|

市场调查报告书

商品编码

1684578

铝罐市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aluminum Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

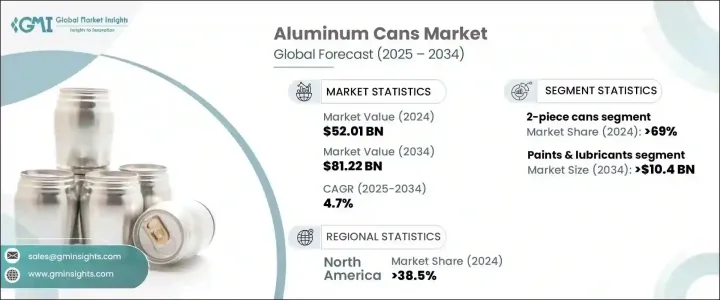

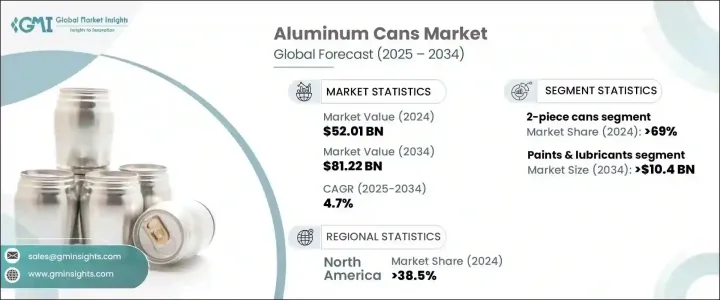

2024 年全球铝罐市场价值为 520.1 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.7%。永续性和便利性是影响市场趋势的主要驱动因素,因为铝罐因其可回收性和环保优势而受到青睐。消费者偏好的变化进一步刺激了需求,越来越多的高檔饮料采用铝罐包装。注重健康的消费者追求高品质的产品,导致对铝包装的优质水、精酿苏打水和能量饮料的需求激增。此外,各大品牌正在采用铝罐来符合全球永续发展目标并减少塑胶浪费。印刷和品牌技术的进步也增强了产品的吸引力,使铝罐成为饮料公司的有吸引力的选择。这种转变反映了各行业向永续包装解决方案的更广泛转变。

依产品类型,市场分为 1 片罐、2 片罐和 3 片罐,其中 2 片罐引领产业,到 2024 年将占据 69% 以上的市场份额。这些罐子因其成本效益高、结构轻巧、材料要求低而越来越受欢迎,降低了生产成本和环境影响。它们的设计最大限度地减少了运输费用和碳排放,使其成为全球的首选。饮料行业广泛采用两片式铝罐,因为它们耐用且能够抵御氧气和污染物,从而确保更长的保质期。改进的品牌推广技术进一步促进了市场成长,特别是在酒精饮料领域,该领域对铝罐的需求持续上升。回收效率和对国际环境法规的遵守使这些罐子成为製造商和消费者的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 520.1亿美元 |

| 预测值 | 812.2亿美元 |

| 复合年增长率 | 4.7% |

根据最终用户,市场分为食品、饮料、个人护理和化妆品、药品、油漆和润滑剂等。预计油漆和润滑油领域的复合年增长率将超过 8.1%,到 2034 年将超过 104 亿美元。铝罐因其重量轻、防漏、耐腐蚀等特性而被广泛应用于该领域,有助于保持产品的完整性。与其他包装相比,铝罐提供了更具成本效益的解决方案,可确保安全储存和运输,同时符合永续发展计画。对高性能涂料和润滑剂的需求不断增加,进一步加速了铝罐的采用,因为它们可以保护产品免受恶劣条件的影响并防止干燥或洩漏。包装技术的进步也增强了防溢设计和防篡改性能,使得铝罐成为工业领域越来越受欢迎的选择。城市化和工业化的不断推进,推动了对高效包装解决方案的需求,促进了市场扩张。

受美国强劲需求的推动,北美在 2024 年占据市场主导地位,占有 38.5% 的份额。消费者越来越喜欢可持续和可回收的包装,促使饮料製造商专注于轻量化容器和改进的回收技术。高檔饮料的兴起进一步刺激了对客製化、外观精美的铝罐的需求。随着企业逐渐放弃使用塑料,铝包装变得越来越重要。在印度,由于环保意识的增强和具有成本效益的製造工艺,市场正在快速成长。当地製造商正在开发适合国内和国际市场的轻量、可回收罐。对永续性和可负担性的日益关注预计将维持市场成长,特别是在软性饮料和啤酒行业。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 中断

