|

市场调查报告书

商品编码

1643067

铝罐:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Aluminum Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

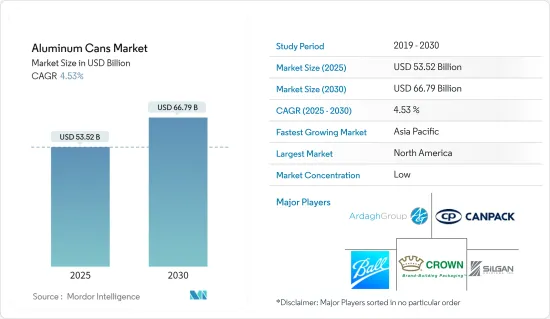

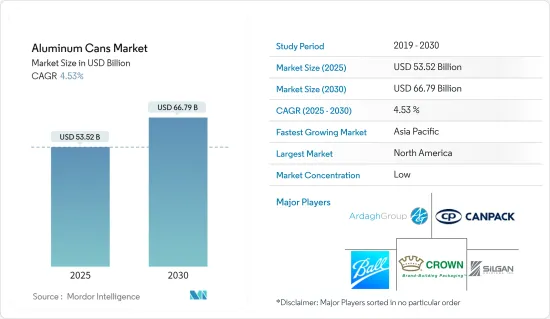

预计 2025 年铝罐市场规模将达到 535.2 亿美元,预计到 2030 年将达到 667.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.53%。

主要亮点

- 铝罐有助于长期维持食品品质。它几乎可以提供 100% 的防光、防氧气、防湿气和其他污染物保护。铝罐不会生锈,而且具有很强的耐腐蚀性,是所有包装类型中保质期最长的包装之一。此外,设计师、工程师和製造商正在利用铝的多种物理特性。与许多金属相比,铝的单位体积重量较轻,因此易于处理且运输成本低。这有利于促进铝罐在市场上的使用。

- 铝罐在食品和饮料行业中的应用越来越广泛,这是因为铝罐具有保护性能、永续性优势以及方便消费者使用。随着製造商和消费者越来越认识到铝包装的好处,这种趋势可能会持续下去。尤其是铝,是世界上最可回收的材料,回收率接近 100%。此外,铝在多次回收循环中仍能保持其完整性,因此它是一种极具永续的选择。回收铝具有显着的环境效益,包括节省能源、减少数百万吨温室气体排放和减少对运输燃料的需求。用回收材料製造铝罐比生产新铝罐消耗的能源少得多,因此可回收铝罐的采用率正在增加。

- 铝罐在回收方面脱颖而出,因为它们经过封闭式过程,可以重复回收。相较之下,玻璃或塑胶一旦被回收,往往会变成不可回收或不太可能再次回收的产品。铝罐相对于其他产品的优点在于它们可以无限回收,主要用于製造新罐。此外,铝具有优良的品质,这使其在包装方面脱颖而出。其独特的物理特性不仅为新品牌的推出铺平了道路,也有利于现有品牌向尚未开发的市场扩张,从而推动食品和饮料行业对铝罐包装的需求。

- 然而,铝罐包装面临来自替代包装解决方案的激烈竞争。塑胶、纸和玻璃包装解决方案是可用的替代包装选择。此外,全球电子商务日益增长的重要性预计也将对整个包装行业产生影响。此外,塑胶包装的逐渐强化对市场构成了威胁,这主要是由于聚对苯二甲酸乙二醇酯(PET)等替代塑胶的流行。 PET 塑胶有可能取代食品和饮料行业的铝罐解决方案。

- 全球经济受到新冠肺炎疫情的严重影响。该行业面临重大挑战,包括供应链中断和政府强制关闭。俄罗斯与乌克兰的战争也引发了对多个国家的经济制裁,导致大宗商品价格飙升、供应链紧张。这导致欧洲铝业公司因铝短缺而减少产量。战争加剧了依赖俄罗斯供应的欧洲製造商的短缺,而大宗商品交易商从中国运输铝的收益很低。此外,欧洲能源成本的急剧上涨对该市场的铝罐生产产生了直接影响。

铝罐市场趋势

饮料板块预计将引领市场

- 年轻人和独居者消费大量罐装饮料。这些用户时间紧迫,预算有限,因此他们选择更昂贵、更方便的产品。全球新兴国家生活方式的改变和都市化进程的加快,促使消费者选择罐装饮料。此外,家庭规模缩小、生活方式改变、在家做饭时间减少以及饮料製造商和食品链之间的合作等因素都在支撑全球对罐头包装的需求。

