|

市场调查报告书

商品编码

1666991

抗菌(酵素)蛋白水解物市场机会、成长动力、产业趋势分析与预测 2025 - 2034Antimicrobial (Enzymatic) Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

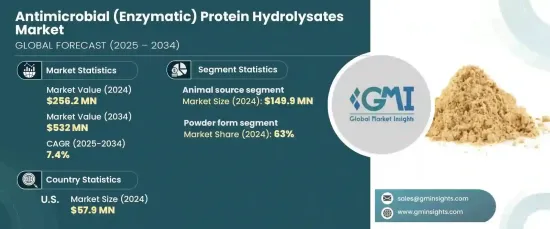

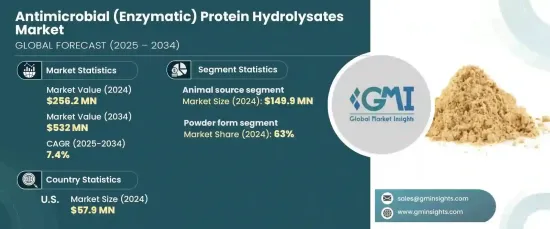

2024 年,食品和宠物食品应用的全球抗菌蛋白水解物市场规模达到 2.562 亿美元,预计 2025 年至 2034 年的复合年增长率为 7.4%。 这一增长主要得益于食品、製药和个人护理等行业对天然、生物基抗菌剂的需求不断增长。

随着消费者越来越意识到合成防腐剂的风险,酵素蛋白水解物因其功能优势(包括延长保质期和增强健康特性)而越来越受欢迎。人们对抗生素抗药性的日益担忧促使各行各业转向蛋白质基水解物,这种水解物已被证明可以有效控制有害微生物。此外,生物技术的进步提高了这些水解产物的生产效率,增加了它们的可用性并支持它们在营养保健品和动物饲料等各个领域的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.562亿美元 |

| 预测值 | 5.32亿美元 |

| 复合年增长率 | 7.4% |

抗菌蛋白水解物市场依来源分类,主要分为植物、动物和微生物。动物性蛋白质在 2024 年占据了最大的市场份额,产值为 1.499 亿美元,预计到 2034 年将达到 3.069 亿美元。来自鱼、牛奶和蛋的动物蛋白因其丰富的氨基酸成分和生物活性肽而备受推崇,这些肽具有抗菌特性。这些蛋白质由于其安全性和抑制有害微生物生长的有效性而被广泛应用于食品保鲜和药物中。

就形态而言,市场分为液体、粉末和膏状类别。粉末形式引领市场,到 2024 年将占据 63% 的份额。它们还提供精确的剂量,使製造商能够更好地控製配方。此外,粉状水解物适应性很强,因为它们可以重新组织成流体或添加到干燥混合物中,从而提高其在各种应用中的适用性。

2024 年,美国食品和宠物食品用抗菌(酵素)蛋白水解物市场价值为 5,790 万美元。人们对合成防腐剂的逐渐弃用,以及对抗菌素抗药性日益增长的担忧,进一步推动了药品和营养保健品对生物基抗菌解决方案的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 天然抗菌药物需求不断成长

