|

市场调查报告书

商品编码

1684559

抗凝血逆转药物市场机会、成长动力、产业趋势分析与预测 2025 - 2034Anticoagulant Reversal Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

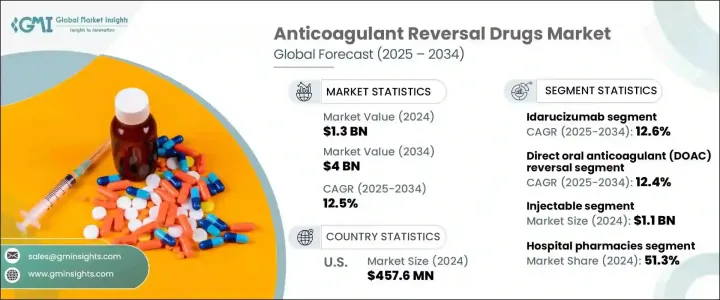

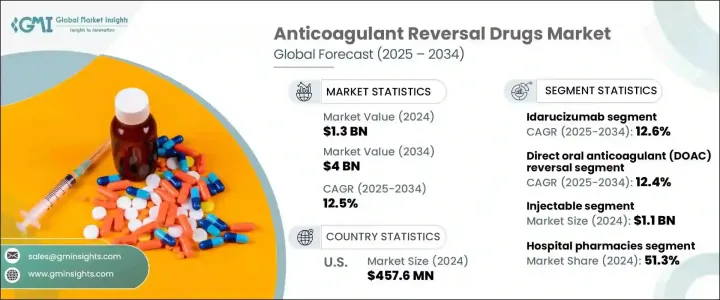

2024 年全球抗凝血逆转药物市场价值为 13 亿美元,将经历令人瞩目的成长,预计 2025 年至 2034 年的复合年增长率为 12.5%。这一市场扩张很大程度上是由于抗凝血剂的使用量不断增加以及出血併发症发生率不断上升,凸显了对有效逆转剂的需求。随着心血管疾病和深部静脉栓塞、肺栓塞、心房颤动等血栓性疾病的发生率不断增加,对能够在紧急情况下快速逆转抗凝血作用的药物的需求也不断增加。随着直接口服抗凝血剂 (DOAC)、华法林和肝素的新型逆转剂的推出,情况正在发生变化,使得治疗对患者和医疗保健提供者来说更加可靠和可及。

全球人口老化,加上慢性病的盛行率上升,大大增加了抗凝血剂的使用。长期抗凝血治疗目前已成为多种心血管及血栓疾病的常见治疗方法。然而,这些治疗方法会增加出血併发症的风险,因此迫切需要可靠的逆转方法。抗凝血逆转药物解决了这项挑战,确保了患者在严重出血或手术等不良事件期间的安全。随着医疗技术的进步推动更有效、更快速的逆转疗法的发展,市场将进一步成长,受益于这些治疗方法在临床和医院环境中更广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 12.5% |

市场按产品类型细分,包括安得拉胺、维生素 K、凝血酶原复合物浓缩物、依达赛珠单抗、鱼精蛋白和其他相关产品。 Idarucizumab 的市值在 2024 年将达到 4.435 亿美元,预计在预测期内的复合年增长率将达到 12.6%,这得益于其在逆转达比加群作用方面所发挥的作用。达比加群是一种广泛使用的 DOAC,特别用于治疗心房颤动和深部静脉栓塞等疾病。

根据给药途径,市场分为注射剂和口服剂。注射剂领域引领市场,到 2024 年价值将达到 11 亿美元,因为注射剂因其快速有效的作用而在危急情况下受到青睐。这些速效药物对于在严重出血或紧急手术等紧急情况下逆转抗凝血至关重要,因为立即干预至关重要。

在美国,2024 年抗凝血逆转药物市值为 4.576 亿美元。心血管疾病和肾臟疾病等需要抗凝血治疗的慢性病发生率不断增加,推动了对抗凝血剂及其逆转剂的需求。此外,鼓励开发更安全的抗凝血剂和逆转疗法的监管支持进一步推动了正在持续成长的美国市场。随着越来越多老年人面临血栓栓塞和出血性疾病的风险,随着新的逆转药物和疗法被引入并纳入临床实践,美国市场预计将出现持续的需求。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 老龄人口不断增加

