|

市场调查报告书

商品编码

1666968

住宅电保险丝市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Residential Electric Fuse Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

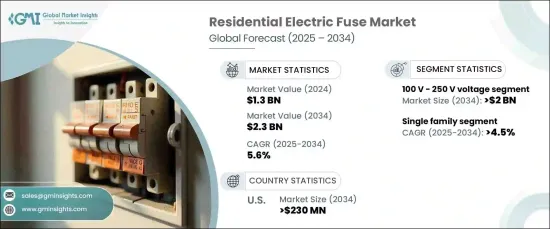

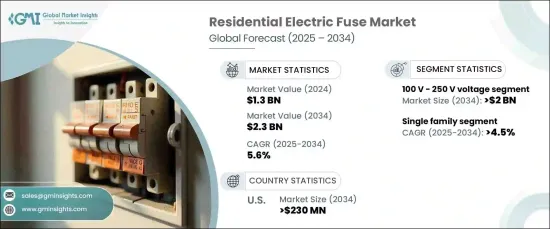

2024 年全球住宅电保险丝市场规模达到 13 亿美元,预计到 2034 年将以 5.6% 的强劲复合年增长率增长。对能源效率和加强安全措施的重视进一步增强了市场的潜力。

优化电力消耗的努力正在促使房主和政府对电力系统进行现代化改造。现代电保险丝处于最前沿,在改善能源利用和确保家庭安全方面发挥着至关重要的作用。保险丝技术的创新,包括先进的材料和尖端的故障检测功能,显着提高了住宅电气系统的安全性和效率,进一步推动了市场的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 5.6% |

预计到 2034 年,100 V - 250 V 电压段的收入将超过 20 亿美元。此外,太阳能电池板等再生能源解决方案的日益普及凸显了对强大的电气保护系统的迫切需求。对安全性、成本节约和智慧家庭自动化系统的广泛整合的高度关注进一步推动了该领域对现代保险丝的需求。

受城市化进程加快和新房屋需求激增的推动,预计到 2034 年,独户住宅市场将实现 4.5% 的稳定复合年增长率。独户住宅建设的繁荣为先进电力基础设施的发展提供了重大机会。随着住宅建筑安全标准和法规的严格实施,智慧家庭技术的采用不断增加,从而增加了对尖端电路保护设备的需求。由于房主寻求保护家用电器和电气系统,这一趋势正在重塑家用电保险丝市场。

在美国,住宅电保险丝市场规模预计到 2034 年将超过 2.3 亿美元。在法规、安全运动和对电气危险的担忧的推动下,消费者对电气安全的认识不断提高,推动了先进保险丝技术的采用。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:按电压,2021 – 2034 年

- 主要趋势

- < 100 伏

- 100 伏 - 250 伏

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 单亲家庭

- 多户家庭

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 科威特

- 土耳其

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Bel Fuse

- Denco

- Eaton

- Efen

- Fuji Electric

- Fuseco

- KYOCERA AVX

- Legrand

- Littelfuse

- McGraw Edison

- Mersen

- Optifuse

- Schurter

- Siba

- Siemens

The Global Residential Electric Fuse Market reached USD 1.3 billion in 2024 and is projected to grow at a robust CAGR of 5.6% through 2034. This growth trajectory is fueled by the rapid expansion of residential infrastructure, driven by accelerating urbanization, population increases, and rising electricity demand. The emphasis on energy efficiency and enhanced safety measures further strengthens the market's potential.

Efforts to optimize electricity consumption are prompting homeowners and governments to modernize electrical systems. Modern electric fuses are at the forefront, playing a vital role in improving energy use and ensuring household safety. Innovations in fuse technology, including advanced materials and cutting-edge fault detection features, are significantly enhancing the safety and efficiency of residential electrical systems, further propelling the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.6% |

The 100 V - 250 V voltage segment is expected to generate over USD 2 billion by 2034. This surge is attributed to the integration of energy-efficient, low-voltage systems in residential construction, which demand reliable protective components. Additionally, the growing adoption of renewable energy solutions like solar panels underscores the critical need for robust electrical protection systems. Heightened focus on safety, cost savings, and the widespread integration of smart home automation systems are further driving demand for modern fuses in this segment.

The single-family housing market segment is expected to experience a steady CAGR of 4.5% through 2034, fueled by increased urbanization and surging demand for new homes. The boom in single-family home construction presents significant opportunities for advanced electrical infrastructure development. With strict safety standards and regulations governing residential buildings, the adoption of smart home technologies continues to rise, bolstering the demand for cutting-edge circuit protection devices. This trend is reshaping the residential electric fuse market as homeowners seek to safeguard appliances and electrical systems.

In the U.S., the residential electric fuse market is expected to exceed USD 230 million by 2034. The combination of growing urbanization, expanding residential construction activities, and retrofitting older homes to meet modern energy efficiency and safety standards is fueling this growth. Consumer awareness regarding electrical safety, spurred by regulations, safety campaigns, and concerns over electrical hazards, is driving the adoption of advanced fuse technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 < 100 V

- 5.3 100 V - 250 V

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Single family

- 6.3 Multi family

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Kuwait

- 7.5.4 Turkey

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Bel Fuse

- 8.2 Denco

- 8.3 Eaton

- 8.4 Efen

- 8.5 Fuji Electric

- 8.6 Fuseco

- 8.7 KYOCERA AVX

- 8.8 Legrand

- 8.9 Littelfuse

- 8.10 McGraw Edison

- 8.11 Mersen

- 8.12 Optifuse

- 8.13 Schurter

- 8.14 Siba

- 8.15 Siemens