|

市场调查报告书

商品编码

1667124

锥形束 CT 扫描仪 (CBCT) 市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Cone Beam CT Scanner (CBCT) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

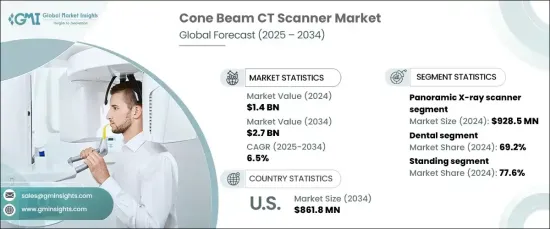

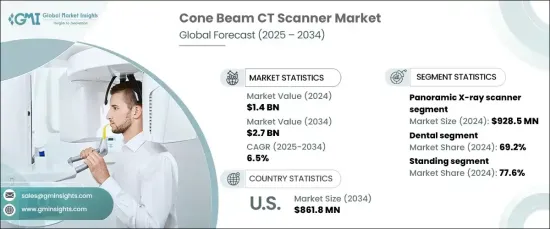

2024 年全球锥形束 CT 扫描仪市场价值为 14 亿美元,预计 2025 年至 2034 年期间将以 6.5% 的强劲复合年增长率增长。随着对先进影像解决方案的需求不断增长,CBCT 扫描仪在诊断各种牙科疾病和支援更准确、微创治疗方面已成为不可或缺的设备。人口老化,特别是北美和欧洲等已开发地区,正面临牙齿问题的增加,进一步推动市场成长。这些扫描仪提供高度详细的 3D 影像,可实现更精确的诊断,减少探查手术的需要并改善患者的治疗效果。对 CBCT 技术的日益依赖正在重塑诊断实践和治疗计划,推动整个医疗保健领域的市场采用。

数位医疗基础设施的兴起和精准诊断的进步推动了对 CBCT 扫描仪的需求,不仅在牙科诊所,而且在骨科环境中。这些扫描仪是评估需要高度详细成像的复杂骨骼结构和状况的重要工具。 CBCT 技术能够捕捉人体复杂解剖结构的清晰 3D 影像,这使得其用途不仅限于牙科影像,还扩展到其他医疗领域。此外,随着市场的不断发展,医疗保健专业人员正在投资这些扫描仪以提高其程序的准确性和有效性,从而增加了全球对 CBCT 系统的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 27亿美元 |

| 复合年增长率 | 6.5% |

根据产品,CBCT 扫描器市场分为全景X光扫描仪和头颅测量X光扫描仪。 2024年,全景X光扫描仪引领市场,创造9.285亿美元的收入。这些扫描仪是牙科诊断的基石,提供口腔的全面视图,包括牙齿、下颚和周围组织。此功能对于矫正规划、一般牙科评估以及识别蛀牙和肿瘤等病症至关重要,进一步巩固了其作为现代牙科护理重要工具的地位。

市场也按应用进行分类,其中牙科领域在 2024 年占据 69.2% 的主导份额。牙科专业人员严重依赖这些扫描仪提供的高清 3D 影像,确保为患者提供准确的诊断和最佳治疗计划。

在美国,CBCT 扫描仪市场规模预计将从 2024 年的 4.536 亿美元增长到 2034 年的 8.618 亿美元。患者对植牙、牙齿矫正和骨科评估的需求不断增加,进一步强调了 CBCT 扫描仪提供精确 3D 影像以改善患者护理和治疗结果的必要性。透过对医疗保健基础设施的投资和对精准诊断的关注,美国 CBCT 扫描仪市场将在未来十年继续成长。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 技术先进的医疗设备普及率不断提高

- 牙齿疾病盛行率上升

- 牙科诊所中 CBCT 的应用增加

- 产业陷阱与挑战

- 设备成本高

- 替代诊断技术的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- CBCT 扫描仪类型的比较分析

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 全景X光扫描仪

- 头颅测量 X 光扫描仪

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 牙科

- 正畸

- 牙髓病学

- 牙周病学

- 颚面影像

- 一般牙科

- 其他牙科应用

- 骨科

- 其他应用

第 7 章:市场估计与预测:按病患情况,2021 – 2034 年

- 主要趋势

- 常设

- 仰卧

- 就座

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 牙医诊所

- 其他最终用途

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 波兰

- 瑞士

- 瑞典

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 印尼

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 科威特

- 阿联酋

- 土耳其

- 埃及

- 以色列

- 卡达

第十章:公司简介

- AB-CT (Advanced Breast-CT)

