|

市场调查报告书

商品编码

1721529

CT 扫描仪市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测CT Scanner Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

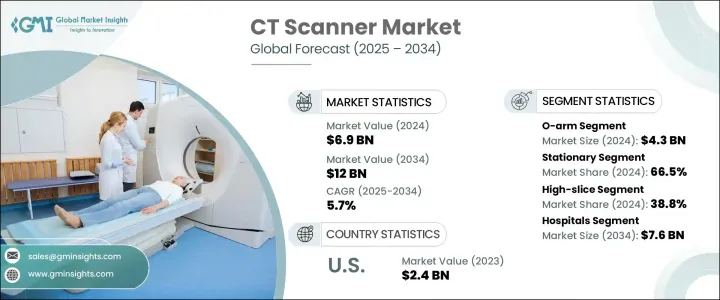

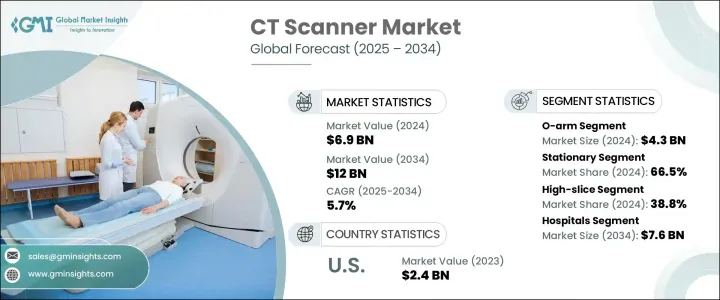

2024 年全球 CT 扫描仪市场价值为 69 亿美元,预计将以 5.7% 的复合年增长率成长,到 2034 年达到 120 亿美元。随着医疗保健提供者优先考虑早期疾病检测、精准医疗和改善治疗结果,对先进诊断影像解决方案的需求持续成长。电脑断层扫描 (CT) 扫描仪透过提供人体的高解析度横断面影像在实现这些目标中发挥关键作用。从常规筛检到紧急诊断,CT 扫描仪已成为现代医学影像的基石。医疗机构越来越依赖这些系统来视觉化复杂的内部结构,从而能够准确诊断癌症、心血管疾病、内伤和神经系统疾病等病症。随着政府和私人医疗保健提供者扩大基础设施并采用数位健康技术,CT 扫描仪市场预计将持续成长。正在进行的创新进一步支持了这一势头,这些创新旨在利用人工智慧和机器学习演算法来减少扫描时间、降低辐射暴露并提高影像清晰度。随着医疗保健产业倾向于微创手术和以患者为中心的护理,CT 影像的采用继续以显着的速度成长。

市场按架构分为 O 型臂和 C 型臂系统,其中 O 型臂部分在 2024 年创收 43 亿美元。预计 2025 年至 2034 年期间该部分的复合年增长率为 5.6%。 O 型臂系统透过在手术室中直接提供即时 2D 和 3D 成像功能,正在改变手术成像格局。其紧凑、移动的设计使其能够无缝整合到手术工作流程中,最大限度地减少了将患者运送到专用成像室的需要。外科医生受益于手术过程中增强的可视性和准确性,从而降低了併发症的风险并带来了更好的手术效果。预计对术中成像和精准引导手术的不断增长的需求将在预测期内推动该领域的持续增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 69亿美元 |

| 预测值 | 120亿美元 |

| 复合年增长率 | 5.7% |

就类型而言,市场分为便携式 CT 扫描仪和固定式 CT 扫描仪。 2024 年,文具市场占据主导地位,产值达 46 亿美元,占 66.5% 的市占率。这些系统以其卓越的影像解析度、高速扫描和在高容量医疗保健环境中的强大性能而闻名。迭代重建、人工智慧诊断工具和多层扫描功能等最新进展提高了固定 CT 系统的诊断价值。对于寻求在广泛的医疗应用中实现一致、高品质成像的医院和诊断中心来说,它们仍然是首选。

2024 年北美 CT 扫描仪市场价值为 27 亿美元,预计到 2034 年将达到 46 亿美元。该地区市场扩张的动力来自于慢性病发病率的上升,以及对诊断基础设施和研发的大力投资。尤其是美国,由于高昂的医疗支出和领先医疗设备製造商的强大影响力,继续透过先进的影像解决方案引领创新。

全球 CT 扫描仪行业的一些知名企业包括富士胶片控股公司、Accuray、美敦力、岛津製作所、Xoran Technologies、Koning Health、佳能、GE HealthCare Technologies、PLANMED、CurveBeam AI、三星电子、西门子医疗、东软医疗系统、荷兰皇家飞利浦和深圳荷兰皇家安科高科技。这些公司正在大力投资人工智慧驱动的增强、迭代成像技术和策略合作,以提升诊断能力并扩大其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球慢性病盛行率不断上升

