|

市场调查报告书

商品编码

1667146

分析仪器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Analytical Instrumentation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

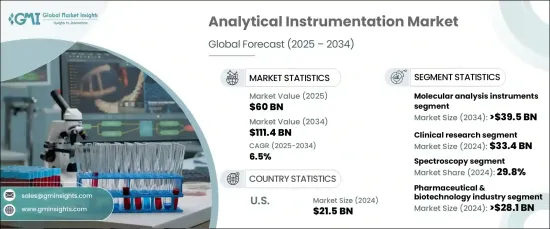

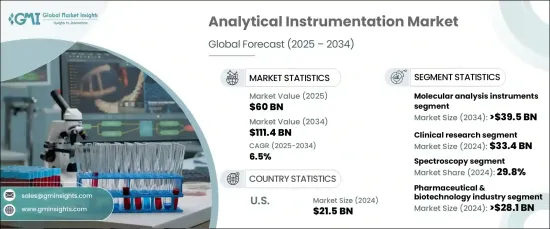

2024 年全球分析仪器市场价值将达到 600 亿美元,预计将大幅成长,预计 2025 年至 2034 年的复合年增长率为 6.5%。尤其是製药和生物技术行业,正在推动这一需求,因为他们优先考虑严格的品质控制措施和遵守监管标准。分析仪器在医疗保健领域的应用日益广泛,再加上材料科学、环境监测和化学分析领域的创新,凸显了市场在现代工业中的多功能性和重要性。

人们对个人化医疗的兴趣日益浓厚,加上慢性病的盛行,刺激了复杂诊断工具的采用。分析仪器在临床实验室和诊断中心发挥关键作用,能够提供准确、高效的测试解决方案。此外,各行各业都在增加对研发的投资,以提高产品品质和永续性,进一步推动了这些工具的采用。这些趋势以及对环保实践的日益重视,正在推动各行各业将先进的分析解决方案融入其营运中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 600亿美元 |

| 预测值 | 1114亿美元 |

| 复合年增长率 | 6.5% |

市场依产品类型分类,包括电化学分析仪器、层析仪器、分子分析仪器、光谱仪器、粒子计数器及分析仪等。其中,分子分析仪器表现突出,预计复合年增长率为 6.9%,到 2034 年将达到 395 亿美元。对分子水平分析精度的不断增长的需求推动了医疗保健和学术研究等各个领域的需求。

按技术划分,市场涵盖光谱学、色谱学、粒子分析、聚合酶链反应和其他方法。 2024 年,光谱学占了 29.8% 的市场份额,价值 179 亿美元。光谱技术的广泛应用归功于其对化学和分子结构进行无损分析的能力。这些方法广泛应用于生物技术、製药和材料科学,支持产品开发和品质保证的创新。

在美国,分析仪器市场在 2024 年创造了 215 亿美元的收入,预计到 2034 年将以 6.2% 的复合年增长率成长。药物开发、临床试验和生物标记研究中先进分析工具的使用正在加速。个人化医疗计划和精准诊断设备的需求进一步推动了临床和研究领域的市场扩张。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 技术进步

- 製药业和政府研究机构的研发支出不断增加

- 精准医疗应用分析仪器的采用日益增多

- 慢性病盛行率不断上升

- 产业陷阱与挑战

- 仪器成本高

- 缺乏熟练的专业人员

- 成长动力

- 成长潜力分析

- 2024 年定价分析

- 监管格局

- 我们

- 欧洲

- 2021 – 2034 年产量分析(单位)

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东及非洲

- 技术格局

- 报销场景

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 竞争定位矩阵

- 供应商矩阵分析

- 策略仪表板

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 分子分析仪器

- 光谱仪器

- 色谱仪器

- 电化学分析仪器

- 粒子计数器和分析仪

- 其他产品

第六章:市场估计与预测:按技术,2021 – 2034 年

- 主要趋势

- 光谱学

- 色谱法

- 颗粒分析

- 聚合酶连锁反应

- 其他技术

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 临床研究

- 临床诊断

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 製药及生技产业

- 研究和学术机构

- 诊断中心

- 其他最终用途

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 波兰

- 瑞典

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 泰国

- 印尼

- 菲律宾

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 以色列

- 土耳其

- 伊朗

第十章:公司简介

- Agilent

- Avantor

- BIO-RAD

- BRUKER

- Danaher

- Eppendorf

- HITACHI

- Illumina

- Malvern Panalytical

- Metrohm

- METTLER TOLEDO

- Revvity (PerkinElmer)

- Roche

- Sartorius

- SHIMADZU

- Thermo Fisher Scientific

- Waters

- ZEISS Group

The Global Analytical Instrumentation Market, valued at USD 60 billion in 2024, is poised for significant growth, with projections indicating a CAGR of 6.5% from 2025 to 2034. This upward trajectory reflects the increasing integration of advanced technologies and the escalating demand for precision and accuracy across industries. Pharmaceutical and biotechnology sectors, in particular, are driving this demand as they prioritize stringent quality control measures and compliance with regulatory standards. The expanding applications of analytical instruments in healthcare, coupled with innovations in materials science, environmental monitoring, and chemical analysis, underscore the market's versatility and importance in modern industries.

