|

市场调查报告书

商品编码

1666710

管道绝缘市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Pipe Insulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

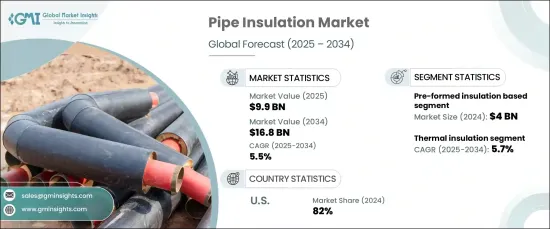

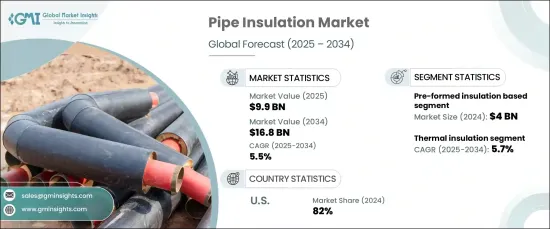

2024 年全球管道绝缘市场价值为 99 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.5%。绝缘管道可有效减少暖气和冷气系统中的能量损失,有助于提高住宅、商业和工业环境的能源效率。

随着能源成本不断攀升以及减少碳排放的紧迫性不断增强,管道保温作为降低整体能源消耗的实用解决方案越来越受到重视。它有助于维持管道系统的恆定温度,减少加热或冷却所需的能量,从而提供长期成本节约和永续发展效益。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 99亿美元 |

| 预测值 | 168亿美元 |

| 复合年增长率 | 5.5% |

依产品类型,市场分为预製绝缘材料、硬质板绝缘材料、毯式绝缘材料、捲式绝缘材料、喷涂泡沫绝缘材料等。其中,预製绝缘材料成为领先细分市场,2024 年创造约 40 亿美元的收入。预製绝缘材料采用玻璃纤维和矿棉等材料製造,可减少人工成本和安装时间,使其成为各行业的首选。

依功能,市场分为隔热、隔音、防火等。 2024 年,隔热材料将占据约 40% 的市场份额,预计在预测期内的复合年增长率为 5.7%。其主要作用是保持管道内的温度一致性,从而最大限度地减少能源浪费并优化工业流程的性能。此功能对于製造业和能源生产等行业尤其重要,因为效率和降低营运成本是这些行业的首要任务。

从地区来看,美国占据北美管道绝缘市场的主导地位,占有约 82% 的份额。更严格的建筑规范和能源效率要求正在推动对先进绝缘解决方案的需求。监管架构旨在减少暖通空调和管道系统的能量损失,并促进高性能绝缘材料的采用。

受人们对节能的日益重视以及对高效、永续基础设施解决方案的需求的推动,管道绝缘市场有望实现强劲成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 增加建筑活动

- 不断成长的产品创新

- 产业陷阱与挑战

- 市场饱和且竞争激烈

- 永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2035 年

- 主要趋势

- 预成型绝缘材料

- 硬质板保温

- 毯式隔热材料

- 捲式绝缘材料

- 喷涂泡棉隔热材料

- 其他(鬆散填充绝缘等)

第 6 章:市场估计与预测:按材料类型,2021-2035 年

- 主要趋势

- 玻璃纤维

- 矿棉

- 聚氨酯

- 聚乙烯

- 弹性泡沫

- 橡皮

- 其他(硅酸钙等)

第 7 章:市场估计与预测:按功能,2021 年至 2035 年

- 主要趋势

- 隔热

- 隔音

- 防火

- 其他(结露控制等)

第 8 章:市场估计与预测:依最终用途,2021 年至 2035 年

- 主要趋势

- 住宅

- 商业的

- 工业的

- 石油和天然气

- 化学

- 能源与电力

- 海洋

- 其他(医药等)

第 9 章:市场估计与预测:按配销通路,2021-2035 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2035 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- 3M

- Alfa Laval

- Armacell International

- BASF

- Covestro

- Huntsman Corporation

- Insulation Technologies

- Johns Manville

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Rockwool International

- Saint Gobain

- Shenzhen Lanxuan Industrial

- Thermaflex

The Global Pipe Insulation Market was valued at USD 9.9 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2034. This growth is largely driven by the increasing focus on energy efficiency, compliance with regulatory standards, and the rising adoption of sustainable construction practices. Insulating pipes effectively minimizes energy loss in heating and cooling systems, contributing to improved energy efficiency in residential, commercial, and industrial settings.

