|

市场调查报告书

商品编码

1666569

车辆追踪设备市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Vehicle Tracking Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

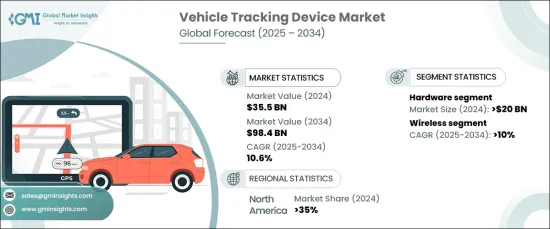

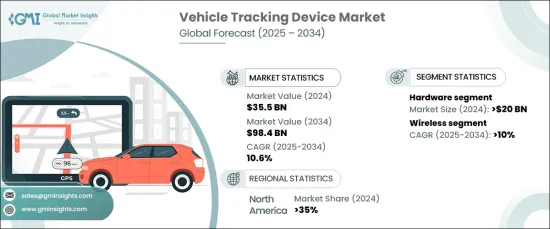

2024 年全球车辆追踪设备市场价值为 355 亿美元,预计 2025 年至 2034 年的复合年增长率为 10.6%。随着企业不断优先考虑营运效率、安全性和成本管理,车辆追踪设备已成为监控资产、优化路线和确保车辆和货物安全不可或缺的工具。事实上,策略伙伴关係正在兴起,以提升这些设备的功能。例如,2024年3月,HERE Technologies与Netstar合作,改善澳洲商用车的资产管理与导航服务。

人们对这些解决方案的兴趣日益浓厚,这可归因于联网设备和物联网 (IoT) 的激增,这使企业能够捕获和分析即时资料,从而做出更明智的决策。这一趋势在物流等行业尤其重要,因为追踪系统对于确保货物及时交付以及公共交通系统发挥至关重要的作用。随着消费者和企业都认识到车辆追踪的诸多优势,例如提高营运效率、安全性和及时交付,市场有望大幅成长。特别是,GPS 追踪设备预计将推动市场发展,到 2032 年预计收入约为 90 亿美元,年增长率将超过 12%。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 355亿美元 |

| 预测值 | 984亿美元 |

| 复合年增长率 | 10.6% |

车辆追踪设备市场分为硬体和软体部分。 2024 年,硬体部分的价值将超过 200 亿美元,并继续快速扩张。随着企业寻求可靠、高效的资产管理解决方案,对高品质远端资讯处理系统和 GPS 设备的需求不断增长,推动了这一成长。值得注意的是,GPS 追踪技术的进步,例如 Monimoto 于 2024 年 6 月发布的 Monimoto 9,体现了该行业对创新的承诺。此新版本为各种资产提供了增强的保护,包括摩托车、船隻和拖车。

资料,市场按连接性进行分类,预计无线追踪设备在 2025 年至 2034 年期间的复合年增长率将超过 10%。物联网应用的不断发展也是一大驱动力,使企业能够利用先进的追踪功能,并透过更好的资料分析和远端监控优化其营运。

2024 年,北美占据全球车辆追踪设备市场的 35% 以上。该地区对车队管理的即时追踪解决方案的严重依赖继续推动市场需求,各公司整合远端资讯处理系统以满足监管要求并提高安全标准。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 组件提供者

- 服务提供者

- 製造商

- 经销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 成本分析

- 案例研究

- 衝击力

- 成长动力

- 人们对车辆安全的担忧日益加剧

- 车辆失窃案数量激增

- 基于人工智慧的事故侦测日益融合

- 车队管理需求日益增加

- 产业陷阱与挑战

- 资料和隐私问题

- 初期成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- OBD 设备/追踪器和高级追踪器

- 独立追踪器

- 软体

- 车队管理平台

- 数据分析工具

- 地图和导航系统

- 即时追踪软体

- 其他的

第六章:市场估计与预测:依连结性,2021 - 2034 年

- 主要趋势

- 有线

- 无线的

第 7 章:市场估计与预测:按通讯追踪器,2021 - 2034 年

- 主要趋势

- 蜂窝网路

- 卫星

- 双模式

第 8 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 9 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 运输与物流