- 铝罐是应用最广泛的饮料罐类型,其中罐装葡萄酒、鸡尾酒、烈性酒和软性饮料尤其呈现出采用金属罐包装的明显趋势,这得益于市场对便携性的需求。金属罐在饮料业的用途根据饮料的性质大致分为酒精饮料和非酒精饮料。啤酒等酒精饮料历来使用金属罐,而葡萄酒等其他类型的酒精饮料传统上用玻璃瓶盛放,但越来越多地采用金属罐。

- 由于罐头具有便携性和易用性,在千禧世代和 Z 世代中越来越受欢迎。此外,越来越多的製造商选择罐装包装以吸引年轻一代。例如,2024 年 1 月,红牛报告称,2023 年其全球销量将达到 121 亿罐,较前几年大幅增长,支持了未来饮料领域罐装饮料的需求和使用量增长趋势。

- 全球饮料公司正在透过提供罐装饮料来扩大其产品组合,以突出高级产品,以支持各个细分市场的成长。例如,2024年4月,可口可乐Smartwater宣布将推出时尚铝罐,并在美国各地以12盎司罐装的形式销售添加抗氧化剂的Smartwater Original和Smartwater Alkaline。

- 铝具有很强的耐腐蚀性,可以有效阻挡饮料与阳光和氧气的接触,最大限度地降低污染的风险。这使得铝罐成为包装啤酒、葡萄酒和苏打水等酸性或碳酸饮料的理想选择,同时又不会影响其初始品质。此外,与其他包装材料相比,铝的优异的冷传导性能可确保饮料冷却更快、保冷时间更长,从而支持市场对罐装饮料的需求。

预计北美将占据较大的市场占有率

- 由于人们对永续包装材料的使用和消费兴趣日益浓厚,预计北美将占据最大的收益占有率。苏打水、能量饮料、气泡水以及最近的精酿啤酒等产品都呈现稳定成长。铝罐是最永续的饮料包装选择之一,并且可以无限回收。它还可以快速冷却并为印刷提供出色的金属画布,从而保护饮料的风味和完整性。

- 2024年2月,倡导饮料罐回收的「Every Can Counts」计画宣布扩展到美国。 Every Can Counts US 是市场主要企业。这些合作伙伴提倡透过回收来负责任地处理空饮料罐,并提高铝罐的采用率和可回收性。

- 随着美国个人护理行业的扩张,气雾罐的需求预计会增加。个人护理行业的成长主要与消费者可支配收入的增加和购买奢侈品的能力有关。气雾剂用于多种个人保健产品。因此,预计市场将受益于气雾剂销售的成长。

- 除臭剂和止汗剂的需求不断增长,导致近年来北美生产线的安装增加。由于个人护理行业对除臭剂、止汗剂、造型慕丝、髮胶喷雾、剃须摩丝等各种产品的需求不断增长,北美占据了铝罐市场的大部分份额。

- 加拿大政府支持这项业务。政府强调,投资能够实现低碳成长潜力的创新对于促进强劲且持久的经济復苏至关重要。预计政府将投入大量资金帮助加拿大铝罐市场成为零排放温室气体排放。据政府称,零碳排放铝冶炼将有助于加拿大实现其经济和气候变迁目标。

铝罐产业概况

由于存在各种全球性和本地性公司,铝罐市场高度分散。主要参与者包括 Ball Corporation、Crown Holdings Inc.、Silgan Holdings Inc.、CAN-PACK SA 和 Ardagh Group SA。为了在市场上保持竞争力,供应商正在根据产品系列、差异化和定价进行合作、确定优先顺序并扩展业务。

- 2024 年 5 月 - 全球永续包装解决方案供应商 Ball Corporation 与乳製品领域的 CavinKare 合作,在乳製品包装方面进行创新。两家公司的合作将包括采用 Ball Corporation 为 CavinKare 着名奶昔设计的两片式铝罐的包装方法,扩大其在铝罐市场的份额。

- 2023 年 8 月,Crown Holdings Inc. 收购了位于德国萨尔路易的饮料罐製造厂 Helvetia Packaging AG。这项策略性倡议使该公司得以进入德国市场,加强了其欧洲饮料罐平台,并增加了每年约10亿个的生产能力。人们对永续性和铝的可回收性的认识不断提高,增加了饮料罐对于酒精和非酒精饮料领域的吸引力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 铝罐回收率高

- 由于成本和便利性,罐头食品的需求不断增加

- 市场限制

- 替代包装解决方案的可用性

第六章 市场细分

- 按类型

- 苗条的

- 光滑

- 标准

- 其他类型

- 按最终用户产业

- 饮料

- 食物

- 气雾剂

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Ball Corporation

- Ardagh Group SA

- Crown Holdings Inc.

