|

市场调查报告书

商品编码

1667191

公用事业电气保险丝市场机会、成长动力、产业趋势分析与预测 2025 - 2034Utility Electric Fuse Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

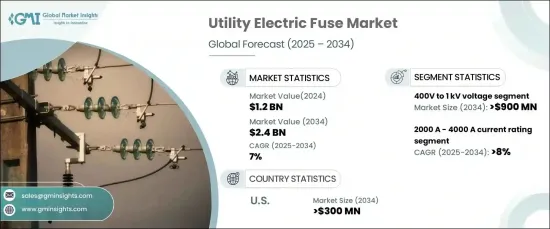

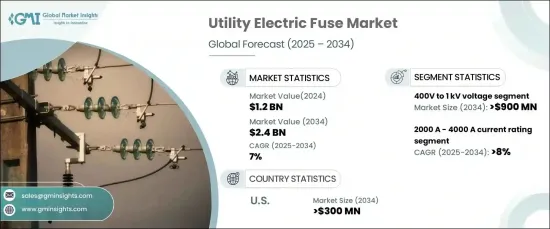

2024 年全球公用事业电熔断器市场价值为 12 亿美元,将实现显着增长,预计在 2025 年至 2034 年期间将实现 7% 的强劲复合年增长率。随着工业化的快速发展和全球人口的成长推动电力需求,公用事业公司正在加大配电网路的开发和建设力度,以满足不断变化的需求。

受城市化、工业成长和电力基础设施扩张的推动,400V 至 1kV 的电压范围预计到 2034 年将产生 9 亿美元的收入。对再生能源(如太阳能和风能)的日益依赖(通常在此电压范围内运作)进一步放大了该领域的潜力。此外,采用提供即时监控、远端诊断和自动故障检测的智慧保险丝技术增强了先进保险丝解决方案在这一领域的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 7% |

预计额定电流为 2000A 至 4000A 的保险丝在 2025 年至 2034 年期间的复合年增长率将达到 8%。这些大电流保险丝对于保护高压设备和确保一致的电力分配至关重要。它们还保护变电站、变压器和大型工业系统等重要基础设施免受故障和过载的影响,在支持电网弹性和能源可靠性方面发挥关键作用。

预计到 2034 年,美国公用事业电保险丝市场规模将达到 3 亿美元,主要得益于电网升级、再生能源整合和能源技术进步方面的大量投资。交通运输的快速电气化,特别是电动车(EV)的日益普及,进一步推动了对耐用、高效保险丝解决方案的需求。这些保险丝对于保护电动车充电系统和相关电力基础设施至关重要,可确保无缝、安全的能量传输。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:按电压,2021 – 2034 年

- 主要趋势

- 400V 至 1kV

- 1kV 至 11kV

- 11kV 至 33kV

- >33千伏

第 6 章:市场规模与预测:按当前评级,2021 年至 2034 年

- 主要趋势

- 2000-4000A

- >4000安

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Bel Fuse

- Denco Fuses

- Eaton

- Enerlux Power

- Fuji Electric

- General Electric

- Hiitio New Energy

- L&T Electrical & Automation

- Littelfuse

- Mersen

- S&C Electric

- Schneider Electric

- SIBA

The Global Utility Electric Fuse Market, valued at USD 1.2 billion in 2024, is set for remarkable growth, projected to achieve a robust CAGR of 7% from 2025 to 2034. This expansion is fueled by the increasing demand for reliable electricity, in line with a worldwide push to modernize power infrastructure. With rapid industrialization and a growing global population driving electricity needs, utilities are ramping up the development and enhancement of power distribution networks to meet these evolving demands.

The voltage range of 400V to 1kV is forecasted to generate $900 million by 2034, driven by urbanization, industrial growth, and the expansion of electrical infrastructure. The increasing reliance on renewable energy sources, such as solar and wind power-often operating within this voltage range-further amplifies the segment's potential. Additionally, the adoption of smart fuse technologies offering real-time monitoring, remote diagnostics, and automated fault detection enhances the appeal of advanced fuse solutions in this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 7% |

Fuses rated for 2000A to 4000A are anticipated to witness a robust CAGR of 8% from 2025 to 2034. This growth aligns with global efforts to modernize power grids and transition toward renewable energy. These high-current fuses are critical in protecting high-voltage equipment and ensuring consistent power distribution. They also safeguard essential infrastructure, including substations, transformers, and large-scale industrial systems, against faults and overloads, playing a pivotal role in supporting grid resilience and energy reliability.

The U.S. utility electric fuse market is projected to reach USD 300 million by 2034, driven by significant investments in grid upgrades, renewable energy integration, and advancements in energy technologies. The rapid electrification of transportation, particularly the increasing adoption of electric vehicles (EVs), is further fueling demand for durable and efficient fuse solutions. These fuses are essential for protecting EV charging systems and associated power infrastructure, ensuring seamless and safe energy transfer.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 400V to 1 kV

- 5.3 1 kV to 11kV

- 5.4 11kV to 33kV

- 5.5 > 33kV

Chapter 6 Market Size and Forecast, By Current Rating, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 2000-4000A

- 6.3 > 4000A

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Bel Fuse

- 8.3 Denco Fuses

- 8.4 Eaton

- 8.5 Enerlux Power

- 8.6 Fuji Electric

- 8.7 General Electric

- 8.8 Hiitio New Energy

- 8.9 L&T Electrical & Automation

- 8.10 Littelfuse

- 8.11 Mersen

- 8.12 S&C Electric

- 8.13 Schneider Electric

- 8.14 SIBA