- 建造

- 石油和天然气

- 矿业

- 紧急服务

- 其他的

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- AT&T Intelligence

- ATrack Technology

- CalAmp

- Concox Information Technology

- Continental

- Garmin

- Geotab

- Laipac Technology

- Laird

- Meitrack

- Queclink Wireless Solutions

- Sensata

- Starcom Systems

- Suntech International

- Teletrac Navman

- Teltonika

- TomTom International

- Trackimo

- Vamosys

- Verizon Communications

The Global Vehicle Tracking Device Market was valued at USD 35.5 billion in 2024 and is projected to grow at a CAGR of 10.6% from 2025 to 2034. This rapid expansion is largely driven by the increasing demand for real-time tracking solutions in fleet management, heightened concerns about vehicle theft, and the rising adoption of advanced telematics technologies across a variety of industries. As businesses continue to prioritize operational efficiency, security, and cost management, vehicle tracking devices have become indispensable tools for monitoring assets, optimizing routes, and ensuring the safety of vehicles and goods. In fact, strategic partnerships are emerging to boost the capabilities of these devices. For example, in March 2024, HERE Technologies teamed up with Netstar to improve asset management and navigation services for commercial vehicles in Australia.

The growing interest in these solutions can be attributed to the surge in connected devices and the Internet of Things (IoT), which enable businesses to capture and analyze real-time data to make better-informed decisions. This trend is particularly significant in industries like logistics, where tracking systems play an essential role in ensuring the timely delivery of goods, as well as in public transport systems. With consumers and businesses alike recognizing the numerous advantages of vehicle tracking, such as enhanced operational efficiency, security, and timely deliveries, the market is poised for substantial growth. In particular, GPS tracking devices are expected to fuel the market, with a projected revenue of around USD 9 billion by 2032 and an annual growth rate surpassing 12%.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.5 Billion |

| Forecast Value | $98.4 Billion |

| CAGR | 10.6% |

The vehicle tracking device market is segmented into hardware and software components. In 2024, the hardware segment accounted for over USD 20 billion in value and continues to expand rapidly. The increasing demand for high-quality telematics systems and GPS devices is driving this growth as businesses seek reliable, efficient solutions for managing their assets. Notably, advancements in GPS tracking technology, such as Monimoto's release of the Monimoto 9 in June 2024, illustrate the industry's commitment to innovation. This new version provides enhanced protection for various assets, including motorcycles, boats, and trailers.

Additionally, the market is categorized by connectivity, with wireless tracking devices projected to experience a CAGR of over 10% from 2025 to 2034. The wireless segment's growth is mainly due to the ease of installation, scalability, and the real-time data capabilities it offers. The continuous development of IoT applications is also a driving force, enabling businesses to harness advanced tracking functionalities and optimize their operations through better data analytics and remote monitoring.

North America accounted for more than 35% of the global vehicle tracking device market in 2024. This dominance is primarily attributed to stringent regulations and a well-established logistics sector. The region's heavy reliance on real-time tracking solutions for fleet management continues to fuel market demand, with companies integrating telematics systems to meet regulatory requirements and enhance safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Service providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Cost analysis

- 3.8 Case study

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing concerns over vehicle safety

- 3.9.1.2 Surge in number of vehicle thefts

- 3.9.1.3 Rising integration of AI-based accident detection

- 3.9.1.4 Increasing need for fleet management

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data and privacy concerns

- 3.9.2.2 High initial cost

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 OBD device/ tracker and advance tracker

- 5.2.2 Standalone tracker

- 5.3 Software

- 5.3.1 Fleet management platforms

- 5.3.2 Data analytics tools

- 5.3.3 Mapping and navigation systems

- 5.3.4 Real-time tracking software

- 5.3.5 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates & Forecast, By Communication Tracker, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cellular networks

- 7.3 Satellite

- 7.4 Dual mode

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Transportation & logistics

- 9.3 Construction

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Emergency services

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AT&T Intelligence

- 11.2 ATrack Technology

- 11.3 CalAmp

- 11.4 Concox Information Technology

- 11.5 Continental

- 11.6 Garmin

- 11.7 Geotab

- 11.8 Laipac Technology

- 11.9 Laird

- 11.10 Meitrack

- 11.11 Queclink Wireless Solutions

- 11.12 Sensata

- 11.13 Starcom Systems

- 11.14 Suntech International

- 11.15 Teletrac Navman

- 11.16 Teltonika

- 11.17 TomTom International

- 11.18 Trackimo

- 11.19 Vamosys

- 11.20 Verizon Communications