|

市场调查报告书

商品编码

1666570

汽车人机介面 (HMI) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Human Machine Interface (HMI) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

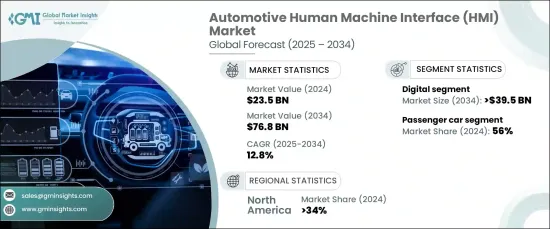

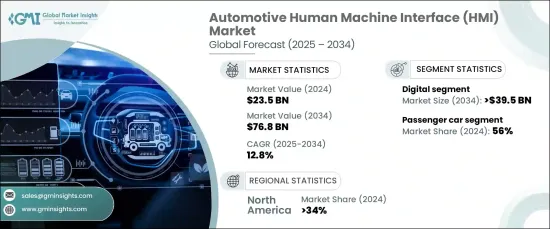

2024 年全球汽车人机介面市场价值为 235 亿美元,预计 2025 年至 2034 年期间将实现 12.8% 的强劲复合年增长率。电动车越来越依赖复杂的 HMI 系统来实现能源管理、充电站导航和高效能电池监控等功能。同样,自动驾驶汽车的日益普及也增加了对增强驾驶员与车辆通讯的先进介面的需求。这些介面对于管理自适应巡航控制、车道维持辅助和自动导航等功能至关重要,确保驾驶者即使在可能需要人工输入的半自动模式下也能保持知情和参与。

消费者现在优先考虑车辆的舒适性、便利性和个人化,这推动了对创新 HMI 技术的需求。随着人们对无缝和直觉技术的期望不断增长,汽车製造商正在超越传统的按钮和旋钮。相反,他们专注于语音识别、触控萤幕、手势控制和扩增实境显示等解决方案。这些进步使得互动性更强、使用者友善的体验更加契合现代的生活方式和喜好。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 235亿美元 |

| 预测值 | 768亿美元 |

| 复合年增长率 | 12.8% |

市场将介面分为实体、数位和多模式选项。数位介面在 2024 年占据了 48% 以上的市场份额,预计到 2034 年将超过 395 亿美元。 它们的受欢迎程度源于其能够提供高度可自订和直观的用户体验。数位显示器结合了多功能仪表板和触控萤幕等功能,为汽车製造商提供了整合高级功能的灵活选项。这些系统简化了车辆操作(例如气候控制、导航、资讯娱乐和驾驶辅助)的访问,提高了便利性和效率。

根据车辆类型,市场分为乘用车、商用车和非公路用车。 2024 年,乘用车将占据整个市场的 56% 左右份额,这主要得益于消费者对日常驾驶舒适性、安全性和可用性提升的需求不断增长。全球范围内乘用车的广泛存在极大地促进了HMI技术的采用。汽车製造商正在采用语音识别、触控萤幕和先进驾驶辅助系统等直觉的介面,以满足不断变化的消费者期望并提升驾驶体验。

从地区来看,北美将在 2024 年占据全球 34% 的收入份额,这得益于其在汽车创新方面的领导地位以及电动和自动驾驶汽车的日益普及。同样,欧洲蓬勃发展的汽车工业以及对连接性和可持续性的高度关注正在加速对尖端 HMI 技术的需求。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 零件製造商

