|

市场调查报告书

商品编码

1667030

消防车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fire Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

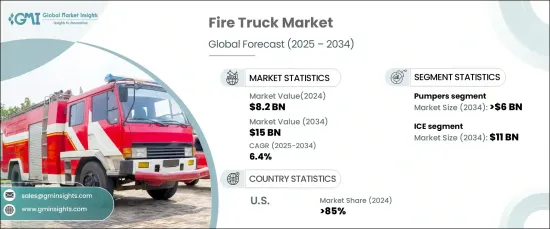

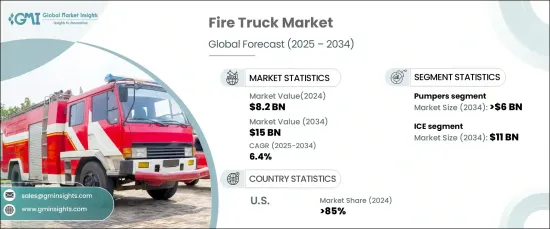

2024 年全球消防车市场价值为 82 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.4%。 这种增长可归因于紧急情况的日益复杂,包括危险材料事故、工业火灾和城市紧急情况,以及火灾相关死亡人数的增加。消防局面临前所未有的需求,需要高度先进、多功能、能够处理各种紧急情况的消防车。因此,消防车正在演变成多功能紧急应变平台,具有模组化设计,可以快速重新配置,确保能够应对各种情况。市场的未来由远端资讯处理、物联网系统和先进动力系统等技术创新所驱动,所有这些技术创新都提高了车辆的效率、可靠性和整体营运效率。

就车辆类型而言,消防车市场分为泵车、云梯车、油罐车、救援车、飞机救援和消防 (ARFF) 车、工业卡车和专用卡车。泵浦车占据市场主导地位,到 2024 年将占总市场份额的 40% 以上。这可以减轻重量,同时提高有效载荷能力和燃油效率。此外,我们还采用了先进的工程技术,包括电脑辅助设计和有限元素分析,以确保结构完整性,同时最大限度地减轻这些车辆的总重量。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 82亿美元 |

| 预测值 | 150亿美元 |

| 复合年增长率 | 6.4% |

就动力系统而言,市场分为内燃机 (ICE)、电动和混合动力类别。预计到 2034 年,内燃机领域将创造 110 亿美元的收入。这对于确保卡车在城市、乡村和荒野环境中的紧急情况下有效运作至关重要。内燃机卡车的创新包括先进的牵引力控制系统、专用悬吊、自适应全轮驱动系统以及专为在极端条件下运作而设计的强大冷却机制。此外,计算模型正被用于优化动力系统,确保其在不同环境中的可靠性。

在美国,消防车市场在 2024 年占据了 85% 的主导份额。这些技术提供即时诊断、性能监控和预测性维护功能,有助于减少车辆停机时间并优化车队管理。卡车上整合的传感器监控引擎的健康和设备状态,而机器学习演算法可以预测潜在的机械故障,确保更高的准备程度并延长消防车的使用寿命。这些技术的不断进步反映了对更有效率、反应更快、更可靠的消防服务日益增长的需求。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 消防车製造商

