|

市场调查报告书

商品编码

1684574

医药泡罩包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pharmaceutical Blister Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

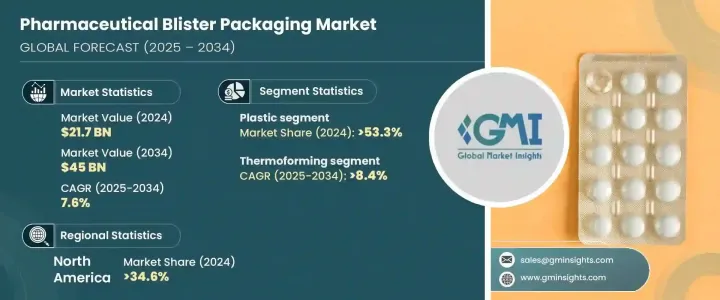

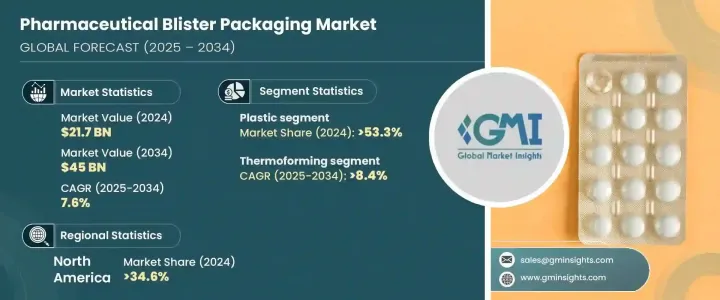

2024 年全球医药泡罩包装市场价值为 217 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 7.6%。这一增长反映了全球对安全、高效和保护性医药产品包装解决方案的需求激增。药品泡罩包装因其能够提供增强的产品保护、延长保质期并提高药物依从性而成为製造商和医疗保健提供者的首选。

包装材料和技术的不断进步,加上对永续解决方案的日益重视,进一步推动了市场的成长。製药业的蓬勃发展、慢性病发病率的上升以及对符合严格监管标准的包装解决方案的需求也推动了这一需求。此外,泡罩包装提供的便利性和易用性,例如内容物的清晰可视性和防篡改功能,继续巩固其作为现代医药包装基本解决方案的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 217亿美元 |

| 预测值 | 450亿美元 |

| 复合年增长率 | 7.6% |

就材料而言,市场分为塑胶、铝箔和纸张,其中塑胶领域处于领先地位,到 2024 年将占据 53.3% 的市场份额。 PVC、PET 和聚碳酸酯等塑胶因其用途广泛且具有成本效益的特性而被广泛使用,使其成为保护敏感医药产品免受潮湿、光照和污染的理想选择。这些材料还具有出色的阻隔性能,使製造商能够设计各种形状和尺寸的泡罩包装,满足製药公司的多样化需求。塑胶的柔韧性和耐用性使製造商能够在设计上进行创新,同时确保遵守安全和品质标准。

市场也根据技术进行细分,包括冷成型、热成型和热封。尤其是热成型,其发展势头十分迅猛,预计将以 8.4% 的强劲复合年增长率增长,到 2034 年将达到 245 亿美元。该技术因其能够大规模生产高品质、高成本效益的泡罩包装而脱颖而出。透过将塑胶片材加热至柔韧状态并将其塑造成精确的腔体尺寸,热成型可确保药片、胶囊和其他药品得到安全存放,从而最大限度地降低储存和运输过程中损坏或污染的风险。

2024年,北美占据药品泡罩包装市场的34.6%,其中美国的成长最为显着。以患者为中心的医疗保健包装的需求不断增长以及对永续解决方案的日益关注刺激了该地区的创新。製造商正在引入可回收材料,如可生物降解的塑胶和纸质替代品来解决环境问题。此外,包装设计也得到了增强,具有防篡改功能和更高的可用性,支持更好地遵守药物治疗并确保患者安全,进一步巩固了该地区在市场上的主导地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 中断