- 抗菌素抗药性问题

- 扩充应用

- 产业陷阱与挑战

- 生产成本高

- 监管挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:依来源,2021-2034 年

- 主要趋势

- 植物

- 鹰嘴豆

- 大豆

- 普通豆类

- 米

- 其他的

- 动物

- 牛奶

- 蛋

- 副产品

- 微生物

- 藻类

- 真菌

- 其他的

第六章:市场规模及预测:依形式,2021-2034

- 主要趋势

- 液体

- 粉末

- 贴上

第 7 章:市场规模与预测:依最终用途,2021-2034 年

- 主要趋势

- 食品和饮料

- 烹饪和功能性食品

- 肉

- 宠物食品

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- A Constantino & C Spa

- Aker Biomarine

- AMCO Proteins

- Biomega Group

- BRF Ingredients

- Cargill Incorporated

- Crescent Biotech

- IQI Petfood

- IsoNova Technologies

- Kemin Industries

- Kerry Group

- Loryma GmbH

- New Alliance Dye Chem

- Pestell Nutrition

- Proliver

- Sonac

- Titan Biotech

- Vetpharm Laboratories

The Global Antimicrobial Protein Hydrolysates Market for food and pet food applications amassed USD 256.2 million in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2034. This growth is primarily driven by the increasing demand for natural, bio-based antimicrobial agents across industries such as food, pharmaceuticals, and personal care.

As consumers become more aware of the risks associated with synthetic preservatives, enzymatic protein hydrolysates are gaining popularity due to their functional benefits, including extended shelf life and enhanced health properties. The growing concern over antimicrobial resistance is prompting industries to turn to protein-based hydrolysates, which have been shown to effectively control harmful microorganisms. Furthermore, advances in biotechnology have improved the production efficiency of these hydrolysates, increasing their availability and supporting their adoption across various sectors, including nutraceuticals and animal feed.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $256.2 Million |

| Forecast Value | $532 Million |

| CAGR | 7.4% |

The antimicrobial protein hydrolysates market is categorized by source, with the main segments being plant, animal, and microorganisms. The animal-derived segment held the largest market share in 2024, generating USD 149.9 million, and is expected to reach USD 306.9 million by 2034. Animal-based proteins, sourced from fish, milk, and eggs, are highly valued for rich amino acid profiles and bioactive peptides, which show antimicrobial features. These proteins are widely used in food preservation and medications owing to their safety and effectiveness in inhibiting the growth of harmful microorganisms.

In terms of form, the market is divided into liquid, powder, and paste categories. The powder form leads the market, accounting for 63% share in 2024. Powders are preferred due to their stability, which makes them easier to transport and handle across different industries, including food, pharmaceuticals, and cosmetics. They also offer precise dosing, allowing manufacturers better control over formulations. Additionally, powdered hydrolysates are highly adaptable, as they can be reorganized into fluids or added to dry mixes, improving their serviceability in various applications.

U.S. antimicrobial (enzymatic) protein hydrolysates market for food and pet food applications was valued at USD 57.9 million in 2024. This market is growing rapidly due to increasing consumer demand for clean-label, natural ingredients in food products. The shift away from synthetic preservatives, along with heightened concerns about antimicrobial resistance, is further driving the demand for bio-based antimicrobial solutions in both pharmaceuticals and nutraceuticals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for natural antimicrobials

- 3.6.1.2 Antimicrobial resistance concerns

- 3.6.1.3 Expanding applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs

- 3.6.2.2 Regulatory challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant

- 5.2.1 Chickpea

- 5.2.2 Soybeans

- 5.2.3 Common beans

- 5.2.4 Rice

- 5.2.5 Others

- 5.3 Animal

- 5.3.1 Milk

- 5.3.2 Eggs

- 5.3.3 By-products

- 5.4 Micro-organisms

- 5.4.1 Algae

- 5.4.2 Fungi

- 5.4.3 Others

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Powder

- 6.4 Paste

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Culinary & functional food

- 7.2.2 Meat

- 7.3 Pet food

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 A Constantino & C Spa

- 9.2 Aker Biomarine

- 9.3 AMCO Proteins

- 9.4 Biomega Group

- 9.5 BRF Ingredients

- 9.6 Cargill Incorporated

- 9.7 Crescent Biotech

- 9.8 IQI Petfood

- 9.9 IsoNova Technologies

- 9.10 Kemin Industries

- 9.11 Kerry Group

- 9.12 Loryma GmbH

- 9.13 New Alliance Dye Chem

- 9.14 Pestell Nutrition

- 9.15 Proliver

- 9.16 Sonac

- 9.17 Titan Biotech

- 9.18 Vetpharm Laboratories