- 微创诊断程序日益受到青睐

- CT 扫描仪相对于其他影像方式的优势

- CT扫描仪的技术进步

- 产业陷阱与挑战

- 安装和维护成本高昂

- CT扫描相关风险

- 成长动力

- 成长潜力分析

- 技术格局

- 监管格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依架构,2021 年至 2034 年

- 主要趋势

- O型臂

- C臂

第六章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 便携的

- 固定式

第七章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 高切片

- 中片

- 低切片

- 锥形束

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 人类

- 诊断

- 神经病学

- 肿瘤学

- 心臟病学

- 其他的

- 术中

- 诊断

- 研究

- 兽医

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- CRO

- 门诊手术中心

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 波兰

- 奥地利

- 瑞士

- 斯洛伐克

- 捷克共和国

- 挪威

- 芬兰

- 瑞典

- 丹麦

- 比荷卢经济联盟

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 台湾

- 印尼

- 越南

- 柬埔寨

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Accuray

- Canon

- CurveBeam AI

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies

- Koning Health

- Koninklijke Philips

- Medtronic

- Neusoft Medical Systems

- PLANMED

- Samsung Electronics

- Shenzhen Anke High-tech

- Shimadzu Corporation

- Siemens Healthineers

- Xoran Technologies

The Global CT Scanner Market was valued at USD 6.9 billion in 2024 and is expected to grow at a CAGR of 5.7% to reach USD 12 billion by 2034. The demand for advanced diagnostic imaging solutions continues to rise as healthcare providers prioritize early disease detection, precision medicine, and improved treatment outcomes. Computed Tomography (CT) scanners play a pivotal role in meeting these goals by delivering high-resolution, cross-sectional images of the human body. From routine screenings to emergency diagnostics, CT scanners have become a cornerstone of modern medical imaging. Healthcare institutions are increasingly relying on these systems to visualize complex internal structures, enabling accurate diagnoses for conditions such as cancer, cardiovascular diseases, internal injuries, and neurological disorders. As governments and private healthcare providers expand infrastructure and adopt digital health technologies, the CT scanner market is expected to witness consistent growth. This momentum is further supported by ongoing innovations that aim to reduce scanning times, lower radiation exposure, and enhance image clarity using AI and machine learning algorithms. With the healthcare industry leaning toward minimally invasive procedures and patient-centric care, the adoption of CT imaging continues to grow at a significant pace.

The market is segmented by architecture into O-arm and C-arm systems, with the O-arm segment generating USD 4.3 billion in 2024. This segment is projected to grow at a CAGR of 5.6% between 2025 and 2034. O-arm systems are transforming the surgical imaging landscape by offering real-time 2D and 3D imaging capabilities directly in operating rooms. Their compact and mobile design enables seamless integration into surgical workflows, minimizing the need to transport patients to dedicated imaging suites. Surgeons benefit from enhanced visibility and accuracy during procedures, which reduces the risk of complications and leads to better surgical outcomes. The growing demand for intraoperative imaging and precision-guided surgeries is expected to drive sustained growth in this segment over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $12 Billion |

| CAGR | 5.7% |

In terms of type, the market is divided into portable and stationary CT scanners. The stationary segment dominated in 2024, generating USD 4.6 billion and accounting for a 66.5% market share. These systems are known for their superior image resolution, high-speed scanning, and robust performance in high-volume healthcare settings. Recent advancements such as iterative reconstruction, AI-powered diagnostic tools, and multi-slice scanning capabilities have elevated the diagnostic value of stationary CT systems. They remain the preferred choice for hospitals and diagnostic centers seeking consistent, high-quality imaging across a wide range of medical applications.

The North America CT Scanner Market was valued at USD 2.7 billion in 2024 and is forecasted to reach USD 4.6 billion by 2034. The region's market expansion is driven by the rising incidence of chronic diseases, along with strong investments in diagnostic infrastructure and R&D. The U.S., in particular, continues to lead innovation through advanced imaging solutions fueled by high healthcare expenditure and a strong presence of leading medical device manufacturers.

Some of the prominent players in the global CT scanner industry include FUJIFILM Holdings Corporation, Accuray, Medtronic, Shimadzu Corporation, Xoran Technologies, Koning Health, Canon, GE HealthCare Technologies, PLANMED, CurveBeam AI, Samsung Electronics, Siemens Healthineers, Neusoft Medical Systems, Koninklijke Philips, and Shenzhen Anke High-tech. These companies are heavily investing in AI-driven enhancements, iterative imaging technologies, and strategic collaborations to elevate diagnostic capabilities and expand their global footprint.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases worldwide

- 3.2.1.2 Rising preference for minimally invasive diagnostic procedures

- 3.2.1.3 Advantages offered by CT scanner over other imaging modalities

- 3.2.1.4 Technological advancements in CT scanner

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Significant installation and maintenance cost

- 3.2.2.2 Risks associated with CT scan

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Regulatory landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Architecture, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 O-arm

- 5.3 C-arm

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Stationary

Chapter 7 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 High-slice

- 7.3 Mid-slice

- 7.4 Low-slice

- 7.5 Cone beam

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Human

- 8.2.1 Diagnostic

- 8.2.1.1 Neurology

- 8.2.1.2 Oncology

- 8.2.1.3 Cardiology

- 8.2.1.4 Others

- 8.2.2 Intraoperative

- 8.2.1 Diagnostic

- 8.3 Research

- 8.4 Veterinary

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 CROs

- 9.4 Ambulatory surgical centers

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Poland

- 10.3.8 Austria

- 10.3.9 Switzerland

- 10.3.10 Slovakia

- 10.3.11 Czech Republic

- 10.3.12 Norway

- 10.3.13 Finland

- 10.3.14 Sweden

- 10.3.15 Denmark

- 10.3.16 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Taiwan

- 10.4.7 Indonesia

- 10.4.8 Vietnam

- 10.4.9 Cambodia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Accuray

- 11.2 Canon

- 11.3 CurveBeam AI

- 11.4 FUJIFILM Holdings Corporation

- 11.5 GE HealthCare Technologies

- 11.6 Koning Health

- 11.7 Koninklijke Philips

- 11.8 Medtronic

- 11.9 Neusoft Medical Systems

- 11.10 PLANMED

- 11.11 Samsung Electronics

- 11.12 Shenzhen Anke High-tech

- 11.13 Shimadzu Corporation

- 11.14 Siemens Healthineers

- 11.15 Xoran Technologies