- Asahi Roentgen

- Brainlab

- Carestream Health

- Cefla Medical Equipment

- CurveBeam AI

- Dentsply Sirona

- Genoray

- Hefei Meyer Optoelectronic Technology

- iCRco

- idetec Medical Imaging

- J. Morita Corporation

- KaVo Dental

- Koninklijke Philips

- Planmeca Group

The Global Cone Beam CT Scanner Market, valued at USD 1.4 billion in 2024, is projected to grow at a robust CAGR of 6.5% from 2025 to 2034. This market expansion is being driven by the increasing prevalence of dental disorders and the expanding use of CBCT technology across dental practices. As the demand for advanced imaging solutions rises, CBCT scanners have become indispensable in diagnosing a variety of dental conditions and supporting more accurate, minimally invasive treatments. The aging population, especially in developed regions such as North America and Europe, is facing an uptick in dental issues, further boosting market growth. These scanners provide highly detailed 3D imaging that enables more precise diagnoses, reducing the need for exploratory surgeries and improving patient outcomes. This growing reliance on CBCT technology is reshaping diagnostic practices and treatment planning, fueling market adoption across the healthcare sector.

The rise of digital healthcare infrastructure and advancements in precision diagnostics have fueled the demand for CBCT scanners, not only in dental practices but also in orthopedic settings. These scanners are critical tools for assessing complex bone structures and conditions that require highly detailed imaging. CBCT technology's ability to capture clear, 3D images of the body's intricate anatomy is enhancing its use beyond dental imaging, expanding its scope into other medical fields. Furthermore, as the market continues to evolve, healthcare professionals are investing in these scanners to improve the accuracy and effectiveness of their procedures, thereby increasing the demand for CBCT systems worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 6.5% |

By product, the CBCT scanner market is segmented into panoramic X-ray scanners and cephalometric X-ray scanners. In 2024, panoramic X-ray scanners led the market, generating USD 928.5 million in revenue. These scanners are a cornerstone of dental diagnostics, providing a comprehensive view of the oral cavity, including teeth, jawbones, and surrounding tissues. This functionality is essential for orthodontic planning, general dental assessments, and identifying conditions such as cavities and tumors, further cementing their place as a vital tool in modern dental care.

The market is also categorized by application, with the dental sector holding the dominant share of 69.2% in 2024. This segment's dominance is attributed to the widespread adoption of CBCT technology for procedures such as implantology, endodontics, and orthodontics. Dental professionals heavily rely on the high-definition 3D imaging these scanners provide, ensuring accurate diagnoses and optimal treatment planning for patients.

In the U.S., the CBCT scanner market is expected to reach USD 861.8 million by 2034, up from USD 453.6 million in 2024. The significant adoption of advanced imaging solutions, particularly in dental and maxillofacial specialties, is driving the growth in this region. The increasing patient demand for dental implants, orthodontic care, and orthopedic evaluations further emphasizes the need for CBCT scanners to provide precise 3D imaging for improved patient care and treatment outcomes. With investments in healthcare infrastructure and a focus on precision diagnostics, the U.S. market for CBCT scanners is set for continued growth over the next decade.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising penetration of technologically advanced medical equipment

- 3.2.1.2 Rising prevalence of dental disorder

- 3.2.1.3 Increase in application of CBCT in dental practices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Availability of alternative diagnostic techniques

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technological landscape

- 3.6 Comparative analysis of type of CBCT scanners

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Panoramic X-ray scanner

- 5.3 Cephalometric X-ray scanner

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental

- 6.2.1 Orthodontics

- 6.2.2 Endodontics

- 6.2.3 Periodontics

- 6.2.4 Maxillofacial imaging

- 6.2.5 General dentistry

- 6.2.6 Other dental applications

- 6.3 Orthopedic

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Patient Position, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Standing

- 7.3 Supine

- 7.4 Seated

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Dental clinics

- 8.4 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Poland

- 9.3.7 Switzerland

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Indonesia

- 9.4.7 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.5.5 Chile

- 9.5.6 Peru

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 Kuwait

- 9.6.4 UAE

- 9.6.5 Turkey

- 9.6.6 Egypt

- 9.6.7 Israel

- 9.6.8 Qatar

Chapter 10 Company Profiles

- 10.1 AB-CT (Advanced Breast-CT)

- 10.2 Asahi Roentgen

- 10.3 Brainlab

- 10.4 Carestream Health

- 10.5 Cefla Medical Equipment

- 10.6 CurveBeam AI

- 10.7 Dentsply Sirona

- 10.8 Genoray

- 10.9 Hefei Meyer Optoelectronic Technology

- 10.10 iCRco

- 10.11 idetec Medical Imaging

- 10.12 J. Morita Corporation

- 10.13 KaVo Dental

- 10.14 Koninklijke Philips

- 10.15 Planmeca Group