|

市场调查报告书

商品编码

1632099

药品泡壳包装:市场占有率分析、产业趋势、成长预测(2025-2030)Pharmaceutical Blister Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

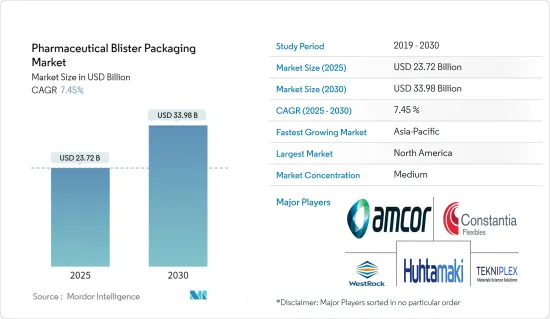

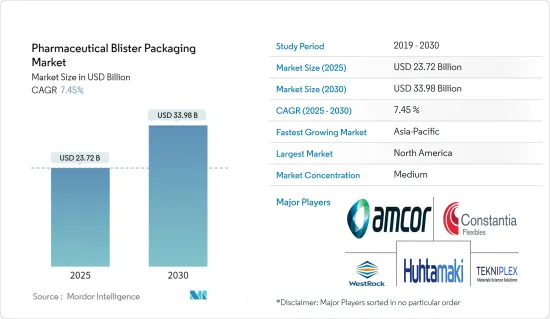

预计2025年药品泡壳包装市场规模为237.2亿美元,预估至2030年将达339.8亿美元,预测期间(2025-2030年)复合年增长率为7.45%。

主要亮点

- 泡壳包装在製药业极为重要。这些专门的包装解决方案可确保药品到达患者手中时不会被篡改或损坏。泡壳包装可保护治疗药物免受湿气和外部污染物的影响。

- 感测器增强型泡壳包装在监测给药活动和确保临床测试的准确性方面发挥关键作用。考虑一下 WestRock 的 CerePak泡壳包装。此泡壳包装包含微处理器,并以导电墨水印製以记录每次剂量的日期、时间和位置。这项特征对于不同剂量的治疗方法或安慰剂和活性药物的组合尤其重要。

- 泡壳包装通常由热成型塑胶製成,盖子由纸、塑胶、铝箔或其组合製成。仅使用透过冷拔工艺製成的箔也是常见的。也可以选择不透明的选项来保护光敏药物免受有害紫外线的影响。

- 泡壳包装是包装和运输医疗必需品的耐用解决方案。保护内容物免受衝击、潮湿和高温,延长药品的保质期和可运输性。泡壳包装的好处在大流行期间变得显而易见,当时其表面在药品的国际运输和储存中发挥着至关重要的作用。然而,病毒透过这些表面传播的潜力凸显了需要改进的领域,特别是在覆材方面。

- 然而,针对塑胶包装的严格法规和措施预计将成为预测期内药品泡壳包装领域成长的潜在挑战。例如,美国(已有 16 个州已通过,预计会有更多州)和欧洲已颁布了遏制塑胶废弃物的法律。

药品泡壳包装市场趋势

纸泡壳明显成长的潜力

- 纸泡壳,通常称为泡壳板,通常用于非处方药和处方笺药、维生素和补充剂,可以将纸板层压到箔片上来製成。此外,还可以将这种纸板与薄膜层压,从而将其应用扩展到各种医疗包装材料。医疗和製药行业的包装材料由于其最终用途,还需要可追溯的製造流程和先进的品管系统。

- 通常认为由纸或纸板製成的包装比其他包装材料更环保。此外,CEPI 报告称,纸和纸板产品在各个行业的采用正在增加,特别是在製药行业。

- 对永续包装不断增长的需求促使市场相关人员推出创新产品。例如,2024年6月,纸板包装专家Keystone Folding Box推出了Push-Pak,这是一款专为药品锭剂设计的纸板泡壳钱包。此解决方案具有简单的推入式开启系统,无需复杂的开启说明。此外,更紧密、更浓缩的泡壳阵列可最大限度地减少整体包装尺寸。

