|

市场调查报告书

商品编码

1687773

活性碳纤维:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Activated Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

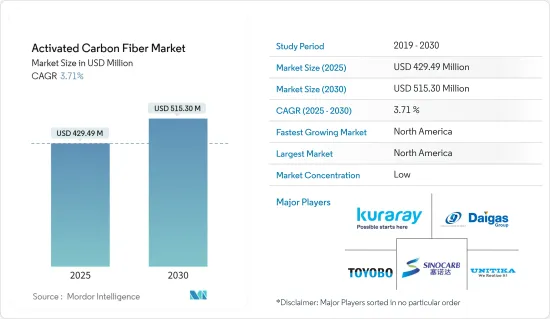

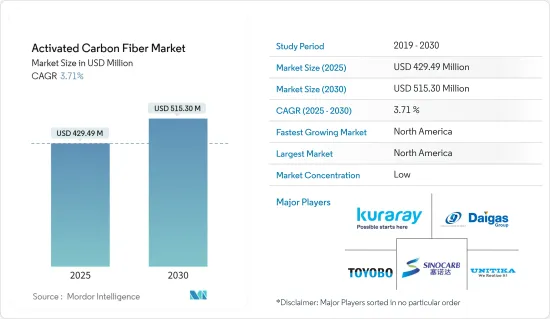

2025 年活性碳纤维市场规模预估为 4.2949 亿美元,预计到 2030 年将达到 5.153 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.71%。

在2020年COVID-19疫情期间,市场生产、销售、行销和分销的成长急剧下降。全球停工导致市场关闭,对许多关键产业造成重大损失。然而,过去两年市场已经復苏并实现强劲成长。

主要亮点

- 人们对空气和水污染等环境问题的日益关注,加上活性碳纤维相对于粉状活性碳(PAC)和颗粒活性碳(GAC)的优越性能,预计将在预测期内推动市场需求。

- 人们对其原料的担忧,例如合成纤维,不可降解,且易与污水中的有害化学污染物分子(如阻燃剂和杀虫剂)结合,可能会阻碍市场的成长。

- 防护衣行业需求的不断增长预计将为未来市场提供有利的机会。

- 预计北美将主导市场,并可能在预测期内实现最高的复合年增长率。

活性碳纤维 (ACF) 市场趋势

净化业需求增加

- 活性碳纤维的主要用途之一是净化。活性碳纤维因其特性而成为气体和水净化的主要用途。

- 许多行业和实验室都需要高纯度气体。水分、碳氢化合物、氧气和含硫化合物等杂质的存在会导致气体的干扰和使用效率低。这使得工业气体的精製成为必要。

- 汽车排放控制、飞机客舱空气净化、废气和气味控制、防毒面具和室内空气品质都需要气体纯化。此外,随着天然气用途变得更加多样化以及人们对空气污染的担忧日益加剧,许多行业对气体纯化的需求也在增加。

- 根据国际汽车製造商组织(OICA)的数据,去年全球汽车产量约为 8,015 万辆,预计 2020 年将成长 3%,达到 7,771 万辆。

- 由于政府采取了多项倡议,预计预测期内印度的水质净化将大幅提高。印度能源、环境和水资源委员会(CEEW)正在与2030水资源小组合作,规划改善印度的污水管理,私人投资也在增加,用于建造污水处理厂。

- 预计所有上述因素都将在预测期内推动全球市场的发展。

北美占据市场主导地位

- 由于美国和加拿大等国家的净化、化学和医疗行业的需求不断增加,预计北美将主导活性碳纤维市场。

- 美国是工业大国,拥有大、中、小型多个工业规模。该国以蓬勃发展的商业活动而闻名。此外,美国是世界上最大的耗水国之一。美国约 80% 的水和污水处理产业为公有和公共控制。