As energy costs continue to climb and the urgency to reduce carbon emissions intensifies, pipe insulation is gaining prominence as a practical solution to lower overall energy consumption. It helps maintain consistent temperatures in piping systems, reducing the energy required for heating or cooling, thus offering long-term cost savings and sustainability benefits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $16.8 Billion |

| CAGR | 5.5% |

The market is segmented by product type into pre-formed insulation, rigid board insulation, blanket insulation, roll insulation, spray foam insulation, and others. Among these, pre-formed insulation emerged as a leading segment, generating approximately USD 4 billion in revenue in 2024. This segment is projected to grow steadily, owing to its user-friendly installation process and ability to accommodate various pipe dimensions and configurations. Manufactured using materials such as fiberglass and mineral wool, pre-formed insulation reduces labor costs and installation time, making it a preferred choice across sectors.

By function, the market is categorized into thermal insulation, acoustic insulation, fire protection, and others. Thermal insulation accounted for around 40% of the market share in 2024 and is anticipated to grow at a CAGR of 5.7% over the forecast period. Its primary role is to maintain temperature consistency in pipes, thus minimizing energy waste and optimizing performance in industrial processes. This functionality is particularly important in sectors like manufacturing and energy production, where efficiency and operational cost reduction are priorities.

Regionally, the United States dominates the North America pipe insulation market, holding a substantial share of approximately 82%. Stricter building codes and energy-efficiency mandates are fueling demand for advanced insulation solutions. Regulatory frameworks aim to reduce energy loss in HVAC and plumbing systems, boosting the adoption of high-performance insulation materials.

The pipe insulation market is poised for robust growth, driven by the increasing emphasis on energy conservation and the need for efficient and sustainable infrastructure solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2035

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Growing product innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2035 (USD Million) (Thousand Square Feet)

- 5.1 Key trends

- 5.2 Pre-formed insulation

- 5.3 Rigid board insulation

- 5.4 Blanket insulation

- 5.5 Roll insulation

- 5.6 Spray Foam insulation

- 5.7 Others (loose fill insulation, etc.)

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2035 (USD Million) (Thousand Square Feet)

- 6.1 Key trends

- 6.2 Fiberglass

- 6.3 Mineral wool

- 6.4 Polyurethane

- 6.5 Polyethylene

- 6.6 Elastomeric foam

- 6.7 Rubber

- 6.8 Others (calcium silicate, etc.)

Chapter 7 Market Estimates & Forecast, By Function, 2021-2035 (USD Million) (Thousand Square Feet)

- 7.1 Key trends

- 7.2 Thermal insulation

- 7.3 Acoustic insulation

- 7.4 Fire protection

- 7.5 Others (condensation control, etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2035 (USD Million) (Thousand Square Feet)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

- 8.4.1 Oil & gas

- 8.4.2 Chemical

- 8.4.3 Energy & power

- 8.4.4 Marine

- 8.4.5 Others (pharmaceutical, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2035 (USD Million) (Thousand Square Feet)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2035 (USD Million) (Thousand Square Feet)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 Alfa Laval

- 11.3 Armacell International

- 11.4 BASF

- 11.5 Covestro

- 11.6 Huntsman Corporation

- 11.7 Insulation Technologies

- 11.8 Johns Manville

- 11.9 Kingspan Group

- 11.10 Knauf Insulation

- 11.11 Owens Corning

- 11.12 Rockwool International

- 11.13 Saint Gobain

- 11.14 Shenzhen Lanxuan Industrial

- 11.15 Thermaflex