|

市场调查报告书

商品编码

1666616

水力压裂市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Hydraulic Fracturing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

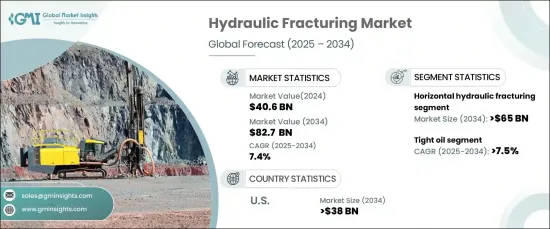

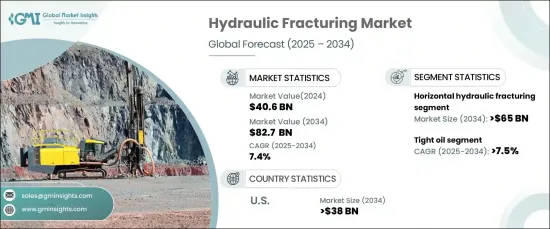

2024 年全球水力压裂市场价值为 406 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.4%。此外,人们越来越重视开发非常规石油和天然气资源,例如页岩气层、煤层气和緻密油储量。这些资源需要先进的水力压裂技术来确保高效开采,进而进一步推动市场成长。钻井和开采技术的不断进步,加上新开采地点的开发和现有油井的最佳化,在满足全球能源需求方面发挥关键作用。

随着水力压裂技术的发展,技术创新正在提高营运效率。石油和天然气行业的公司越来越多地采用最先进的方法从非常规油藏中提取碳氢化合物。预计天然气和石油需求的成长将推动市场发展,特别是在緻密油和页岩气储量丰富的地区。此外,对水力压裂技术研发和基础建设的投资不断增加,以及对能源独立的更加重视,也促进了市场对前景的乐观。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 406亿美元 |

| 预测值 | 827亿美元 |

| 复合年增长率 | 7.4% |

市场上一个突出的趋势是水平水力压裂越来越受欢迎。预计到 2034 年,该技术的价值将达到 650 亿美元。与传统的垂直钻井相比,这种方法效率更高,因此在页岩开发案中特别受欢迎。该方法能够提高产量并开采以前无法开采的天然气矿藏,预计将进一步推动其应用。

緻密油领域的水力压裂市场也有望大幅成长,预计到 2034 年复合年增长率将超过 7.5%。在基础设施投资和国内能源独立的推动下,緻密油产量持续扩大,对市场的成长轨迹产生了正面影响。

预计到2034年,美国水力压裂市场规模将超过380亿美元。各大油田服务公司正致力于提高技术能力、增强国内产量,以满足日益增长的需求,同时减少对外国能源的依赖。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:依技术,2021 – 2034 年

- 主要趋势

- 封堵和穿孔

- 滑动套筒

第六章:市场规模及预测:依地区划分,2021 – 2034 年

- 主要趋势

- 水平的

- 垂直的

第 7 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 原油

- 页岩气

- 緻密气

- 緻密油

- 其他的

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 俄罗斯

- 挪威

- 亚太地区

- 中国

- 汶莱

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿曼

- 拉丁美洲

- 阿根廷

第九章:公司简介

- Baker Hughes

- Calfrac

- Evolution

- Halliburton

- Liberty

- National Energy Services

- NexTier

- NOV

- ProFrac

- Schlumberger

- Shell

- Tacrom

- TechnipFMC

- Trican

- Weatherford

The Global Hydraulic Fracturing Market was valued at USD 40.6 billion in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2034. The rising energy demand across various sectors, including industrial and commercial operations, is driving the market's expansion. In addition, there is a growing emphasis on tapping into unconventional oil and gas resources, such as shale gas formations, coal bed methane, and tight oil reserves. These resources require advanced hydraulic fracturing technologies to ensure efficient extraction, further fueling market growth. Continuous advancements in drilling and extraction technologies, coupled with the development of new extraction sites and optimizing existing wells, are playing a key role in meeting the global energy demand.

As hydraulic fracturing techniques evolve, technological innovations are enhancing operational efficiency. Companies in the oil and gas sector are increasingly adopting state-of-the-art methods for extracting hydrocarbons from unconventional reservoirs. The rise in demand for natural gas and oil, especially in areas with tight oil and shale gas formations, is expected to boost the market. Additionally, rising investments in research and development of hydraulic fracturing technologies, infrastructure development, and a stronger focus on energy independence are contributing to the market's optimistic outlook.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $40.6 Billion |

| Forecast Value | $82.7 Billion |

| CAGR | 7.4% |

One of the prominent trends in the market is the growing popularity of horizontal hydraulic fracturing. This technique is anticipated to reach a value of USD 65 billion by 2034. Horizontal fracturing is highly effective in extracting hydrocarbons from unconventional reservoirs as it allows operators to access a larger surface area with a single well. This approach is more efficient compared to traditional vertical drilling, making it particularly popular in shale development projects. The method's ability to enhance production rates and access previously unreachable natural gas deposits is expected to further drive its adoption.

The hydraulic fracturing market within the tight oil sector is also poised for significant growth, with an expected CAGR of over 7.5% through 2034. The advancement of drilling and fracturing technologies, along with rising oil prices and strong global demand, are making tight oil extraction more profitable. The continued expansion of tight oil production, driven by infrastructure investments and the push for domestic energy independence, is positively influencing the market's growth trajectory.

The hydraulic fracturing market in the U.S. is set to surpass USD 38 billion by 2034. The rapid development of shale resources, coupled with the discovery of new oil and gas fields, is fueling the market's expansion. Major oilfield service companies are focusing on improving their technical capabilities and enhancing domestic production to meet increasing demand while reducing reliance on foreign energy sources.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Plug and perforation

- 5.3 Sliding sleeves

Chapter 6 Market Size and Forecast, By Well, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Horizontal

- 6.3 Vertical

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Crude oil

- 7.3 Shale gas

- 7.4 Tight gas

- 7.5 Tight oil

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Russia

- 8.3.3 Norway

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Brunei

- 8.4.3 Australia

- 8.4.4 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Oman

- 8.6 Latin America

- 8.6.1 Argentina

Chapter 9 Company Profiles

- 9.1 Baker Hughes

- 9.2 Calfrac

- 9.3 Evolution

- 9.4 Halliburton

- 9.5 Liberty

- 9.6 National Energy Services

- 9.7 NexTier

- 9.8 NOV

- 9.9 ProFrac

- 9.10 Schlumberger

- 9.11 Shell

- 9.12 Tacrom

- 9.13 TechnipFMC

- 9.14 Trican

- 9.15 Weatherford