|

市场调查报告书

商品编码

1721593

中压数位变电站市场机会、成长动力、产业趋势分析及2025-2034年预测Medium Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

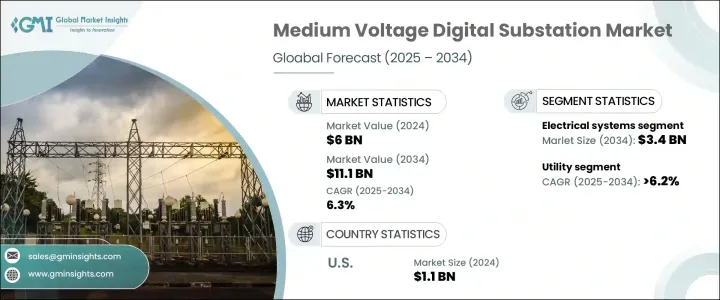

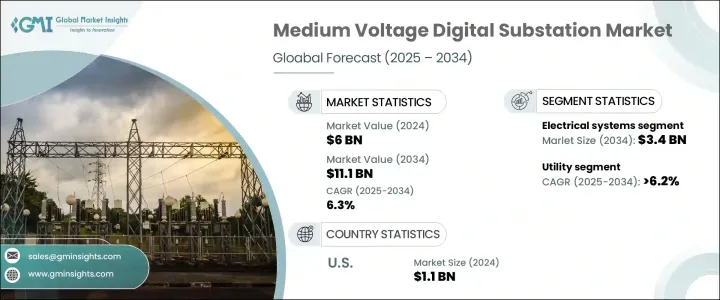

2024 年全球中压数位变电站市场规模达到 60 亿美元,预计到 2034 年将以 6.3% 的复合年增长率成长,达到 111 亿美元。这一增长是由电网现代化需求的不断增长、自动化和数位技术的兴起以及可再生能源的整合所推动的。从传统变电站到数位化系统的转变正在提高营运效率、降低维护成本并提高电网的可靠性和弹性。这些数位化变电站在管理即时资料、优化性能和提高电网稳定性方面提供了更先进的功能。

数位化变电站的兴起采用了物联网感测器、云端运算和人工智慧分析等创新技术。这些变电站可以捕获和分析来自各种组件(包括变压器、断路器和开关设备)的大量资料。这些资料被安全地传输到云端,在那里应用机器学习和高级分析来评估效能和预测故障,从而实现主动维护和提高营运效能。这种数据驱动的方法正在改变电网管理并显着改善紧急情况下的决策。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 60亿美元 |

| 预测值 | 111亿美元 |

| 复合年增长率 | 6.3% |

市场进一步按组件细分,由断路器、变压器、开关设备和保护装置组成的电气系统占据市场主导地位。在电网自动化不断进步和再生能源日益整合的推动下,电力系统部门预计到 2034 年将创造 34 亿美元的收入。这些组件对于维持高效可靠的配电系统所需的数位化变电站不间断的运作至关重要。随着各行各业追求更智慧、更永续的能源解决方案,对这些组件的需求必将上升。

除电气系统外,工业领域预计到 2034 年将创造 58 亿美元的产值。该行业的成长得益于对能源自动化的投资、环保技术的采用以及全球工业设施的持续发展。高效配电的需求以及基于物联网的监控和智慧技术的整合也是推动市场扩张的因素。

美国中压数位变电站市场价值 2022 年为 9 亿美元,预计在未来几年将稳定成长。这一增长主要受到中国不断增长的能源需求和快速的工业化步伐的推动。随着产业的扩张,对可靠、高效和现代化配电系统的需求变得更加明显。中压数位变电站整合了数位技术,以提高效能、监控和自动化程度,作为向智慧电网系统转变的一部分,其应用越来越广泛。

全球中压数位变电站市场的一些知名参与者包括 ABB、施耐德电气、西门子、通用电气、百通、日立能源、思科系统、东芝、Larsen & Toubro Limited 和伊顿。为了巩固其在中压数位变电站市场的地位,公司专注于透过技术进步来增强其产品供应。关键策略包括投资研发以创新和改善数位变电站解决方案。许多参与者透过进入新的区域市场并与其他技术提供者建立策略合作伙伴关係来扩大其全球影响力。此外,併购正在成为一种常见的策略,以结合专业知识、简化营运并满足不断发展的电力产业日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 变电所自动化系统