- 然而,农村地区获得水处理基础设施和设施的机会明显少于都市区。自2003年以来,美国农业部(USDA)已提供了近100亿美元的资金用于建造和维护7,500个农村用水和污水系统,并计划在未来几年进一步增加投资。该国对水处理的投资不断扩大可能会增加对活性碳纤维的需求。

- 据美国工业理事会称,去年美国化学品出货收益达到 7,689 亿美元(2020 年将达到 6,960 亿美元),支持了化学工业对活性碳纤维基过滤器的需求。

- 老年人口的不断增长和对治疗慢性病的医疗设施的需求不断增加,推动了该国医疗保健行业的增长和各种应用的活性碳纤维的消费。

- 在加拿大的医疗保健产业中,医疗设备产业是一个高度多元、出口导向的产业,主要生产设备和消耗品。该行业由产品创新推动。该行业能够利用加拿大大学、研究机构和医院进行的世界级的创新研究,其中一些研究被分拆为加拿大医疗设备公司。

- 因此,预计上述因素导致的需求成长将推动北美地区的成长。

活性碳纤维 (ACF) 产业概况

活性碳纤维市场比较分散。活性碳纤维市场的主要参与者有大阪瓦斯化学公司、可乐丽、尤尼吉可有限公司、鞍山中碳碳纤维公司、可乐丽、东洋纺等(不分先后顺序)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 对空气和水污染日益增长的关注

- 活性碳纤维的优异性能

- 限制因素

- 成分问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 原料

- 自然的

- 合成

- 基于音调

- 锅底

- 苯酚类

- 黏胶基

- 其他材料

- 应用

- 精製

- 化学分离与催化作用

- 防护衣

- 医疗

- 超级电容

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Anshan Sinocarb Carbon Fibers Co. Ltd

- China Beihai Fiberglass Co. Ltd

- Evertech Envisafe Ecology Co. Ltd

- Hangzhou Nature Technology Co. Ltd(Nature Carbon)

- HPMS Graphite

- Jiangsu Tongkang Activated Carbon Fiber Co. Ltd

- Kuraray Co. Ltd

- Nantong Yongtong Environmental Technology Co. Ltd

- Osaka Gas Chemicals Co. Ltd

- Toyobo Co. Ltd

- Unitika LTD

第七章 市场机会与未来趋势

- 扩大防护衣的用途

The Activated Carbon Fiber Market size is estimated at USD 429.49 million in 2025, and is expected to reach USD 515.30 million by 2030, at a CAGR of 3.71% during the forecast period (2025-2030).

During the COVID-19 pandemic in 2020, the market experienced a sharp decline in growth in output, sales, marketing, and distribution. The global shutdown has resulted in a series of market closures that have resulted in significant losses to many key industries. However, the market has recovered in the two years to post strong growth.

Key Highlights

- Increasing environmental concerns related to air and water pollution, coupled with activated carbon fiber's superior properties in comparison to that of powdered activated carbons (PAC) and granular activated carbons (GAC), are expected to drive the demand for the market during the forecast period.

- Concerns related to its raw materials, such as that synthetic fiber, which is non-degradable and tends to bind with molecules of harmful chemical pollutants in wastewater, such as flame retardants and pesticides, are likely to hinder the market's growth.

- Rising demand from the protective clothing industry is projected to act as an opportunity for the market in the future.

- The North American region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Activated Carbon Fiber (ACF) Market Trends

Increasing Demand from the Purification Industry

- One of the major applications of activated carbon fiber includes purification. Gas and water purification involve the major usage of activated carbon fibers owing to their properties.

- High-purity gases are required in various industries and laboratories. The presence of impurities, such as moisture, hydrocarbons, oxygen, or sulfur compounds, can lead to interference or inefficient use of the gases. This creates a need for the purification of industrial gases.

- Gas purification is required for automotive emission control, aircraft cabin air purification, emission and odor control, gas masks, and maintaining indoor air quality. Moreover, gas purification requirements are increasing in numerous industries, with the diversifying application of gases and growing concerns about air pollution.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), around 80.15 million vehicles were produced across the world last year, witnessing a growth rate of 3% compared to ~77.71 million vehicles in 2020, thereby enhancing the demand for activated carbon fibers for automotive emission control.

