|

市场调查报告书

商品编码

1666638

极低硫燃料油 (VLSFO) 市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Very Low Sulphur Fuel Oil (VLSFO) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

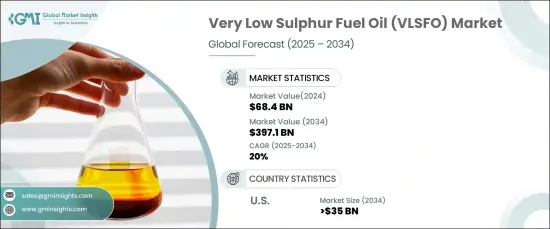

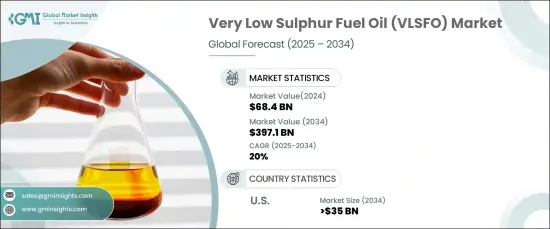

2024 年全球极低硫燃料油市场价值 684 亿美元,预计将大幅扩张,预计 2025 年至 2034 年的复合年增长率为 20%。预计将大幅扩张,预计 2025 年至 2034 年的复合年增长率为 20%。这种转变不仅推动了对低硫燃料的需求,也促使炼油厂提高生产能力以满足不断变化的标准,从而进一步推动市场成长。

除了监管驱动因素外,航运业正在快速发展,环保意识的增强也促进了对 VLSFO 的需求增加。永续航运实践现在比以往任何时候都更加受到关注,目的是减少碳排放和保护海洋生态系统。向环保燃料的转变与这些目标完全一致。随着更多加油设施的投入使用以及欧洲和亚太等主要地区的船舶交通量不断增加,VLSFO 市场在这些地区已广泛应用。企业正在投资创新技术,以优化营运效率,同时确保遵守环境法规,从而确保市场持续扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 684亿美元 |

| 预测值 | 3971亿美元 |

| 复合年增长率 | 20% |

采用低硫推进技术改造现有船舶的趋势进一步推动了 VLSFO 的需求。随着海上客运量的持续成长和区域港口的发展,市场的发展趋势仍然积极。此外,政府对扩大海军舰队的投资,特别是在国防领域,例如航空母舰和潜舰等军舰,也可能增加这些领域对 VLSFO 的需求。

在美国,超低硫燃料油 (VLSFO) 市场规模预计到 2034 年将达到 350 亿美元。此外,当地法规正在促进使用更清洁的燃料,而减少海上活动污染的需求进一步推动了对 VLSFO 的需求。随着人们对豪华性和可靠性船舶的需求不断增长,对营运可靠性的关注度也不断提高,这继续推动市场的成长。随着经济持续稳定和对环保航运的更加重视,美国 VLSFO 市场预计将在未来十年继续蓬勃发展。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 西班牙

- 俄罗斯

- 英国

- 义大利

- 法国

- 德国

- 比利时

- 荷兰

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 新加坡

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第六章:公司简介

- BP

- Chevron

- Exxon Mobil

- Hindustan Petroleum

- Indian Oil

- Marathon Petroleum

- Mediterranean Fuels

- Phillips 66

- Rosneft

- Saudi Aramco

- Shell

- Sinopec

- TotalEnergies

- Viva Energy

- Vitol

The Global Very Low Sulphur Fuel Oil Market, valued at USD 68.4 billion in 2024, is poised for significant expansion, with an expected CAGR of 20% from 2025 to 2034. This market surge is largely driven by the stringent sulphur emission regulations enforced by the International Maritime Organization (IMO) since 2020. These regulations require shipping companies worldwide to transition to VLSFO, a cleaner marine fuel alternative that complies with the new sulphur content standards. This shift is not only pushing the demand for low-sulphur fuels but also prompting refineries to enhance their production capabilities to meet these evolving standards, further fueling market growth.

Beyond regulatory drivers, the maritime sector is growing rapidly, with rising environmental awareness also contributing to the increased demand for VLSFO. Sustainable shipping practices are now more than ever a central focus, with the aim to reduce carbon emissions and protect marine ecosystems. The shift toward eco-friendly fuels aligns perfectly with these objectives. As more bunkering facilities become available and vessel traffic intensifies in key regions like Europe and Asia-Pacific, the VLSFO market is seeing widespread adoption across these regions. Companies are investing in innovative technologies to optimize operational efficiency while ensuring compliance with environmental regulations, thus ensuring continued market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.4 Billion |

| Forecast Value | $397.1 Billion |

| CAGR | 20% |

The trend toward retrofitting existing vessels with low-sulphur propulsion technologies is boosting the VLSFO demand even further. As seaborne passenger traffic continues to grow and regional ports develop, the market's trajectory remains positive. In addition, government investments in expanding naval fleets, particularly in the defense sector with military vessels such as aircraft carriers and submarines, will likely increase the demand for VLSFO in these segments as well.

In the U.S., the Very Low sulphur Fuel Oil (VLSFO) market is projected to reach USD 35 billion by 2034. The increasing demand for low-sulphur fuels is being driven by tighter sulphur emission regulations and the proximity of refineries that can meet the new standards. Additionally, local regulations are fostering the adoption of cleaner fuels, while the need to reduce pollution from seaborne activities is further pushing the demand for VLSFO. The growing focus on operational reliability, in line with the rising demand for vessels that offer luxury and dependability, continues to fuel the market's growth. With ongoing economic stability and a stronger focus on eco-friendly shipping, the U.S. VLSFO market is expected to continue flourishing in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 North America

- 5.2.1 U.S

- 5.2.2 Canada

- 5.3 Europe

- 5.3.1 Spain

- 5.3.2 Russia

- 5.3.3 UK

- 5.3.4 Italy

- 5.3.5 France

- 5.3.6 Germany

- 5.3.7 Belgium

- 5.3.8 Netherlands

- 5.4 Asia Pacific

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 South Korea

- 5.4.4 India

- 5.4.5 Australia

- 5.4.6 Singapore

- 5.5 Middle East & Africa

- 5.5.1 UAE

- 5.5.2 Saudi Arabia

- 5.5.3 Turkey

- 5.5.4 South Africa

- 5.6 Latin America

- 5.6.1 Brazil

- 5.6.2 Mexico

- 5.6.3 Argentina

Chapter 6 Company Profiles

- 6.1 BP

- 6.2 Chevron

- 6.3 Exxon Mobil

- 6.4 Hindustan Petroleum

- 6.5 Indian Oil

- 6.6 Marathon Petroleum

- 6.7 Mediterranean Fuels

- 6.8 Phillips 66

- 6.9 Rosneft

- 6.10 Saudi Aramco

- 6.11 Shell

- 6.12 Sinopec

- 6.13 TotalEnergies

- 6.14 Viva Energy

- 6.15 Vitol