- 通讯网路

- 电气系统

- 监控系统

- 其他的

第六章:市场规模及预测:依架构,2021 - 2034

- 主要趋势

- 过程

- 湾

- 车站

第七章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 公用事业

- 工业的

第 8 章:市场规模与预测:按安装量,2021 年至 2034 年

- 主要趋势

- 新的

- 翻新

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- ABB

- Belden

- Cisco Systems

- Eaton

- Efacec

- General Electric

- Grid to Great

- Hitachi Energy

- Larsen & Toubro Limited

- Netcontrol Group

- Schneider Electric

- Siemens

- SIFANG

- Tesco Automation

- Texas Instruments Incorporated

- Toshiba

The Global Medium Voltage Digital Substation Market reached USD 6 billion in 2024 and is projected to grow at a CAGR of 6.3% to reach USD 11.1 billion by 2034. This growth is driven by the increasing demand for grid modernization, the rise of automation and digital technologies, and the integration of renewable energy sources. The transition from traditional substations to digital systems is enhancing the efficiency of operations, lowering maintenance costs, and improving the reliability and resilience of the power grid. These digital substations offer more advanced capabilities in managing real-time data, optimizing performance, and improving grid stability.

The rise of digital substations uses innovative technologies such as IoT sensors, cloud computing, and AI-driven analytics. These substations can capture and analyze massive amounts of data from various components, including transformers, circuit breakers, and switchgear. This data is transmitted securely to the cloud, where machine learning and advanced analytics are applied to assess performance and predict failures, allowing for proactive maintenance and enhanced operational performance. This data-driven approach is transforming grid management and significantly improving decision-making during emergencies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 6.3% |

The market is further segmented by components, with electrical systems comprising circuit breakers, transformers, switchgear, and protection devices leading the market. The electrical systems segment is expected to generate USD 3.4 billion by 2034, supported by ongoing advancements in grid automation and the increased integration of renewable energy sources. These components are critical for maintaining the uninterrupted operation of digital substations essential for efficient and reliable power distribution systems. As industries push for smarter and more sustainable energy solutions, the demand for these components is set to rise.

In addition to electrical systems, the industrial segment is projected to generate USD 5.8 billion by 2034. The sector's growth is driven by investments in energy automation, the adoption of eco-friendly technologies, and the ongoing development of industrial facilities globally. The need for efficient power distribution and the integration of IoT-based monitoring and smart technologies are also contributing factors to the market's expansion.

U.S. Medium Voltage Digital Substation Market, valued at USD 0.9 billion in 2022, is poised to experience steady growth in the upcoming years. This growth is primarily driven by the country's escalating demand for energy and the rapid pace of industrialization. As industries expand, the need for reliable, efficient, and modernized power distribution systems becomes more pronounced. Medium voltage digital substations, which integrate digital technologies to improve performance, monitoring, and automation, are increasingly being adopted as part of the broader shift towards smart grid systems.

Some of the Global Medium Voltage Digital Substation Market prominent players in the market include ABB, Schneider Electric, Siemens, General Electric, Belden, Hitachi Energy, Cisco Systems, Toshiba, Larsen & Toubro Limited, and Eaton. To strengthen their positions in the medium voltage digital substation market, companies focus on enhancing their product offerings through technological advancements. Key strategies include investing in research and development to innovate and improve digital substation solutions. Many players expand their global footprint by entering new regional markets and forming strategic partnerships with other technology providers. Additionally, mergers and acquisitions are becoming a common strategy to combine expertise, streamline operations, and meet the growing demands of the evolving power industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Utility

- 7.3 Industrial

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 New

- 8.3 Refurbished

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Belden

- 10.3 Cisco Systems

- 10.4 Eaton

- 10.5 Efacec

- 10.6 General Electric

- 10.7 Grid to Great

- 10.8 Hitachi Energy

- 10.9 Larsen & Toubro Limited

- 10.10 Netcontrol Group

- 10.11 Schneider Electric

- 10.12 Siemens

- 10.13 SIFANG

- 10.14 Tesco Automation

- 10.15 Texas Instruments Incorporated

- 10.16 Toshiba