- Water purification in India is expected to register a decent increase during the forecast period, owing to various government initiatives. The Council on Energy, Environment, and Water (CEEW), in association with the 2030 Water Resources Group, is planning to improve wastewater management in India, along with increasing private investments to build wastewater treatment plants.

- All the aforementioned factors are expected to drive the global market during the forecast period.

North America to Dominate the Market

- North America is expected to dominate the activated carbon fiber market due to increasing demand from purification, chemicals, and the medical industry in countries such as the United States and Canada.

- The United States is a major industrialized nation that houses multiple industries in heavy-scale, medium-scale, and small-scale categories. The country is known for its booming commercial activities. Moreover, the United States is one of the highest consumers of water in the world. Approximately 80% of the US water and wastewater treatment industry is owned and managed publicly.

- However, the rural part of the country has significantly lower access to water treatment infrastructure and facilitates in comparison to the urban areas. Since 2003, the United States Department of Agriculture (USDA) has funded around USD 10 billion for the construction and maintenance of 7,500 rural water and wastewater systems and is planning to further increase its investment in the coming years. This growing investment in water treatment in the country is likely to boost the demand for activated carbon fiber.

- According to the American Chemistry Council, the value of United States chemical shipments accounted for USD 768.9 billion last year, compared to USD 696 billion in 2020, thereby supporting the demand for activated carbon fiber-based filters from the chemical industry.

- The increasing geriatric population and the growing requirement for medical facilities for the treatment of chronic diseases have been supporting the growth of the healthcare sector, as well as the consumption of activated carbon fibers for various applications in the country.

- In the healthcare industry in Canada, the medical device sector is a highly diversified and export-oriented industry that manufactures equipment and supplies. The sector is driven by product innovation. The industry can draw on world-class innovative research being conducted in Canadian universities, research institutes, and hospitals, some of which have been spun off into Canadian medical device companies.

- Thus, rising demands from the above-mentioned factors are expected to drive growth in the North American region.

Activated Carbon Fiber (ACF) Industry Overview

The activated carbon fiber market is fragmented in nature. Key players in the activated carbon fiber market include (not in any particular order) Osaka Gas Chemicals Co. Ltd, Kuraray Co. Ltd, Unitika Ltd, Anshan Sinocarb Carbon Fibers Co. Ltd, Kuraray Co. Ltd, and Toyobo Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Environmental Concerns Related to Air and Water Pollution

- 4.1.2 Superior Properties of Activated Carbon Fiber

- 4.2 Restraints

- 4.2.1 Concerns Related to Raw Materials

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Raw Material

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.1.2.1 Pitch-based

- 5.1.2.2 Pan-based

- 5.1.2.3 Phenolic-based

- 5.1.2.4 Viscose-based

- 5.1.2.5 Other Materials

- 5.2 Application

- 5.2.1 Purification

- 5.2.2 Chemical Separation and Catalysis

- 5.2.3 Protective Clothing

- 5.2.4 Medical

- 5.2.5 Super Capacitors

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Middle East & Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anshan Sinocarb Carbon Fibers Co. Ltd

- 6.4.2 China Beihai Fiberglass Co. Ltd

- 6.4.3 Evertech Envisafe Ecology Co. Ltd

- 6.4.4 Hangzhou Nature Technology Co. Ltd (Nature Carbon)

- 6.4.5 HPMS Graphite

- 6.4.6 Jiangsu Tongkang Activated Carbon Fiber Co. Ltd

- 6.4.7 Kuraray Co. Ltd

- 6.4.8 Nantong Yongtong Environmental Technology Co. Ltd

- 6.4.9 Osaka Gas Chemicals Co. Ltd

- 6.4.10 Toyobo Co. Ltd

- 6.4.11 Unitika LTD

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in Protective Clothing