- 未来展望

- 製造商

- 经销商

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 推出可持续且符合法规要求的泡罩包装解决方案

- 慢性病盛行率不断上升推动药品消费

- 仿製药生产扩张

- 冷成型箔技术进步增强了药物保护

- 电子药局的成长和对防窜改包装解决方案的需求

- 产业陷阱与挑战

- 针对不同药物配方订製泡罩包装的复杂性

- 经济放缓对医药包装投资的影响

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 塑胶

- 铝箔

- 纸

第 6 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 冷成型

- 热成型

- 热封

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 片剂和胶囊

- 医疗设备

- 注射剂

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ACG

- Amcor

- Aptar

- Borealis

- Caprihans

- Carcano

- Constantia

- Dow

- Honeywell

- Huhtamaki

- Renolit

- Rohrer

- Romaco

- Sonoco

- Sudpack

- Syensqo

- Tekni-Plex

- Tjoapack

- VinylPlus

- WestRock

- Winpak

The Global Pharmaceutical Blister Packaging Market was valued at USD 21.7 billion in 2024 and is projected to grow at an impressive CAGR of 7.6% between 2025 and 2034. This growth reflects a surging demand for secure, efficient, and protective packaging solutions for pharmaceutical products worldwide. Pharmaceutical blister packaging has emerged as a preferred choice among manufacturers and healthcare providers due to its ability to offer enhanced product protection, extended shelf life, and improved medication adherence.

Rising advancements in packaging materials and technologies, coupled with an increasing emphasis on sustainable solutions, are further fueling market growth. The demand is also driven by the growing pharmaceutical industry, rising prevalence of chronic diseases, and a need for packaging solutions that comply with stringent regulatory standards. Moreover, the convenience and ease of use offered by blister packaging, such as clear visibility of contents and tamper-evident features, continue to solidify its position as an essential solution for modern pharmaceutical packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.7 Billion |

| Forecast Value | $45 Billion |

| CAGR | 7.6% |

In terms of material, the market is categorized into plastic, aluminum foil, and paper, with the plastic segment leading, holding 53.3% of the market share in 2024. Plastics such as PVC, PET, and polycarbonate are widely used due to their versatile and cost-effective nature, making them an ideal choice for protecting sensitive pharmaceutical products from moisture, light, and contamination. These materials also offer excellent barrier properties and enable manufacturers to design blister packs in a wide array of shapes and sizes, meeting the diverse needs of pharmaceutical companies. The flexibility and durability of plastics allow manufacturers to innovate in design while ensuring adherence to safety and quality standards.

The market is also segmented by technology, including cold forming, thermoforming, and heat sealing. Thermoforming, in particular, is gaining significant traction and is projected to grow at a robust CAGR of 8.4%, reaching USD 24.5 billion by 2034. This technology stands out for its ability to produce high-quality and cost-efficient blister packs on a large scale. By heating plastic sheets into a pliable state and molding them into precise cavity dimensions, thermoforming ensures that tablets, capsules, and other pharmaceutical products are securely housed, minimizing the risk of damage or contamination during storage and transport.

In 2024, North America accounted for 34.6% of the pharmaceutical blister packaging market, with the United States experiencing remarkable growth. The increasing demand for patient-centric healthcare packaging and the rising focus on sustainable solutions have spurred innovation in the region. Manufacturers are introducing recyclable materials like biodegradable plastics and paper-based alternatives to address environmental concerns. Additionally, packaging designs are being enhanced with tamper-evident features and improved usability, supporting better medication adherence and ensuring patient safety, further solidifying the region's dominance in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Introduction of sustainable and regulatory-compliant blister packaging solutions

- 3.5.1.2 Growing prevalence of chronic diseases driving pharmaceutical consumption

- 3.5.1.3 Expansion of generic drug manufacturing

- 3.5.1.4 Advancements in cold form foil technology for enhanced drug protection

- 3.5.1.5 Growth in e-pharmacies and demand for tamper-evident packaging solutions

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Complexities in customization of blister packaging for diverse drug formulations

- 3.5.2.2 Impact of economic slowdowns on pharmaceutical packaging investments

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Aluminum foil

- 5.4 Paper

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Cold forming

- 6.3 Thermoforming

- 6.4 Heat seal

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Tablets & capsules

- 7.3 Medical devices

- 7.4 Injectables

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACG

- 9.2 Amcor

- 9.3 Aptar

- 9.4 Borealis

- 9.5 Caprihans

- 9.6 Carcano

- 9.7 Constantia

- 9.8 Dow

- 9.9 Honeywell

- 9.10 Huhtamaki

- 9.11 Renolit

- 9.12 Rohrer

- 9.13 Romaco

- 9.14 Sonoco

- 9.15 Sudpack

- 9.16 Syensqo

- 9.17 Tekni-Plex

- 9.18 Tjoapack

- 9.19 VinylPlus

- 9.20 WestRock

- 9.21 Winpak