- 未来展望

- 製造商

- 经销商

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 高端饮料品牌推动铝罐需求

- 铝罐作为保鲜包装的正面看法

- 铝罐回收率高,市场需求旺盛

- 即饮 (RTD) 饮料需求激增

- 饮料品牌与包装之间的策略伙伴关係

- 产业陷阱与挑战

- 罐头在运输过程中容易凹陷和损坏

- 包装标准的监管障碍和合规成本

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 1 件罐

- 两片罐

- 三片罐

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 最多 200 毫升

- 201 至 450 毫升

- 451 至 700 毫升

- 701 至 1000 毫升

- 超过1000毫升

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 食物

- 饮料

- 个人护理及化妆品

- 製药

- 油漆和润滑剂

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Ajanta Bottle

- Albott Containers

- Baixicans

- Ball Corporation

- Canpack

- CCL Industries

- Ceylon Beverage Can

- Crown Holdings

- Envases Group

- GZI Industries

- Nampak

- Orora Packaging

- Scan Holdings

- Shiba Containers

- Silgan Containers

- Swan Industries

- Thai Beverage Can

- Toyo Seikan

The Global Aluminum Cans Market, valued at USD 52.01 billion in 2024, is set to grow at a CAGR of 4.7% from 2025 to 2034. Sustainability and convenience are key drivers shaping market trends, as aluminum cans gain traction due to their recyclability and eco-friendly benefits. Changing consumer preferences have further fueled demand, with premium beverages increasingly packaged in aluminum cans. Health-conscious consumers seek high-quality products, leading to a surge in demand for premium water, craft sodas, and energy drinks in aluminum packaging. Additionally, brands are adopting aluminum cans to align with global sustainability goals and reduce plastic waste. Technological advancements in printing and branding also enhance product appeal, making aluminum cans an attractive choice for beverage companies. This shift reflects a broader move toward sustainable packaging solutions across industries.

The market is segmented by product type into 1-piece, 2-piece, and 3-piece cans, with 2-piece cans leading the industry, holding over 69% market share in 2024. These cans are gaining popularity due to their cost-effectiveness, lightweight structure, and reduced material requirements, which lower production costs and environmental impact. Their design minimizes transportation expenses and carbon emissions, making them a preferred choice globally. The beverage sector widely adopts 2-piece aluminum cans for their durability and ability to protect against oxygen and contaminants, ensuring a longer shelf life. Improved branding techniques further enhance market growth, particularly in the alcoholic beverage segment, where demand for aluminum cans continues to rise. The recycling efficiency and adherence to international environmental regulations make these cans a preferred option among manufacturers and consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.01 Billion |

| Forecast Value | $81.22 Billion |

| CAGR | 4.7% |

By end-user, the market is categorized into food, beverage, personal care & cosmetics, pharmaceuticals, paints & lubricants, and others. The paints & lubricants segment is expected to grow at a CAGR of over 8.1% and exceed USD 10.4 billion by 2034. Aluminum cans are widely used in this sector due to their lightweight, leak-proof, and corrosion-resistant properties, which help maintain product integrity. Compared to alternative packaging, aluminum cans offer a more cost-effective solution that ensures safe storage and transportation while aligning with sustainability initiatives. Increasing demand for high-performance coatings and lubricants has further accelerated the adoption of aluminum cans, as they protect products from exposure to harsh conditions and prevent drying or leakage. Advancements in packaging technology have also enhanced spill-proof designs and tamper resistance, making aluminum cans an increasingly preferred choice in the industrial sector. The rising trend of urbanization and industrialization is driving higher demand for efficient packaging solutions, contributing to market expansion.

North America led the market in 2024, holding a 38.5% share, driven by strong demand in the United States. Consumers increasingly prefer sustainable and recyclable packaging, prompting beverage manufacturers to focus on lightweight containers and improved recycling technologies. The rise of premium beverages has further fueled demand for customized and visually appealing aluminum cans. As businesses shift away from plastic, aluminum packaging has gained prominence. In India, the market is experiencing rapid growth due to rising environmental awareness and cost-effective manufacturing processes. Local manufacturers are developing lightweight, recyclable cans suitable for domestic and international markets. The increasing focus on sustainability and affordability is expected to sustain market growth, particularly in the soft drink and beer industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Premium beverage brands driving demand for aluminum cans

- 3.5.1.2 Positive perception of aluminum cans as a freshness retention packaging

- 3.5.1.3 High recycling rate of aluminum cans enhancing market demand

- 3.5.1.4 Surge in demand for ready-to-drink (RTD) beverages

- 3.5.1.5 Strategic partnerships between beverage brands and packaging

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Vulnerability of cans to denting and damage during transportation

- 3.5.2.2 Regulatory barriers and compliance costs for packaging standards

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 1-piece cans

- 5.3 2-piece cans

- 5.4 3-piece cans

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 200 ml

- 6.3 201 to 450 ml

- 6.4 451 to 700 ml

- 6.5 701 to 1000 ml

- 6.6 more than 1000 ml

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food

- 7.3 Beverage

- 7.4 Personal care & cosmetic

- 7.5 Pharmaceutical

- 7.6 Paints & lubricants

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ajanta Bottle

- 9.2 Albott Containers

- 9.3 Baixicans

- 9.4 Ball Corporation

- 9.5 Canpack

- 9.6 CCL Industries

- 9.7 Ceylon Beverage Can

- 9.8 Crown Holdings

- 9.9 Envases Group

- 9.10 GZI Industries

- 9.11 Nampak

- 9.12 Orora Packaging

- 9.13 Scan Holdings

- 9.14 Shiba Containers

- 9.15 Silgan Containers

- 9.16 Swan Industries

- 9.17 Thai Beverage Can

- 9.18 Toyo Seikan