|

市场调查报告书

商品编码

1766354

吸附设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Adsorption Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

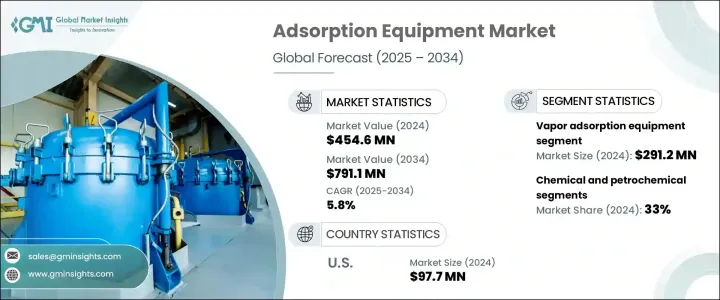

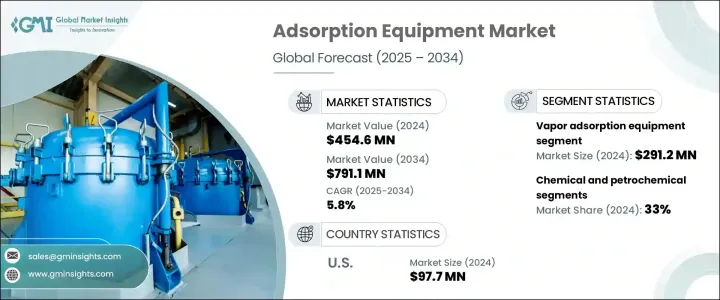

2024 年全球吸附设备市场价值为 4.546 亿美元,预计到 2034 年将以 5.8% 的复合年增长率增长至 7.911 亿美元。该市场的快速成长可归因于更严格的环境法规以及对清洁水和空气日益增长的需求。活性碳系统通常用于水处理,对于去除毒素、有机化合物和重金属至关重要。这些系统对于市政水处理和各种工业应用(包括食品和饮料生产)尤其重要。製药和食品加工等行业对高品质水和原材料的需求进一步推动了吸附设备市场的发展。技术进步也在这一增长中发挥重要作用。金属有机骨架 (MOF) 和先进活性碳等创新使吸附过程更有效率、更具成本效益。

人们对环境保护的日益重视,尤其是在空气和水质至关重要的行业,推动了先进吸附材料的广泛应用。这些材料不仅性能卓越,还能提高营运效率并降低成本。随着污染控制法规的收紧,各行各业正在寻求更有效的解决方案以满足合规标准。向永续实践的转变正推动製造商采用能够以更低的能耗和更少的废弃物产生最佳效果的吸附剂。此外,吸附技术的进步使各行各业能够提高资源回收率并最大限度地减少排放,进一步刺激了对这些高性能材料的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.546亿美元 |

| 预测值 | 7.911亿美元 |

| 复合年增长率 | 5.8% |

2024年,蒸汽吸附设备市场规模达2.912亿美元,预计未来十年成长率为5.9%。该设备对于去除工业空气和排气系统中的挥发性化合物和气体至关重要,可用于空气净化和挥发性有机化合物(VOC)去除。人们对清洁空气的需求日益增长,尤其是在污染严重的城市地区,这推动了蒸汽吸附系统的需求。汽车、製药和製造业等产业对这些技术的依赖程度日益加深。

2024年,化工和石化产业占比33%,预计2025年至2034年期间的复合年增长率为6.2%。吸附技术在这些产业中发挥着至关重要的作用,有助于气体分离、有用物质的回收和排放的减少。变压器吸附(PSA)和真空变压吸附(VSA)等技术在天然气加工和沼气纯化中越来越受欢迎,提高了气体分离效率。

2024年,美国吸附设备市场规模达9,770万美元,预计2025年至2034年的成长率为5.7%。美国环保署(EPA)等机构推出的严格环境法规推动了该市场的扩张,这些法规鼓励各行各业采用基于吸附的系统,以符合空气和水质标准。此外,对製程最佳化、效率和成本降低的需求日益增长,也进一步刺激了对这些系统的需求。化学和石化产业,尤其是天然气加工和溶剂回收等领域,是市场成长的关键驱动力。

吸附设备产业由多家知名企业领军,包括卡尔冈炭素 (Calgon Carbon)、Bry-Air、杜尔 (Durr)、Evoqua 和希柯环境 (CECO Environmental)。这些公司专注于推动创新,透过投资先进技术并提供解决方案来扩大市场份额,以满足工业和市政部门日益增长的清洁空气和水需求。为了提升市场地位,吸附设备产业的公司正在实施各种策略,包括专注于研发,推出更有效率、更具成本效益的解决方案。此外,他们正在扩大产品组合,以满足从水处理到空气净化等更广泛的行业需求。此外,他们也正在寻求策略伙伴关係和收购,以增强自身能力和影响力。各公司正在投资金属有机骨架和先进吸附材料等尖端技术,以保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 蒸汽吸附设备。

