|

市场调查报告书

商品编码

1684567

绞肉机市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Meat Grinder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

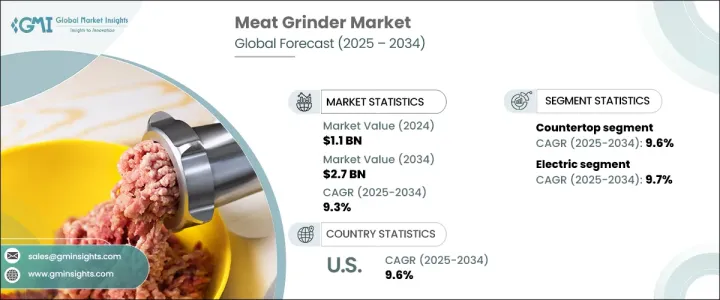

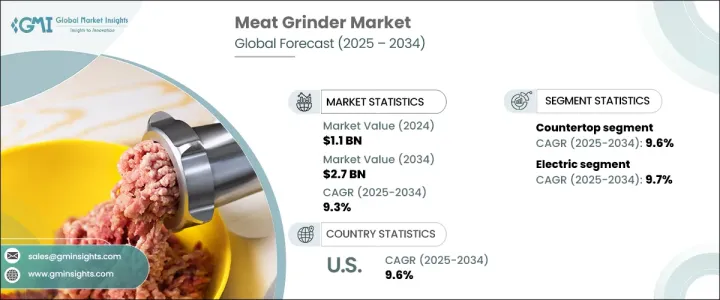

2024 年全球绞肉机市场规模达到 11 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9.3%。该市场是食品加工设备产业的重要组成部分,在全球供应链中发挥重要作用。消费者对食品安全和肉质意识的不断增强以及自製食品的流行趋势推动了家庭和工业用途对绞肉机的需求。大型商业肉类加工商也在投资大容量研磨机以满足日益增长的需求。此外,对永续生产实践的关注和强大食品零售网路的发展进一步推动了该行业的成长。

市场分为手动和电动绞肉机。 2024 年,电动绞肉机市场占据主导地位,估值达 9 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 9.7%。电动绞肉机因其效率高、使用方便而受到青睐,无论是在商业或住宅环境中都不可或缺。这些研磨机操作起来只需要很少的力气,非常适合肉店、餐厅、餐饮准备中心和繁忙的家庭。手动部分虽然规模较小,但仍继续迎合以可负担性和简单性为关键因素的利基市场。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 27亿美元 |

| 复合年增长率 | 9.3% |

市场的进一步细分包括檯面式和壁挂式绞肉机。 2024 年,桌上型绞肉机占了 74% 的市场份额,预计 2025 年至 2034 年期间的复合年增长率为 9.6%。桌上型绞肉机因其便携性、价格实惠和多功能性而广受欢迎。它们特别受到需要中等程度绞肉能力的小型企业、房主和餐厅的青睐。另一方面,在稳定性和耐用性至关重要的工业和大批量环境中,安装式磨床是首选。

从地区来看,美国绞肉机市场规模在 2024 年达到 2.6 亿美元,预计在 2025 年至 2034 年的预测期内复合年增长率为 9.6%。凭藉在食品加工和家电行业的领导地位,美国在北美绞肉机市场占据主导地位。美国是世界上最大的人均肉类消费国,尤其是牛肉、猪肉和鸡肉,这推动了对绞肉机的需求。这些设备广泛用于准备香肠、汉堡和其他碎肉製品,满足商业和住宅需求。

全球绞肉机市场也见证了技术的进步,例如智慧功能和节能设计的整合。製造商正专注于创新以增强产品功能并满足不断变化的消费者偏好。电子商务平台的日益普及进一步提高了市场可及性,使消费者能够探索各种各样的产品并做出明智的购买决定。这些因素共同表明,预测期内绞肉机市场将呈现良好的成长轨迹。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 技术格局

- 衝击力

- 成长动力

- 全球肉类消费量不断增加

- 家庭肉品加工越来越受欢迎

- 肉类加工设备的技术进步

- 产业陷阱与挑战

- 工业研磨机的初始成本高

- 严格的食品安全法规

- 成长动力

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 偏好价格范围

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 手动绞肉机

- 电动绞肉机

第 6 章:市场估计与预测:按材料类型,2021 年至 2034 年

- 主要趋势

- 铝

- 铸铁

- 不銹钢

- 其他(碳钢等)

第七章:市场估计与预测:依结构,2021 – 2034 年

- 主要趋势

- 桌上型绞肉机

- 挂装绞肉机

- 落地式

- 桌面安装

第 8 章:市场估计与预测:按产能,2021 年至 2034 年

- 主要趋势

- 小型(最高 150 磅/小时)

- 中(150-500 磅/小时)

- 大型(500 磅/小时以上)

第 9 章:市场估计与预测:按运营,2021 – 2034 年

- 主要趋势

- 轻型

- 中型

- 重负

第 10 章:市场估计与预测:按价格范围,2021 年至 2034 年

- 主要趋势

- 低(500 美元以下)

- 中型(500 美元 - 1000 美元)

- 高(1000 美元以上)

第 11 章:市场估计与预测:按饲料类型,2021 年至 2034 年

- 主要趋势

- 托盘进料磨床

- 垂直进给

- 螺旋给料

- 手动推料

- 其他(真空进料等)

第 12 章:市场估计与预测:按最终用户,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- 饭店和餐厅

- 餐饮服务

- 肉店

- 其他的

- 工业的

- 肉类加工厂

- 食品生产设施

第 13 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务网站

- 公司网站

- 离线

- 大卖场和超市

- 专卖店

- 其他(百货商场、个体店等)

