|

市场调查报告书

商品编码

1687752

消防车:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Fire Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

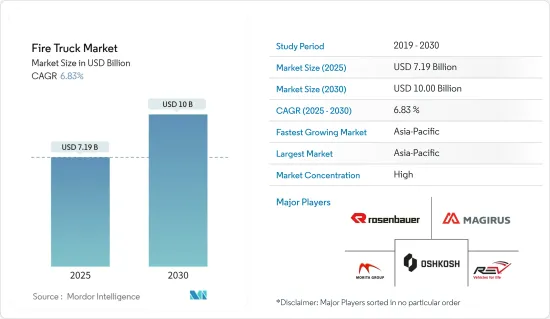

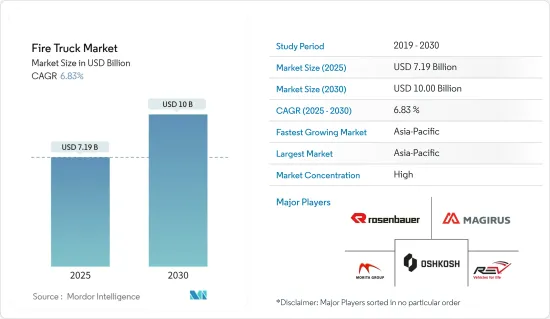

预计 2025 年消防车市场规模将达到 71.9 亿美元,预计到 2030 年将达到 100 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.83%。

随着新冠疫情有限的国家汽车销量稳步增长以及汽车製造商恢復运营,市场很可能在预测期内復苏。此外,製造商正在实施应急计划,以减轻未来的业务不确定性,从而与汽车行业关键领域的客户保持连续性。

从长远来看,严格的消防安全规范的采用、市议会对老化消防车队的更新以增强消防能力以及主要行业参与者对研发的加大投入,正在为汽车和运输行业创造需求,导致消防车销量飙升。

市场的主要企业正在确保新订单、推出新产品并扩大生产能力,以满足日益增长的消防车需求。例如

主要亮点

- 2022年6月,罗森宝亚集团向德国北威斯特法伦州诺韦尼格市交付了一辆配备罗森宝亚RT(革命性技术)的全电动消防车。

亚太地区是全球最大的消防车市场,其中中国和印度是全球消防车的主要市场。这是因为这些国家采取了严格的防火措施,以减少火灾事故和伤亡。这些国家的许多城市正在为消防队配备新型消防车,特别是配备旋转云梯车的消防车,以扑灭高层建筑的火灾。

主要亮点

- 2022 年 1 月:印度孟买市政公司 (BMC) 宣布计划为孟买消防队采购 36 辆消防车,其中包括 22 辆快速反应多用途车和 14 辆消防救援车。

因此,由于上述因素,预计消防车市场在预测期内将以健康的复合年增长率成长。

消防车市场趋势

住宅和商业领域对消防车的需求不断增长,推动了市场

住宅和商业部分包括市政使用的消防车和森林灭火应用。

根据美国国家消防协会统计,美国每年报告的住宅火灾超过 40 万起。这些火灾事件给人们带来了一种恐惧文化。这种情况不仅在美国存在,在世界各地都存在。

根据美国国家消防协会的数据,2021 年,美国消防部门平均每 23 秒就会回应一次火灾。每 89 秒就会发生一次住宅火灾,每 3 小时 24 分钟就会发生住宅火灾死亡事件,每 46 分钟就会发生一次住宅火灾受伤事件。

此外,世界各地相继发生多起山林火灾,造成民众生命财产损失。

例如,根据美国国家跨部门消防中心(NIFC)的数据,2021 年美国发生了 58,733 起山火,每起火灾烧毁了 121.6 英亩土地。由于野火数量的增加,美国政府正在采购消防车和其他消防设备,以增强其灭火能力。

此外,世界各国政府都在密切研究城市火灾的成因,以避免发生像印度新德里蒙德卡大火(造成27人死亡)和英国伦敦格伦费尔塔大火(造成72人死亡)那样的灾难。此类事故主要是由于数百家商业机构和医院、工厂、学校等机构没有消防安全证书而造成的。这使成千上万的人面临进一步的风险,并增加了火灾事故的严重程度。