- 零件供应商

- 服务提供者

- 经销商

- 最终用途

- 利润率分析

- 技术差异化

- 电气化和混合动力系统

- 先进的远端资讯处理

- 远端控制灭火

- 增强型航空系统

- 其他的

- 成本明细分析

- 重要新闻及倡议

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 不断增加的城市基础建设

- 有关火灾隐患的政府法规和安全标准日益增多

- 紧急应变复杂度高

- 消防车采用安全增强技术

- 产业陷阱与挑战

- 初期投资成本高

- 复杂的供应链管理

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 泵工

- 云梯车

- 油轮

- 救援车

- 飞机救援与消防 (ARFF) 车辆

- 工业卡车

- 专用卡车

第六章:市场估计与预测:按动力系统,2021 - 2034 年

- 主要趋势

- 冰

- 电的

- 杂交种

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 市消防部门

- 机场消防

- 工业消防

- 野火管理

- 其他的

第 8 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- BME Fire Trucks

- Bronto Skylift

- Danko Emergency Equipment

- Darley

- Desautel

- HME Ahrens

- IVECO

- KME Fire Apparatus

- Metz Fire & Rescue

- Morita Holdings

- Oshkosh

- REV Group

- Rosenbauer Group

- Seagrave Fire Apparatus

- Terberg DTS

- Vema Lift

- Volkan

- XCMG

- Ziegler Group

- Zoomlion

The Global Fire Truck Market was valued at USD 8.2 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2034. This growth can be attributed to the rising complexity of emergencies, including hazardous material incidents, industrial fires, and urban emergencies, as well as an increasing number of fire-related fatalities. Fire departments are facing unprecedented demands, requiring highly advanced, multifunctional fire trucks that are equipped to handle a wide array of emergencies. As a result, fire trucks are evolving into versatile emergency response platforms with modular designs that allow for rapid reconfiguration, ensuring they can address diverse situations. The market's future is driven by technological innovations such as telematics, IoT systems, and advanced powertrains, all of which enhance vehicle efficiency, reliability, and overall operational effectiveness.

In terms of vehicle types, the fire truck market is divided into pumpers, aerial ladder trucks, tankers, rescue trucks, aircraft rescue and firefighting (ARFF) trucks, industrial trucks, and specialty trucks. The pumper trucks dominate the market, accounting for over 40% of the total market share in 2024. This segment is forecasted to generate USD 6 billion in revenue through 2034. Modern pumpers are built using lightweight materials like aluminum, carbon fiber, and high-strength composites. This reduces weight while boosting payload capacity and fuel efficiency. Additionally, advanced engineering technologies, including computer-aided design and finite element analysis, are being employed to ensure structural integrity while minimizing the overall weight of these vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.2 Billion |

| Forecast Value | $15 Billion |

| CAGR | 6.4% |

When it comes to powertrains, the market is divided into internal combustion engine (ICE), electric, and hybrid categories. The ICE segment is projected to generate USD 11 billion in revenue by 2034. Fire truck manufacturers are enhancing internal combustion platforms to improve the vehicles' adaptability to various terrains. This is crucial for ensuring the trucks perform effectively during emergency situations in urban, rural, and wilderness settings. Innovations in ICE-powered trucks include advanced traction control systems, specialized suspensions, adaptive all-wheel-drive systems, and robust cooling mechanisms designed to perform under extreme conditions. Moreover, computational modeling is being used to optimize powertrains, guaranteeing their dependability in diverse environments.

In the United States, the fire truck market held a dominant 85% share in 2024. U.S. fire departments are increasingly adopting state-of-the-art technologies like advanced telematics and Internet of Things (IoT) systems. These technologies provide real-time diagnostics, performance monitoring, and predictive maintenance features that help reduce vehicle downtime and optimize fleet management. Sensors integrated into the trucks monitor engine health and equipment status, while machine learning algorithms predict potential mechanical failures, ensuring a higher level of readiness and extending the life of fire trucks. The continuous advancement of these technologies reflects the growing need for more efficient, responsive, and reliable fire services.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Fire truck manufacturers

- 3.2.2 Component suppliers

- 3.2.3 Service providers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology differentiators

- 3.4.1 Electrification and hybrid powertrains

- 3.4.2 Advanced telematics

- 3.4.3 Remote-controlled firefighting

- 3.4.4 Enhanced aerial systems

- 3.4.5 Others

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing urban infrastructure developments

- 3.9.1.2 Growing government regulations and safety standards regarding fire hazards

- 3.9.1.3 High emergency response complexity

- 3.9.1.4 Adoption of safety enhancement technologies in fire trucks

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial investment costs

- 3.9.2.2 Complex supply chain management

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Pumpers

- 5.3 Aerial ladder trucks

- 5.4 Tankers

- 5.5 Rescue trucks

- 5.6 Aircraft Rescue and Firefighting (ARFF) vehicles

- 5.7 Industrial trucks

- 5.8 Specialty trucks

Chapter 6 Market Estimates & Forecast, By Powertrain, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Municipal fire departments

- 7.3 Airport fire services

- 7.4 Industrial fire services

- 7.5 Wildfire management

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BME Fire Trucks

- 10.2 Bronto Skylift

- 10.3 Danko Emergency Equipment

- 10.4 Darley

- 10.5 Desautel

- 10.6 HME Ahrens

- 10.7 IVECO

- 10.8 KME Fire Apparatus

- 10.9 Metz Fire & Rescue

- 10.10 Morita Holdings

- 10.11 Oshkosh

- 10.12 REV Group

- 10.13 Rosenbauer Group

- 10.14 Seagrave Fire Apparatus

- 10.15 Terberg DTS

- 10.16 Vema Lift

- 10.17 Volkan

- 10.18 XCMG

- 10.19 Ziegler Group

- 10.20 Zoomlion