- 需要抗凝血治疗的疾病盛行率不断上升

- 新型抗凝血剂的出现

- 产业陷阱与挑战

- 与这些药物相关的副作用

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 伊达珠单抗

- 维生素 K

- 凝血酶原复合物浓缩物

- 安地沙奈特阿尔法

- 鱼精蛋白

- 其他产品

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 直接口服抗凝血剂 (DOAC) 逆转

- 华法林逆转

- 肝素和低分子量肝素 (LMWH) 逆转

- 其他应用

第 7 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 注射剂

- 口服

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amneal Pharmaceuticals

- AstraZeneca

- Cipla

- CSL Behring Limited

- Dr. Reddy's Laboratories

- Endo International

- Lupin

- Mylan NV

- Novartis

- Pfizer

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

The Global Anticoagulant Reversal Drugs Market, valued at USD 1.3 billion in 2024, is set to experience impressive growth, projected at a CAGR of 12.5% from 2025 to 2034. This market expansion is largely driven by the growing usage of anticoagulants and the rising incidence of bleeding complications, which emphasize the need for effective reversal agents. As cardiovascular diseases and thrombotic conditions like deep vein thrombosis, pulmonary embolism, and atrial fibrillation continue to increase, so does the demand for drugs that can quickly reverse anticoagulation effects in emergency situations. With the introduction of novel reversal agents for direct oral anticoagulants (DOACs), warfarin, and heparin, the landscape is transforming, making treatment more reliable and accessible for both patients and healthcare providers.

Aging populations worldwide, coupled with an increasing prevalence of chronic conditions, have significantly amplified the use of anticoagulants. Long-term anticoagulation therapy is now a common treatment for a variety of cardiovascular and thrombotic diseases. However, these treatments increase the risk of bleeding complications, creating a critical need for reliable reversal options. Anticoagulant reversal drugs address this challenge, ensuring patient safety during adverse events like severe bleeding or surgeries. As advancements in medical technology drive the development of more effective and rapid reversal therapies, the market is poised for further growth, benefiting from the wider adoption of these treatments in both clinical and hospital settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 12.5% |

The market is segmented by product type, which includes andexanet alfa, phytonadione (vitamin K), prothrombin complex concentrates, idarucizumab, protamine, and other related products. Idarucizumab, valued at USD 443.5 million in 2024, is anticipated to experience a CAGR of 12.6% during the forecast period, driven by its role in reversing the effects of dabigatran. Dabigatran is a widely used DOAC, particularly for managing conditions such as atrial fibrillation and deep venous thrombosis.

When it comes to the route of administration, the market is split into injectable and oral forms. The injectable segment leads the market, valued at USD 1.1 billion in 2024, as injectables are preferred in critical situations for their quick and effective action. These fast-acting drugs are essential for reversing anticoagulation during emergencies like severe bleeding or urgent surgeries, where immediate intervention is crucial.

In the U.S., the anticoagulant reversal drugs market was valued at USD 457.6 million in 2024. The increasing incidence of chronic conditions requiring anticoagulation therapy, such as cardiovascular and kidney diseases, has driven the demand for both anticoagulants and their reversal agents. Furthermore, regulatory support that encourages the development of safer anticoagulants and reversal therapies further boosts the U.S. market, which is experiencing continued growth. With a large and growing elderly population at risk for thromboembolic and bleeding disorders, the U.S. market is expected to see sustained demand as new reversal drugs and therapies are introduced and incorporated into clinical practices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing aging population

- 3.2.1.2 Rising prevalence of conditions requiring anticoagulation therapy

- 3.2.1.3 Emergence of new anticoagulants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with these drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Idarucizumab

- 5.3 Phytonadione (Vitamin K)

- 5.4 Prothrombin complex concentrates

- 5.5 Andexanet alfa

- 5.6 Protamine

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Direct oral anticoagulant (DOAC) reversal

- 6.3 Warfarin reversal

- 6.4 Heparin and low-molecular-weight heparin (LMWH) reversal

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injectable

- 7.3 Oral

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amneal Pharmaceuticals

- 10.2 AstraZeneca

- 10.3 Cipla

- 10.4 CSL Behring Limited

- 10.5 Dr. Reddy’s Laboratories

- 10.6 Endo International

- 10.7 Lupin

- 10.8 Mylan N.V.

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sun Pharmaceutical Industries

- 10.12 Teva Pharmaceutical Industries