|

市场调查报告书

商品编码

1666909

汽车预测技术市场机会、成长动力、产业趋势分析与预测 2025 - 2034Automotive Predictive Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

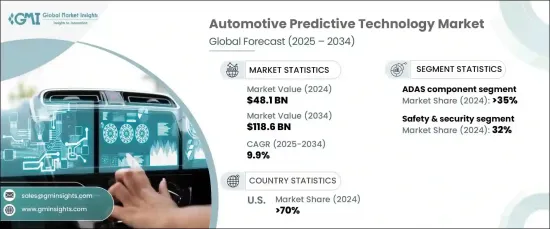

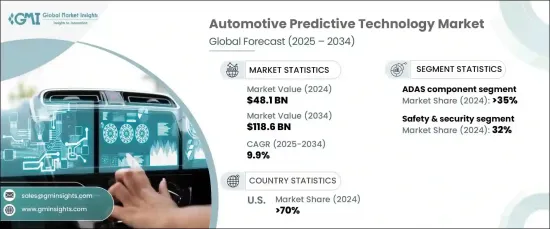

2024 年全球汽车预测技术市场价值为 481 亿美元,预计 2025 年至 2034 年期间将以 9.9% 的复合年增长率强劲增长。汽车製造商正在加速采用预测技术,透过分析交通模式、驾驶员行为和车辆性能等即时资料来提高车辆安全性、防止事故并改善整体驾驶体验。预测性维护也获得了显着的关注,可以提前发现潜在问题,防止意外故障,确保车辆的可靠性。

推动市场扩张的关键因素是电动车(EV)普及率的上升。随着汽车产业走向永续发展,预测技术对于优化电动车性能和延长电池寿命变得至关重要。这些技术使用先进的分析技术来预测电池磨损、监控充电习惯并提高能源效率,确保电动车的最佳性能和使用寿命。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 481亿美元 |

| 预测值 | 1186亿美元 |

| 复合年增长率 | 9.9% |

市场的硬体部分包括 ADAS 组件、OBD 设备和远端资讯处理系统。 2024 年,ADAS 组件占据了 35% 的市场份额,预计到 2034 年将创造 480 亿美元的市场价值。透过利用感测器、摄影机、雷达和人工智慧,这些技术使车辆能够即时预测和降低风险,从而显着提高道路安全。

市场也根据应用进行细分,包括预测性维护、车辆健康监测、安全保障以及驾驶模式分析。 2024 年,在全球重点关注减少交通事故死亡人数的推动下,安全和安保领域将占据 32% 的市场份额。由于人为错误是造成道路事故的主要因素,预测技术对于预测危险和提高整体道路安全至关重要。

2024 年,美国汽车预测技术市场占据全球 70% 的份额,领先全球。预测技术对于自动驾驶汽车至关重要,它使它们能够处理来自感测器和摄影机的资料,以便在复杂的环境中导航、避免碰撞并做出快速、准确的决策。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 汽车原厂设备製造商

- 技术提供者

- 数据分析和云端服务供应商

- 最终用途

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 案例研究

- 衝击力

- 成长动力

- 对车辆安全性和效率的需求不断增加

- 对个人化和互联体验的需求

- 人工智慧(AI)与机器学习(ML)的快速融合

- 连网汽车的普及率不断提高

- 产业陷阱与挑战

- 资料隐私和安全问题

- 实施成本高

- 成长动力

3.10 成长潜力分析

3.11 波特分析

3.12 PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 预测性维护

- 车辆健康监测

- 安全与保障

- 驾驶模式分析

- 其他的

第六章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 本地

- 云

第 7 章:市场估计与预测:按硬件,2021 - 2034 年

- 主要趋势

- ADAS 元件

- 车载诊断系统 (OBD)

- 远端资讯处理

第 8 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aisin

- Aptiv

- Bosch

- Continental

- Garrett Motion

- HARMAN

- Honeywell

- Infineon

- Intel

- Lear

- Magna

- Mobileye

- NVIDIA

- NXP

- Qualcomm

- Renesas

- Siemens

- Valeo

- Visteon

- ZF Friedrichshafen

The Global Automotive Predictive Technology Market, valued at USD 48.1 billion in 2024, is expected to experience robust growth at a CAGR of 9.9% from 2025 to 2034. This growth is driven by the increasing demand for advanced safety features and driver assistance systems. Automakers are adopting predictive technologies at an accelerating pace to enhance vehicle safety, prevent accidents, and improve overall driving experiences by analyzing real-time data such as traffic patterns, driver behavior, and vehicle performance. Predictive maintenance has also gained significant traction, allowing for early detection of potential issues to prevent unexpected breakdowns and ensure greater vehicle reliability.

A key factor fueling market expansion is the rise in electric vehicle (EV) adoption. As the automotive industry moves toward greater sustainability, predictive technologies are becoming essential for optimizing EV performance and extending battery life. These technologies use advanced analytics to forecast battery wear, monitor charging habits, and enhance energy efficiency, ensuring optimal performance and longevity of EVs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.1 Billion |

| Forecast Value | $118.6 Billion |

| CAGR | 9.9% |

The hardware segment of the market includes ADAS components, OBD devices, and telematics systems. In 2024, ADAS components accounted for 35% of the market share and are expected to generate USD 48 billion by 2034. The increasing demand for automation and safer driving solutions has led to the integration of ADAS features such as adaptive cruise control, lane assist, and collision detection. By leveraging sensors, cameras, radar, and artificial intelligence, these technologies enable vehicles to predict and mitigate risks in real-time, significantly enhancing road safety.

The market is also segmented by applications, including predictive maintenance, vehicle health monitoring, safety and security, and driving pattern analysis. In 2024, the safety and security segment held 32% of the market share, driven by the global focus on reducing traffic fatalities. With human error being a major factor in road accidents, predictive technologies have become crucial in anticipating hazards and improving overall road safety.

The U.S. automotive predictive technology market led the global market with a dominant 70% share in 2024. The country's leadership in developing autonomous vehicles (AVs) and advanced predictive systems has attracted significant investments from automakers and tech companies alike. Predictive technology is crucial for AVs, enabling them to process data from sensors and cameras to navigate complex environments, avoid collisions, and make quick, precise decisions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automotive OEMs

- 3.1.2 Technology providers

- 3.1.3 Data analytics & cloud service providers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Case study

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for vehicle safety & efficiency

- 3.9.1.2 Demand for personalized & connected experiences

- 3.9.1.3 Rapid integration of Artificial Intelligence (AI) and Machine Learning (ML)

- 3.9.1.4 Rising adoption of connected cars

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data privacy & security concerns

- 3.9.2.2 High implementation costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

CHAPTER 4 : Competitive Landscape

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Predictive maintenance

- 5.3 Vehicle health monitoring

- 5.4 Safety & security

- 5.5 Driving pattern analysis

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Hardware, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 ADAS component

- 7.3 OBD

- 7.4 Telematics

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Passenger vehicle

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUVs

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCVs)

- 8.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 94.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aisin

- 10.2 Aptiv

- 10.3 Bosch

- 10.4 Continental

- 10.5 Garrett Motion

- 10.6 HARMAN

- 10.7 Honeywell

- 10.8 Infineon

- 10.9 Intel

- 10.10 Lear

- 10.11 Magna

- 10.12 Mobileye

- 10.13 NVIDIA

- 10.14 NXP

- 10.15 Qualcomm

- 10.16 Renesas

- 10.17 Siemens

- 10.18 Valeo

- 10.19 Visteon

- 10.20 ZF Friedrichshafen