- 纸泡壳包装是一种轻盈、灵活且环保的包装解决方案。随着世界各国政府加强禁止使用非生物分解的塑胶和其他对环境有害的材料,对纸张和纸板药品泡壳包装的需求预计将增加。

- 此外,Suzano 的报告指出,未来几年纸张消费量将增加,预计到 2032 年将达到 4.76 亿吨。鑑于世界纸张生产的很大一部分用于包装行业,这种上升趋势表明对药品纸包装的需求不断增长。

亚太地区实现最快的产业成长

- 中国医药产业的蓬勃发展,为医药塑胶包装产业提供了无数商机。中国政府加速医疗改革的措施也可能支持药品包装产业的成长。

- 活性药物成分 (API) 製造和开发的最新进展增加了对泡壳包装组件的需求。随着印度扩大原料药的生产规模,对药物包装选择的需求也随之激增。注意到这一趋势,印度联邦卫生部长于 2023 年 8 月宣布,根据生产连结奖励(PLI)计划,印度在过去一年半的时间里增加了 38 种原料药的产量,而此前一直依赖于宣布开始进口。

- 该地区不断上涨的医疗成本对泡壳包装市场产生了积极影响。亚洲国家,包括中国、印度、印尼、马来西亚、菲律宾和泰国,越来越多地采用增强的医疗诊断和标准,导致医疗保健支出增加。此外,已开发市场和新兴市场的药品取得情况均有所改善,导致药品消费量大幅增加。

- 2024 年 2 月,AP 穆勒-马士基进行了一项研究,强调印度药品供应链的重大变化。在全球化、技术进步、监管变化和医疗产品需求增加的推动下,这种转变已将焦点从手动交易转向自动化和策略创新。由于製药业的这些变化,泡壳包装市场可望进一步成长。

- 根据 IQVIA 报告,中国在原始品牌药品上的支出已从 2018 年的 290 亿美元飙升至 2023 年的 440 亿美元。药品支出的增加将与泡壳包装的需求相对应。

- 此外,印度等国家正在修改其製药法和指南,以加强医疗保健并促进药品出口。这些措施预计将扩大对单位剂量药品包装的需求并使之多样化。印度品牌资产基金会的报告显示,2023年印度药品出口额从173亿美元飙升至254亿美元。这种成长趋势预计将持续下去,进一步推动国内药品泡壳包装的需求,以实现更安全的运输。

医药泡壳包装产业概况

药品泡壳包装市场按 Amcor PLC、Constantia Flexibles 和 WestRock Company 的存在进行细分。该市场由提供原材料和包装服务的大型企业以及本地参与企业组成。包装和薄膜材料的最新发展正在塑造市场。

- 2024 年 1 月,总部位于宾州韦恩的 TekniPlex Healthcare 与 Alpek Polyester 合作推出医药级聚对苯二甲酸乙二醇酯 (PET)泡壳膜。这种创新薄膜含有 30% 的消费后回收 (PCR) 单体。据该公司称,当这种泡壳薄膜与该公司的 Teknilid Push 聚酯盖相结合时,只要必要的基础设施到位,薄膜+盖子泡壳系统就可以在聚酯回收链内完全回收。

- 2023 年 7 月,Constantia Flex 推出了 REGULA CIRC,这是一种「完全屏障」和回收再生用冷泡沫箔解决方案,适用于永续药品泡壳包装应用。聚乙烯密封层将取代传统的 PVC 解。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 单位剂量包装的需求增加

- 各行业增加使用可回收材料

- 市场限制因素

- 禁止使用塑胶包装材料

第六章 市场细分

- 按材质

- 塑胶(聚氯乙烯(PVC)、聚丙烯(PP))

- 纸

- 铝

- 依技术

- 冷成型

- 热成型

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 中东/非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Amcor PLC

- Constantia Flexibles

- WestRock Company

- Tekni-Plex Inc.

