4 Electronics

- 10.5 Food & beverages

- 10.6 Pharmaceutical

- 10.7 Consumer goods

- 10.8 Others (logistics and shipping etc.)

Chapter 11 Automated Labeling Machines Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Automated Labeling Machines Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 United States

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Unites kingdom

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 Middle East & Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 United Arab Emirates

Chapter 13 Company Profiles

- 13.1 Accutek

- 13.2 B + B Automations

- 13.3 BellatRx

- 13.4 Brady

- 13.5 CTM Labeling Systems

- 13.6 FoxJet

- 13.7 Herma

- 13.8 KHS

- 13.9 Krones

- 13.10 Marchesini Group

- 13.11 P.E. Labellers

- 13.12 ProMach

- 13.13 Sacmi Imola

- 13.14 SaintyCo

- 13.15 Sidel Group