- Silgan Holdings Inc.

- CAN-PACK SA

- CCL Container Inc.(CCL Industries Inc.)

- Tecnocap Group

- Saudi Arabia Packaging Industry WLL(SAPIN)

- Massilly Holding SAS

- CPMC HOLDINGS Limited(COFCO Group)

第八章投资分析

第九章:市场的未来

The Aluminum Cans Market size is estimated at USD 53.52 billion in 2025, and is expected to reach USD 66.79 billion by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

Key Highlights

- Aluminum cans offer long-term food quality preservation benefits. They deliver nearly 100% protection against light, oxygen, moisture, and other contaminants. They do not rust and are corrosion-resistant, providing one of the most extended shelf lives of any packaging. Additionally, designers, engineers, and manufacturers leverage aluminum's diverse physical properties. Compared to many metals, aluminum has a lighter weight per volume, making it easier to handle and more cost-effective to ship. This fuels the usage of aluminum cans in the market.

- The food and beverage industry's increasing adoption of aluminum cans stems from their protective nature, sustainability benefits, and consumer ease. This trend is set to persist, given that manufacturers and consumers alike are increasingly acknowledging the advantages of aluminum packaging. Notably, aluminum stands out as the most recyclable material globally, boasting a nearly 100% recyclability rate. Moreover, aluminum retains its integrity through multiple recycling cycles, making it a highly sustainable choice. The environmental benefits are significant, such as recycling aluminum conserves energy, reduces millions of tons of greenhouse gas emissions, and decreases the demand for transportation fuel. Manufacturing aluminum cans from recycled materials consumes significantly less energy than producing new cans, driving the adoption of recyclable aluminum cans.

- Aluminum cans stand out in recycling, undergoing a closed-loop process where they are recycled repeatedly. In contrast, glass and plastic, once recycled, often transform into products that are either not recyclable or have low chances of being recycled again. Aluminum cans outshine their counterparts by being infinitely recyclable, primarily to create fresh cans. Moreover, aluminum boasts premium qualities that set it apart in packaging. Its distinct physical attributes not only pave the way for new brand launches but also facilitate the expansion of existing brands into untapped markets, propelling the demand for aluminum can packaging in the food and beverage industry.

- However, aluminum can packaging faces high competition from alternative packaging solutions. Plastic, paper, and glass packaging solutions are the alternative packaging options available. Also, the increasing importance of e-commerce worldwide is expected to influence the overall packaging industry. Moreover, incremental enhancements in plastic packaging are posing a threat to the market, which can primarily be attributed to the popularity of plastics, such as polyethylene terephthalate (PET), as substitutes. PET plastics threaten to displace aluminum can solutions in the food and beverage industry.

- The global economy was significantly affected by the COVID-19 pandemic. Industries faced substantial challenges from supply chain disruptions and government-mandated lockdowns. The war between Russia and Ukraine also triggered economic sanctions against multiple nations, escalating commodity prices and straining supply chains, which reverberated through global markets and led to trade disruptions. This caused European aluminum firms to scale back production due to metal shortages. With the war intensifying these shortages for European manufacturers reliant on Russian supplies, commodity traders registered low profits by shipping aluminum from China. Furthermore, Europe witnessed a notable surge in energy costs, directly impacting the production volume of aluminum cans in the market.

Aluminum Cans Market Trends

The Beverages Segment is Expected to Drive the Market

- The younger population and people who live alone are consuming more canned beverages. These users have less time and are budget-restrained, opting for products with premium costs and higher convenience. Changing lifestyles in developing countries worldwide and the growing rate of urbanization are resulting in consumers opting for canned beverages. Additionally, with the shrinking size of the family and changing lifestyle patterns, the declining amount of time spent on cooking at home, and the collaboration of beverage companies with food chains are supporting the demand for can packaging worldwide.

- Aluminum cans are most widely used for beverages, with the most notable trend of canned wine, cocktails, hard beverages, and soft beverages being packaged in metal, driven by the need for portability in the market. The usage of metal cans in the beverage industry can be widely classified into alcoholic and non-alcoholic drinks based on the nature of the beverage. Alcoholic drinks, such as beer, have historically used metal cans, while other kinds of liquor, like wine, traditionally served in glass bottles, are increasingly adopting metal cans.

- Cans have surged in popularity with millennials and Gen Z due to their portability and user-friendly nature. Moreover, manufacturers are increasingly opting for can packaging, given its appeal to the younger demographic. For instance, in January 2024, Redbull reported that the company sold 12.1 billion cans worldwide in 2023, a significant increase from the previous years, underscoring the future demand and increasing trend of can usage in the beverage segment.

