|

市场调查报告书

商品编码

1684623

自行车链条装置市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Bicycle Chain Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

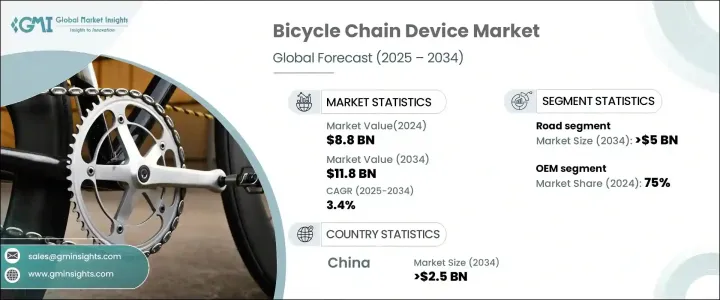

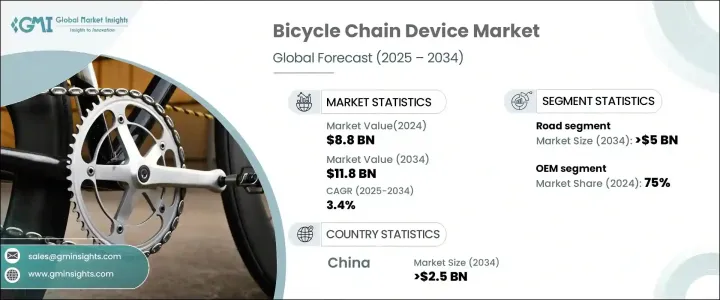

2024 年全球自行车链条装置市场价值为 88 亿美元,预计 2025 年至 2034 年的复合年增长率为 3.4%。这一增长可归因于几个关键因素,包括电动自行车 (e-bikes) 的日益普及,它将传统自行车与现代机动化支援相结合,提供了一种可持续且高效的交通方式。电动自行车正在迅速普及,尤其是对于寻求环保汽车替代品的城市通勤者。随着城市朝着永续发展的方向发展,骑自行车作为减少交通拥堵和降低碳排放的首选解决方案正日益受到青睐。此外,随着消费者越来越重视健康,骑自行车已成为一种受青睐的休閒活动,这导致对自行车及其基本零件(包括先进的链条装置)的需求不断增加。全球范围内使用自行车健身的趋势日益增长,进一步推动了这项需求。

自行车链条装置市场的另一个重要驱动因素是消费者偏好向优质和技术先进的零件的转变。随着骑乘爱好者追求更好的性能、耐用性和舒适性,对高品质链条装置的需求不断增加。製造商正在创新和开发可增强整体骑乘体验的产品,提供更平稳的换檔、改进的能量传输和更持久的耐用性。随着都市化进程以及自行车作为实用交通方式在各地区的普及,对优质自行车零件,尤其是链条装置的需求将持续上升。此外,休閒和竞技自行车运动的兴起趋势进一步推动了市场的发展,骑乘者要求自行车在休閒和高强度骑乘活动中都具有顶级的表现。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 88亿美元 |

| 预测值 | 118亿美元 |

| 复合年增长率 | 3.4% |

根据应用,市场分为几个主要部分,包括公路车、登山车和电动自行车。公路车占了最大的市场份额,2024 年占比为 55%,预计到 2034 年将创造 50 亿美元的市场价值。这些自行车在健身、休閒和竞技骑行中很受欢迎,需要高性能链条装置来确保平稳换檔和高效的动力传输。由于公路车仍然是全球最受欢迎的类别,该领域对先进链条装置的需求将继续推动市场成长。

在检查销售管道时,市场分为OEM (原始设备製造商)和售后市场销售。 2024 年, OEM领域占据市场主导地位,占有 75% 的份额。该部门致力于在生产过程中将链条装置整合到新自行车中,确保相容性、可靠性和一流的品质。随着全球对自行车(尤其是电动自行车)的需求持续激增,原始设备製造商专注于生产高品质的整合组件,以满足消费者对性能和耐用性的期望。

在区域主导地位方面,中国在 2024 年占据全球自行车链条装置市场 50% 的份额,预计到 2034 年将保持这一地位。中国在自行车生产领域的主导地位可归因于其作为世界上最大的自行车製造商和出口国的地位。该国拥有强大、具有成本效益的生产生态系统和广泛的供应商网络。此外,随着骑自行车作为交通、健身和娱乐的日益流行,中国对自行车的需求不断增加,进一步巩固了该国的市场领导地位。此外,在政府旨在促进自行车基础设施和绿色交通解决方案的激励措施的支持下,中国在电动自行车製造业的作用进一步加强了其在全球市场的地位。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 自行车链条装置厂商

- OEM经销商

- 售后市场供应商

- 最终用户

- 利润率分析

- 专利格局

- 成本明细

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 越来越多的人选择骑自行车进行健身和休閒

- 电动自行车日益流行

- 链条装置的技术进步,例如轻质耐用的材料

- 人们对竞技自行车和山地自行车的兴趣日益浓厚

- 产业陷阱与挑战

- 新兴市场价格敏感度较高

- 耐用性问题,导致在恶劣条件下频繁更换

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 自行车链条

- 链轮

- 变速箱

- 链条导轨

- 链条张紧器

- 其他的

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 公路自行车

- 登山车

- 电动自行车

第 7 章:市场估计与预测:按销售管道,2021 - 2032 年

- 主要趋势

- OEM

- 售后市场

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Bafang Electric

- Campagnolo

- Cane Creek Cycling Components

- FSA (Full Speed Ahead)

