|

市场调查报告书

商品编码

1684585

真空变压吸附市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vacuum Pressure Swing Adsorption Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

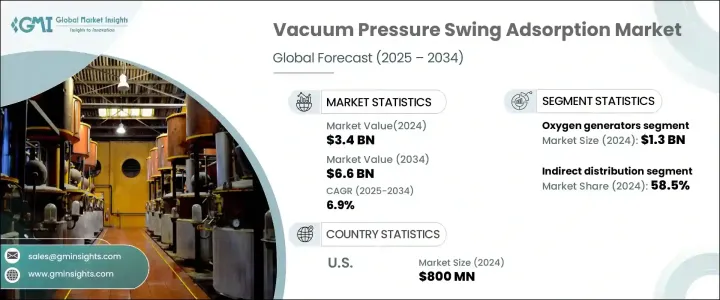

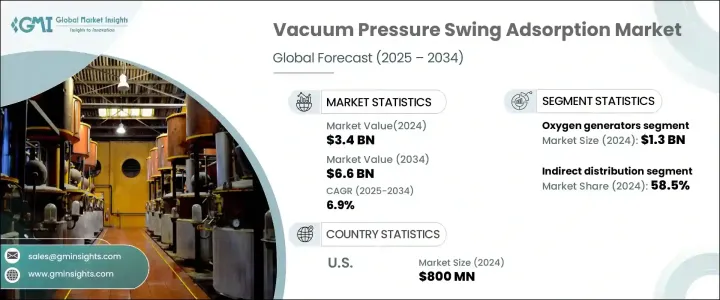

2024 年全球真空变压器吸附市场价值为 34 亿美元,预估 2025 年至 2034 年期间复合年增长率为 6.9%。市场扩张主要得益于医疗保健、化学品、石化和冶金等关键领域对氧气、氮气和氢气等工业气体日益增长的需求。这些气体对于各种工业应用至关重要,钢铁製造等产业的生产过程中需要大量的氧气。

随着工业不断现代化和扩张,对高效能气体分离技术(如 VPSA 系统)的需求变得更加明显。此外,人们对环境影响的日益关注和永续发展的趋势正在鼓励更多行业采用现场天然气发电系统,减少对传统天然气供应商的依赖。 VPSA 技术能够高效提取气体,同时降低能耗并提高成本效益,使其成为广泛工业应用的理想选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 66亿美元 |

| 复合年增长率 | 6.9% |

VPSA 市场按产品类型细分,包括氧气产生器、氮气产生器、氢气发生器、二氧化碳 (CO2) 产生器以及氩气和氦气等其他发生器。 2024 年,氧气产生器占据市场主导地位,估值达 13 亿美元。预计预测期内该部分将以 7.1% 的强劲复合年增长率增长。全球医疗保健基础设施建设的激增,特别是为应对 COVID-19 疫情,大大增加了医院和医疗机构对可靠的现场制氧系统的需求。此外,氧气在钢铁生产、化学製造和水处理等各种工业应用中都至关重要,从而进一步推动了对 VPSA 系统的需求。

市场也根据配销通路分为直接通路和间接通路。 2024 年,间接分销通路占 58.5% 的市占率。这些管道包括拥有广泛网路和在地化专业知识的中介机构,预计将继续成长,预计 2025 年至 2034 年之间的复合年增长率为 6.6%。透过利用间接分销管道,製造商可以扩大其影响范围,而无需在每个地区建立直销团队,使 VPSA 系统更容易被广泛的行业所接受。

在美国,VPSA 市场在 2024 年创造了 8 亿美元的收入。该国先进的工业基础设施和对医用级氧气的高需求(尤其是在医疗保健领域)在这一市场表现中发挥了重要作用。此外,医疗保健、化学品、石化和冶金等领域的大量投资推动了 VPSA 技术的广泛应用,尤其是在医疗领域,对现场气体生成系统(尤其是氧气)的需求正在增加。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 工业气体需求不断成长

- 新兴经济体的采用率不断提高

- 扩大再生能源和氢经济

- 产业陷阱与挑战

- 初期投资及维护成本高

- 来自替代技术的竞争

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 氧气发生器

- 氮气产生器

- 氢气发生器

- 二氧化碳(CO2)产生器

- 其他(氩、氦)