高层建筑的兴起也迫使地方政府升级现有的消防设备,包括消防车。

- 例如,2022年10月,REV Group Inc.的子公司E-ONE向亚利桑那州凤凰城消防局交付了两台E-ONE HP 95中置平台。

- 2021 年 4 月,喀拉拉邦消防救援部门将购买旋转云梯车 (TTL) 纳入其新的现代化进程。该部门宣布将采购一座65公尺高的TTL,可用于高层建筑的救援和消防行动。

因此,预计上述因素和案例将在预测期内促进美国、印度和英国等国家的消防车市场的成长。

亚太地区将迎来显着成长

在预测期内,消防车市场预计将以亚太地区为主导,其次是北美和欧洲。中国主要低成本製造商的存在,加上中国、韩国和印度等新兴经济体对住宅和商业应用的需求不断增长,预计将在预测期内推动市场成长。

中国是亚洲最大的消防车市场。在与美国的经济僵局之后,中国引入了贸易壁垒,这有可能会提高总体成本和汽车进口量,并且需要财政部的核准。严重的商业制约和不断加剧的经济、政治衝突,抑制了国际製造商的发展,也降低了中国企业的收益水准。

然而,近年来印度都市化加快,导致对消防车的需求增加。精製、钢铁厂、工业、火力发电厂等产业对工业消防车的需求较大,尤其需要泡沫灭火车。

这种需求主要体现在国内的一线和二线城市,消防车製造商正在研究这一点,并进一步合作以利用这一痛点。此外,都市化加快、安全意识增强以及新产品的推出预计将进一步推动市场需求。例如

- 2021 年 11 月,班加罗尔国际机场有限公司 (BIAL) 向奥地利消防设备製造商 Rosenbauer 集团订购了四辆现代消防车和一台灭火刺激器。 BIAL 是南亚第一家订购此类设施的机场。

在日本,火灾死亡人数正在下降。 2020 年火灾死亡人数为 1,486 人,但截至 2021 年,这一数字已下降至约 1,000 人。这种下降趋势主要是由于消防车的技术趋势先进以及火灾警报响应时间更快。

北美的成长主要归因于住宅和商业综合体对先进安全基础设施的需求不断增加,预计将推动市场需求。

EMEA 消防车市场主要以企业、工业、机场和军事应用为特点,为主要企业提供了新的市场扩张机会。

消防车产业概况

消防车市场高度整合。该市场的特点是存在大型全球参与者和一些与地方议会消防部门签订长期供应协议的本地参与者。这些参与者还透过合资、併购、新产品发布、订单和产品开发等方式扩大其品牌组合併巩固其市场地位。

主导全球市场的一些主要参与者包括 Rosenbauer Group、REV Group Inc.、Magirus、Oshkosh Corporation 和 Morita Holdings Corporation。主要参与者正在进行併购并推出新产品,以确保其在市场中的地位并保持领先于市场趋势。

- 2022 年 10 月,罗森宝亚集团向苏黎世专业消防部门 Schutz & Rettung 提供了世界上第一台基于沃尔沃底盘的电动云梯车。

- 2022 年 7 月,Magirus GmbH 向巴西塞阿拉州交付了世界上第一辆履带式消防车 Magirus FireBull。

- 2022 年 4 月,Magirus GmbH 向义大利韦尔巴诺-库西奥-奥索拉省消防队交付了8 辆 Magirus CITY 2020 消防车,用于志愿消防。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 按类型

- 救援车

- 油船

- 泵浦车

- 多用途卡车

- 按应用

- 住宅/商业

- 公司和机场

- 军队

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- WS Darley & Co.

- Oshkosh Corporation

- WeihaiGuangtai

- Albert Ziegler GmbH

- Magirus GmbH(CNH Industrial Group)

- Rosenbauer International AG

- Gimaex GmbH

- Morita Holdings Corporation

- E-ONE

- Spartan Motors Inc.

