|

市场调查报告书

商品编码

1667113

循环聚合物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Circular Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

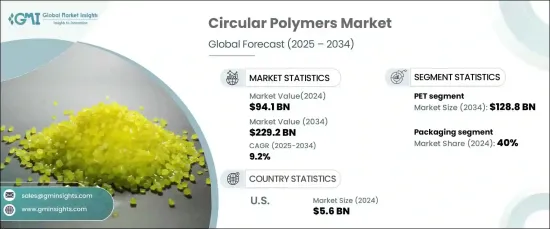

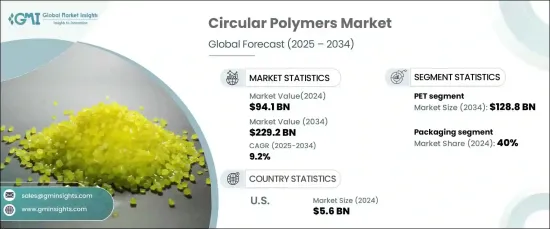

2024 年全球循环聚合物市场规模将达到 941 亿美元,预计 2025 年至 2034 年期间将以 9.2% 的强劲复合年增长率增长。这种向永续资源管理的转变涉及製造、包装和消费品等各个领域,从而推动了对循环聚合物的需求。

消费者对环境永续性的意识不断增强,极大地影响了购买决策,推动了对循环聚合物包装产品的需求。消费者越来越意识到塑胶垃圾的有害影响,并积极寻求更环保的替代品。因此,製造商正在转向循环聚合物作为包装解决方案,以满足对耐用和永续产品日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 941亿美元 |

| 预测值 | 2292亿美元 |

| 复合年增长率 | 9.2% |

市场主要按聚合物类型细分,包括 PET、聚乙烯、聚丙烯、PVC 等。其中,PET 领域在 2024聚对苯二甲酸乙二酯创收 504 亿美元,预计到 2034 年将达到 1,288 亿美元。 PET 广泛用于包装,尤其是瓶子和容器,其回收率高,确保了稳定的回收供应。它能够透过多次回收循环保留其特性,这使得它成为闭环系统的理想选择。此外,化学解聚等回收技术的进步正在提高 PET 的品质并增强其再利用潜力。

包装是循环聚合物市场的主要应用领域,到 2024 年将占据 40% 的份额。循环聚合物在包装中的应用越来越多,因为它们有助于减少对环境的影响,同时保持性能和效率。食品、饮料、消费品和医药等产业都明显转向永续包装。品牌越来越多地寻求环保包装解决方案来满足消费者需求并满足监管标准。循环聚合物,尤其是再生 PET(r-PET),为包装提供了耐用、可回收且高品质的替代品。

2024 年,美国循环聚合物市场价值为 56 亿美元。消费者对环保产品(尤其是包装)的偏好日益增长,促使製造商采用再生聚合物。对化学回收等先进回收技术的投资正在提高回收材料的质量,扩大其在各个行业的应用。企业永续发展计画和领导企业对碳中和的承诺也推动了循环聚合物的广泛应用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 各行各业越来越意识到使用再生材料来减少碳足迹

- 包装产业越来越多地采用可回收材料,推动市场发展

- 促进再生塑胶发展的有利倡议

- 产业陷阱与挑战

- 倾向于使用原生塑胶而非再生聚合物

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:按聚合物,2021-2034 年

- 主要趋势

- 宠物

- 聚乙烯

- 聚丙烯

- PVC

- 其他的

第 6 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 包装

- 建筑与施工

- 汽车

- 电气和电子产品

- 农业

- 其他的

第 7 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Advanced Circular Polymers

- ALBA Group

- Banyan

- BASF

- Borealis

- Circular Polymers

- Dow

- ExxonMobil

- KW Plastics

- PlastiCycle

- Quality Circular Polymers

- SABIC

- The Shakti Plastic Industries

- Total Energies

- Veolia

The Global Circular Polymers Market reached USD 94.1 billion in 2024 and is projected to grow at a robust CAGR of 9.2% between 2025 and 2034. As environmental concerns intensify and the availability of natural resources dwindles, industries are increasingly adopting practices that focus on waste reduction and maximizing resource efficiency. This shift toward sustainable resource management spans various sectors, including manufacturing, packaging, and consumer goods, boosting the demand for circular polymers.

Rising awareness among consumers about environmental sustainability has significantly influenced purchasing decisions, driving demand for products packaged in circular polymers. Consumers are becoming more conscious of the detrimental impact of plastic waste and are actively seeking more environmentally friendly alternatives. As a result, manufacturers are turning to circular polymers for packaging solutions to meet the growing demand for durable and sustainable products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $94.1 Billion |

| Forecast Value | $229.2 Billion |

| CAGR | 9.2% |

The market is primarily segmented by polymer type, including PET, polyethylene, polypropylene, PVC, and others. Among these, the PET segment generated USD 50.4 billion in 2024 and is projected to reach USD 128.8 billion by 2034. PET (Polyethylene Terephthalate) is favored in the circular polymer market due to its exceptional recyclability and versatility. Widely used in packaging, especially for bottles and containers, PET benefits from high recovery rates, ensuring a consistent supply for recycling. Its ability to retain its properties through multiple recycling cycles makes it ideal for closed-loop systems. Furthermore, advances in recycling technologies, like chemical depolymerization, are improving PET's quality and enhancing its reuse potential.

Packaging is the dominant application segment in the circular polymers market, accounting for a 40% share in 2024. This growth is driven by the need to combat plastic waste and enhance sustainability efforts across industries. Circular polymers are increasingly used in packaging because they help reduce environmental impact while maintaining performance and efficiency. The shift toward sustainable packaging is noticeable across sectors such as food, beverage, consumer goods, and pharmaceuticals. Brands are increasingly seeking eco-friendly packaging solutions to cater to consumer demand and meet regulatory standards. Circular polymers, particularly recycled PET (r-PET), provide a durable, recyclable, and high-quality alternative for packaging.

U.S. circular polymers market was valued at USD 5.6 billion in 2024. The growth in this market is largely driven by regulations promoting sustainable waste management and a reduction in the use of virgin plastics. The rising consumer preference for eco-friendly products, particularly in packaging, is encouraging manufacturers to adopt recycled polymers. Investment in advanced recycling technologies, such as chemical recycling, is improving the quality of recycled materials, broadening their applications across various industries. Corporate sustainability initiatives and commitments to carbon neutrality by leading companies are also driving the widespread adoption of circular polymers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising awareness among various industries to use recycled materials to reduce their carbon footprints

- 3.6.1.2 Increasing adoption of recyclable materials in the packaging industry is driving the market

- 3.6.1.3 Favorable initiatives to promote recycled plastics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Inclination toward the use of virgin plastics over recycled polymers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Polymer, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 PET

- 5.3 Polyethylene

- 5.4 Polypropylene

- 5.5 PVC

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Packaging

- 6.3 Building & construction

- 6.4 Automotive

- 6.5 Electrical & electronics

- 6.6 Agriculture

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Advanced Circular Polymers

- 8.2 ALBA Group

- 8.3 Banyan

- 8.4 BASF

- 8.5 Borealis

- 8.6 Circular Polymers

- 8.7 Dow

- 8.8 ExxonMobil

- 8.9 KW Plastics

- 8.10 PlastiCycle

- 8.11 Quality Circular Polymers

- 8.12 SABIC

- 8.13 The Shakti Plastic Industries

- 8.14 Total Energies

- 8.15 Veolia