- 液体吸附设备

第六章:市场估计与预测:按流量,2021 - 2034 年

- 主要趋势

- 高达 10,000 CFM

- 10,000 - 20,000 立方英尺/分钟

- 超过 20,000 CFM

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 製药

- 废弃物和废水处理。

- 化工和石化

- 汽车

- 印刷

- 其他(农药、涂料等)

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Bry-Air

- Calgon Carbon

- Carbtrol

- CECO Environmental

- Durr

- Evoqua

- General Carbon

- GUNT

- KCH

- Microtrac

- Munters

- Process Combustion Corporation

- Suny Group

- Thermax

- TIGG

The Global Adsorption Equipment Market was valued at USD 454.6 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 791.1 million by 2034. The rapid growth in this market can be attributed to stricter environmental regulations and the increasing need for clean water and air. Activated carbon systems, commonly used for water treatment, are essential for removing toxins, organic compounds, and heavy metals. These systems are particularly important for municipal water treatment and various industrial applications, including food and beverage production. The demand for high-quality water and raw materials in industries like pharmaceuticals and food processing is further driving the market for adsorption equipment. Technological advancements are also playing a significant role in this growth. Innovations like metal-organic frameworks (MOFs) and advanced activated carbon are making adsorption processes more efficient and cost-effective.

The growing emphasis on environmental protection, particularly in industries where air and water quality are critical, is driving the widespread use of advanced adsorption materials. These materials not only offer superior performance but also enhance operational efficiency while reducing costs. As regulations around pollution control tighten, industries are turning to more effective solutions to meet compliance standards. The shift toward sustainable practices is pushing manufacturers to adopt adsorbents that deliver optimal results with lower energy consumption and reduced waste generation. Furthermore, advancements in adsorption technologies are enabling industries to improve resource recovery and minimize emissions, further boosting the demand for these high-performance materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $454.6 Million |

| Forecast Value | $791.1 Million |

| CAGR | 5.8% |

The vapor adsorption equipment segment generated USD 291.2 million in 2024, with an estimated growth rate of 5.9% over the next decade. This equipment is essential for removing volatile compounds and gases from industrial air and exhaust systems, with applications in air purification and VOC removal. The growing need for cleaner air, especially in polluted urban areas, is pushing the demand for vapor adsorption systems. Industries such as automotive, pharmaceuticals, and manufacturing are increasing their reliance on these technologies.

The chemical and petrochemical segment accounted for a 33% share in 2024 and is expected to grow at a CAGR of 6.2% between 2025 and 2034. Adsorption plays a vital role in these industries by helping with the separation of gases, the recovery of useful materials, and the reduction of emissions. Technologies like pressure swing adsorption (PSA) and vacuum swing adsorption (VSA) are becoming increasingly popular in natural gas processing and biogas upgrading, offering improved efficiency in gas separation.

U.S. Adsorption Equipment Market was valued at USD 97.7 million in 2024, with an estimated growth rate of 5.7% from 2025 to 2034. The market's expansion is being driven by stringent environmental regulations from bodies like the EPA, which are encouraging industries to adopt adsorption-based systems to comply with air and water quality standards. Additionally, the increasing demand for process optimization, efficiency, and cost reduction is further fueling the demand for these systems. The chemical and petrochemical sectors, particularly in areas like natural gas processing and solvent recovery, are key contributors to market growth.

Several prominent players are leading the Adsorption Equipment Industry, including Calgon Carbon, Bry-Air, Durr, Evoqua, and CECO Environmental. These companies are focused on driving innovation and expanding their market presence by investing in advanced technologies and offering solutions that meet the growing demands for clean air and water in the industrial and municipal sectors. To enhance their market position, companies in the adsorption equipment industry are implementing various strategies. These include focusing on research and development to introduce more efficient and cost-effective solutions. Additionally, they are expanding their product portfolios to cater to a wider range of industries, from water treatment to air purification. Strategic partnerships and acquisitions are also being pursued to strengthen their capabilities and reach. Companies are investing in state-of-the-art technologies like metal-organic frameworks and advanced adsorption materials to maintain their competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Flow rate

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vapor adsorption equipment.

- 5.3 Liquid adsorption equipment

Chapter 6 Market Estimates & Forecast, By Flow Rate, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 10,000 CFM

- 6.3 10,000 - 20,000 CFM

- 6.4 More than 20,000 CFM

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceutical

- 7.3 Waste & wastewater treatment.

- 7.4 Chemical and Petrochemical

- 7.5 Automotive

- 7.6 Printing

- 7.7 Others (pesticide, coating etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bry-Air

- 10.2 Calgon Carbon

- 10.3 Carbtrol

- 10.4 CECO Environmental

- 10.5 Durr

- 10.6 Evoqua

- 10.7 General Carbon

- 10.8 GUNT

- 10.9 KCH

- 10.10 Microtrac

- 10.11 Munters

- 10.12 Process Combustion Corporation

- 10.13 Suny Group

- 10.14 Thermax

- 10.15 TIGG