|

市场调查报告书

商品编码

1667200

活性碳纤维 (ACF) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Activated Carbon Fiber (ACF) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

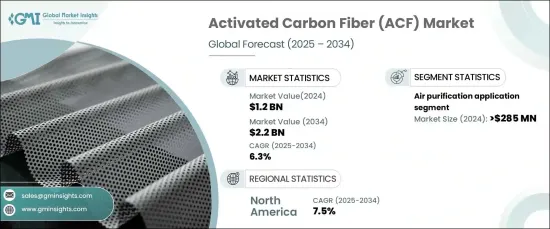

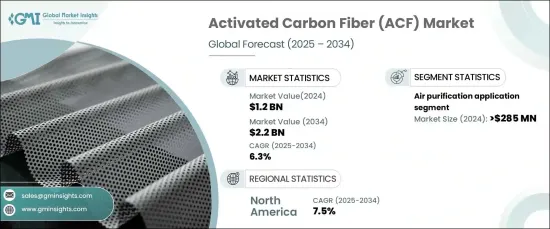

2024 年全球活性碳纤维市场规模达到 12 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.3%。随着工业化的快速发展和水资源的日益减少,对有效的废水处理解决方案的需求比以往任何时候都更加迫切。来自工业和生活来源的污染物,包括固体、液体和气体污染物,带来了严重的环境风险,这进一步加速了对基于 ACF 的解决方案的需求。

聚丙烯腈 (PAN) 基 ACF 因其优异的抗拉强度和多功能性预计将实现强劲增长。 PAN作为一种热塑性半结晶聚合物,经过碳化、控制活化、稳定化等工艺,可生产出高品质的ACF。它的耐用性和效率使其成为电容器、催化剂载体和过滤系统等应用的理想选择。对催化剂载体的需求不断增加,加上超级电容器技术的进步,进一步推动了对 PAN 基材的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 6.3% |

空气净化应用在 2024 年占据了相当大的收入,凸显了 ACF 在解决空气品质问题方面日益增长的重要性。全球空气污染法规促使各行各业采用先进的过滤技术,其中ACF过滤器已被证明能有效吸收氮氧化物 (NOx) 等污染物。交通运输、工业单位和住宅环境等领域采用基于 ACF 的空气过滤系统对市场扩张做出了重大贡献。

预计北美将实现显着成长,到 2034 年复合年增长率将达到 7.5%。增加对环境保护的投资,加上向永续解决方案的转变,进一步促进了采用。美国仍然是ACF的主要消费国,特别是在水处理和空气净化应用领域。北美各地成熟的製造商和广泛的分销网络进一步增强了市场前景。

受环境问题、材料技术进步和永续工业解决方案日益普及的推动,活性碳纤维市场将稳步扩大。各行各业对高效水和空气处理系统的需求日益增长,使得 ACF 成为实现全球环境和法规合规性的关键组成部分。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 北美:废水处理需求不断增加

- 欧洲:活性碳纤维在空气净化领域的新兴应用

- 亚太地区:与空气和水污染相关的环境问题日益严重

- 产业陷阱与挑战

- 产品成本高且原料供应波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:按材料,2021-2034 年

- 主要趋势

- 纤维素基

- 聚丙烯腈(PAN)基

- 酚醛树脂基

- 基于音调

- 其他的

第 6 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 空气净化

- 水处理

- 化学回收

- 催化剂载体

- 其他的

第 7 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Anshan Sinocarb Carbon Fibers

- Awa Paper & Technological Company

- Evertech Envisafe Ecology

- Gun Ei Chemical Industry

- Hangzhou Nature Technology

- HP Materials Solutions

- Jiangsu Kejing Carbon Fiber

- Jiangsu Sutong Carbon Fiber

- Jiangsu Tongkang Activated Carbon Fiber

- Kuraray

- OJSC – Open Joint Stock Company

- Osaka Gas Chemical

- Toyobo

- Unitika

The Global Activated Carbon Fiber Market reached USD 1.2 billion in 2024 and is projected to grow at a CAGR of 6.3% between 2025 and 2034. The rising focus on water treatment, driven by strict government regulations and increasing public health concerns, is fueling market growth. With rapid industrialization and dwindling water resources, the need for effective wastewater treatment solutions is more critical than ever. Contaminants from industrial and domestic sources, including solid, liquid, and gaseous pollutants, pose significant environmental risks, which further accelerates demand for ACF-based solutions.

Polyacrylonitrile (PAN) based ACF is expected to witness robust growth owing to its superior tensile strength and versatility. As a thermoplastic semi-crystalline polymer, PAN undergoes processes such as carbonization, controlled activation, and stabilization to produce high-quality ACF. Its durability and efficiency make it ideal for applications such as capacitors, catalyst carriers, and filtration systems. The increasing need for catalyst carriers, combined with advancements in supercapacitor technologies, is further driving demand for PAN-based materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 6.3% |

Air purification applications accounted for significant revenue in 2024, highlighting the growing importance of ACF in addressing air quality concerns. Global air pollution regulations are prompting industries to adopt advanced filtration technologies, with ACF filters proving effective in absorbing pollutants like nitrogen oxides (NOx). The adoption of ACF-based air filtration systems across sectors such as transportation, industrial units, and residential settings is contributing significantly to market expansion.

North America is anticipated to record notable growth, with a projected CAGR of 7.5% through 2034. The region's thriving chemical and petroleum industries are key drivers for ACF demand, particularly for chemical recovery and solvent purification systems. Increasing investments in environmental protection, coupled with a shift toward sustainable solutions, further bolster adoption. The U.S. remains a major consumer of ACF, particularly in water treatment and air purification applications. The presence of established manufacturers and extensive distribution networks across North America further strengthens the market outlook.

The activated carbon fiber market is set to expand steadily, driven by environmental concerns, advancements in material technologies, and the growing adoption of sustainable industrial solutions. The rising need for efficient water and air treatment systems across industries positions ACF as a critical component in achieving environmental and regulatory compliance globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 North America: Increasing demand for wastewater treatment

- 3.6.1.2 Europe: Emerging application of activated carbon fiber in air purification

- 3.6.1.3 Asia Pacific: Increasing environmental concerns related to air and water pollution

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High product cost and fluctuation in raw material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Material, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cellulose based

- 5.3 Polyacrylonitrile (PAN) based

- 5.4 Phenolic resin based

- 5.5 Pitch based

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Air purification

- 6.3 Water treatment

- 6.4 Chemical recovery

- 6.5 Catalyst carrier

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Anshan Sinocarb Carbon Fibers

- 8.2 Awa Paper & Technological Company

- 8.3 Evertech Envisafe Ecology

- 8.4 Gun Ei Chemical Industry

- 8.5 Hangzhou Nature Technology

- 8.6 HP Materials Solutions

- 8.7 Jiangsu Kejing Carbon Fiber

- 8.8 Jiangsu Sutong Carbon Fiber

- 8.9 Jiangsu Tongkang Activated Carbon Fiber

- 8.10 Kuraray

- 8.11 OJSC – Open Joint Stock Company

- 8.12 Osaka Gas Chemical

- 8.13 Toyobo

- 8.14 Unitika