Rising interest in personalized medicine, coupled with the prevalence of chronic diseases, has spurred the adoption of sophisticated diagnostic tools. Analytical instruments are playing a pivotal role in clinical laboratories and diagnostic centers, enabling accurate and efficient testing solutions. Additionally, industries are increasingly investing in R&D to enhance product quality and sustainability, further fueling the adoption of these tools. These trends, along with the growing emphasis on eco-friendly practices, are pushing industries to integrate advanced analytical solutions into their operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $60 Billion |

| Forecast Value | $111.4 Billion |

| CAGR | 6.5% |

The market is categorized by product types, including electrochemical analysis instruments, chromatography instruments, molecular analysis instruments, spectroscopy instruments, particle counters and analyzers, and others. Among these, molecular analysis instruments stand out with a projected CAGR of 6.9%, expected to reach USD 39.5 billion by 2034. This segment's growth is fueled by the increasing adoption of cutting-edge techniques in research and diagnostics, particularly in genomics and proteomics. The rising need for precision in molecular-level analysis is driving demand across various sectors, including healthcare and academic research.

By technology, the market encompasses spectroscopy, chromatography, particle analysis, polymerase chain reaction, and other methods. Spectroscopy held a significant 29.8% market share in 2024, valued at USD 17.9 billion. The widespread adoption of spectroscopic techniques is attributed to their ability to perform non-destructive analyses of chemical and molecular structures. These methods are extensively used in biotechnology, pharmaceuticals, and materials science, supporting innovations in product development and quality assurance.

In the United States, the analytical instrumentation market generated USD 21.5 billion in revenue in 2024 and is forecast to grow at a CAGR of 6.2% through 2034. This growth is primarily driven by advancements in the pharmaceutical and biotechnology industries. The adoption of advanced analytical tools for drug development, clinical trials, and biomarker research has been accelerating. Personalized medicine initiatives and the need for precise diagnostic devices are further propelling market expansion in both clinical and research domains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements

- 3.2.1.2 Rising R&D spending by pharmaceutical industry & government research organizations

- 3.2.1.3 Increasing adoption of analytical instrumentation for precision medicine applications

- 3.2.1.4 Growing prevalence of chronic diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of instruments

- 3.2.2.2 Lack of skilled professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.6 Volume analysis, 2021 – 2034 (Units)

- 3.6.1 Global

- 3.6.2 North America

- 3.6.3 Europe

- 3.6.4 Asia Pacific

- 3.6.5 Latin America

- 3.6.6 MEA

- 3.7 Technology landscape

- 3.8 Reimbursement scenario

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Vendor matrix analysis

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Molecular analysis instruments

- 5.3 Spectroscopy instruments

- 5.4 Chromatography instruments

- 5.5 Electrochemical analysis instruments

- 5.6 Particle counters and analyzers

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spectroscopy

- 6.3 Chromatography

- 6.4 Particle analysis

- 6.5 Polymerase chain reaction

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Clinical research

- 7.3 Clinical diagnostics

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical & biotechnology industry

- 8.3 Research and academic institutes

- 8.4 Diagnostic centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Poland

- 9.3.7 Sweden

- 9.3.8 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Indonesia

- 9.4.8 Philippines

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Columbia

- 9.5.5 Chile

- 9.5.6 Peru

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Israel

- 9.6.5 Turkey

- 9.6.6 Iran

Chapter 10 Company Profiles

- 10.1 Agilent

- 10.2 Avantor

- 10.3 BIO-RAD

- 10.4 BRUKER

- 10.5 Danaher

- 10.6 Eppendorf

- 10.7 HITACHI

- 10.8 Illumina

- 10.9 Malvern Panalytical

- 10.10 Metrohm

- 10.11 METTLER TOLEDO

- 10.12 Revvity (PerkinElmer)

- 10.13 Roche

- 10.14 Sartorius

- 10.15 SHIMADZU

- 10.16 Thermo Fisher Scientific

- 10.17 Waters

- 10.18 ZEISS Group