- Gates Carbon Drive

- Hawley-Lambert

- KMC Chains

- Mavic

- Microshift

- Prologo

- Race Face

- Rotor Bike Components

- Shimano

- SR Suntour

- SRAM

- Sugino

- Trek Bicycle

- TRP Cycling

- Wippermann Chains

- Zee Industry

The Global Bicycle Chain Device Market, valued at USD 8.8 billion in 2024, is projected to expand at a CAGR of 3.4% from 2025 to 2034. This growth can be attributed to several key factors, including the growing popularity of electric bicycles (e-bikes), which blend traditional cycling with modern motorized support, offering a sustainable and efficient mode of transportation. E-bikes are quickly gaining traction, particularly among urban commuters seeking eco-friendly alternatives to cars. As cities work toward becoming more sustainable, cycling is gaining momentum as a preferred solution for reducing traffic congestion and lowering carbon emissions. Furthermore, with health and wellness increasingly prioritized by consumers, cycling has become a favored recreational activity, contributing to rising demand for bicycles and their essential components, including advanced chain devices. This demand is further driven by the trend of using bicycles for fitness purposes, which continues to rise globally.

Another significant driver for the bicycle chain device market is the shift in consumer preferences toward premium and technologically advanced components. As cycling enthusiasts seek better performance, durability, and comfort, demand for high-quality chain devices is on the rise. Manufacturers are innovating and developing products that enhance the overall cycling experience, offering smoother shifting, improved energy transfer, and longer-lasting durability. With urbanization and the adoption of bicycles as a practical mode of transport growing across regions, the demand for quality bicycle components, especially chain devices, will continue to rise. Additionally, the increasing trend of cycling for leisure and competitive sports is propelling the market further, with cyclists demanding top-tier performance for both casual and high-intensity cycling activities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $11.8 Billion |

| CAGR | 3.4% |

The market is divided into several key segments based on application, including road bicycles, mountain bicycles, and electric bicycles. Road bicycles hold the largest share of the market, accounting for 55% in 2024, and are expected to generate USD 5 billion by 2034. These bicycles are popular for fitness, recreation, and competitive cycling, which require high-performance chain devices to ensure smooth shifting and efficient power transfer. As road cycling remains the most popular category globally, the demand for advanced chain devices in this segment will continue to drive market growth.

When examining sales channels, the market is segmented into OEM (Original Equipment Manufacturer) and aftermarket sales. The OEM segment dominated the market in 2024 with a 75% share. This segment is driven by the integration of chain devices into new bicycles during production, ensuring compatibility, reliability, and top-tier quality. As the demand for bicycles, especially e-bikes continues to surge globally, OEMs are focused on producing high-quality, integrated components that meet consumer expectations for performance and durability.

In terms of regional dominance, China holds a significant 50% share of the global bicycle chain device market in 2024 and is expected to maintain this position through 2034. China's dominance in the bicycle production sector can be attributed to its position as the world's largest manufacturer and exporter of bicycles. The country benefits from a strong, cost-effective production ecosystem and an extensive supplier network. Additionally, the increasing demand for bicycles within China, spurred by the growing popularity of cycling for transportation, fitness, and recreation, further reinforces the country's market leadership. Moreover, China's role in the e-bike manufacturing sector further strengthens its position in the global market, supported by government incentives aimed at promoting cycling infrastructure and green mobility solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Bicycle chain device manufacturers

- 3.2.2 OEM distributors

- 3.2.3 Aftermarket providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Patent Landscape

- 3.5 Cost Breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of cycling for fitness and recreation

- 3.9.1.2 Rising popularity of electric bicycles (e-bikes)

- 3.9.1.3 Technological advancements in chain devices, such as lightweight and durable materials

- 3.9.1.4 Growing interest in competitive cycling and mountain biking

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High price sensitivity in emerging markets

- 3.9.2.2 Durability concerns, leading to frequent replacements in harsh conditions

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Bicycle chains

- 5.3 Chainrings

- 5.4 Derailleurs

- 5.5 Chain guides

- 5.6 Chain tensioners

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road bicycles

- 6.3 Mountain bicycles

- 6.4 Electric bicycles

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2032 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Bafang Electric

- 9.2 Campagnolo

- 9.3 Cane Creek Cycling Components

- 9.4 FSA (Full Speed Ahead)

- 9.5 Gates Carbon Drive

- 9.6 Hawley-Lambert

- 9.7 KMC Chains

- 9.8 Mavic

- 9.9 Microshift

- 9.10 Prologo

- 9.11 Race Face

- 9.12 Rotor Bike Components

- 9.13 Shimano

- 9.14 SR Suntour

- 9.15 SRAM

- 9.16 Sugino

- 9.17 Trek Bicycle

- 9.18 TRP Cycling

- 9.19 Wippermann Chains

- 9.20 Zee Industry