第 14 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 15 章:公司简介

- ABM Company

- ADE Germany

- AlexanderSolia GmbH

- Amisy

- Ari Makina

- ASGO

- Bizerba

- CRM srl

- Clearline

- Dadaux SAS

- Dito Sama

- Fatosa, SA

- Fimar Spa

- Hobart

- Nikai Group

- Roser Group

- Weston Brands

The Global Meat Grinder Market reached USD 1.1 billion in 2024 and is projected to grow at a CAGR of 9.3% between 2025 and 2034. This market forms a vital component of the food processing equipment sector, which plays a significant role in the global supply chain. Increasing consumer awareness about food safety and meat quality, and the rising trend of homemade food preparation have driven the demand for meat grinders for both residential and industrial purposes. Large-scale commercial meat processors are also investing in high-capacity grinders to meet the growing demand. Additionally, the focus on sustainable production practices and the development of strong food retail networks have further fueled the sector's growth.

The market is categorized into manual and electric meat grinders. In 2024, the electric meat grinder segment dominated the market with a valuation of USD 900 million and is expected to grow at a CAGR of 9.7% between 2025 and 2034. Electric grinders are preferred for their efficiency and ease of use, making them indispensable in both commercial and residential settings. These grinders require minimal effort to operate, making them ideal for butcher shops, restaurants, meal prep centers, and busy households. The manual segment, while smaller, continues to cater to niche markets where affordability and simplicity are key factors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 9.3% |

Further segmentation of the market includes countertops and mounted meat grinders. In 2024, countertop meat grinders held a 74% market share and are anticipated to grow at a CAGR of 9.6% between 2025 and 2034. Countertop grinders are popular due to their portability, affordability, and versatility. They are particularly favored by small businesses, homeowners, and restaurants that require moderate meat grinding capabilities. Mounted grinders, on the other hand, are preferred in industrial and high-volume settings where stability and durability are critical.

Regionally, the U.S. meat grinder market reached USD 260 million in 2024 and is projected to grow at a CAGR of 9.6% during the forecast period between 2025 and 2034. The country holds a dominant position in the North American market for meat grinders due to its leadership in the food processing and home appliance industries. The U.S. is the world's largest consumer of meat per capita, particularly beef, pork, and chicken, which has driven the demand for meat grinders. These devices are widely used for preparing sausages, burgers, and other ground meat products, catering to both commercial and residential needs.

The global meat grinder market is also witnessing advancements in technology, such as the integration of smart features and energy-efficient designs. Manufacturers are focusing on innovation to enhance product functionality and cater to evolving consumer preferences. The increasing penetration of e-commerce platforms has further boosted market accessibility, enabling consumers to explore a wide range of products and make informed purchasing decisions. These factors collectively indicate a promising growth trajectory for the meat grinder market over the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing meat consumption worldwide

- 3.7.1.2 Rising popularity of home meat processing

- 3.7.1.3 Technological advancements in meat processing equipment

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs for industrial grinders

- 3.7.2.2 Stringent food safety regulations

- 3.7.1 Growth drivers

- 3.8 Consumer buying behavior analysis

- 3.8.1 Demographic trends

- 3.8.2 Factors affecting buying decision

- 3.8.3 Consumer product adoption

- 3.8.4 Preferred distribution channel

- 3.8.5 Preferred price range

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Manual meat grinder

- 5.3 Electric meat grinder

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Cast iron

- 6.4 Stainless steel

- 6.5 Others (carbon steel, etc.)

Chapter 7 Market Estimates and Forecast, By Structure, 2021 – 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Countertop meat grinder

- 7.3 Mounted meat grinder

- 7.3.1 Floor mounted

- 7.3.2 Table mounted

Chapter 8 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Small (Up to 150 lbs/hour)

- 8.3 Medium (150-500 lbs/hour)

- 8.4 Large (Above 500 lbs/hour)

Chapter 9 Market Estimates and Forecast, By Operation, 2021 – 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Light-duty

- 9.3 Medium-duty

- 9.4 Heavy-duty

Chapter 10 Market Estimates and Forecast, By Price Range, 2021 – 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Low (under USD 500)

- 10.3 Medium (USD 500 - USD 1000)

- 10.4 High (above USD 1000)

Chapter 11 Market Estimates and Forecast, By Feed Type, 2021 – 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Tray feed grinder

- 11.3 Vertical feed

- 11.4 Auger feed

- 11.5 Manual push feed

- 11.6 Others (vacuum feed, etc.)

Chapter 12 Market Estimates and Forecast, By End User, 2021 – 2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Residential

- 12.3 Commercial

- 12.3.1 Hotels and restaurants

- 12.3.2 Catering services

- 12.3.3 Butcher shops

- 12.3.4 Others

- 12.4 Industrial

- 12.4.1 Meat processing plants

- 12.4.2 Food manufacturing facilities

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 E-commerce website

- 13.2.2 Company website

- 13.3 Offline

- 13.3.1 Hypermarkets and supermarkets

- 13.3.2 Specialty stores

- 13.3.3 Others (department stores, individual stores, etc.)

Chapter 14 Market Estimates & Forecast, By Region, 2021 – 2034 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 UK

- 14.3.2 Germany

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.3.6 Russia

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 Japan

- 14.4.3 India

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 15.1 ABM Company

- 15.2 ADE Germany

- 15.3 AlexanderSolia GmbH

- 15.4 Amisy

- 15.5 Ari Makina

- 15.6 ASGO

- 15.7 Bizerba

- 15.8 C.R.M. s.r.l.

- 15.9 Clearline

- 15.10 Dadaux SAS

- 15.11 Dito Sama

- 15.12 Fatosa, S.A.

- 15.13 Fimar S.p.a.

- 15.14 Hobart

- 15.15 Nikai Group

- 15.16 Roser Group

- 15.17 Weston Brands