- HME Incorporated

第七章 市场机会与未来趋势

The Fire Truck Market size is estimated at USD 7.19 billion in 2025, and is expected to reach USD 10.00 billion by 2030, at a CAGR of 6.83% during the forecast period (2025-2030).

As automotive manufacturers have resumed operations due to steadily rising automobile sales in countries with a limited number of COVID-19 cases, the market is likely to recover during the forecast market. Furthermore, the manufacturers are implementing contingency plans to mitigate future business uncertainties to retain continuity with clients in the critical sectors of the automobile industry.

Over the long term, the adoption of stringent fire safety standards, the renewing of old fleets of fire trucks by the city councils to bolster their fire-fighting capabilities, and increasing investments in R&D by major industry players are creating demand in the automotive and transportation industry with a surge in sales of fire trucks.

Key players in the market are securing new orders, launching new products, and expanding their production capacity to cater to the increased demand for fire trucks. For instance,

Key Highlights

- June, 2022 : Rosenbauer Group delivered a fully electric fire truck featuring Rosenbauer RT (Revolutionary Technology) to the municipality of Norvenich in North Westphalia, Germany.

Asia-Pacific has been identified as the world's biggest fire truck market, with China and India being the major markets for fire trucks in the world. This is due to stringent fire protection measures adopted in these countries to reduce fire-related accidents and casualties. Many cities in these countries are inducting new fire trucks in their firefighting fleets, especially firetrucks equipped with turntable ladders to combat fires occurring in high-rise buildings. For instance

Key Highlights

- January, 2022: Brihannamumbai Municipal Corporation (BMC) of Mumbai in India, announced plans to procure 36 firefighting including 22 quick response multi-purpose vehicles and 14 firefighting-cum-rescue vehicles for Mumbai Fire Brigade.

Thus the market for fire trucks is forecasted to grow at a healthy CAGR during the forecast period due to the above factors.

Fire Truck Market Trends

Rising Demand for Fire Trucks in the Residential and Commercial Sector to Drive the Market

The residential and commercial segment includes fire trucks used by municipal bodies and forest fire fighting applications.

According to the National Fire Protection Association, there have been more than 400,000 house fire cases reported in the United States every year. These fire incidents bring dreadful culture to the people. The scenarios remain the same not just in the United States but across the world.

In 2021, a fire department responded to a fire on average every 23 seconds in the United States, according to the National Fire Protection Association. A home fire was reported every 89 seconds, a home fire death occurred every three hours and 24 minutes, and a home fire injury occurred every 46 minutes.

Moreover, several wildfire fire incidents are being reported across the world where fire incidents have destroyed the lives and property of people. For instance:

According to The National Interagency Fire Center (NIFC) 58733 wildfires occurred in the United States and 121.6 acres burned per fire in 2021. Thus the rising incidences of wildfires has prompted the government in United States to procure firefighting equipment including fire trucks to bolster their fire fighting preparedness.

Furthermore, the governments are closely examining the reasons behind urban fire incidences to avoid disasters like the Mundka fire accident in New Delhi, India which left 27 people dead and Grenfell Tower fire incident in London, United Kingdom in which 72 people died. This incidences mainly happened due to noncompliance action pulled by hundreds of commercial and institutional buildings, including hospitals, factories, and even schools, which are operating without a fire and safety certificates. These things further make thousands of people vulnerable and help raise the intensity of fire incidents.

An increasing number of high-rise buildings are also leading local municipalities to upgrade their existing fleet of fire fighting equipment, including trucks. For instance

- October, 2022: E-ONE a subsidiary of REV Group Inc., delivered two E-ONE HP 95 Mid-Mount Platforms to the Phoenix Fire Department in Arizona as a part of an eight-unit order that includes a total of five platforms and three E-ONE HR 100 single axle ladder trucks.

- April, 2021: the Kerala Fire and Rescue Services Department included the purchase of a Turn Table Ladder (TTL) in their new modernization process. The department announced to procure TTL with a height of 65 m that can be used for rescue and firefighting missions on high-rise buildings.

Therefore, the aforementioned factors and instances are anticipated to contribute for growth of fire truck market in countries like United States India, United Kingdom.etc. over the forecasted period.

