|

市场调查报告书

商品编码

1666675

软糖市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Gummy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

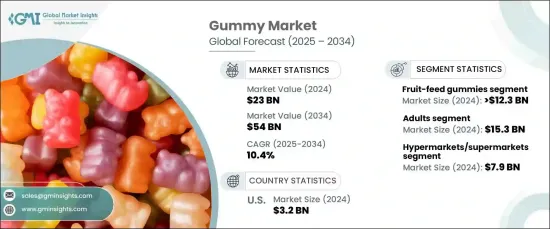

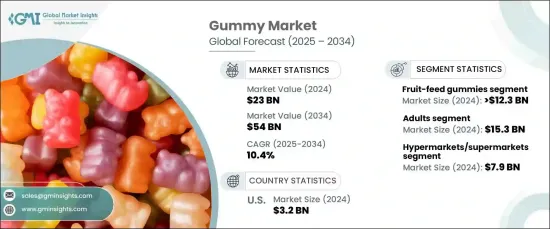

2024 年全球软糖市场价值为 230 亿美元,预计 2025 年至 2034 年期间将以 10.4% 的强劲复合年增长率增长。软糖因其吸引人的外形、口味以及提供必需营养素的多功能性而成为不同人群的首选。

向天然和有机产品的转变是市场成长的重要动力。采用真正的水果萃取物製作且不含合成添加剂的水果软糖特别受到注重健康的消费者的欢迎。这些产品能够提供维生素、抗氧化剂和其他必需营养素,满足追求功能性和营养益处的个人的需求。此外,对植物性和清洁标籤产品的需求不断增长,促进了有机和纯素软糖的采用,符合全球对更健康、无过敏原替代品的趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 230亿美元 |

| 预测值 | 540亿美元 |

| 复合年增长率 | 10.4% |

成年人群体正迅速崛起,成为软糖产品的主要消费群体,标誌着其与儿童的传统联繫发生了转变。越来越多的成年人喜欢用软糖作为膳食补充剂,包括维生素、益生菌、胶原蛋白和 CBD。与传统药片或胶囊相比,软糖的便利性、口味和易用性推动了这个细分市场的成长。该领域内的热门类别包括针对美容、免疫和缓解压力的保健产品,这对製造商来说是一个有利可图的机会。

大卖场、超市等零售通路在软糖市场扩张中扮演关键角色。这些网点让消费者可以轻鬆购买到各种各样的软糖产品,从糖果到功能性补充剂。这些商店的可见性和便利性使其成为品牌接触更广泛受众的理想平台。此外,折扣和捆绑销售等促销活动进一步提高了透过该管道的产品销售量。

美国仍然是软糖市场的主导力量,这得益于传统软糖和针对特定健康需求的功能性软糖日益流行的推动。植物性、无糖和有机软糖的创新正在吸引註重健康的消费者,而电子商务的兴起和零售网路的不断扩大则促进了市场渗透。随着需求不断增长,在消费者偏好不断变化和产品持续创新的推动下,软糖市场将迎来重大进步。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 健康与保健趋势

- 方便、轻鬆消费

- 产品不断创新

- 对天然和清洁标籤产品的需求不断增加

- 产业陷阱与挑战

- 含糖量问题

- 供应链中断

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 水果软糖

- CBD/THC 软糖

- 益生菌软糖

- 维生素软糖

- 其他的

第六章:市场估计与预测:依人口统计,2021-2034 年

- 主要趋势

- 孩子们

- 成年人

- 老年人

第 7 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 大卖场/超市

- 专卖店

- 在线的

- 品牌网站

- 电子商务平台

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Amway Corp.

- Bayer AG

- Catalent, Inc.

- Church & Dwight Co. Inc.

- GSK Plc

- H&H Group

- Haleon Group of Companies

- Nestle SA

- Otsuka Holdings Co., Ltd.

- Procter & Gamble

- Procaps Group

- Unilever PLC (OLLY)

The Global Gummy Market, valued at USD 23 billion in 2024, is projected to grow at a robust CAGR of 10.4% from 2025 to 2034. This remarkable expansion highlights the increasing demand for convenient and enjoyable health and wellness solutions among consumers. Gummies are becoming a preferred choice across demographics due to their appealing format, taste, and versatility in delivering essential nutrients.

The shift toward natural and organic products is a significant growth driver for the market. Fruit-based gummies crafted using real fruit extracts and free from synthetic additives are particularly popular among health-conscious consumers. With their ability to provide vitamins, antioxidants, and other essential nutrients, these products cater to individuals seeking functional and nutritional benefits. Additionally, the rising demand for plant-based and clean-label products is bolstering the adoption of organic and vegan gummies, aligning with global trends for healthier, allergen-free alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23 Billion |

| Forecast Value | $54 Billion |

| CAGR | 10.4% |

The adult segment is rapidly emerging as a key consumer base for gummy products, marking a shift from their traditional association with children. Adults increasingly prefer gummies for dietary supplements, including vitamins, probiotics, collagen, and CBD. This segment's growth is fueled by the convenience, taste, and ease of use that gummies offer compared to traditional pills or capsules. Popular categories within this segment include wellness products targeting beauty, immunity, and stress relief, making them a lucrative opportunity for manufacturers.

Retail channels such as hypermarkets and supermarkets are playing a pivotal role in the gummy market's expansion. These outlets provide consumers with easy access to a diverse range of gummy products, from candy to functional supplements. The visibility and convenience of these stores make them an ideal platform for brands to reach a wider audience. Additionally, promotional activities like discounts and bundled offerings further enhance product sales through this channel.

The U.S. remains a dominant force in the gummy market, driven by the growing popularity of both traditional gummies and functional variants designed to address specific health needs. Innovations in plant-based, sugar-free, and organic gummies are attracting health-conscious consumers, while the rise of e-commerce and expanding retail networks contribute to market penetration. As demand continues to grow, the gummy market is poised for significant advancements, driven by evolving consumer preferences and ongoing product innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Health and wellness trends

- 3.6.1.2 Convenience and easy consumption

- 3.6.1.3 Continuous innovation in products

- 3.6.1.4 Increasing demand for natural and clean-label products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Sugar content concerns

- 3.6.2.2 Supply chain disruptions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fruit-feed gummies

- 5.3 CBD/THC gummies

- 5.4 Probiotic gummies

- 5.5 Vitamin gummies

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Demography, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Children

- 6.3 Adults

- 6.4 Seniors

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Hypermarkets/Supermarkets

- 7.3 Specialty stores

- 7.4 Online

- 7.4.1 Brand websites

- 7.4.2 E-commerce platforms

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amway Corp.

- 9.2 Bayer AG

- 9.3 Catalent, Inc.

- 9.4 Church & Dwight Co. Inc.

- 9.5 GSK Plc

- 9.6 H&H Group

- 9.7 Haleon Group of Companies

- 9.8 Nestle SA

- 9.9 Otsuka Holdings Co., Ltd.

- 9.10 Procter & Gamble

- 9.11 Procaps Group

- 9.12 Unilever PLC (OLLY)