- 技术提供者

- 软体开发者

- 最终用途

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 电动车和自动驾驶汽车的成长

- 消费者对增强使用者体验的需求

- 汽车技术的进步

- 更重视驾驶员和乘客的安全

- 产业陷阱与挑战

- 实施成本高

- 整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 触控式介面

- 语音控制系统

- 手势识别

- 扩增实境显示器

- 触觉回馈系统

第 6 章:市场估计与预测:按介面,2021 - 2034 年

- 主要趋势

- 身体的

- 数位的

- 多式联运

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 资讯娱乐

- 导航

- 驾驶员协助

- 气候控制

- 车辆诊断

- 连线服务

第 8 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 越野车

- 轿车

- 商用车

- 轻型商用车

- 丙型肝炎病毒

- 非公路用车

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alpine Electronics

- Bosch

- Cerence

- Clarion

- Continental

- Denso

- Faurecia

- Garmin

- Harman

- LG Electronics

- LUXOFT

- Marelli Holdings

- Mitsubishi

- Panasonic

- Socionext

- Synaptics

- TATA ELXSI

- Valeo

- Visteon

- Yazaki

The Global Automotive Human Machine Interface Market was valued at USD 23.5 billion in 2024 and is anticipated to experience a robust CAGR of 12.8% between 2025 and 2034. The rapid adoption of electric and autonomous vehicles is a primary driver of this market's expansion. Electric vehicles increasingly depend on sophisticated HMI systems for functions such as energy management, navigation to charging stations, and efficient battery monitoring. Similarly, the rising prevalence of autonomous vehicles amplifies the need for advanced interfaces that enhance driver-vehicle communication. These interfaces are essential for managing features like adaptive cruise control, lane-keeping assistance, and automated navigation, ensuring drivers remain informed and engaged, even in semi-autonomous modes where human input might be necessary.

Consumers now prioritize comfort, convenience, and personalization in their vehicles, which is fueling the demand for innovative HMI technologies. With growing expectations for seamless and intuitive technology, automakers are moving beyond traditional buttons and knobs. Instead, they are focusing on solutions like voice recognition, touchscreens, gesture control, and augmented reality displays. These advancements enable a more interactive and user-friendly experience, aligning with modern lifestyles and preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.5 Billion |

| Forecast Value | $76.8 Billion |

| CAGR | 12.8% |

The market categorizes interfaces into physical, digital, and multimodal options. Digital interfaces accounted for more than 48% of the market share in 2024 and are projected to exceed USD 39.5 billion by 2034. Their popularity stems from their ability to deliver a highly customizable and intuitive user experience. Digital displays incorporate features like multifunctional dashboards and touchscreens, providing automakers with flexible options to integrate advanced functionalities. These systems simplify access to vehicle operations such as climate control, navigation, infotainment, and driver assistance, enhancing convenience and efficiency.

Based on vehicle type, the market is segmented into passenger cars, commercial vehicles, and off-highway vehicles. Passenger cars represented around 56% of the total market share in 2024, largely driven by increasing consumer demand for improved comfort, safety, and usability in everyday driving. The widespread presence of passenger vehicles globally significantly boosts the adoption of HMI technologies. Automakers are incorporating intuitive interfaces like voice recognition, touchscreens, and advanced driver assistance systems to cater to evolving consumer expectations and elevate the driving experience.

Regionally, North America held 34% of the global revenue share in 2024, driven by its leadership in automotive innovation and rising adoption of electric and autonomous vehicles. Similarly, Europe's thriving automotive industry and strong focus on connectivity and sustainability are accelerating the demand for cutting-edge HMI technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturer

- 3.2.2 Technology providers

- 3.2.3 Software developers

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growth of electric and autonomous vehicles

- 3.7.1.2 Consumer demand for enhanced user experience

- 3.7.1.3 Advancements in automotive technology

- 3.7.1.4 Increasing focus on driver and passenger safety

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High implementation costs

- 3.7.2.2 Complexity in integration

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Touch-based interfaces

- 5.3 Voice control systems

- 5.4 Gesture recognition

- 5.5 Augmented reality displays

- 5.6 Haptic feedback systems

Chapter 6 Market Estimates & Forecast, By Interface, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Physical

- 6.3 Digital

- 6.4 Multimodal

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Infotainment

- 7.3 Navigation

- 7.4 Driver assistance

- 7.5 Climate control

- 7.6 Vehicle diagnostics

- 7.7 Connectivity services

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Passenger car

- 8.2.1 Hatchback

- 8.2.2 SUV

- 8.2.3 Sedan

- 8.3 Commercial vehicle

- 8.3.1 LCV

- 8.3.2 HCV

- 8.4 Off-highway vehicle

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alpine Electronics

- 10.2 Bosch

- 10.3 Cerence

- 10.4 Clarion

- 10.5 Continental

- 10.6 Denso

- 10.7 Faurecia

- 10.8 Garmin

- 10.9 Harman

- 10.10 LG Electronics

- 10.11 LUXOFT

- 10.12 Marelli Holdings

- 10.13 Mitsubishi

- 10.14 Panasonic

- 10.15 Socionext

- 10.16 Synaptics

- 10.17 TATA ELXSI

- 10.18 Valeo

- 10.19 Visteon

- 10.20 Yazaki