Asia-Pacific Region is Expected to Witness Significant Growth

During the forecast period, the fire truck market is expected to be dominated by Asia-Pacific, followed by North America and Europe. The presence of key low-cost manufacturers in China, coupled with the rising demand for residential and commercial applications in emerging economies such as China, South Korea, and India, is expected to drive market growth during the forecast period.

China is the largest Asian market for fire trucks. The country has introduced trade barriers in the wake of economic conflict with the United States, which tends to increase the overall cost and vehicle imports and has been subjected to approval by the ministry of finance. Rigorous business constraints and growing economic and political conflicts have resulted in the restraint of the development of international manufacturers while insulating the revenue bars of China-based companies.

However, India has witnessed a key increase in the demand for fire trucks over the past years, owing to the high urbanization the country is undergoing. Industries from segments like oil refineries, steel plants, industrial corporations, and thermal power generation plants have been demanding industrial-grade fire trucks with special emphasis on foam trucks.

The demand is primarily noticeable from tier 1 and tier 2 cities of the country, which has been scrutinized by the fire truck manufacturers and further collaborated and partnered to capitalize on this pain point; moreover, with increasing urbanization, growing security awareness, and new product launches, further demand is expected to drive the market. For instance

- November, 2021: Bengaluru International Airport Ltd. (BIAL) ordered four advanced fire trucks and one firefighting stimulator from Austrian firefighting equipment manufacturer Rosenbauer Group. BIAL is the first airport in South Asia to order such equipment.

Japan registered a decreasing trend in the number of fire-related fatalities. The number of fire-related fatalities in 2020 accounted for 1,486 and was reduced to around 1000 fire-related fatalities as of 2021. This decreasing trend is mostly attributed to the advanced technological developments of fire trucks and decreased response time to a fire alert.

North America's growth is primarily driven by the growing requirement for advanced safety infrastructure in residential buildings and commercial complexes, which is expected to augment the market demand.

The fire truck market in Europe, the Middle East and Africa is characterized primarily by the consumption of applications, such as enterprises, industries, airports, and the military, providing new opportunities for key players to expand in the market.

Fire Truck Industry Overview

The Fire Truck market is highly consolidated. The market is characterized by the presence of considerably large global players as well as some local players who have secured long-term supply contracts with fire departments of local city councils. These players also engage in joint ventures, mergers and acquisitions, new product launches, secure orders, and product development to expand their brand portfolios and cement their market positions.

Some of the major players dominating the global market are Rosenbauer Group, REV Group Inc., Magirus, Oshkosh Corporation, and Morita Holdings Corporation. Key players are engaging in mergers and acquisitions and launching new products to secure their market position and stay ahead of the market curve. For instance,

- October, 2022: Rosenbauer Group supplied Schutz & Rettung, the professional Zurich firefighting department, with the world's first electric aerial ladder based on Volvo chassis.

- July, 2022: Magirus GmbH delivered Magirus FireBull, the world's first tracked fire engine, to the state of Ceara in Brazil.

- April ,2022: Magirus GmbH delivered eight Magirus CITY 2020 fire trucks for volunteer firefighting to firefighting brigades of the Italian province Verbano-Cusio-Ossola.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Driver

- 4.2 Market Restraint

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining power of suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size value in USD Billion)

- 5.1 By Type

- 5.1.1 Rescue Trucks

- 5.1.2 Tanker

- 5.1.3 Pumper

- 5.1.4 Multi-Tasking Trucks

- 5.2 By Application

- 5.2.1 Residential and Commercial

- 5.2.2 Enterprises and Airports

- 5.2.3 Military

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 W.S. Darley & Co.

- 6.2.2 Oshkosh Corporation

- 6.2.3 WeihaiGuangtai

- 6.2.4 Albert Ziegler GmbH

- 6.2.5 Magirus GmbH (CNH Industrial Group)

- 6.2.6 Rosenbauer International AG

- 6.2.7 Gimaex GmbH

- 6.2.8 Morita Holdings Corporation

- 6.2.9 E-ONE

- 6.2.10 Spartan Motors Inc.

- 6.2.11 HME Incorporated