- Huhtamaki Oyj

- Sonoco Products Company

- Winpak Ltd

- ACG Pharmapack Pvt. Ltd

- Aptar CSP Technologies Inc.

- The Dow Chemical Company

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 91309

The Pharmaceutical Blister Packaging Market size is estimated at USD 23.72 billion in 2025, and is expected to reach USD 33.98 billion by 2030, at a CAGR of 7.45% during the forecast period (2025-2030).

Key Highlights

- Blister packaging is crucial in the pharmaceutical industry. These specialized packaging solutions guarantee that medicinal products reach patients without tampering or damage. Blister packaging safeguards therapeutic commodities, keeping them moisture-free and shielded from external contaminants.

- Blister packaging, enhanced with sensors, plays a key role in monitoring dosing activities and ensuring clinical trials' accuracy. Consider WestRock's CerePak blister packs: they come equipped with concealed microprocessors and printed conductive inks, meticulously logging the date, time, and location of each dose. This feature is especially vital for treatment regimens that involve fluctuating dosages or a combination of placebo and active medications.

- Blister packaging typically consists of thermoformed plastic, with lids made from paper, plastic, foil, or a combination. Another common variant utilizes solely foil, crafted through a cold-stretching process. Opaque options are available to shield light-sensitive medications from harmful UV rays.

- Blister packaging is a durable solution for packaging and transporting medical essentials. It shields contents from impacts, moisture, and heat, enhancing the medicines' shelf life and transportability. The advantages of blister packaging became evident during the pandemic, as its surfaces were pivotal in the international transport and storage of medications. Yet, the potential for virus transfer via these surfaces highlighted areas for improvement, particularly in the outer materials, which packaging manufacturers will likely prioritize in the future.

- However, strict regulations and policies targeting plastic packaging are expected to present a potential challenge to the growth of the pharmaceutical blister packaging segment during the forecast period. For instance, the United States (with 16 states already on board and more anticipated) and Europe have enacted laws to curb plastic waste.

Pharmaceutical Blister Packaging Market Trends

The Paper Blister Segment May Witness Significant Growth

- Commonly referred to as blister board, the paper blister is often used for over-the-counter and prescription pharmaceuticals, vitamins, and supplements and can have its paperboard laminated to foil. Additionally, this paperboard can be laminated to film, broadening its application in diverse medical packaging materials. Moreover, given their end-use, packaging materials in the healthcare and pharmaceutical industries mandate traceable manufacturing processes and sophisticated quality control systems.

- Generally, packaging made from paper and paperboard is considered more environmentally friendly than other packaging materials. Moreover, CEPI reports a growing adoption of paper and board products across various industries, notably in the pharmaceutical industry.

- Market players are introducing innovative products in response to the rising demand for sustainable packaging. For example, in June 2024, Keystone Folding Box, a specialist in paperboard packaging, launched the "Push-Pak," a paperboard blister wallet designed for medicine tablets. This solution features a straightforward push-through opening system, eliminating the need for complex opening instructions. Additionally, its tighter and more condensed blister arrangement minimizes the overall size of the package.

- Paper blister packs provide a lightweight, flexible, and eco-friendly packaging solution. As governments worldwide intensify their bans on non-biodegradable plastics and other environmentally harmful materials, the demand for paper and paperboard pharmaceutical blister packaging is anticipated to rise.

- Further, as per a report by Suzano, paper consumption is set to climb, reaching an estimated 476 million tons by 2032. Given that a significant share of global paper production caters to the packaging industry, this upward trajectory signals a growing demand for pharmaceutical paper packaging.

Asia-Pacific to Witness Fastest Growth in the Industry

- China's booming pharmaceutical industry is set to open numerous opportunities for its pharmaceutical plastic packaging businesses. Also, initiatives by the Chinese government aimed at accelerating healthcare system reforms are likely to bolster the growth of the pharmaceutical packaging industry.