第六章:市场估计与预测:按运营,2021 – 2034 年

- 主要趋势

- 半自动

- 自动的

第 7 章:市场估计与预测:按产能,2021 年至 2034 年

- 主要趋势

- 高达 50 Nm³/h

- 50 Nm³/h 和 500 Nm³/h

- 高于 500 Nm³/h

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 卫生保健

- 工业的

- 化学

- 环境的

- 石油和天然气

- 能源与电力

- 其他(食品饮料、冶金等)

第 9 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- AirSep

- NOVAIR USA

- Precision Medical

- Air Products and Chemicals

- PKU Pioneer

- Adsorption Research

- Valmet

- NES Company

- Chenrui Air Separation Technology

- CAIRE

- Linde

- Praxair Technology

- Messer Group

- Oxymat

- PCI Gases

The Global Vacuum Pressure Swing Adsorption Market was valued at USD 3.4 billion in 2024 and is expected to expand at a CAGR of 6.9% from 2025 to 2034. This market expansion is largely fueled by the growing demand for industrial gases like oxygen, nitrogen, and hydrogen across key sectors such as healthcare, chemicals, petrochemicals, and metallurgy. These gases are crucial for various industrial applications, and industries like steel manufacturing require large volumes of oxygen for their production processes.

As industries continue to modernize and expand, the need for efficient gas separation technologies, like VPSA systems, becomes more apparent. Additionally, rising concerns about environmental impact and the growing trend of sustainability are encouraging more industries to adopt on-site gas generation systems, reducing reliance on traditional gas suppliers. VPSA technology enables the efficient extraction of gases with reduced energy consumption and greater cost-effectiveness, making it an attractive option for a wide range of industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 6.9% |

The VPSA market is segmented by product type, including oxygen generators, nitrogen generators, hydrogen generators, carbon dioxide (CO2) generators, and others such as argon and helium. In 2024, oxygen generators dominated the market with a valuation of USD 1.3 billion. This segment is expected to grow at a robust CAGR of 7.1% during the forecast period. The surge in global healthcare infrastructure development, particularly in response to the COVID-19 pandemic, has significantly increased the demand for reliable on-site oxygen generation systems in hospitals and medical facilities. In addition, oxygen is essential in various industrial applications, such as steel production, chemical manufacturing, and water treatment, driving further demand for VPSA systems.

The market is also divided by distribution channel into direct and indirect channels. In 2024, indirect distribution channels held a leading market share of 58.5%. These channels, which include intermediaries with extensive networks and localized expertise, are expected to continue their growth, with a forecasted CAGR of 6.6% between 2025 and 2034. By leveraging indirect distribution channels, manufacturers can extend their reach without the need to establish direct sales teams in every region, making VPSA systems more accessible to a broad range of industries.

In the United States, the VPSA market generated USD 800 million in 2024. The country's advanced industrial infrastructure and the high demand for medical-grade oxygen, particularly in healthcare, have played a significant role in this market performance. Moreover, major investments in sectors like healthcare, chemicals, petrochemicals, and metallurgy have driven the increased adoption of VPSA technology, especially in medical settings, where the need for on-site gas generation systems, particularly for oxygen, is on the rise.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for industrial gases

- 3.2.1.2 Growing adoption in emerging economies

- 3.2.1.3 Expansion of renewable energy and hydrogen economy

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance cost

- 3.2.2.2 Competition from alternative technologies

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Oxygen generators

- 5.3 Nitrogen generators

- 5.4 Hydrogen generators

- 5.5 Carbon dioxide (CO2 ) generators

- 5.6 Others (Argon, Helium)

Chapter 6 Market Estimates & Forecast, By Operation, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Billion)

- 7.1 Key trends

- 7.2 Up to 50 Nm³/h

- 7.3 50 Nm³/h and 500 Nm³/h

- 7.4 Above 500 Nm³/h

Chapter 8 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 Industrial

- 8.4 Chemical

- 8.5 Environmental

- 8.6 Oil & gas

- 8.7 Energy & power

- 8.8 Other (Food & Beverages, Metallurgy, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 AirSep

- 11.2 NOVAIR USA

- 11.3 Precision Medical

- 11.4 Air Products and Chemicals

- 11.5 PKU Pioneer

- 11.6 Adsorption Research

- 11.7 Valmet

- 11.8 NES Company

- 11.9 Chenrui Air Separation Technology

- 11.10 CAIRE

- 11.11 Linde

- 11.12 Praxair Technology

- 11.13 Messer Group

- 11.14 Oxymat

- 11.15 PCI Gases