|

市场调查报告书

商品编码

1667015

公用事业规模中压开关设备市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Utility Scale Medium Voltage Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

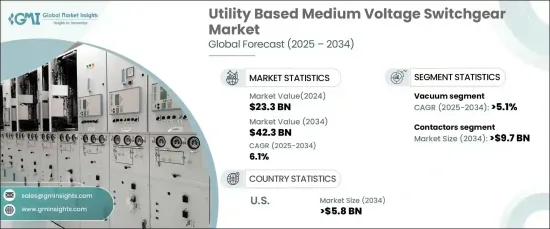

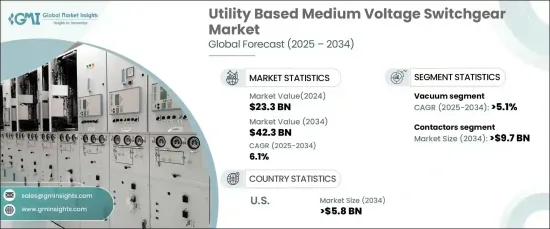

2024 年全球公用事业规模中压开关设备市场价值达到 233 亿美元,预计 2025 年至 2034 年期间复合年增长率为 6.1%。世界各国政府都在强调工业电气化和脱碳努力,这导致对电网基础设施的投资增加。

风能、太阳能等再生能源併入电网也推动了对中压开关设备的需求。智慧电网技术与先进的监控解决方案相结合,正在改变公用事业管理配电的方式。这些技术透过实现即时故障检测和增强系统可靠性来提高营运效率。此外,电网管理越来越重视电网现代化和数位化,这促进了预测性维护和能源优化解决方案的使用,确保公用事业能够实现具有成本效益的高效能营运。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 233亿美元 |

| 预测值 | 423亿美元 |

| 复合年增长率 | 6.1% |

市场扩张的驱动力之一是接触器的作用,预计到 2034 年将产生 97 亿美元的市场价值。它们管理、切换和保护中压系统内的电路,提供高可靠性和效率。随着再生能源设施(特别是风能和太阳能发电场)的增加,对中压接触器的需求日益增加。这是因为接触器对于管理波动的能量负荷和确保电力分配的稳定性至关重要。

绝缘领域也正在经历成长,预计到 2034 年真空绝缘类型的复合年增长率将达到 5.1%。真空绝缘技术可实现高效的灭弧,同时只需极少的维护,这使其成为中压应用的一个有吸引力的选择。此外,随着全球焦点转向永续发展,真空绝缘开关设备因消除了强效温室气体(SF6)而越来越受到关注。这符合全球环境目标并支持减少电网的碳排放。

预计到 2034 年,美国公用事业规模中压开关设备市场将创收 58 亿美元。促进清洁能源采用和脱碳的联邦政策正在加速风能和太阳能发电场的部署,进一步增加了对能够处理这些能源提供的动态能源输入的先进开关设备解决方案的需求。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模及预测:按组件,2021 – 2034 年

- 主要趋势

- 断路器

- 接触器

- 开关和断路器

- 保险丝

- 其他的

第 6 章:市场规模及预测:依绝缘材料,2021 – 2034 年

- 主要趋势

- 空气

- 气体

- 油

- 真空

- 其他的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Bharat Heavy Electricals

- CG Power and Industrial Solutions

- E + I Engineering

- Eaton

- Fuji Electric

- General Electric

- HD Hyundai Electric

- Hitachi

- Hyosung Heavy Industries

- Lucy Group

- Mitsubishi Electric

- Ormazabal

- Schneider Electric

- Siemens

- Skema

- Toshiba

The Global Utility Scale Medium Voltage Switchgear Market reached a value of USD 23.3 billion in 2024 and is expected to expand at a CAGR of 6.1% from 2025 to 2034. The increasing demand for reliable power distribution systems, driven by rising electricity consumption and aging infrastructure in developed nations, is a major factor contributing to this growth. Governments across the globe are emphasizing the electrification of industries and decarbonization efforts, which are leading to increased investments in grid infrastructure.

The demand for medium voltage switchgear is also being fueled by the integration of renewable energy sources, such as wind and solar, into the power grid. Smart grid technology, combined with advanced monitoring solutions, is transforming how utilities manage power distribution. These technologies improve operational efficiency by enabling real-time fault detection and enhancing system reliability. Furthermore, the growing focus on grid modernization and digitalization in grid management is promoting the use of predictive maintenance and energy optimization solutions, ensuring that utilities can achieve cost-effective, high-performance operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.3 Billion |

| Forecast Value | $42.3 Billion |

| CAGR | 6.1% |

One of the driving forces behind market expansion is the role of contactors, which are anticipated to generate USD 9.7 billion by 2034. These devices are essential in industrial applications, renewable energy projects, and efforts to modernize the electrical grid. They manage, switch, and protect electrical circuits within medium-voltage systems, offering high reliability and efficiency. With the rise in renewable energy installations, particularly wind and solar farms, the need for medium-voltage contactors is intensifying. This is because contactors are crucial for managing fluctuating energy loads and ensuring the stability of power distribution.

The insulation segment is also witnessing growth, with the vacuum insulation type projected to expand at a CAGR of 5.1% by 2034. This growth can be attributed to the vacuum's environmental benefits and its superior performance in modern power systems. Vacuum insulation technology provides efficient arc extinction while requiring minimal maintenance, making it an attractive option for medium-voltage applications. Additionally, as the global focus shifts towards sustainability, vacuum-insulated switchgear is gaining traction due to its elimination of SF6 gas-a potent greenhouse gas. This aligns with global environmental goals and supports the reduction of carbon emissions across power grids.

The U.S. utility-scale medium voltage switchgear market is forecast to generate USD 5.8 billion by 2034. This growth is driven by continuous investments in grid modernization, renewable energy integration, and infrastructure upgrades. Federal policies promoting clean energy adoption and decarbonization are accelerating the deployment of wind and solar farms, further increasing the demand for advanced switchgear solutions capable of handling the dynamic energy inputs these sources provide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Circuit breakers

- 5.3 Contactors

- 5.4 Switches & disconnector

- 5.5 Fuses

- 5.6 Others

Chapter 6 Market Size and Forecast, By Insulation, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Air

- 6.3 Gas

- 6.4 Oil

- 6.5 Vacuum

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Bharat Heavy Electricals

- 8.3 CG Power and Industrial Solutions

- 8.4 E + I Engineering

- 8.5 Eaton

- 8.6 Fuji Electric

- 8.7 General Electric

- 8.8 HD Hyundai Electric

- 8.9 Hitachi

- 8.10 Hyosung Heavy Industries

- 8.11 Lucy Group

- 8.12 Mitsubishi Electric

- 8.13 Ormazabal

- 8.14 Schneider Electric

- 8.15 Siemens

- 8.16 Skema

- 8.17 Toshiba