- Recent advancements in the manufacturing and development of active pharmaceutical ingredients (API) have increased the demand for blister packaging components. As India ramps up its production of APIs, the demand for pharma packaging options is witnessing a parallel surge. Highlighting this trend, the Union Health Minister announced in August 2023 that, under the production-linked incentive (PLI) scheme, India has begun producing 38 APIs previously reliant on imports over the past year and a half.

- Rising medical expenditures in the region are positively influencing the blister packaging market. Countries in Asia, including China, India, Indonesia, Malaysia, the Philippines, and Thailand, are increasingly adopting enhanced healthcare diagnostics and standards, leading to heightened medical spending. Also, advancements in drug accessibility in both developed and emerging markets have significantly boosted drug consumption, thereby elevating the demand for blister packaging in pharmaceuticals.

- In February 2024, A.P. Moller-Maersk conducted a study highlighting a major transformation in India's pharmaceutical supply chain. This shift, driven by globalization, technological advancements, regulatory changes, and increasing demand for healthcare products, moved the focus from manual transactions to automation and strategic innovation. As a result of these changes in the pharmaceutical industry, the market for blister packaging is poised for further growth.

- An IQVIA report highlights that China's spending on original branded pharmaceuticals surged from USD 29 billion in 2018 to an impressive USD 44 billion in 2023. This increase in pharmaceutical spending is set to drive a corresponding demand for blister packs.

- Moreover, countries like India are revising their pharmaceutical laws and guidelines to enhance healthcare and boost medicine exports. These initiatives are likely to drive a growing and diversifying demand for unit-dose pharmaceutical packaging. As reported by the India Brand Equity Foundation, India's pharmaceutical exports surged to USD 25.4 billion in 2023, a notable increase from USD 17.3 billion. This upward trend is anticipated to continue, further fueling the demand for pharmaceutical blister packs in the country for safer shipments.

Pharmaceutical Blister Packaging Industry Overview

The pharmaceutical blister packaging market is fragmented with the presence of Amcor PLC, Constantia Flexibles, and WestRock Company. The market comprises major and local players supplying raw materials and packaging services. The latest developments in packaging and film materials are shaping the market.

- January 2024: TekniPlex Healthcare, headquartered in Wayne, Pennsylvania, partnered with Alpek Polyester to introduce a pharmaceutical-grade polyethylene terephthalate (PET) blister film. This innovative film incorporates 30% post-consumer recycled (PCR) monomers. According to the company, when this blister film is paired with its Teknilid Push polyester lidding, the resulting film-plus-lidding blister system can be fully recycled within the polyester recycling stream, provided the necessary infrastructure is in place.

- July 2023: Constantia Flexibles revealed REGULA CIRC, its 'total barrier,' designed-for-recycling cold-form foil solution for sustainable pharmaceutical blister packaging applications. A polyethylene sealing layer is set to replace traditional PVC solutions; a transition is seeking to simplify the sorting process, improve the pack's recyclability, and, in turn, improve material recovery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for Unit Dose Packaging

- 5.1.2 Growing Use of Recyclable Materials Across the Industry

- 5.2 Market Restraints

- 5.2.1 Ban on Plastic Packaging Materials

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic (Poly Vinyl Chloride (PVC), Polypropylene (PP))

- 6.1.2 Paper

- 6.1.3 Aluminum

- 6.2 By Technology

- 6.2.1 Cold Forming

- 6.2.2 Thermoformed

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

- 6.3.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Constantia Flexibles

- 7.1.3 WestRock Company

- 7.1.4 Tekni-Plex Inc.

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Sonoco Products Company

- 7.1.7 Winpak Ltd

- 7.1.8 ACG Pharmapack Pvt. Ltd

- 7.1.9 Aptar CSP Technologies Inc.

- 7.1.10 The Dow Chemical Company

8 INVESTMENT ANALYSIS

9 MARKET FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219