- Beverage companies worldwide are broadening their portfolio by offering canned beverages to showcase their premium products, supporting segmental growth. For instance, in April 2024, Coca-Cola's Smartwater launched sleekly designed aluminum cans and announced that Smartwater Original and Smartwater Alkaline with antioxidants would be available across the United States in single 12-oz. cans.

- Aluminum is highly corrosion resistant, effectively shielding beverages from sunlight and oxygen, minimizing the risk of contamination. This renders aluminum cans ideal for packaging acidic or carbonated drinks, including beer, wine, and soda, without compromising their initial quality. Furthermore, aluminum's superior cold-conducting properties ensure that beverages chill rapidly and remain colder for extended periods compared to alternative packaging materials, supporting the demand for canned drinks in the market.

North America is Expected to Hold a Significant Market Share

- North America accounts for the largest revenue share due to growing concerns regarding using and consuming sustainable packaging materials. There has been steady growth in products such as sodas, energy drinks, sparkling waters, and, increasingly, craft brew beers. Aluminum cans are among the most sustainable beverage packages and are infinitely recyclable. They also chill quickly, provide a superior metal canvas to print, and offer protection for the flavor and integrity of beverages.

- In February 2024, Every Can Counts, a program advocating for drink can recycling, announced its expansion into the United States. Every Can Counts US would be a collaborative effort between key players in the market, including Ardagh Metal Packaging, CANPACK, Crown Holdings, and Envases, representing the manufacturers, and Constellium, Kaiser Aluminum, Novelis, and Tri-Arrows Aluminum, the aluminum suppliers. These partners would promote responsible disposal of empty drink cans through recycling, bolstering the adoption and recyclability of aluminum cans.

- The demand for aerosol cans is anticipated to rise with the personal care industry's expansion in the United States. The growth of the personal care industry is primarily related to consumers' increased disposable income and ability to purchase luxury goods. Aerosols are utilized in several personal care products. Thus, the market is projected to profit from their increased sales.

- Higher demand for deodorants and antiperspirants led to the installation of an increasing number of production lines in North America over the past few years. North America accounts for a significant share of the aluminum cans market due to the growing demand from the personal care industry, which spans products of various types, such as deodorants, antiperspirants, hair mousses, hair sprays, and shaving mousses.

- The government of Canada assisted its businesses. The government claimed that it was vital to foster a strong and lasting economic recovery by investing in innovation, which could allow the country to achieve its potential for low-carbon growth. The government is expected to invest heavily in helping Canada's aluminum cans market eliminate greenhouse gas emissions. According to the government, zero-carbon aluminum smelting would help meet Canada's economic and climate change objectives.

Aluminum Cans Industry Overview

The aluminum cans market is highly fragmented, owing to the presence of various global and local players. Some major players include Ball Corporation, Crown Holdings Inc., Silgan Holdings Inc., CAN-PACK SA, and Ardagh Group SA. To be competitive in the market, vendors collaborate, prioritize, and expand their businesses based on product portfolio, differentiation, and pricing.

- May 2024: Ball Corporation, a global sustainable packaging solutions provider, partnered with CavinKare, a player in the dairy sector, to innovate dairy packaging. Their collaboration includes using the two-piece aluminum cans from Ball Corporation under its packaging approach, designed for CavinKare's renowned milkshakes, which would support its market presence in the aluminum cans market.

- August 2023: Crown Holdings Inc. acquired Helvetia Packaging AG, a beverage can manufacturing facility in Saarlouis, Germany. This strategic move marked the company's entry into the German market and bolstered its European beverage can platform, adding an annual capacity of around one billion units. The rising awareness of sustainability and aluminum's recyclability amplify beverage cans' appeal across the alcoholic and non-alcoholic drink segments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Aluminum Cans

- 5.1.2 Increasing Demand for Canned Foods driven by Cost and Convenience-related Advantages

- 5.2 Market Restraints

- 5.2.1 Availability of Alternative Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Slim

- 6.1.2 Sleek

- 6.1.3 Standard

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Aerosol

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Thailand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group S.A.

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 CAN-PACK SA

- 7.1.6 CCL Container Inc. (CCL Industries Inc.)

- 7.1.7 Tecnocap Group

- 7.1.8 Saudi Arabia Packaging Industry WLL (SAPIN)

- 7.1.9 Massilly Holding SAS

- 7.1.10 CPMC HOLDINGS Limited (COFCO Group)